Lead: This month, the intensification of inflation in the United States, coupled with GDP falling short of expectations, has raised concerns in the market about "stagflation" in the US economy. Under such concerns, coupled with the impact of geopolitical conflicts, the capital market experienced a pullback this month. The US and Japanese stock markets experienced significant pullbacks, while Europe fared better, indicating that global investors are not worried about the so-called systemic risks in the global economy. Despite the volatility in the crypto market and the black swan event causing Bitcoin to drop below $60,000, a historic moment was reached on April 29th when the Hong Kong cryptocurrency ETF was approved, indicating that incremental funds are still entering the market and the market outlook is positive.

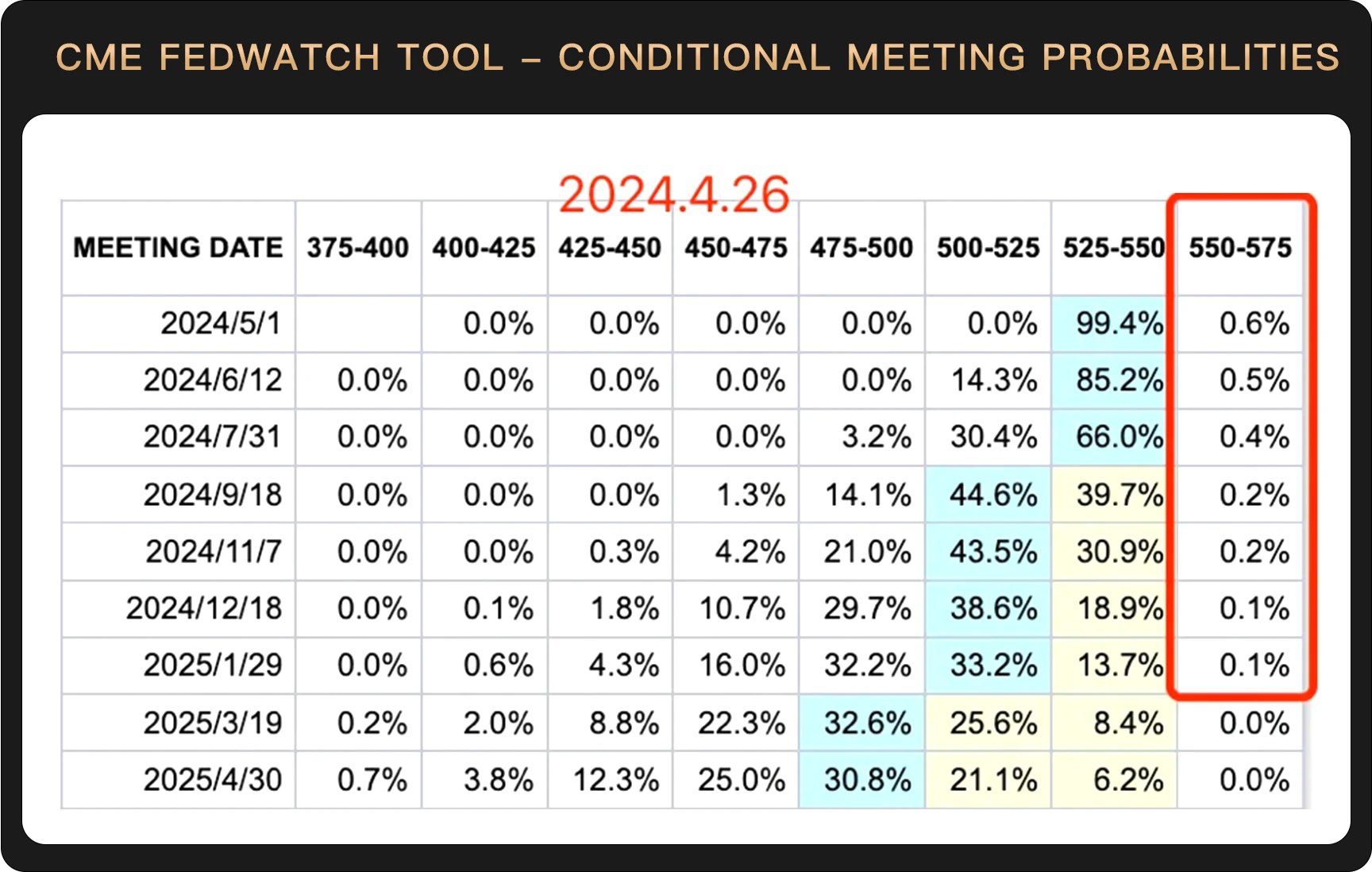

At the beginning of the year, as the Fed's rate cut expectations and the Consumer Price Index (CPI) continued to decline, concerns about inflation were put on hold. However, inflation data continued to rise, leading to a repeated decline in rate cut expectations. The CME FEDWATCH TOOL shows that the market still expects no rate cut in May, and even a very small number of people expect further rate hikes.

From the current data, it seems that the United States has entered a state of "stagflation" - high inflation but low economic growth. The US GDP grew by only 1.6% year-on-year in the first quarter, well below expectations, while the core PCE price index grew by 3.7% in the first quarter, exceeding expectations. In other words, even after excluding the recent surge in international commodity prices, inflation in the US remains very severe.

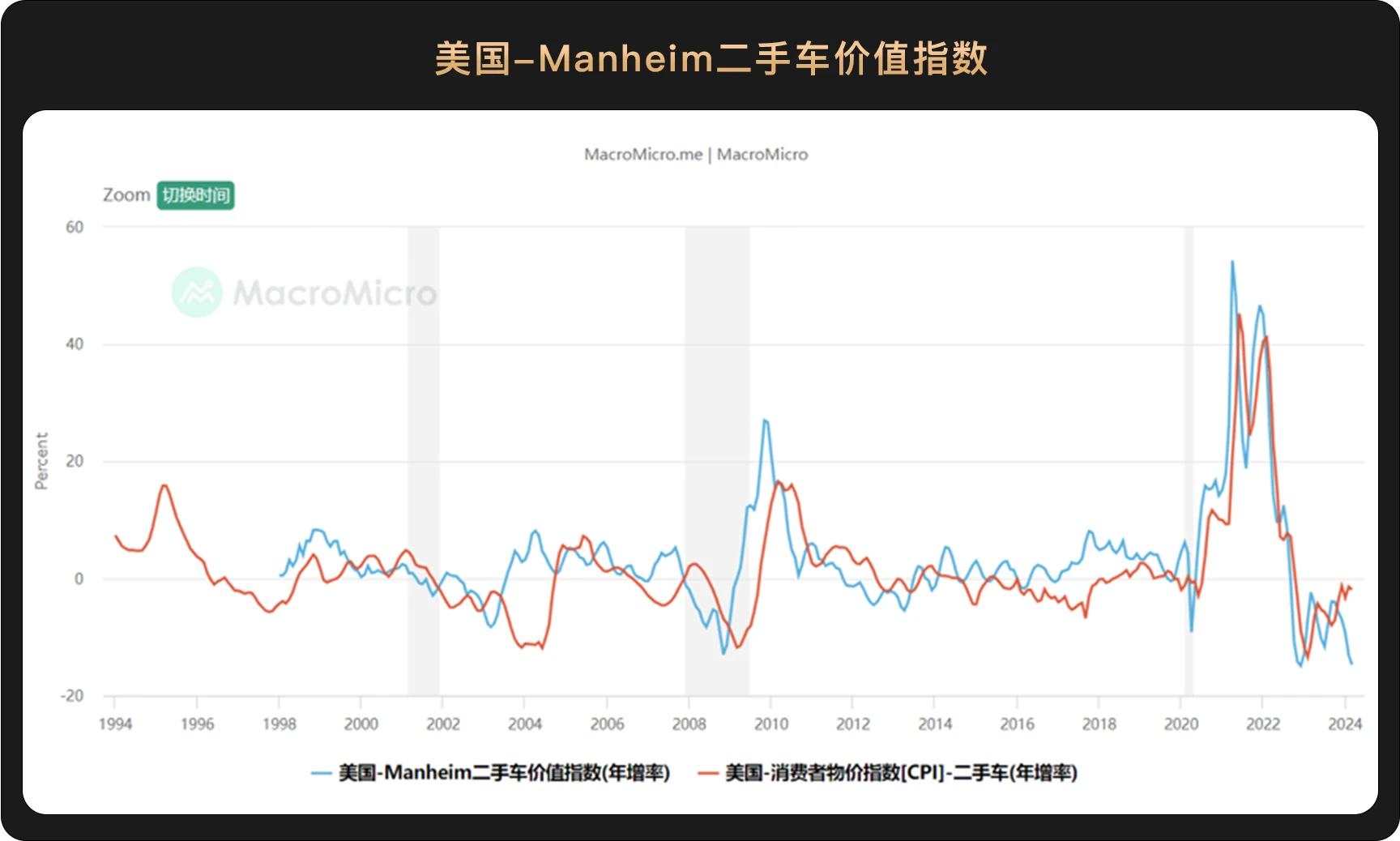

At the beginning of the year, the US economy presented a "high growth, low inflation" situation, and the "golden-haired girl" economic narrative became the mainstream narrative that global investors bet on. In just a few months, the situation has changed from "all is well" to "stagflation crisis," and the focus for the US going forward will be how to deal with the "inflation" issue. Currently, there is a very small part of the market that is even starting to bet on further rate hikes, but WealthBee believes that the likelihood of further rate hikes is small, and it will only delay the timing of rate cuts and reduce the number and basis points of rate cuts. The current inflation in the US is influenced by multiple factors such as upstream raw material prices, employment, and demand. With the subsequent rationalization of commodity prices, labor market rebalancing, and the continuation of the trend of falling used car prices, core inflation in the US will decline.

At present, the economic situation in the US is exactly what the Federal Reserve wants to see, and there are many ways to break the "wage-inflation" spiral, and it is not necessary to choose to continue raising interest rates, which would have a greater impact on the economy. This month, the yen and Japanese stocks experienced a significant drop. In this situation, international investors will sell the yen and buy back the US dollar, which may raise suspicions of US manipulation behind the scenes, and this will also help to tighten US dollar liquidity.

Overall, Federal Reserve officials are generally dovish and have not released a clear signal for further rate hikes, which may indicate that the US has certain policy tools to deal with inflation issues. In short, the US economy is indeed facing the difficult problem of inflation pressure at the current stage, causing some concerns in the market, but investors do not need to be overly panicked about the inflation issue.

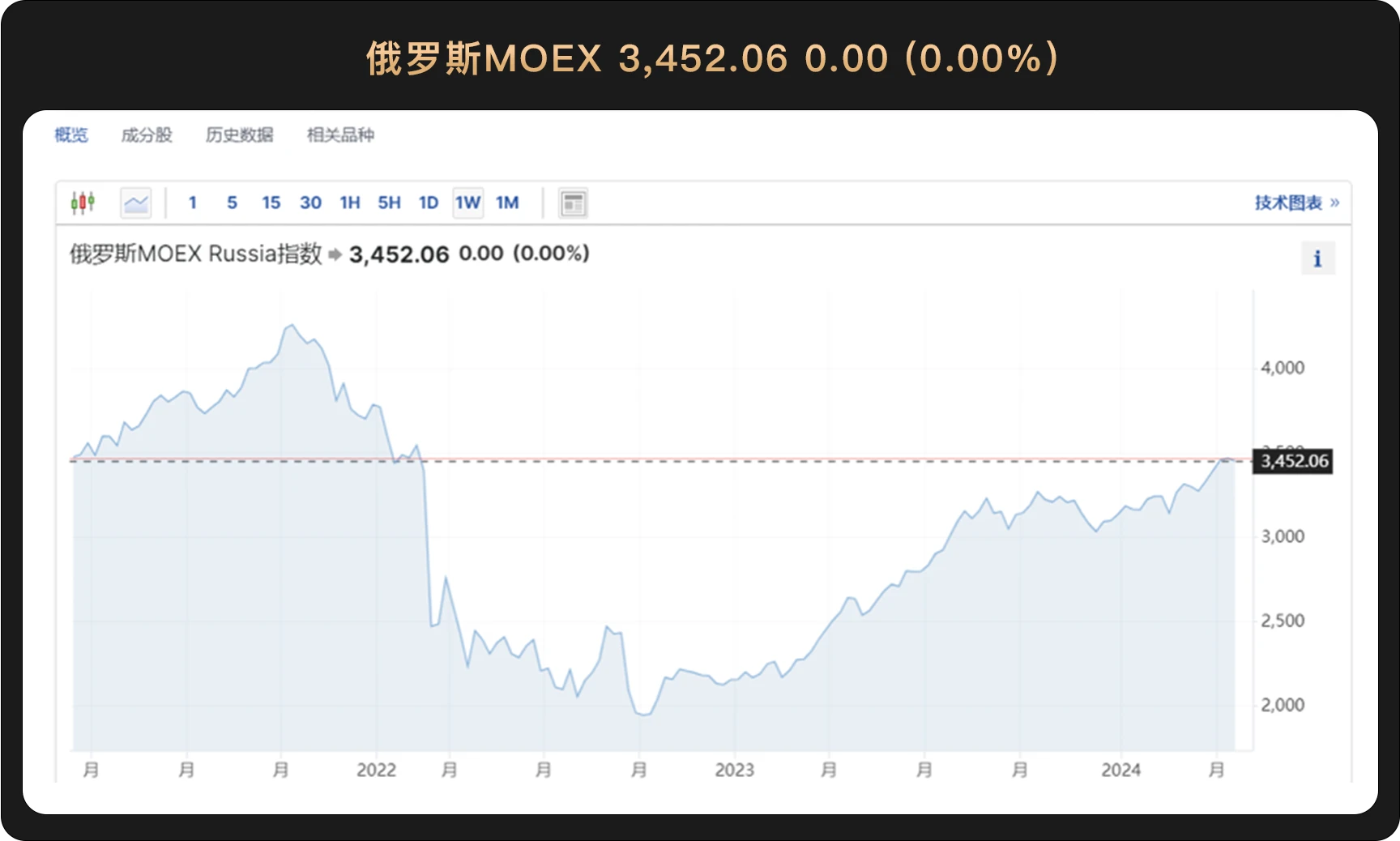

Additionally, there have been more geopolitical conflicts this month, which have also contributed to the volatility in the capital market. Currently, both Iran and Israel have shown relative restraint and there are no signs of further escalation of conflict. Moreover, in modern society, the likelihood of a large-scale war breaking out under the deterrence of major powers is extremely low, so the impact of geopolitical issues on the financial market is often sudden but short-lived. Even if a war were to break out between Russia and Ukraine and NATO, the country's stock market has almost recovered all its losses since the war. Therefore, the impact of the war this month is only a sudden variable.

After the US stock market's continuous "bull run" for 5 months, a significant adjustment has finally occurred - the Nasdaq index hit its lowest point at the 120-day moving average, and Nvidia (NVDA) experienced a 10% drop on April 19th.

The current trend of the US stock market more reflects the changes in rate cut expectations, with geopolitical conflicts being a secondary factor. The valuation of tech stocks is directly related to liquidity, and a delay in rate cut expectations will directly compress the valuation space of tech stocks. UBS downgraded its rating of the six major tech stocks in the US (Apple AAPL, Amazon AMZN, Alphabet, Meta, Microsoft MSFT, Nvidia NVDA) from "buy" to "neutral" this month, citing the sector's previously enjoyed profit momentum facing a slowdown and the disappearing momentum. However, UBS strategists also stated that this downgrade is a recognition of the "difficult comparison and cyclical constraints" faced by these stocks, rather than "based on predictions of valuation expansion or doubts about artificial intelligence."

UBS's reasoning is actually quite reasonable, as the valuations of the giants have already reflected future profit expectations under the influence of AI. If the giants were to experience another surge in the future, it would only be due to AI development exceeding market expectations once again.

In addition to the US, the Japanese stock market also experienced a significant pullback this month. The situation in Japan is mainly due to the recent crazy depreciation of the yen, leading investors to sell off Japanese assets. In addition, the yen is strongly correlated with the US dollar, and the delayed rate cut expectations of the Federal Reserve are also one of the important reasons for the recent volatility of the yen.

The less-than-satisfactory performance of the stock markets in the US and Japan has led some to worry that the US inflation issue may lead to a global financial crisis. WealthBee believes that it is still too early to draw such a conclusion, as apart from the US and Japan, the stock markets of other countries have not experienced significant pullbacks: the French CAC40 and German DAX have not experienced major pullbacks and remain strong; the Indian Mumbai Sensex30 has been fluctuating above 70,000 points. The recent pullback in the US stock market is likely just a sudden reaction to changes in expectations and black swan events, and there is no clear systemic risk.

The trend of the crypto market this month has been less than satisfactory, with the price of BTC dropping below $60,000 and the price of ETH dropping below $2,800. Since reaching a new high in mid-March, Bitcoin has entered a period of adjustment, which has lasted for a month and a half. During this period, black swan events such as geopolitical conflicts and disappointing US economic data have added to the woes of the already lackluster crypto market, and the mid-April downturn was caused by the Middle East geopolitical conflict.

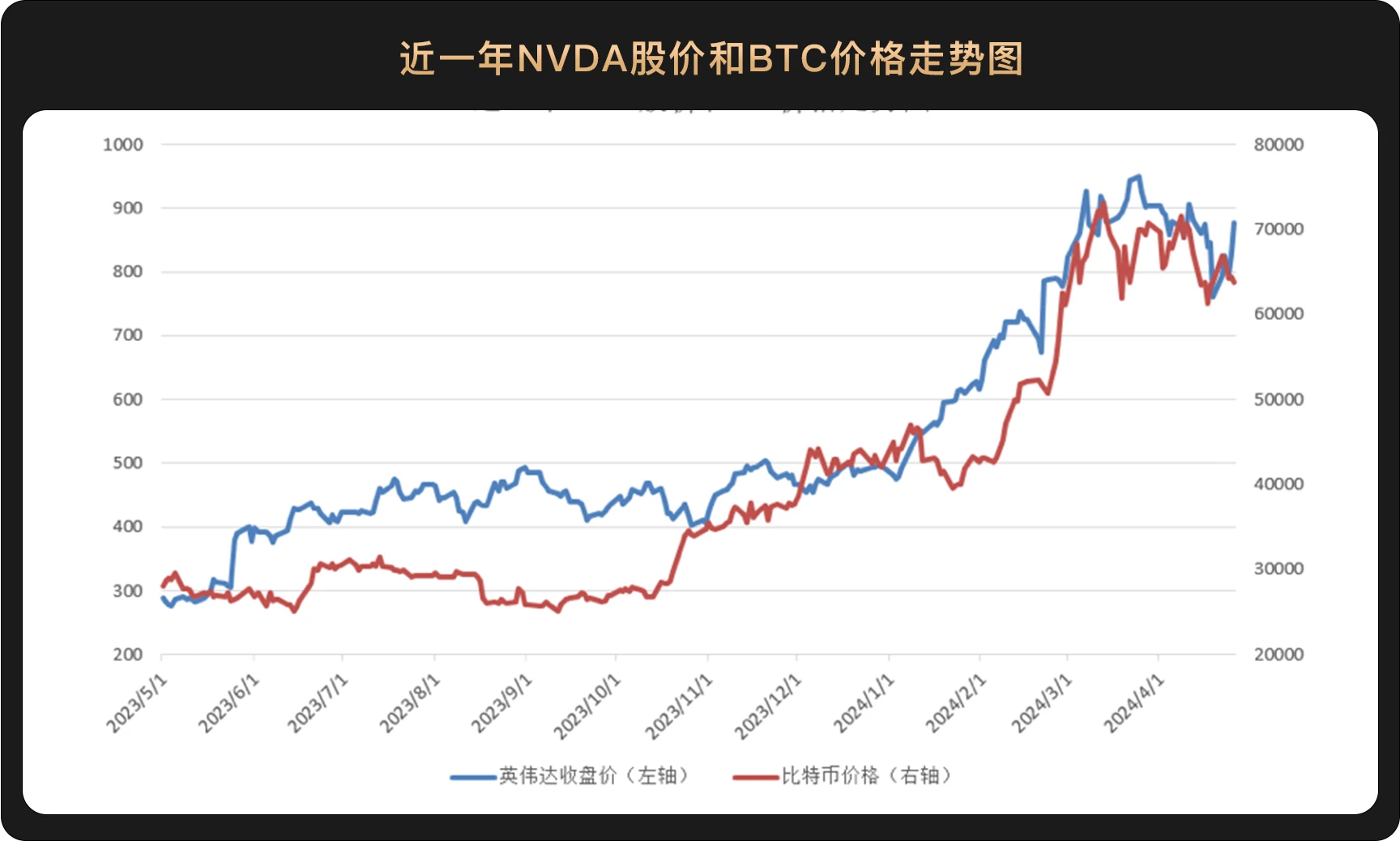

Currently, the crypto market has entered a state strongly correlated with traditional assets - the price of Bitcoin and the stock price of Nvidia (NVDA) have shown an astonishing correlation over the past year. This strong correlation is very intriguing, and there is currently no recognized explanation.

If Bitcoin is indeed considered "digital gold" by the market consensus, then theoretically its trend should be related to gold, and the corresponding trend in response to geopolitical conflicts should be a surge rather than a drop. From the price trend of gold, it can be seen that gold hit a historic high during the days of the conflict between Iran and Israel, fully demonstrating the safe-haven properties of gold.

This situation may indicate that the trend of Bitcoin is indeed now tied to US ETFs. Throughout April, ETFs have shown a trend of net outflows.

This trend of being tied to the assets of a single country is not particularly reasonable. Bitcoin's most notable decentralized attribute has become a consensus value storage tool for everyone, with no one having the right to issue or destroy Bitcoin. This different attribute from fiat currency has become a breath of fresh air in the era of credit currency. However, currently, a single country's ETF already has the pricing power of Bitcoin, and although it cannot create or destroy it, it does deviate to some extent from its decentralized attribute.

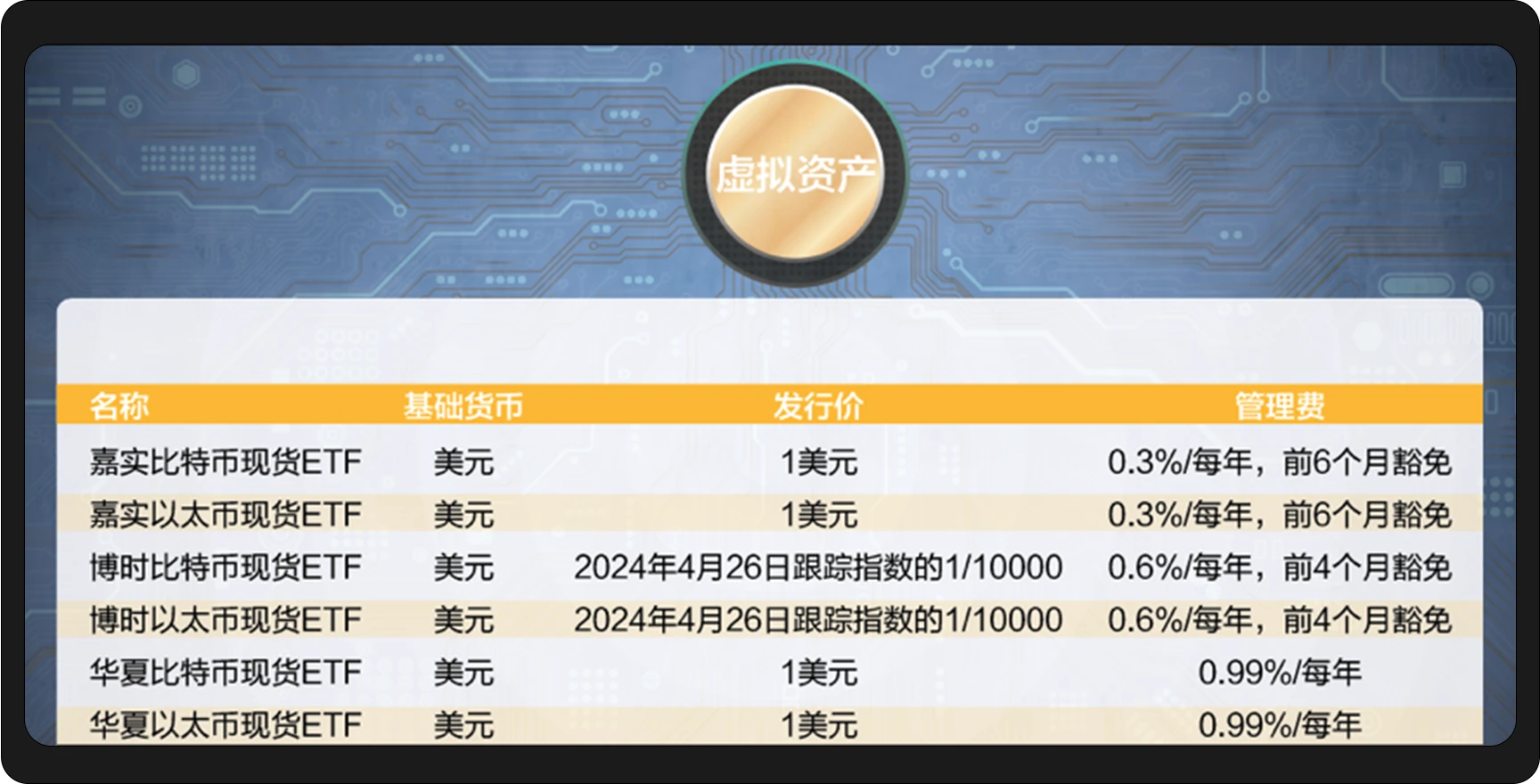

Fortunately, following the United States, on April 29th, Hong Kong, China officially approved 6 virtual asset spot ETFs, including 3 Bitcoin ETFs and 3 Ethereum ETFs. These ETF products differ in product fee structure, trading efficiency, and issuance strategy, providing investors with diversified choices, and they are already ahead of the United States in terms of categories. The United States has not yet approved Ethereum spot ETFs. Institutions predict that as the market's interest in these innovative ETFs grows, these six ETFs will bring an additional $1 billion in incremental funds to the crypto market.

The latest news also shows that Australia will launch a Bitcoin ETF by the end of this year.

This multi-point ETF listing is somewhat similar to the early distribution of mines and mining machines around the world, which can fully maintain the decentralized attribute of Bitcoin in the secondary market - no institution or country has the right to price Bitcoin alone.

Therefore, as more and more institutions in various countries or regions list Bitcoin spot ETFs, the holdings of whales will become more and more diversified. At that time, in the secondary market, the pricing power of Bitcoin will also demonstrate its decentralized characteristics, possibly returning to the intrinsic value of digital gold.

Conclusion: In April, hawkish remarks from the Federal Reserve and geopolitical conflicts in the Middle East brought volatility to the capital market, but the strategic stability among nuclear powers provided a certain degree of security for the market. In terms of inflation suppression strategies, the Federal Reserve is actively addressing potential financial risks. Although the US and Japanese stock markets experienced pullbacks, there are no widespread signs of a financial crisis in global capital markets.

At this critical moment, financial innovation initiatives in the Asian market, especially in Hong Kong, are particularly important. The approval and upcoming listing of the Hong Kong Bitcoin ETF not only signify a major step in the cryptocurrency field in the Asian financial market but may also become a new trigger point for the global capital market. This development not only provides new asset allocation options for investors but may also drive the cryptocurrency market towards a more mature and standardized direction, heralding the birth of new investment opportunities and market trends, and is also driving the "decentralization" of Bitcoin pricing power in the secondary market.

Copyright statement: For reprinting, please contact the assistant on WeChat (WeChat ID: hir3po). Unauthorized reprinting or plagiarism will result in legal action.

Disclaimer: The market carries risks, and investment should be cautious. Readers should strictly comply with local laws and regulations when considering any opinions, viewpoints, or conclusions in this article. The above content does not constitute any investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。