找了一下这个图的出处,这个故事不是这么简单的。我们看三张图:

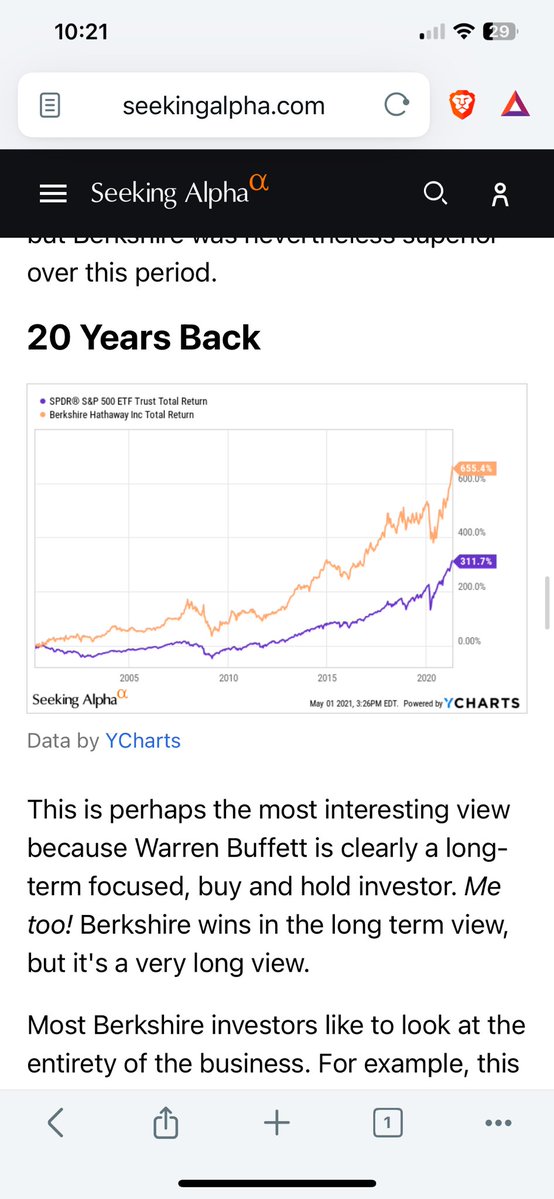

20年:bk超Snp

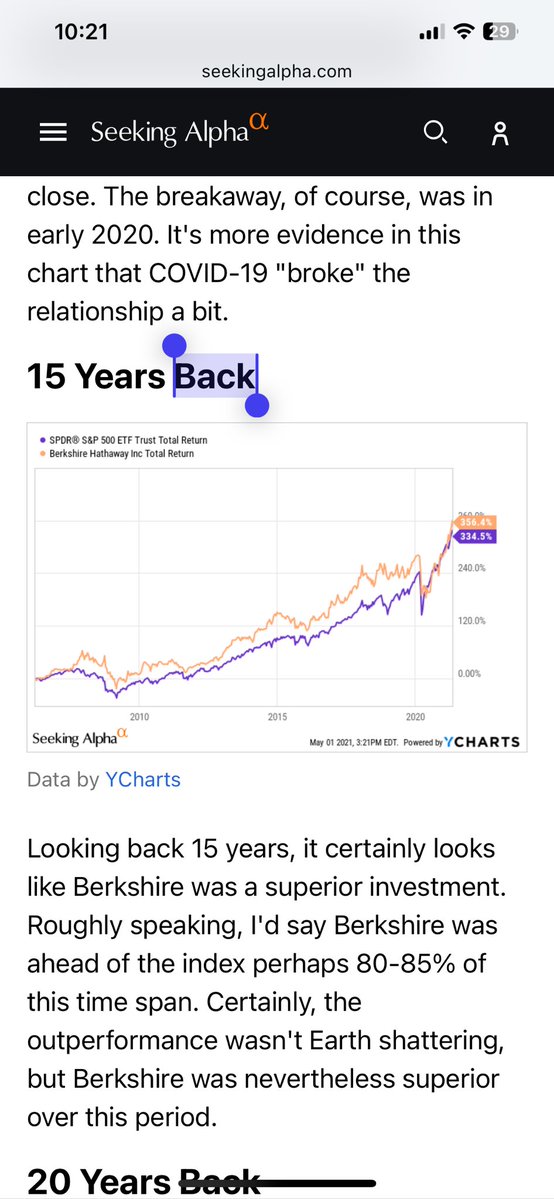

15年:打平(也就是下面这张)

5年:bk不如Snp ,差距主要是疫情后拉开的

所以这个故事就是这样:

00-10年,巴菲特做对了很多事情,回报远远超过Snp。我记得其中一个就是中石油,赚了很多。

巴菲特与Snp的差异主要是疫情后拉开的,这期间大家都很清楚,钱乱放,科技股大幅攀升。即使巴菲特当时也忍不住买了家做数据服务的云公司。

这个再往后看,也很难说。

结论:

价值投资信仰还在😂

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。