原文作者:@DodoResearch

厌倦了在中心化交易所二级市场的打打杀杀?不妨来看一下人迹罕至的链上策略,相比于中心化交易所庞大的用户和交易量,玩家更少的链上或许是当前市场情况下的相对优解。链上收益源有很多,但大部分用户还停留在交互撸空投,跟着项目方活动质押攒积分以及打新土狗的初级阶段。

本期 #HottestCoin 将从几个方面来揭秘链上收益玩法,教你如何在链上赚取相对稳定且高效的被动收益,跑赢大多数资管收益水平,并在接下来几期详解热门的几个项目。

链上收益源有很多,在当下市场环境下,链,DAPP 和叙事都很重要,但和策略本身没有特别直接的关系。比如 EVM 系,有长期稳定收益率的,目前看只有主网,Arbitrum 和 BNB Chain。有些 EVM L2 在初期质押收益预期很高,但生态稳定后,能形成稳定收益源的少之又少。DAPP 上来讲,主要是 DEX,借贷,稳定币,收益市场 Pendle 以及各种单独的项目。

拿大家熟知的 LRT,LSD 相关项目来说,按照项目规则质押拿积分在叙事高涨的时候趋势是不错的策略,最终空投兑现的时候,收益相对不错,但是在当下项目方空投规则不明朗,流动性差,二级市场接盘乏力的情况下,单纯质押拿积分显然就不是特别好的策略了。

如果项目本身支持@pendle_fi的话,那么赚取 20-40% 年化的被动收益显然要香很多,同时还有可能更好的策略,比如去 DEX 里面提供流动性,在集中流动性的池子中有时能赚取超过 40% 的年化收益。由于质押锁仓,从项目方兑出 ETH 遥遥无期,很多用户退出其实是直接 swap 退出的,而有些项目的流动性池其实很小,这就有了相对高的收益机会。

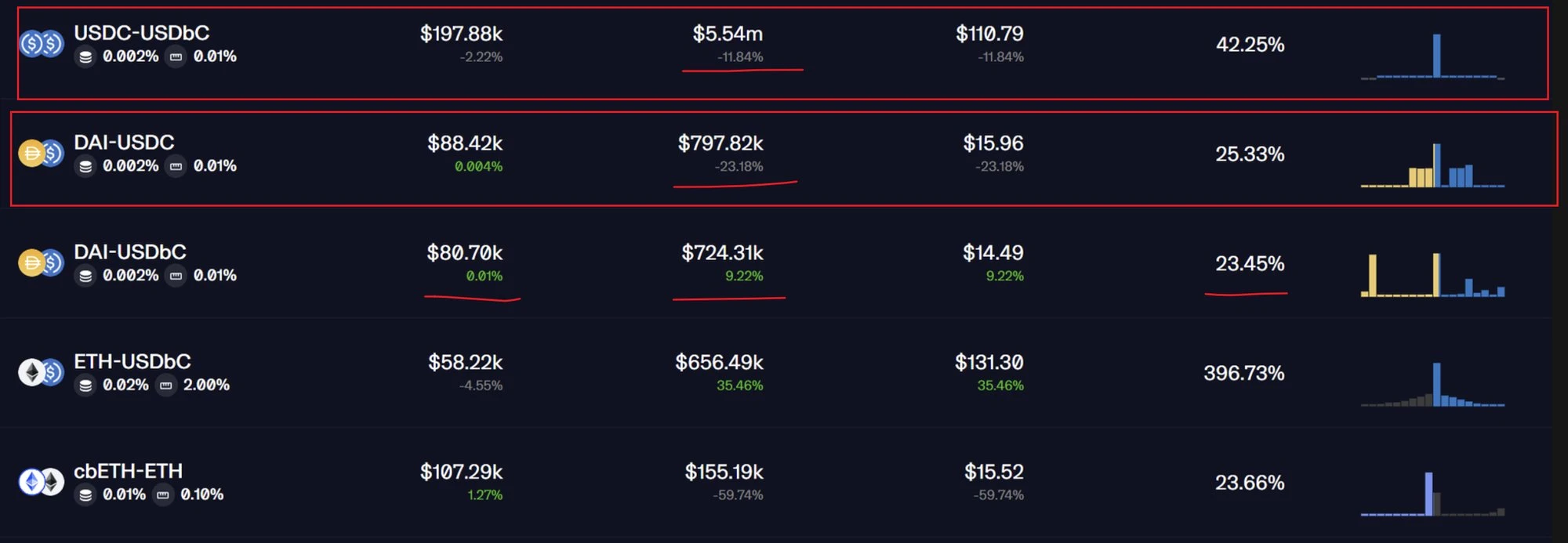

顺着讲,那么 DEX 如何选池子呢,是单纯看 APR,越高越好吗?不是的,DEX 提供流动性,收益一般由三个因素影响,手续费,代币激励和无常损失带来的成本。有些 DEX 手续费收益率算上了代币激励本身,不过不影响我们分开分析。

适合散户选的池子包括各种稳定币池子和 LRT/LST 池子,注意要选集中流动性的池子,集中流动性带来做市效率提升,会使得收益率变高,这些池子还有一个很好的优势,不用担心无常损失带来的风险,也不用频繁换仓没有操作上的门槛,只要池子选的合适,收益率超过资管是很容易的事情。

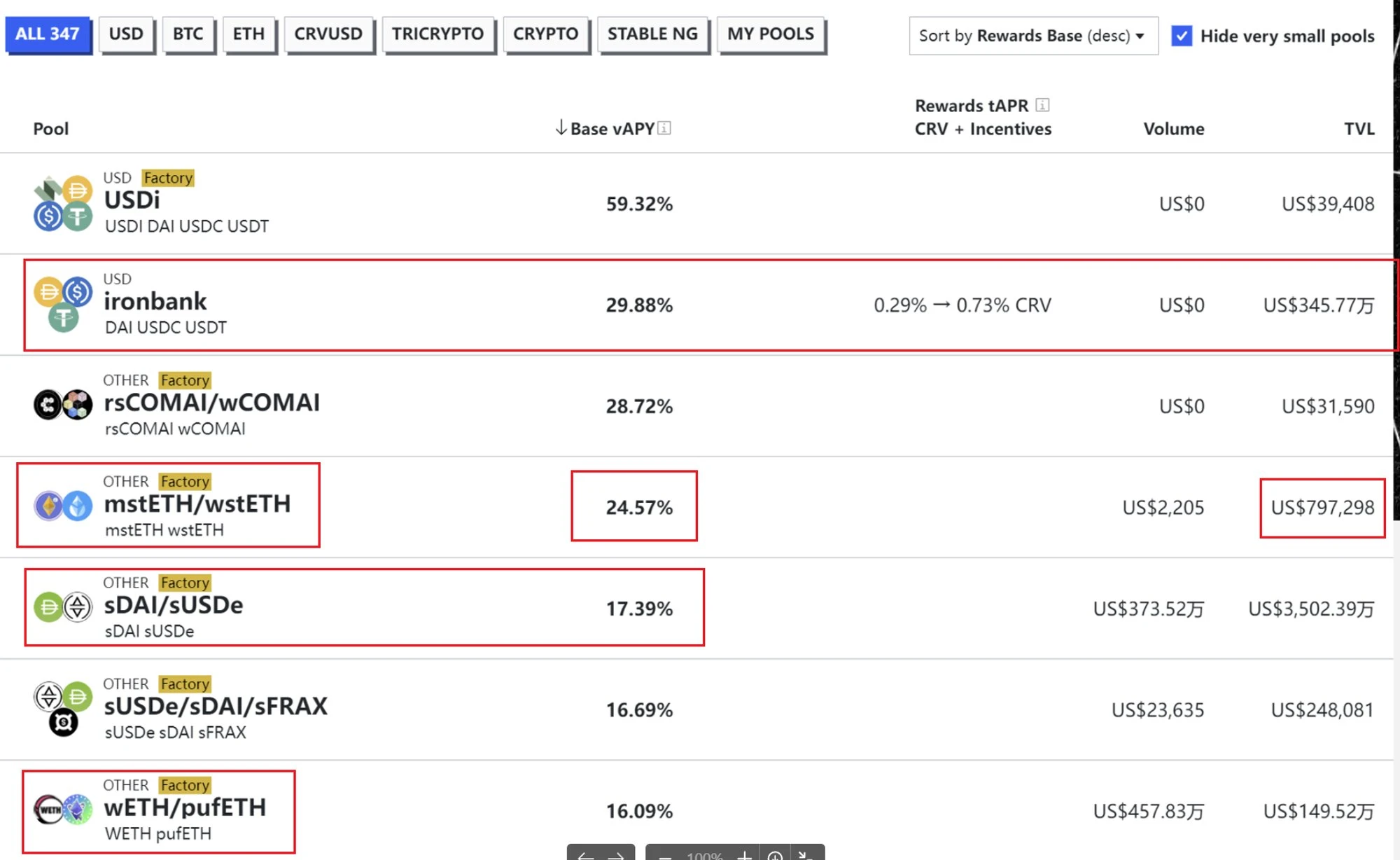

举例说明,Curve 上的三池,收益率相对较高。

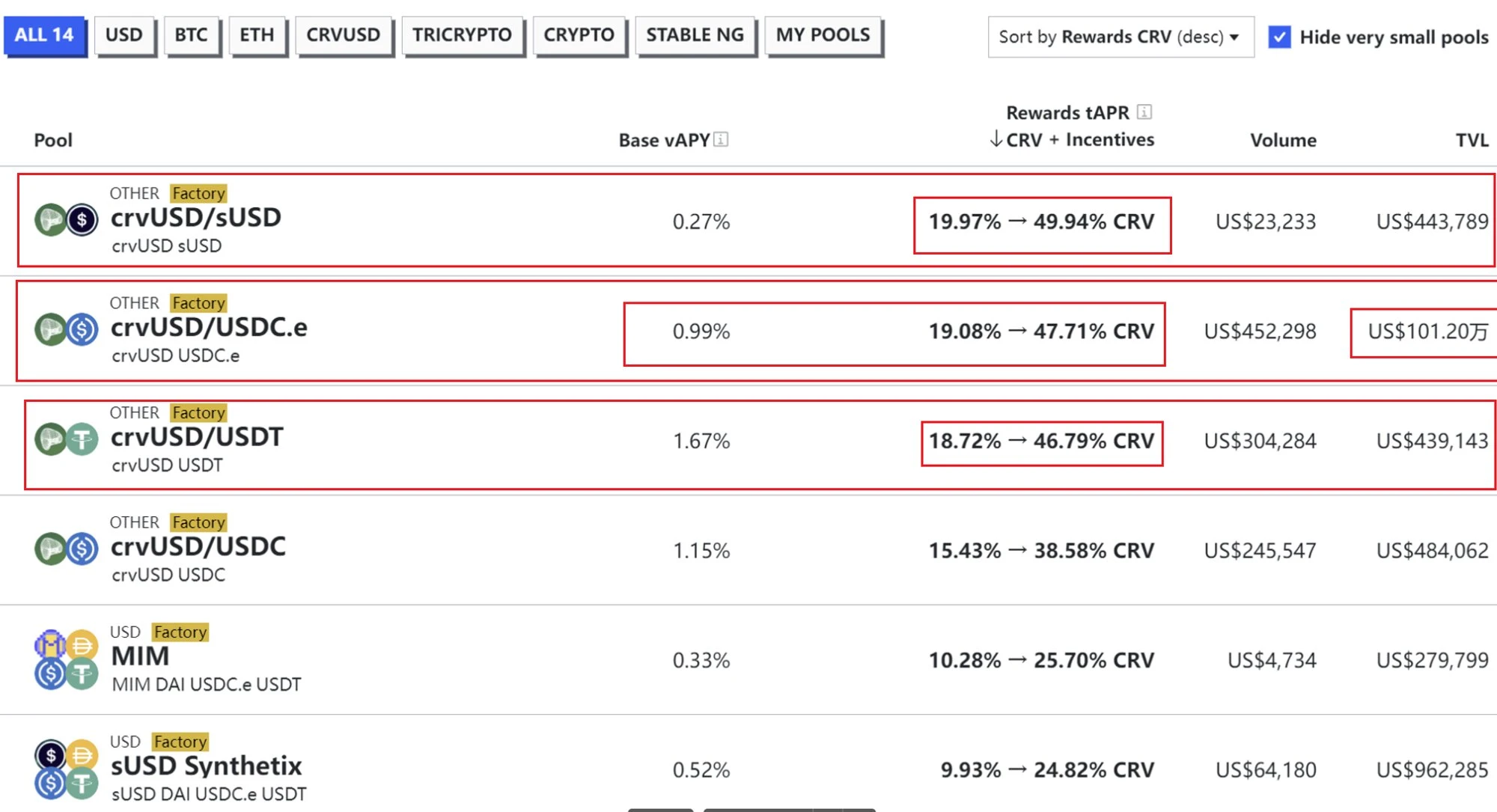

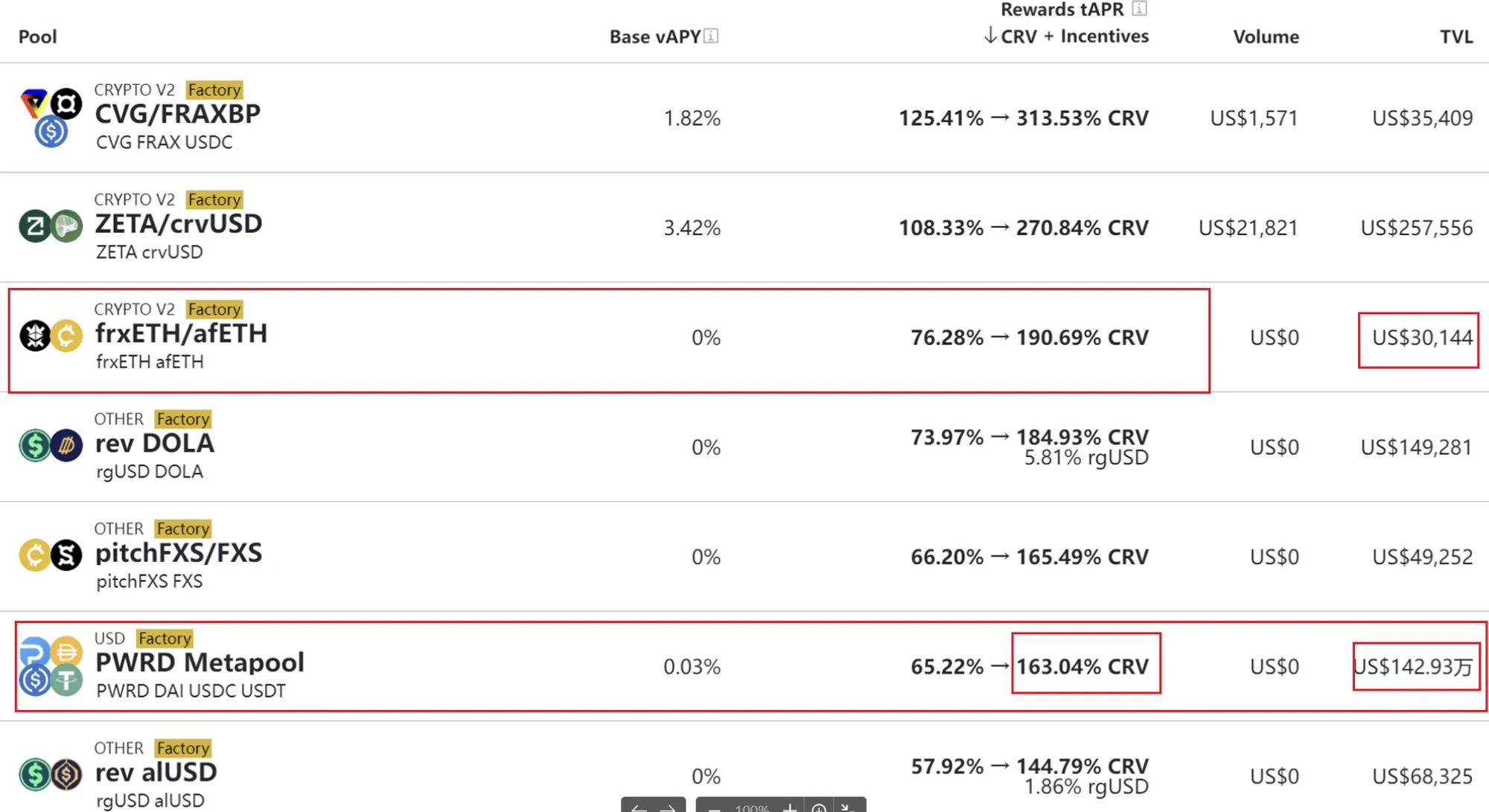

像 WETH/pufETH 还有 mstETH/wstETH 这种池子收益率也能超过 15%,crvUSD 相关的挖矿收益更是超过 20%,而且随时可退出,是不是比起单纯锁仓要更香呢。

再比如 Curve 上的稳定币 PWRD Metapool 四池,代币激励很高,池子较深,是可选池子之一。

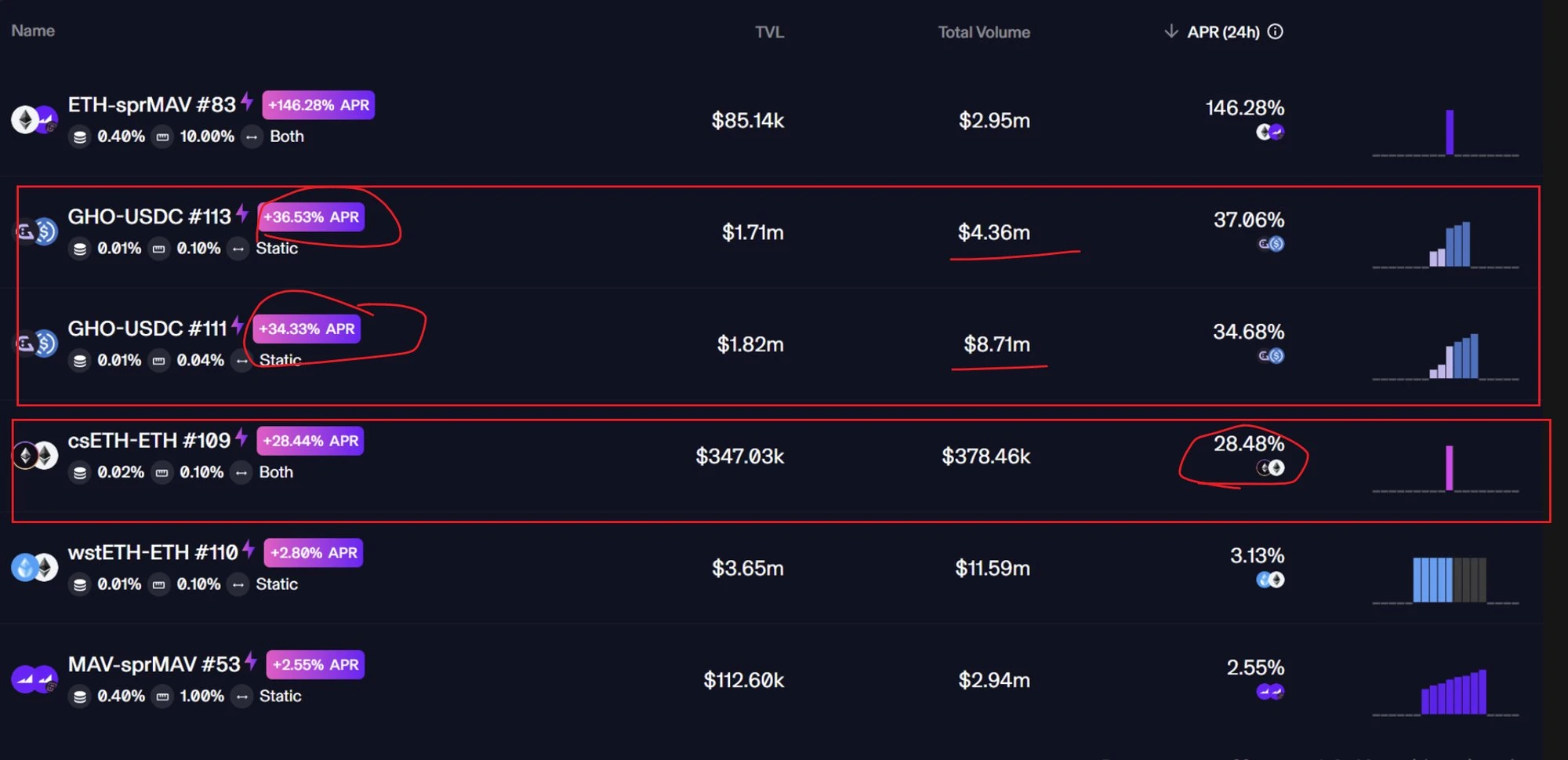

@mavprotocol也是典型的集中流动性的 DEX 之一,GHO 稳定币相关池子深度高,激励强,也是很适合散户参与的池子。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。