币圈资讯

9月1日热点;

1.Yuga Labs 首席执行官 :已推出 Workshop 团队 专注于构建创新 ApeChain 产品

2.UniSat :公共矿池 FairPool 已在 Fractal 测试网上线

3.Symbiotic TVL 突破 16 亿美元,过去一个月涨幅 32.68%

4.HKDAX 已向香港证监会提交虚拟资产交易平台牌照申请

5.Uniswap 将与 Pudgy Penguins 在韩国区块链周合作

交易心得

其实穿越牛熊我感觉比较重要的还是风险/仓位管理。1,从不满仓,7成便是满仓。主要是情绪管理会好很多,如果牛市,7成赚钱也知足,如果看错,下跌,还有3层仓可以补,被情绪左右的可能性就变低2,满仓开始看空,空仓开始看多,这是很反直觉的事情,但我觉得,这是我穿越两个牛熊最重要的一个原则。你满仓的时候就是你风险最大的时候,你空仓的时候就是你机会最多的时候。应该在满仓的时候,规避风险,开始看空,寻找及时止盈的时机和点位,而不是幻想着btc可以涨到10万,20万。空仓的时候,同理,主动寻找机会,主动看多。但往往,更多人,是在满仓看多,空仓看空。你可以说我没有格局,btc这么多人,从3000拿到现在都不知道多少倍了。但我觉得更多的是,7万买,1.5万卖的人吧。3,纯现货,从不合约。这一条没什么好说的,希望你能深刻理解这句话的时候,你还有机会东山再起,与君共勉。

LIFE IS LIKE

A JOURNEY ▲

下方是大白社区本周实盘群单子,恭喜跟上的币友,如果你操作不顺,可以来试试水。

数据真实,每一单都有当时发出的截图。

搜索公众号:大白论币

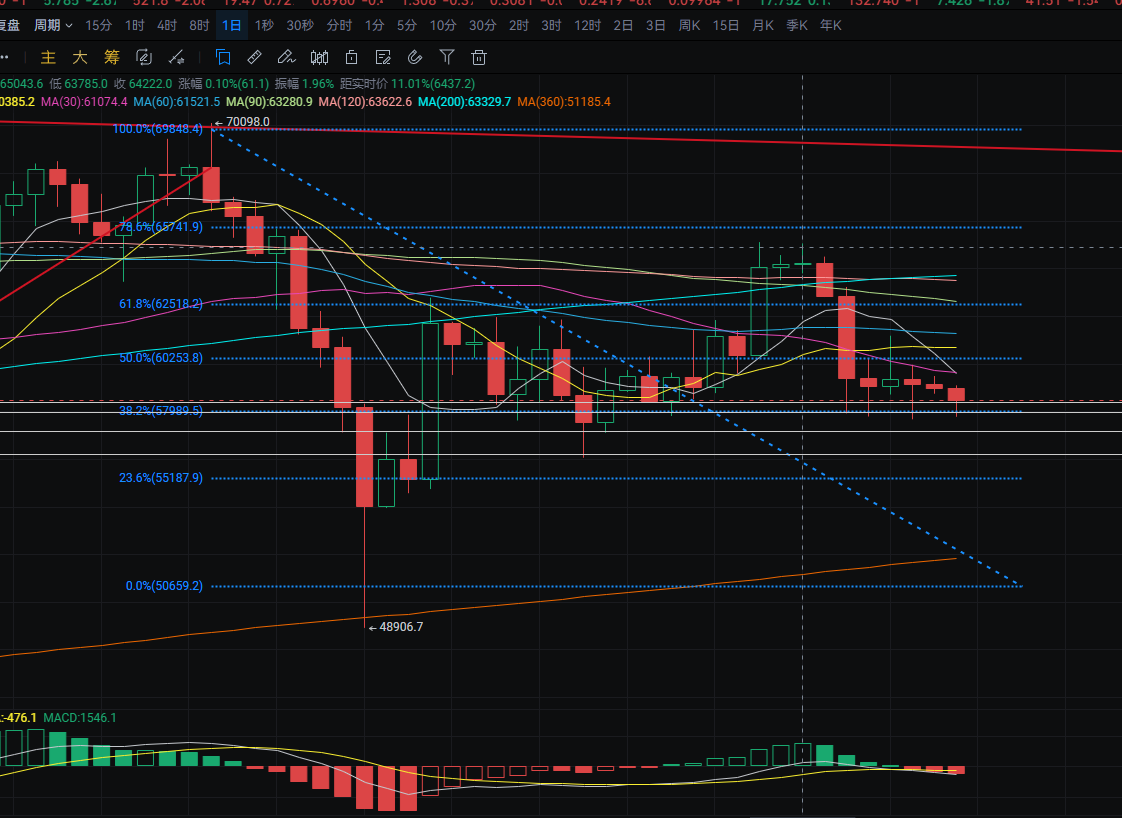

BTC

分析

大饼日线昨日收出十字星 最高涨至59500附近 低点位于58750附近 收线在59000附近 下方支撑位于58000附近 上方压力位于MA30附近 形成突破则可看至MA14附近 MACD空头增量 四小时重点关注58000点关口 若持续收线在58000点下方则会去看到56000点附近 上方压力位于MA7附近 形成突破则可看至MA30附近 下方支撑位于0.382附近 MACD震荡走平 双线粘合 短线给至57150-56200附近可进行接多 反弹目标可看至57900-58400附近 中线给至56750-56200附近可进行接多 反弹目标可看至57900-58400附近 月线埋伏单给至54670-53600附近可进行接多 目标可看至57000-60000附近

ETH

分析

以太日线昨日收出十字星 最高插针至2535附近 最低到达2490附近 收线在2515附近 上方压力位于MA7附近 形成突破则可看至MA30附近 MACD双线粘合有形成死叉的迹象 四小时上方压力位于MA14附近 形成突破则可看至MA120附近 MACD震荡走平 短线给至2360-2307附近可进行接多 反弹目标可看至2500-2650附近

免责声明:以上内容均为个人观点,仅供参考!不构成具体操作建议,也不负法律责任。市场行情瞬息万变,文章具有一定滞后性,如果有什么不懂的地方,欢迎咨询

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。