昨日师爷文章中在66800-67200区间预埋做多,行情在凌晨最低跌至67296附近。随后一路反弹最高涨至68480,但因为入场点位仅仅只间隔96个点的差距,导致多单踏空未能进场。

而在68100-68500区间的预埋空单,在昨晚10点价格最低跌至了68548,随后凌晨的行情最低跌到了67296。文章中预埋空单目标67700-67200均完美到达并拿下1300多点利润!

BTC4小时:

正如在师爷昨日图表分析中提到的,比特币在收敛三角形态内波动。并守住了120日均线,成功突破了收敛三角的上方。

所以在日内师爷会关注67200附近的重要支撑线能否守住,从而可以维持看涨的观点。

尽管目前的市场上存在着利空因素,因为比特币ETF市场连续三周录得资金净流入。反而主力会将这视为空头的机会,目前整个图表趋势也显示着反弹。

昨日守住了120日均线,并以大阳线突破了收敛三角上方,因此预期调整时提高支撑线来应对会是一个不错的选择。

阻力位参考:

第一阻力位:68,660美元

第二阻力位:69,120美元

对于第一阻力位师爷认为现阶段不应期待价格会去突破,而是应该关注是否能够守住第一支撑并进行重新测试。

持续形成的大阳线并上涨的概率不高,通常是形成大阳线后再调整,然后再次上涨。因此我们可以等待回调后再考虑入场。

支撑位参考:

第一支撑位: 68,140美元

第二支撑位: 67,700美元

昨日比特币突破了第一阻力位,所以师爷将其调整为了支撑线。若短期内守住第一支撑线,则重新测试高点的概率将会大大增加。

如果价格持续反弹,那么就可以调整支撑位或阻力位应对,从而有助于保持盈亏比的合理性。

今日交易建议:

由于比特币已突破收敛三角上方,所以短线交易主要可以围绕在多头趋势上。关注收敛三角在确定方向前的波动趋势,若跌破第一支撑线,那么就可以关注120日均线走势从而进行交易。

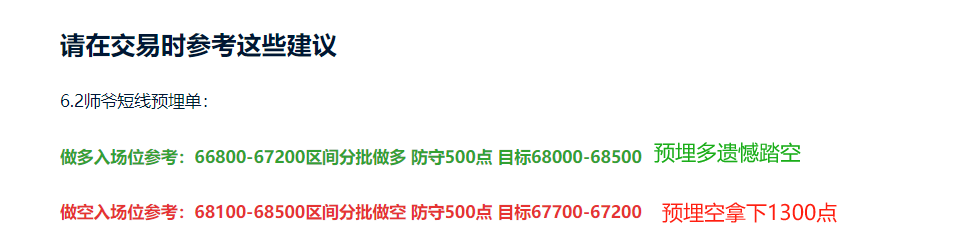

请在交易时参考这些建议

6.3师爷短线预埋单:

做多入场位参考:66800-67200区间分批做多 防守500点 目标68100-68600

做空入场位参考:68800-69200区间分批做空 防守500点 目标68100-67700

本文内容由师爷陈(公众号:币神师爷陈)独家策划发布,如需了解更多实时投资策略、解套、现货合约交易手法、操作技巧以及K线等知识可以加到师爷陈学习交流,希望能帮助到你在币圈找到自己想要的。专注BTC、ETH及山寨币现货合约多年,没有100%的方法,只有100%的顺势而为;每日全网更新宏观面分析文章,主流币及山寨币技术指标分析及现货中长线复盘价格预测视频。

温馨提示:本文只有专栏公众号(上图)是师爷陈所写,文章末尾及评论区其他广.告均与笔者本人无关!!请大家谨慎辨别真假,感谢阅读。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。