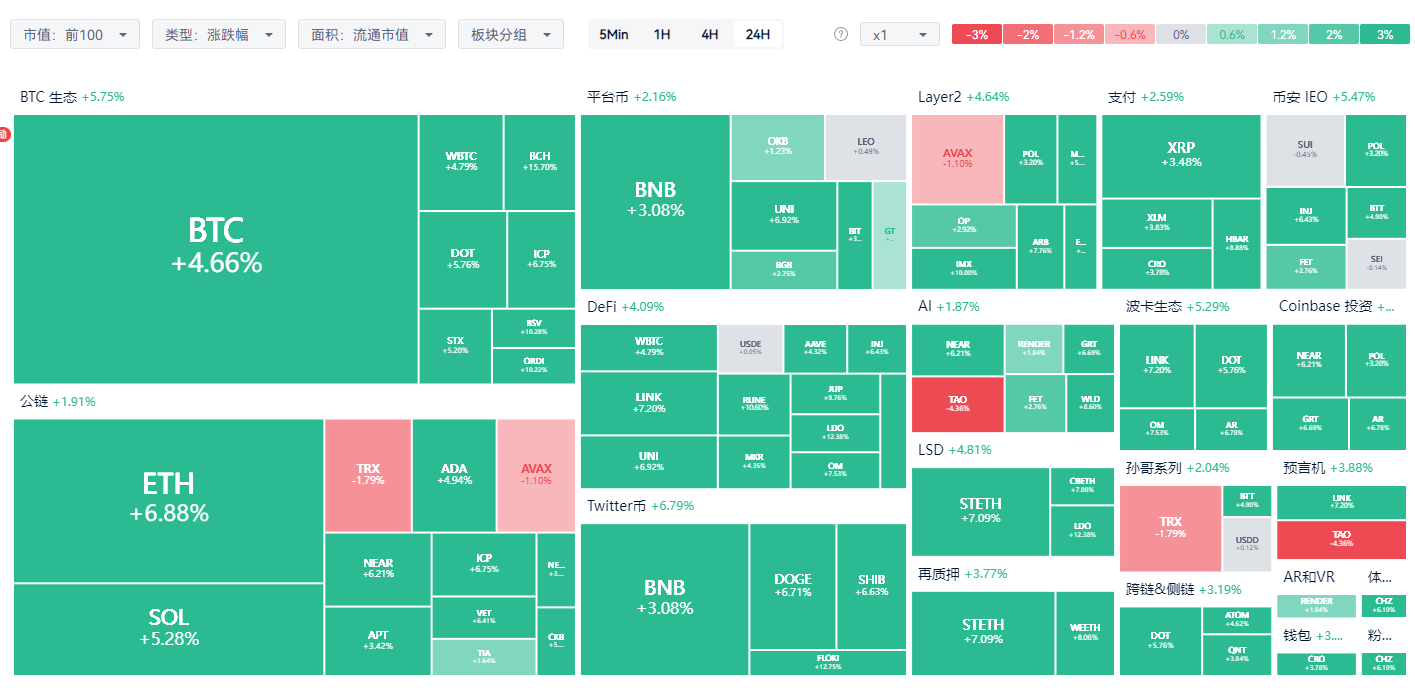

In the past 24 hours, BTC surged violently by over 6.6%, reaching a high of $66,680, setting a new record since August. The rise in BTC has led to a recovery in the entire cryptocurrency market, with market sentiment shifting from neutral to greedy, and ETH and other altcoins experiencing significant gains to varying degrees.

Download the AICoin PC client to view cloud chart details: https://www.aicoin.com/zh-Hans/download

According to AICoin (aicoin.com), the recent rise in BTC is mainly influenced by significant inflows of ETF funds, the upcoming U.S. elections, and reduced market selling pressure, as detailed below.

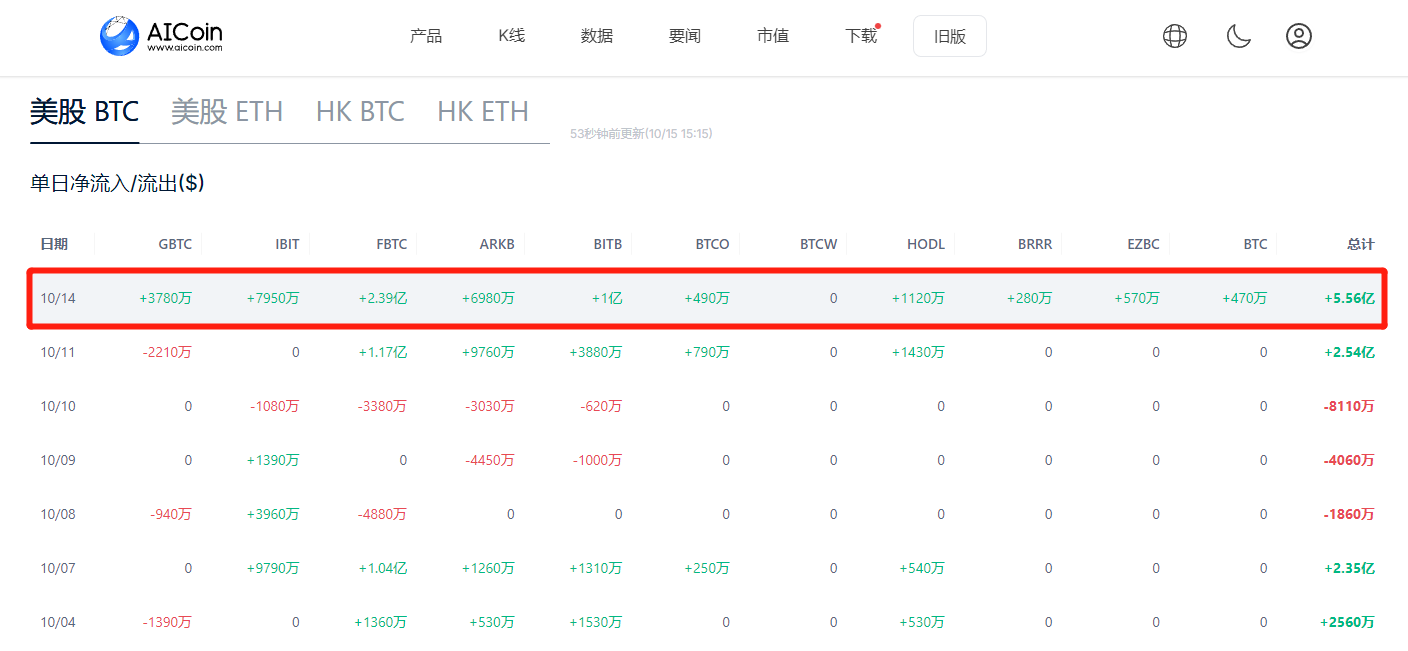

1. ETF Fund Stimulus

Currently, the inflow of funds into the U.S. spot Bitcoin ETF has a significant impact on Bitcoin's price fluctuations: net inflow indicates bullish sentiment; net outflow indicates bearish sentiment.

According to AICoin monitoring, the net inflow into the U.S. spot Bitcoin ETF yesterday reached $556 million. Except for BTCW, all other ETFs experienced inflows, with FBTC seeing an inflow of $239 million, the highest for yesterday. Additionally, GBTC saw a rare inflow of over $37 million.

ETF data tracking: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

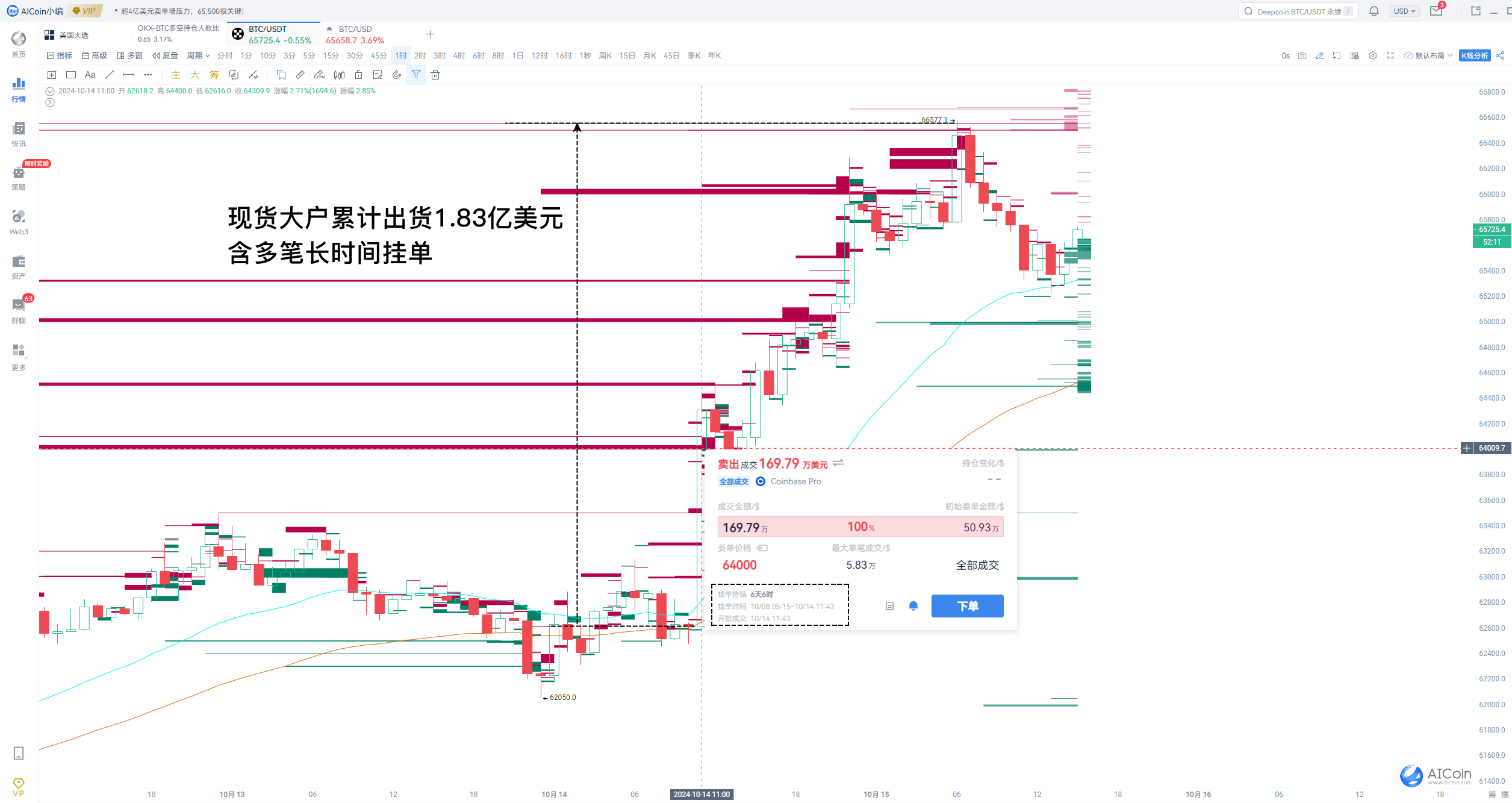

2. Bullish Sentiment Among Whales

The ratio of long to short positions in OKX BTC has dropped to 0.65. According to index usage, when the number of positions is less than 1, it indicates that there are more bearish participants, while the main players are on the bullish side.

Additionally, according to the main order tracking indicator, after BTC broke through the resistance level of $63,000 yesterday, the spot main players began to sell, accumulating a total of $183 million in sales, with large holders concentrating their sales above $65,000, totaling $104 million. During this period, multiple long-standing orders were executed.

Main order usage: Before the sell orders are executed, it indicates bullish sentiment; after execution, it indicates bearish sentiment. The duration of the orders represents the determination of the main players; the longer the sell orders remain, the stronger the bullish determination.

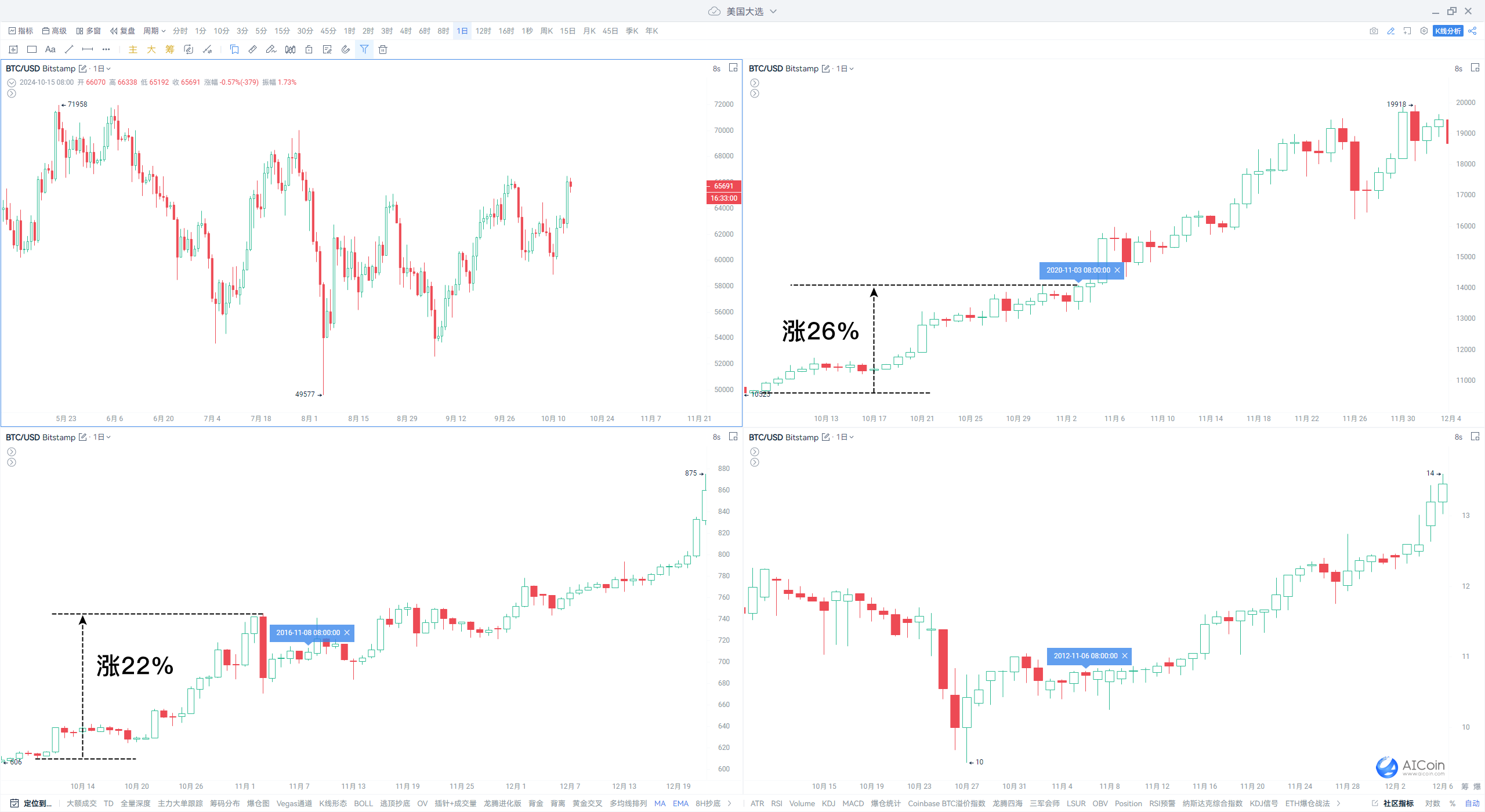

3. Upcoming U.S. Elections

U.S. presidential candidate Kamala Harris announced in her campaign speech her support for a "regulatory framework for cryptocurrencies and other digital assets." Although she did not disclose more details, this has somewhat stimulated the rise in the cryptocurrency market.

Currently, there are less than three weeks until the U.S. elections, and Harris's change in attitude suggests that regardless of which candidate takes office, there will not be a severe negative impact on the cryptocurrency market.

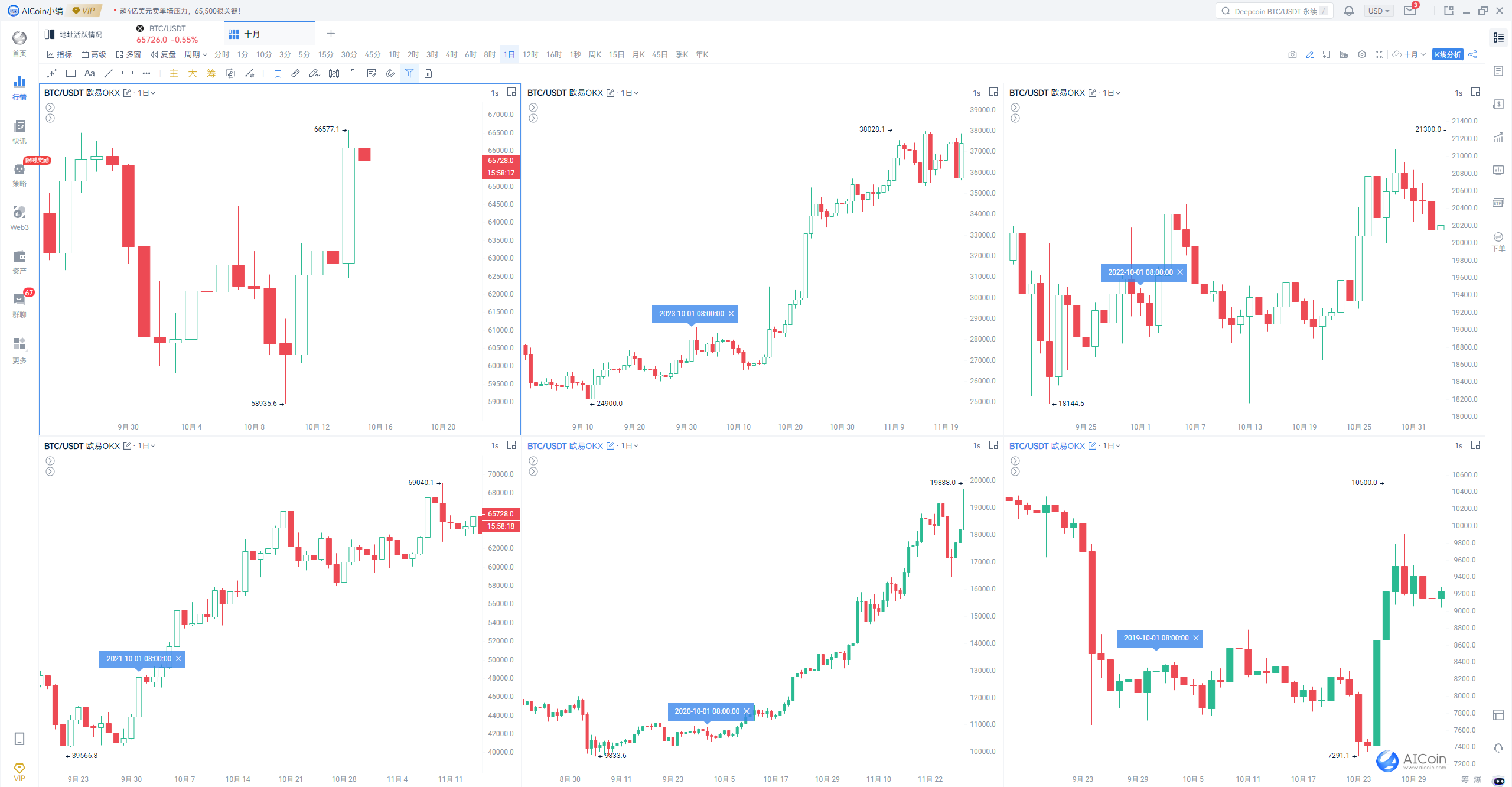

Moreover, historical data shows that in the past two major rallies, BTC has experienced a sustained rise in October, and following the presidential election, BTC is expected to continue its upward trend.

4. Mt. Gox Repayment Deadline Extension

Last week, Mt. Gox officials announced that the bankruptcy administrator, after obtaining court approval, has changed the compensation deadline from October 31, 2024, to October 31, 2025. According to statistics, its remaining assets are approximately $2.9 billion, and the extension of the repayment date has somewhat alleviated concerns about creditors seeking to sell Bitcoin for repayment, which could lead to oversupply.

Additionally, stimulus policies in the Chinese stock market and positive earnings reports from financial giants like BlackRock and JPMorgan have also been viewed as favorable news by the market, positively impacting Bitcoin prices.

5. Trading Signals

Currently, on the daily level, BTC has crossed the MA200 bull-bear boundary and touched the upper trend line of the parallel channel, while the upper resistance level at $66,550 is present.

Furthermore, the spot main players still maintain a bullish sentiment, placing $282 million in sell orders above the current price, focusing on the $70,000 level (with a concentration of $58.96 million in sell orders). Notably, large holders on Bitstamp remain firmly bullish up to $70,000, with orders lasting over 24 days.

● Resistance level: $66,550, if broken, bullish to $67,400, $70,000

● Support level: $63,480, if broken, bearish to $61,735, $59,075

According to historical data, Bitcoin typically experiences an "Uptober" trend (Uptober refers to the past occurrences of price increases in October). Last year, BTC surged over 30% in October. Additionally, with the upcoming U.S. election narrative and expectations of interest rate cuts from the Federal Reserve, BTC's return to $70,000 is in sight.

The multi-window feature on the same screen is a unique feature of AICoin PRO, allowing for up to 9 custom layouts, saved in the cloud: https://www.aicoin.com/vip/chartpro

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。