Coin Circle Ye Qiu: The narrowing of the 3.22 daily line closure is inevitable

Over the past week, there has been a performance of smashing the market, pulling the market, and wide-ranging warehouse shocks, which is inevitable in every bull market. Historical trends will tell you that selling at high levels and intentionally smashing the market are normal trends. The most important aspect is to participate decisively in a timely manner on the eve of the market change, in order to have the opportunity to grasp the timely market change and the profits it brings.

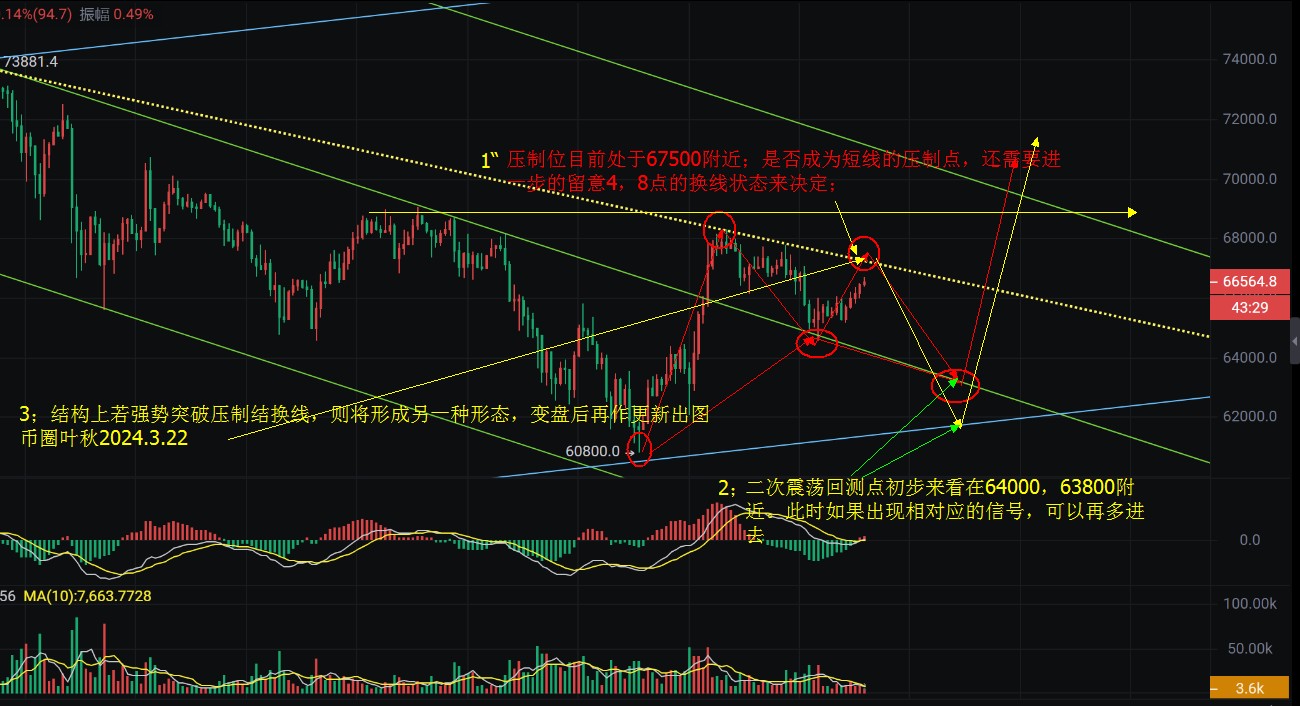

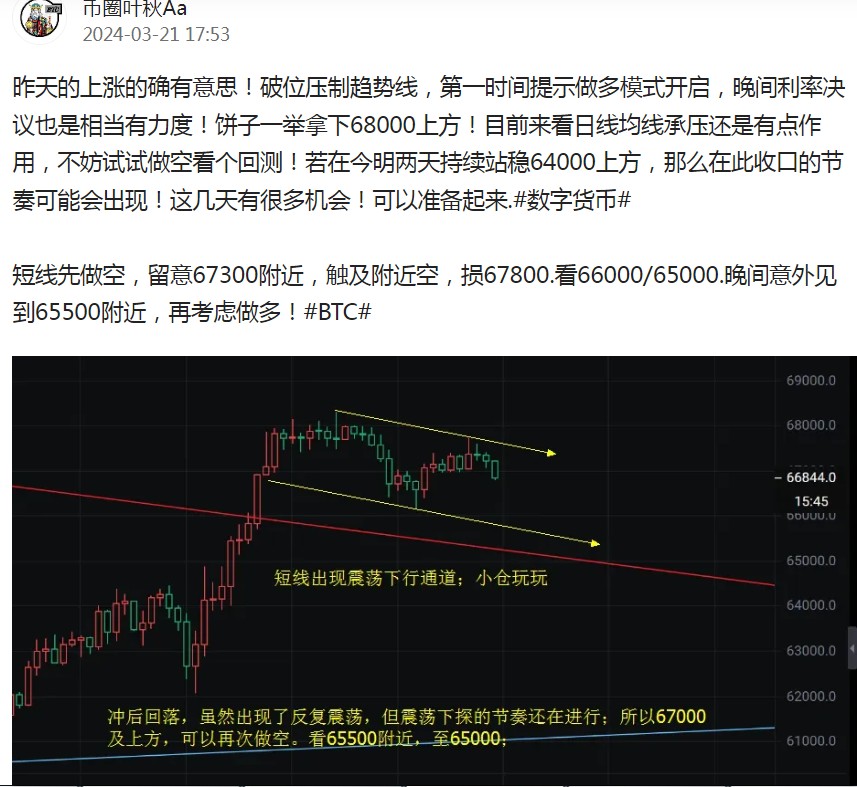

Looking back at yesterday's trend, it basically met expectations, and opened a short position near 67300 to target 65000, with the lowest reaching around 64500, perfectly positioned at the 50% retracement level. For the pullback below 61000 in this round, it is reasonable to see a rebound near the 50% retracement level, which also proves that once the short-term market stabilizes at the key support level, it will usher in an effective rebound trend. How to view the current market, whether it is the continuation of the reversal or another round of warehouse shocks after the rebound, requires careful analysis and cautious handling. First of all, there is suppression in the 4-hour cycle, and there was a retracement probe after midnight last night. Although there was a breakthrough near the middle rail of the Bollinger Bands, it once again stood above the middle rail at the end of the session, and formed a rebound with consecutive positive candles. Although the short-term moving averages have crossed, the consecutive positive candles are worth noting to prevent upward piercing behavior. Secondly, if the consecutive positive candles continue to rise and a small high point in the short-term appears, then from a logical perspective, the preliminary form of a harmonic pattern is beginning to emerge in the subsequent form. Therefore, the trend from now until midnight is relatively crucial, and it will definitely influence the formation of the pattern. Pay attention to the range of 67000 and above 67500. If there is a strong pullback and change above this range, the subsequent trend will once again refresh the high point and form a daily level extreme exploration trend. Otherwise, the oscillation and probe of the Z period will continue until the weekly change.

In terms of operation, maintain short positions around 67300 in the short term, with a stop loss above 67800 and a target of 65500-64000; for long positions, it is necessary to confirm once again whether the daily line can undergo an extreme probe to test support, paying attention to the 200-point range around 64000. For sharing only, please use caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。