Master Discusses Hot Topics:

The May Day holiday is here, and those big players in the A-share market might just enter the market during this holiday. The main forces may aggressively push up stock prices following the trend, so as long as Bitcoin holds its key support level, there is still room for upward movement.

Additionally, there is a monetary policy meeting in Japan tomorrow. If the result is no interest rate hike, Bitcoin is likely to surge immediately. By May 5th, the last day of the holiday, especially late at night, the main forces, those old foxes, will likely take advantage of everyone being too tired to launch a surprise attack and sell off.

It’s even possible they might start as early as the night of May 4th, Sunday, to pave the way for the Federal Reserve's monetary policy meeting two days later. Generally, the market starts to fluctuate 1-2 days before the meeting, and when the U.S. market opens on May 7th, it’s likely to show a decline.

So, bulls should not be too reckless next week; it’s better to hold low leverage and light positions for now. The Federal Reserve's meeting is on May 8th, and the main forces usually exit 24 hours in advance to watch the show. It’s already anticipated that there will be no rate cuts in May, which isn’t considered bad news, but the probability of a rate cut in June is quite high, and May might preemptively absorb the positive news for June.

Therefore, Master advises you not to short aggressively at a single price point; prolonged sideways movement can lead to unexpected events. Always set stop losses on your last position, and it’s still worth trying to short lightly in batches at new high points between 96.6k and 99.2k.

Back to Bitcoin, the medium-term support looks quite solid, and it’s unlikely to drop too severely for now. Although the 12-hour MACD has already crossed bearish, indicating a downward trend, it is still far from the zero line, and the lower Bollinger Band on the 4 to 8-hour chart is still providing support.

Thus, it needs to break below 92,700 for a significant drop to be possible; this is a key level. The day before yesterday, it bounced back 2,800 points after a retest here, so it’s likely to rebound if it touches this level again in the short term.

Now, let’s talk about Ethereum. Recently, it has rebounded strongly, but Master doesn’t think this can last, mainly because there aren’t any compelling independent stories to tell. However, those wealthy individuals in the U.S. are indeed buying ETH like crazy; I guess it’s mostly because Bitcoin has risen, which has also lifted ETH along with it.

Although from Monday's data, the net inflow of ETH spot ETFs has been quite strong, with BlackRock buying over 37,000 coins, more than last Friday. Grayscale's Mini ETF is also not to be outdone, adding over 5,000 ETH on Monday, and recent sell-offs of ETHE have been minimal.

But Master still believes this wave of ETH is riding on Bitcoin's coattails; if Bitcoin can’t move up, ETH will also stall. Additionally, let’s wait for tonight’s U.S. GDP data to see which way the wind blows.

Master Looks at Trends:

Resistance Levels Reference:

First Resistance Level: 96,000

Second Resistance Level: 95,300

Support Levels Reference:

First Support Level: 94,000

Second Support Level: 93,400

Today's Suggestions:

Yesterday, Bitcoin failed to stabilize above 95.5k. If it fails to hold again upon retesting, it may trigger a disappointing sell-off. Therefore, with 94k as a maintained support level, a conservative trading strategy is recommended.

The first resistance at 95.3k is a clear peak, so it needs to break above 95k and stabilize above 95.3k to expect further upward movement.

The first support at 94k is the closing bearish candlestick from yesterday and the starting point of the rebound, which can be seen as the current key low point. 94k is an important support level; if it breaks below this level, the downward momentum will likely continue in the short term.

If the price breaks below the upward trend line and the area between 93.8k and 94k, a short-term sharp drop may occur, and 93.4k can be seen as a potential ultra-short entry opportunity.

From the chart's trend, even if a long bearish candlestick appears, Bitcoin can still recover quickly, indicating that buying power remains active. With 94k and the upward trend line as support below, it is recommended to focus on bullish positions in the short term while paying attention to the risk-reward ratio.

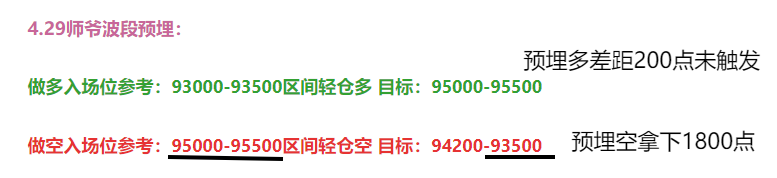

4.30 Master’s Wave Strategy:

Long Entry Reference: Buy in batches in the 93,400-94,000 range. Target: 95,300-96,000

Short Entry Reference: Sell in batches in the 95,300-96,000 range. Target: 94,000-93,400

This content is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official public account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。