Original | Odaily Planet Daily

Author | Wenser

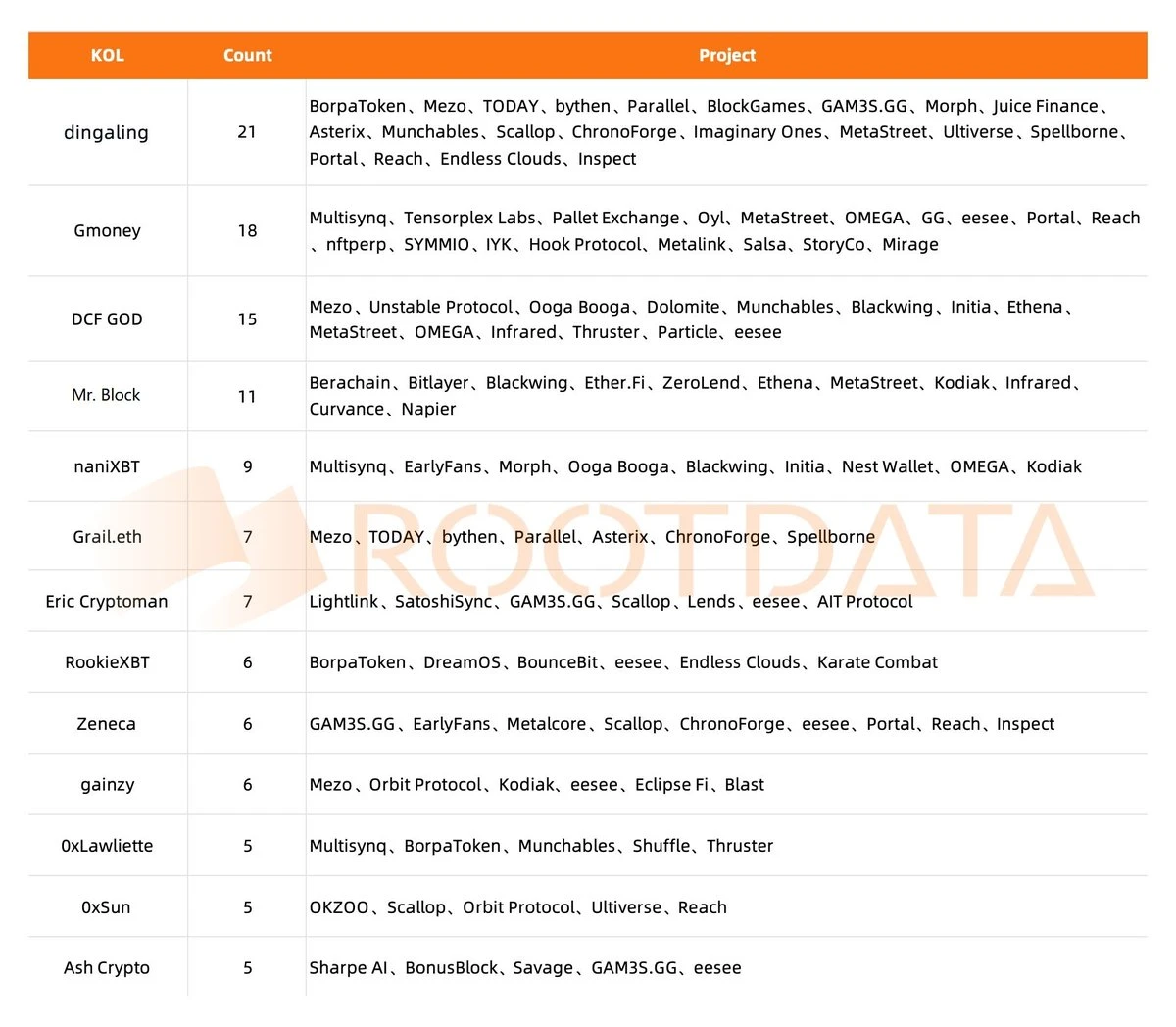

In April 2024, Web3 asset data platform RootData released the statistical data on the participation in project financing by KOLs in the past six months. According to the statistics, dingaling ranked first with participation in 21 project financings, followed by GmoneyNFT and DCF GOD in second and third place, respectively. Today, Odaily Planet Daily will dissect the investment strategies of KOLs from this list and search for new Alpha.

https://x.com/RootDataLabs/status/1779848819364245812

Hot Tracks: Gaming, BTC L2, Social

Based on the information in the table and the Rootdata official website, many KOLs mainly invest in popular tracks such as gaming, social, and BTC L2 networks. Among them, the following projects have received considerable recognition and investment from multiple KOLs:

eesee has investments from 7 KOLs. It is a decentralized aggregation trading and lottery platform within the Blast ecosystem, mainly providing additional liquidity and trading market services for digital assets, tokens, and RWA to both buyers and sellers, and offsetting the negative effects of users not winning by using a special token cash-back form. Winners receive lottery pool rewards, while losers receive points linked to future rewards. The token ESE is currently priced at $0.08, with a 24-hour trading volume of $1.82 million.

Mezo has investments from 4 KOLs. It is one of the latest Bitcoin L2 networks created by the developer Thesis team, which previously completed a $21 million Series A financing led by Pantera Capital, with participation from Multicoin, Hack VC, Draper Associates, and others. Mezo utilizes a "Proof of HODL" points program to utilize idle Bitcoin held by users, with the longer the holding time, the higher the user's "HODL score multiplier." No coins have been issued yet.

GAM3S.GG has investments from 4 KOLs. It is a Web3 gaming content platform. According to its official introduction, it has currently launched 400+ games, and its mission is to allow gamers to join web3 through game discovery, content, live streaming, and community activities. GAM3S.GG's super application simplifies the user experience, provides opportunities for early access, plans content to highlight popular web3 games, and eliminates barriers for beginners. The token G3 is currently priced at $0.177, with a total market value of $170 million.

Scallop has investments from 4 KOLs. It is a lending market within the Sui ecosystem. It is committed to building a dynamic currency market, providing high-yield lending, low-cost lending, AMM, and asset management tools on a unified platform, and providing SDKs for professional traders. The token SCA is currently priced at $0.61, with a circulating market value of $18.54 million.

MetaStreet has investments from 4 KOLs. It is a liquidity expansion protocol for the Blast ecosystem's NFT credit market. Its main product is a capital pool that can provide secondary market liquidity for NFT-backed bills, allowing participants to deposit funds to earn returns from a diversified investment portfolio of NFT-backed bills. Star capital investors include Dragonfly, DCG, OpenSea, Nascent, and others, and it previously completed a $25 million financing. No coins have been issued yet.

Reach has investments from 4 KOLs. It is a SocialFi collaboration platform designed for creators and contributors within the Web3 community. Reach allows anyone wishing to promote their content to utilize a user group for participation, verification, and auditing, and to pay them for their contributions to network effects. As a Discord Bot developer, it allows creators to easily set tasks to promote their content. Tasks can be customized based on the target audience, including followers, likes, retweets, and tweet comments on the X.com platform. Some tasks also have rewards (ETH) sponsored by creators, while others have leaderboard points rewards that can be used to purchase tasks. The token REACH is currently priced at $0.045, with a total market value of $4.888 million.

In addition, the Defi track is also a focus of attention for many KOLs, with products such as Kodiak, Orbit Protocol, and Particle also receiving significant attention.

KOL Characteristics: Mostly NFT Players

It is worth mentioning that in the list of KOLs surveyed this time, the proportion of NFT players is relatively high. Individuals such as dingaling, Gmoney, Mr. Block, Grail.eth, Zeneca, and 0xSun all have NFT-related elements in their avatars or IDs, and are well-known KOLs in the NFT market.

Similarly, the previous Memecoin craze also started from NFT players and gradually spread to different groups in the crypto market. In my opinion, the main reasons why NFT players are active in the investment market are as follows:

Strong community influence. KOLs in the NFT track generally have strong cohesion within their communities and wield significant influence, making them valuable for content marketing and gaining recognition from investment projects.

Good cultural aesthetics. Unlike KOLs in other tracks, NFT track KOLs not only consider team background, capital support, and project resources when judging project quality, but also place importance on the cultural background, project aesthetics, and operational methods of a project. Therefore, they tend to prefer investing in teams and projects with a certain aesthetic ability, making it difficult for poorly made projects to gain their favor.

NFT market downturn, seeking new breakthroughs. Due to liquidity issues, the NFT market has been underperforming in recent years. Therefore, compared to others, NFT track KOLs are more motivated to seek new growth points and breakthroughs. This is also one of the reasons why many NFT players have flocked to the primary and secondary markets in large numbers. To some extent, this is also a choice made out of necessity.

Commonalities: Emerging ecosystems + mature models

In addition, through the analysis of KOL investment projects, we can also see that apart from Ethereum staking tracks such as Ethena and Ether.fi, the investment targets chosen by KOLs are mostly focused on emerging ecosystems that have mature models that can be used for reference, such as:

Blast: As an L2 network backed by the "point system aggregator" Blur, Blast has gradually grown into an "application-oriented network" with a rich ecosystem through step-by-step operational activities such as the points system, gold point rewards, and Big Bang events. Whether it's gaming, social, Defi, or NFTFi, Blast's points are the "best selling point" of the product, attracting numerous teams and investors, including KOLs, to join in.

Berachain: As an L1 public chain that completed a $100 million Series B financing and has a valuation of at least $10 billion, Berachain's ecosystem is also gradually developing. Its positioning as a "community-driven blockchain network" with strong meme attributes has made many KOLs pioneers and advocates of this ecosystem.

Sui Network: Supported by the Move language, Sui's high throughput, low latency, and asset-oriented programming model have also gained recognition from many projects. According to recent data from the Artemis platform, Sui's daily on-chain transaction volume has briefly surpassed that of the Solana network, reaching as high as 41 million times. In the long run, casual games are a major advantage for Sui. The previous Paris Sui Basecamp event also showcased the highly active status of this ecosystem in the market, providing a good foundation for the implementation of mature models.

Conclusion: KOL rounds are normal, take it in stride

Previously, KOL rounds of financing became a periodic hot topic in the crypto industry. Many people have a negative attitude towards this, believing that KOL rounds of financing will lead to the abuse of KOL influence and prompt ordinary users to FOMO and follow the crowd. Some people believe that KOL rounds of financing are a manifestation of market forces changing, to some extent replacing the important role of institutional investment in the past. Of course, some people disdain this, believing that KOL rounds of financing have significant drawbacks, and that many times KOLs may not necessarily receive high returns on the amounts they receive, given the existence of high-risk factors such as "project rug, security risks, and a cold market sentiment," which can easily lead to KOLs becoming "free labor" or even "spending money and effort, only to end up with nothing."

In response to this issue, the attitudes of overseas KOLs are more moderate. The founder of Endless Clouds, Loopify, and the well-known overseas KOL OSF have both made relevant remarks. Starting from obscurity, they gradually accumulated resources in the crypto industry through their own efforts and content output, and eventually became choices for many projects. Although it may seem like a cliché, it is indeed the reality.

So, instead of complaining, it's better to accept it and then find your own Alpha. Perhaps, the next big name in the crypto world could be you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。