交易理念:大周期看趋势,小周期找点位;

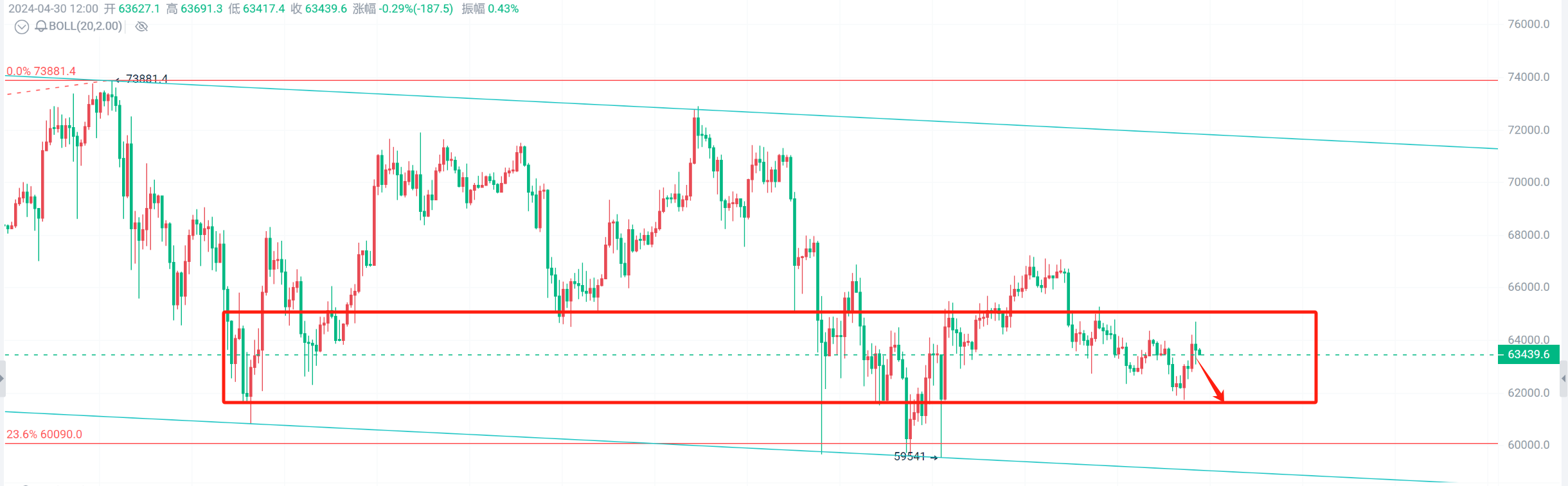

技术分析:比特币方面,日线级别布林带中轨再次承压回落,MACD均线平缓向下运行,空头量能继续微弱放量表现,KDJ线向下运行,4时线级别布林带平口运行,MACD均线向上运行,多头量能继续放量,KDJ线向上运行;以太坊方面各项技术指标基本与比特币基本同步!

综上来看,目前行情走势还是偏震荡,4时线级别布林带平口运行,日线级别布林带收口运行,预计行情还得震荡一两天,借助美联储利率决议来临,行情才会选择方向,届时也会给大家明确方向,昨日布局的空单策略也是小赚出局,高位空单建议继续持有,结合周线级别的空头趋势,期间操作建议还是以高空为主!

操作建议:

比特币63700-64200区域做空,目标62700-61700,防守64700!

以太坊3180-3210区域做空,目标3100-3050,防守3260!

策略具有时效性,具体以私下实时指导为准!

关注微信公众号允彦!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。