21年的时候,情况是这么个情况:

- 欧美和其他地方因为疫情,制造业不开工

- 同时欧美又印了海量的钱,把需求推高

- 因此21年兔子的制造业吃的饱饱,觉得自己强的吓人

略有些飘,要和美帝争平等地位。同时也开始搞类似教培、平台这些行业。包括温xx这个煞笔开始鼓吹人民经济。

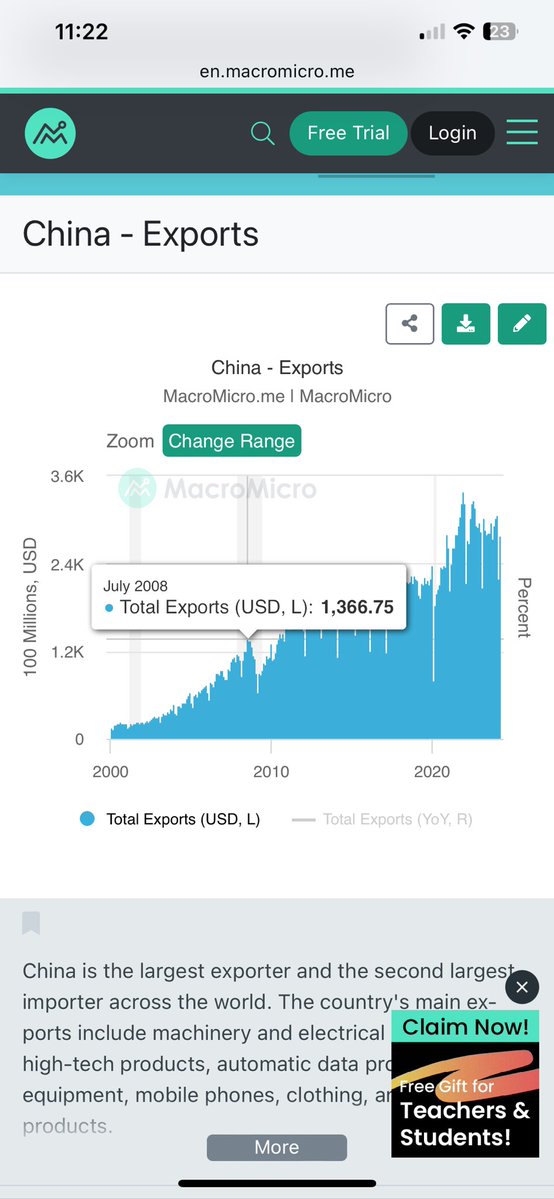

但是这种机缘巧合的出口增长到了2022年下半年就开始转为负增长,到了年底大约打回原有的趋势线(仍然高于疫情前)。后面外资往外走…

后面就回到开放的市场经济、欢迎外资的老路上来。

所以说,对周期研究还是很有意义的。牛市的时候容易过于乐观,熊市的时候又太过悲观。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。