如果说2023年是牛市的起点,那么2024年一定是牛市的爆发点,而这一点和2020年至2021年的趋势很类似,但是2024年会更胜一筹。2024年初比特币生态逐渐迎来重大变化,铭文实现启航,现货ETF的通过,种种事件都在潜伏的推动币价上涨站上70000美元关口,甚是一度刷新2021年牛市新高。随着即将到来的“比特币减半事件”,市场愈发疯狂,散户情绪高涨,主流币和山寨币更是被捧上了天。作为散户的你,你是打算怎么迎接这史上最难得的破天富贵呢?

2024年1月11日,美国证监会正式批准了11支比特币现货ETF的申请,这无疑是足以载入比特币历史的里程碑时刻。比特币ETF的发行,意味着投资者可以通过传统的证券账户来持有和交易比特币,这就与传统的股票和基金投资别无二致。其次,证监会的正式批准会产生连锁反应,很大程度促进了加密货币市场的合法化。最后,也是最为重要的一点,即将到来的比特币减半(2024年4月17日)会成为导致比特币行情爆发的重要原因。加密货币市场利好不断,全球的散户都异常兴奋希望能在这一刻抓住财富的密码,早日实现财富自由。普通人的眼光和知觉还停留在观望,聪明的人早就已经布局并为之行动。你呢?心动了吗?行动了吗?

守得云开见月明,静待花开终有时。守的不仅仅是这震荡的行情,更是这煎熬的心。本周行情基本处于高位调整之中,上下波幅,除了偶尔插针,基本处于震荡。对于这样的行情,仍是那句话多空无错,只要不追涨杀跌,上下都有利润可图。昨天比特币和以太坊给出的多空单大获全胜,尤其是在美盘阶段再度抓取高位空。震荡行情,逢压力位或支撑位附近,稳准狠操作进场,最容易抓高点或者低点,对于交易你还会觉得难吗?什么样的行情就应该做什么单子,哪怕试错也不要出错(与行情对抗)。

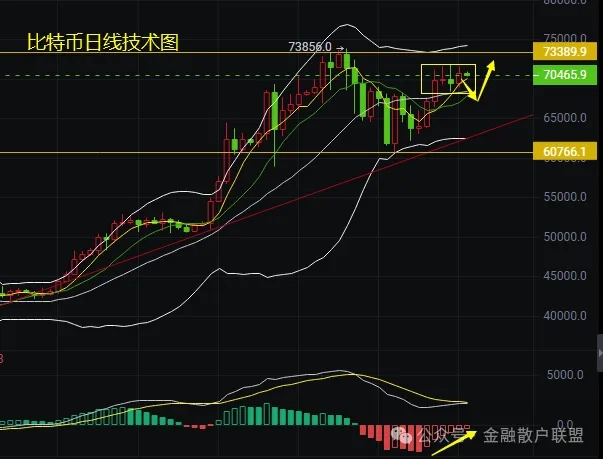

比特币行情分析:日线阴阳转换,币价位于上行通道之中运行,虽多次承压72000美元关口回落,但下方受两大均线给与支撑,多头依然强势。短线上看BOLL呈持平状态,预计比特币将继续维持调整。综上所述:随着比特币减半事件临近,市场情绪依然保持乐观。技术面上看比特币调整的势头仍将蔓延,尤其是在站稳70000美元关口之上,趋势倾向于多头。上方重点关注72000美元关口压力位,该位置也将是二次牛市的切入点。下方则重点关注68500美元支撑,一旦下破币价则会继续下探。周期内大区间看68500-72000美元区间,日区间看69500-72000美元区间,操作上保持主多辅空思路进行,如若破位顺势而为之。若对技术行情以及消息面解读把握不定或者持有套单的朋友皆可与金老师进行探讨。订阅公众号:金融散户联盟

短期上方压力位:72000/72500 短期下方支撑位:69500/69000

比特币实时操作策略:

1、回落在69500-69800美元区间附近做多,止损自行控制,目标70500-70700美元附近;

2、反弹在71800-72000美元区间附近做空,止损自行控制,目标70800-71000美元附近;

以太坊实时操作策略:

1、亚盘回落在3540美元附近做多,止损自行控制,目标3580-3600美元区间附近;

2、亚盘反弹在3600-3620美元附近做空,止损自行控制,目标3550-3570美元区间附近;

现货、合约、主流币、山寨币被套怎么办?

此时此刻定然会有一些套单的朋友在到处找老师,但金老师想说的是,给了你解套的方法,你确定自己能安然解套吗?你把握得住行情变动后的每一个点位吗?给你一个思路,你不如在心中确立一个方向。你的犹豫不决或许就会使自己错过最佳的点位。而套牢之后,无论如何处理都是被动的操作,解套固然是投资者必须掌握的基本功,但是投资者更应该把精力放在套牢之前,想办法提高分析技巧和买卖水平,尽可能减少被套牢的次数,始终占据资金和心态的主动。这才是最重要的,如果你是潜在加密投资者或已经是标准投资者,在投资的路途上如有套单锁单,看不懂趋势,不管你是做实仓,还是模拟,新手还是老手,套单,爆仓的都可以均可询笔者金宇辉。

在这个多空难测的市场上,仍然是有人赚的到钱,也有很多朋友做的不够理想,在该做空的时候,怕冲高,该做多的时候,怕回落,其实这就是人心,这就是技术,人心就是最大的技术。有时候你会知道,真正影响你的不是价格,而是心中想象的东西太过于多,金宇辉愿做你的引路人。趋势在心中,操作在指导,行情到来时,你若把握不住或不准,套单、锁单、亏损,可随时找笔者本人。

每一篇文章都是作者亲身感受,在加密货币市场这么多年遇到各种各样的朋友,由他们的故事为未遇见我的你给你带来不一样的经验之谈。坚持贯彻“大道至简、顺势而为、勿贪勿念、稳健执行”交易理念才能奔向财富的道路,专注比特币、以太坊等现货合约多年,用市场众多散户“血”的教训指导你前行。关注宇辉不迷路,宇辉带你创造财富!

本文出自笔者金宇辉,转载请注明出处,请尊重个人观点,请勿抄袭。盘中行情多变,文章具有时效性,滞后性,本文不对所包含内容的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,严格做好仓位控制,并请自行承担全部责任。最后祝大家投资愉快,天天快乐!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。