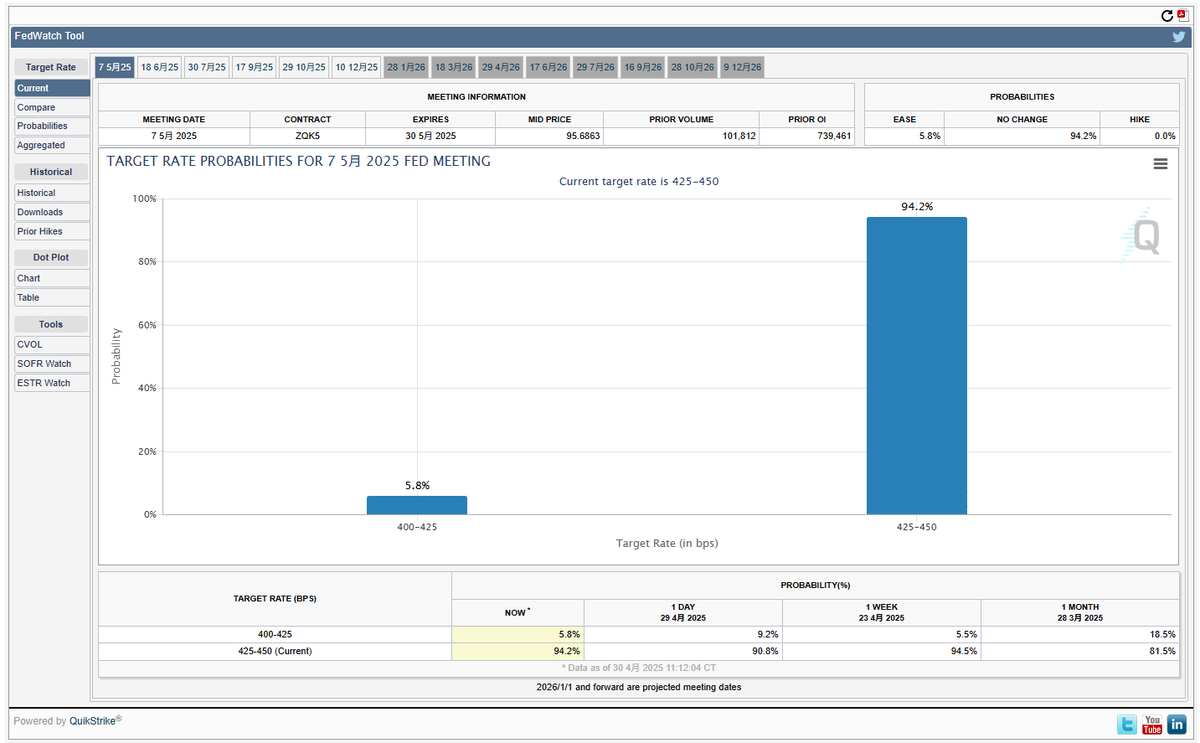

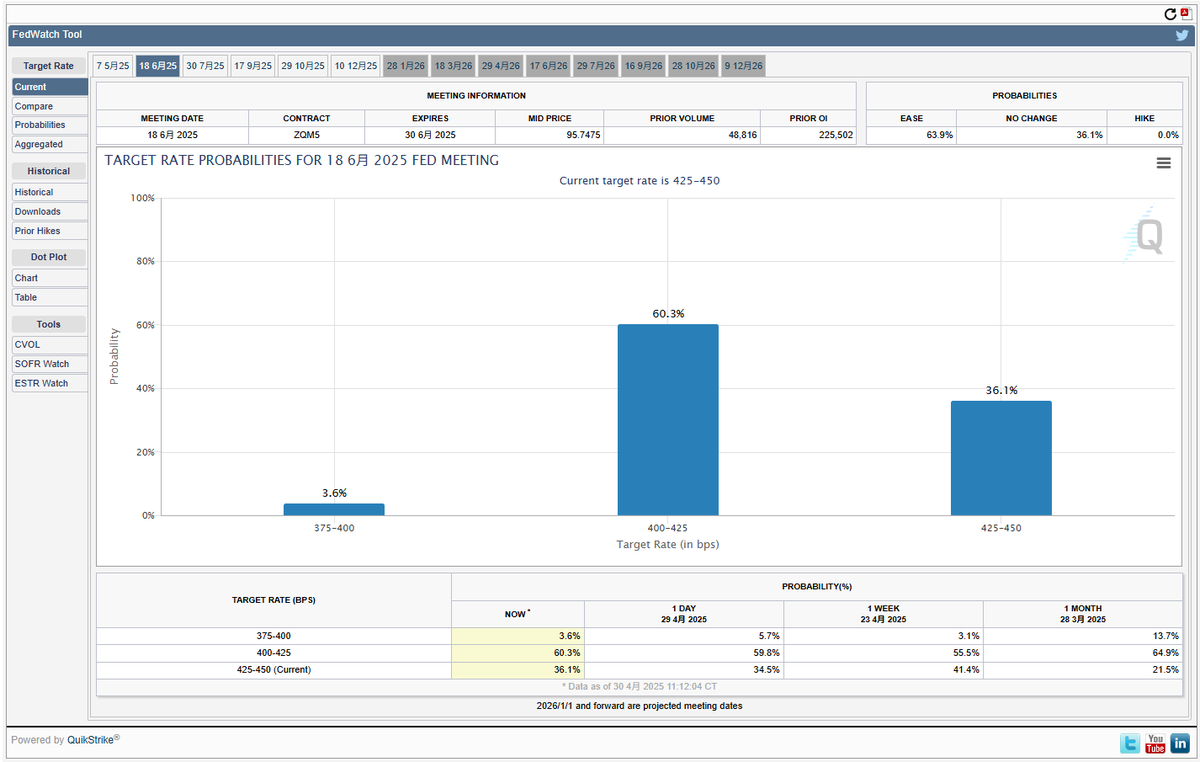

This data is very important because it involves whether the Federal Reserve will implement additional interest rate cuts. Let's first look at the data. Before the GDP was announced today, the CME predicted the probabilities of the Federal Reserve not cutting rates in May and June to be 92.3% and 35.2%, respectively. Four hours after the GDP data was released, the current predicted probabilities are 94.2% and 36.1%.

This means that the market's expectation of the Federal Reserve not cutting rates in June has increased. This is because, although the GDP data is negative, the blame lies with Trump's tariff policy, not the Federal Reserve's monetary policy. The stability of the domestic economy remains very high, so the probability that the Federal Reserve will not be in a hurry to cut rates in June has risen.

Trump is currently facing a dilemma. If he insists on pushing forward with the tariff path, he may personally push the United States into a recession. However, if he abandons the tariff route, the "manufacturing return" and protectionist stance will be weakened, potentially negating the main policy achievements of the past few months. Meanwhile, the market has begun to worry that the uncertainty of his policies itself will become a trigger for a new round of economic decline.

Therefore, the upcoming decline in the risk market has shifted from a recession path to the added uncertainty of Trump's trade policy. The market decline is more due to "hopes for interest rate cuts being suppressed" rather than "extremely poor data." This is a pricing process under the dual pressure of political risk and policy lag.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。