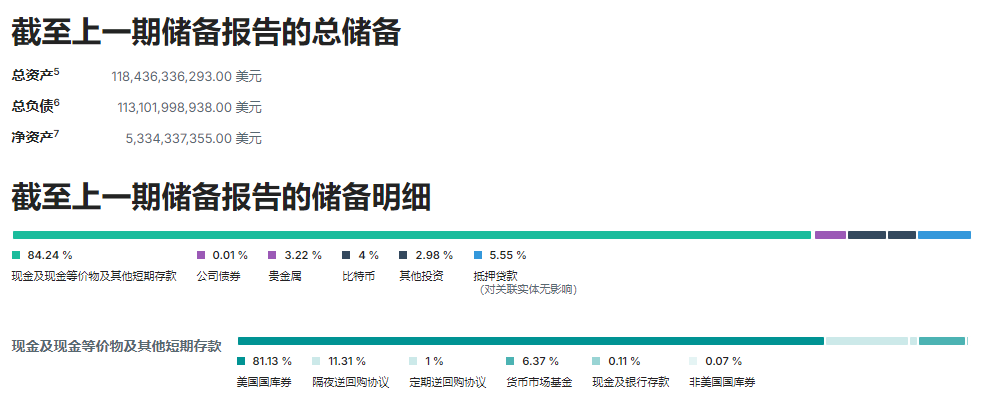

Yesterday, I was discussing this issue with my friends. Many of them are still concerned about USDT, but I think there's no need to worry. In the latest quarterly financial report, Tether directly and indirectly holds over $97.6 billion in US Treasury bonds, surpassing Germany, the United Arab Emirates, and Australia. It ranks 18th in the list of countries holding US debt. Tether is also the third-largest purchaser of 3-month US Treasury bonds, following only the UK and the Cayman Islands.

Certainly, many people may argue that Tether's audit is self-conducted, and no one knows the actual situation. However, the audit report is provided by BDO (Italy), which is just below the "Big Four" accounting firms. If you insist that Tether has influenced BDO, I can't do anything about it. But based on Tether's publicly disclosed US Treasury bond reserves, there should be no problem. At the very least, no one has ever questioned the reserves of US Treasury bonds held by Tether.

In fact, the blockchain has always been saying "Don't trust, verify," but the cryptocurrency industry is a place of high trust. Investors in the cryptocurrency industry may not conduct due diligence before investing millions of dollars in individuals. You can provide all your information to cryptocurrency exchanges without being familiar with them and put most of your assets in them. You can follow the advice of cryptocurrency analysts without knowing who they are.

I'm not saying that Tether can be 100% trusted, but compared to the vast majority of the cryptocurrency ecosystem, it's already quite rare.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。