2024年12月5日,比特币浩浩荡荡突破10万美元大关...

12月6日凌晨时分,比特币经历了一波剧烈的“插针”行情。AICoin数据显示,比特币盘中突然跳水,一度跌至90000美元附近,随后又快速回弹,截至12月6日15:30,比特币价格反弹至98000美元左右。

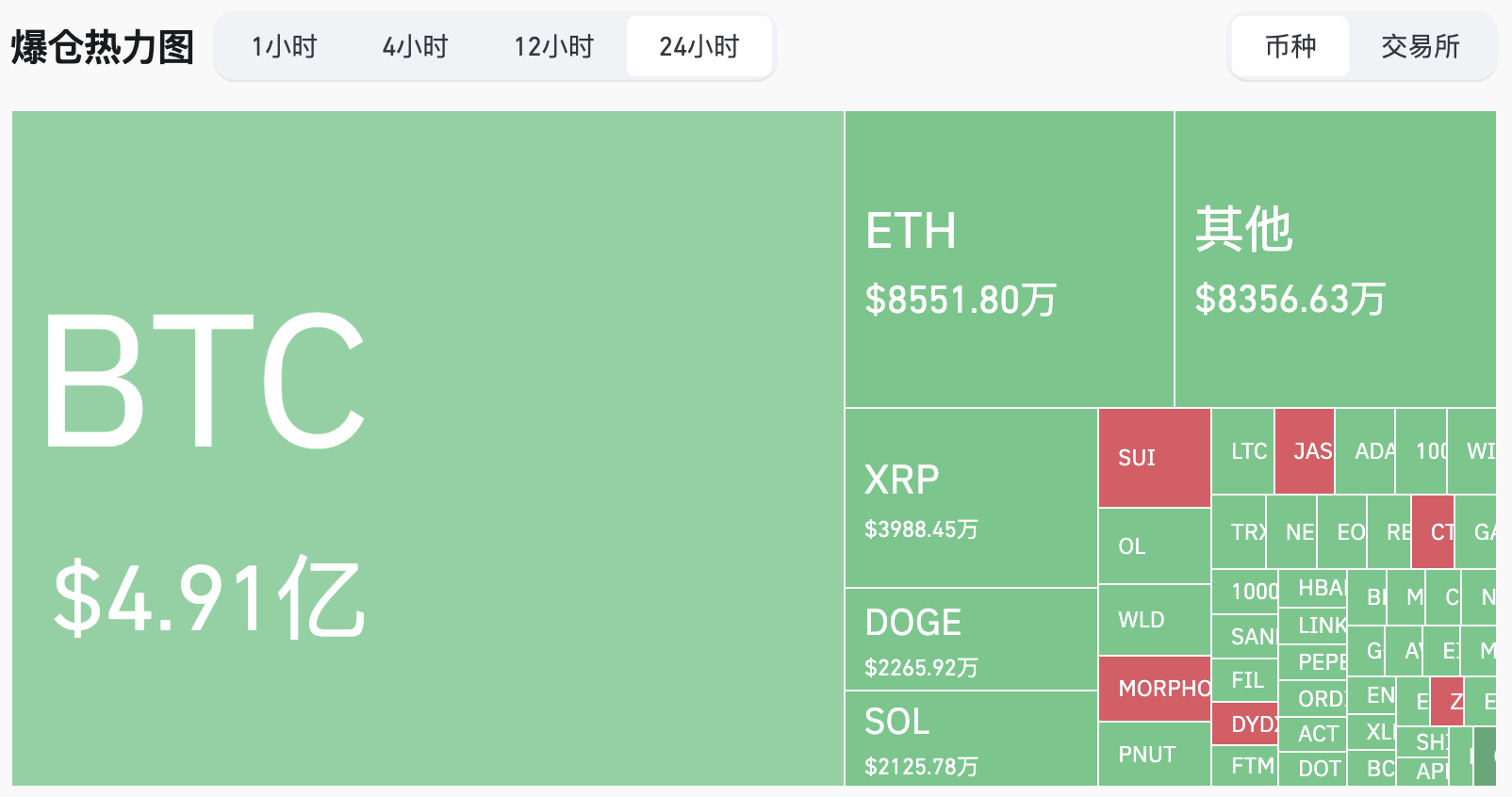

比特币的价格走势剧烈波动下,最近24小时内有几十万人爆仓,爆仓总额为4.91亿美元。

比特币(BTC)近期下跌的原因可以归结为以下几大因素:

1、市场心理因素

·比特币最近突破了10万美元的重要心理关口,历史上当价格达到显著高点时,许多投资者会选择获利回吐,导致价格回调。这种行为不仅在亚洲市场普遍,也在美国投资者中较为常见。投资者往往会在达到预期价格后选择退出,造成卖压增加,进而影响价格走向。

·美联储的货币政策不确定性以及即将发布的美国非农就业数据也加剧了市场的不安。如果数据预期不佳(如失业率上升或工资增速放缓),投资者可能会产生避险情绪,转而抛售风险资产,包括比特币,进一步压低价格。

2、资金流动因素

·根据数据显示,Grayscale比特币基金(GBTC)出现了148.7万美元的资金净流出。这意味着一些机构投资者正在减少对比特币的持仓,从而可能加剧市场上的抛售压力,进一步推动比特币价格下行。

3、宏观经济因素

·然比特币现货ETF的需求依然强劲,但市场上长期持有者(LTH)的大量持币如果没有足够的短期市场需求(STH)来消化,这可能会造成供需失衡,导致价格面临下行压力。供需失衡的状态,尤其是缺乏足够的短期买盘,可能是导致比特币价格波动的关键因素。

4、杠杆交易

·CryptoQuant 分析师 Maartunn 提到,比特币今晨的价格回落与以下因素密切相关:

·Binance平台的净吃单交易量出现大量卖盘,买盘力量明显放缓。市场上的抛压增大导致回调的主要原因之一。

·此次比特币的上涨主要由杠杆交易推动,未平仓合约增长超过15%。这意味着许多交易者在市场上使用杠杆加大了风险,造成了价格的剧烈波动。

·市场情绪目前处于「极度贪婪」状态,投资者过度乐观,加剧了短期内的价格波动。总的来说,这些信号显示比特币价格回调并非意外,市场的杠杆效应和过度乐观的情绪可能导致更大的价格波动。

5、展望未来

·多位分析师预计比特币将在明年第一季度飙升至12万美元。机构资金持续流入,比特币市值不断攀升,离泡沫阈值还有43%的上涨空间。许多交易所和机构都对比特币的前景持乐观态度,认为它正处于全球主流采用的边缘。

·尽管市场情绪看好,但也存在分化,有些投资者对未来走势保持谨慎。比特币突破10万美元标志着其成为公认资产,但未来仍有不确定性,投资者需保持警惕,做好风险管理。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。