看大家在周日的情绪都比较乐观,那我就稍微泼点冷水,这并不代表我看空,而是周日的流动性实在是太低了,低到什么程度呢,我们可以看到最近24小时 #BTC 在链上的地址移动只有52,500余枚,这个数字和BTC在2023年初期的非常相似,而一个月以前这个数字最少要乘以2,甚至是上周的今天,这个数据也要乘以1.5以上,这代表的是越来越多的真实BTC持有者不愿意参与到换手中。

即便是BTC的价格从56,000美元回到了64,000美元的上方,反而是流动性越来越低,尤其是看持仓数据的时候是否依稀觉得似曾相识,因为最近一个月在65,000美元上下震荡的时候,BTC的持仓者走势大多数的情况下都是这样,早期获利和亏损的投资者对于当前的价格或者是更低的价格完全无动于衷,有小伙伴说是不是价格更低的时候这些投资者会有反应?

这我并不知道,但我知道在BTC跌到56,000美元的时候,持仓在63,000美元到68,000美元这个阶段的投资者并为出现大规模的离场,甚至可以说并未出现超过10%的换手数据!这可能才是跌到56,000美元就跌不动的原因之一,毕竟愿意离场的投资者太少了,所以即便是流动性不好,即便是购买力不足,但仍然跌不下去了,所以在目前也很难测试到更低价格时投资者的反应。

冷水就是在这里,虽然目前来看BTC的价格好像站稳了64,000美元,回到了一周以前的水平,上周的这个时候BTC的价格也是64,000美元,如果有小伙伴一周之内不看价格的话,会发现最近一周前和一周后自己的BTC都保持同样的收益,但这一周中已经有数亿美元的被动减持数据了,为什么会这样,除了流动性就是情绪。

已经过了还在说目前币市和传统风险市场完全无关的时候,也过了说币市和美国宏观政策无关的时候了,需要承认,美联储的态度就是风险市场的风向标,而当市场的流动性越低的时候,这个风向标带来的波动就越大。

而现在就是处于这样的一个阶段,因为预期美联储的动作而市场处于兴奋状态,但说不定什么时候又会因为新的变动市场又转换了态度,这谁说的好呢,这也不是我们任何一个人,或者是任何一个“狗庄”能左右的,甚至美联储这个最大的“狗庄”都很难估计到自己下一步要怎么走,所以我的态度仍然是

“在情绪驱动下的价格走势,涨了看涨,跌了看跌,未必是正确的。”看的在准,也抵不过一篇消息带动的利好或者利空。

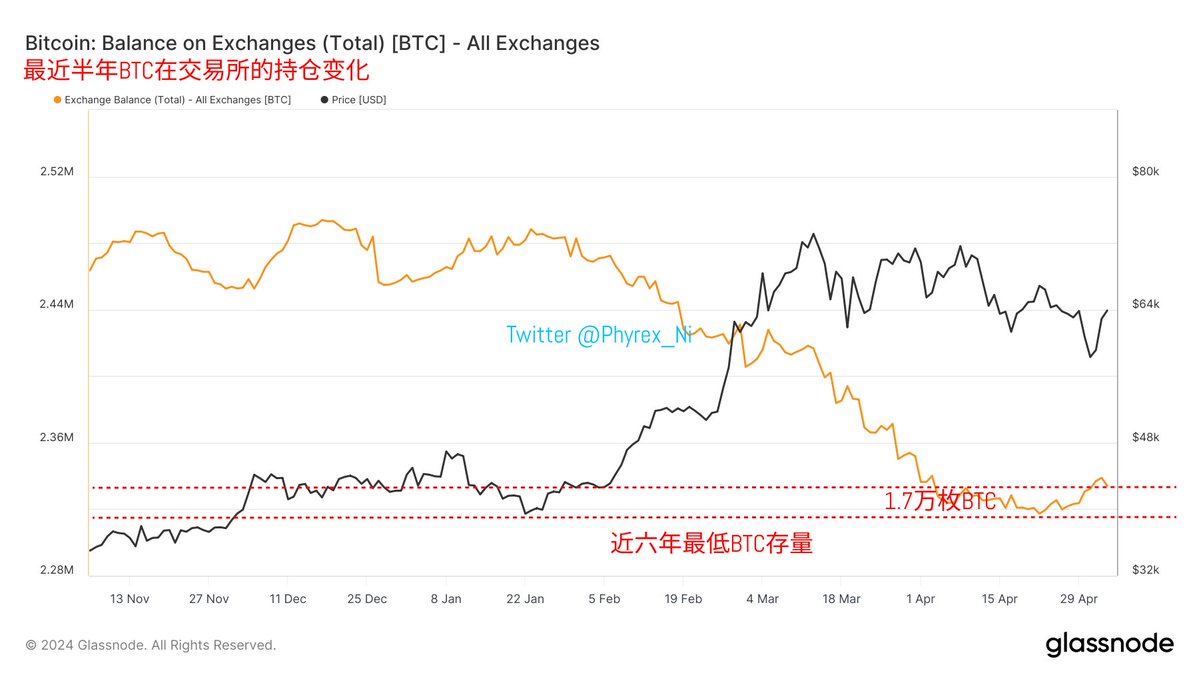

目前也有比价好的消息,虽然现在的流动性仍然不好,但随着情绪的上涨,交易所存量的 #BTC 再次开始下降,目前距离近六年的最低存量还有不足1.7万枚,如果这样的状态能继续保持到下周一美股开盘以后,那么BTC的价格会更加的稳定一些。

数据已更新,地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。