盘面回顾

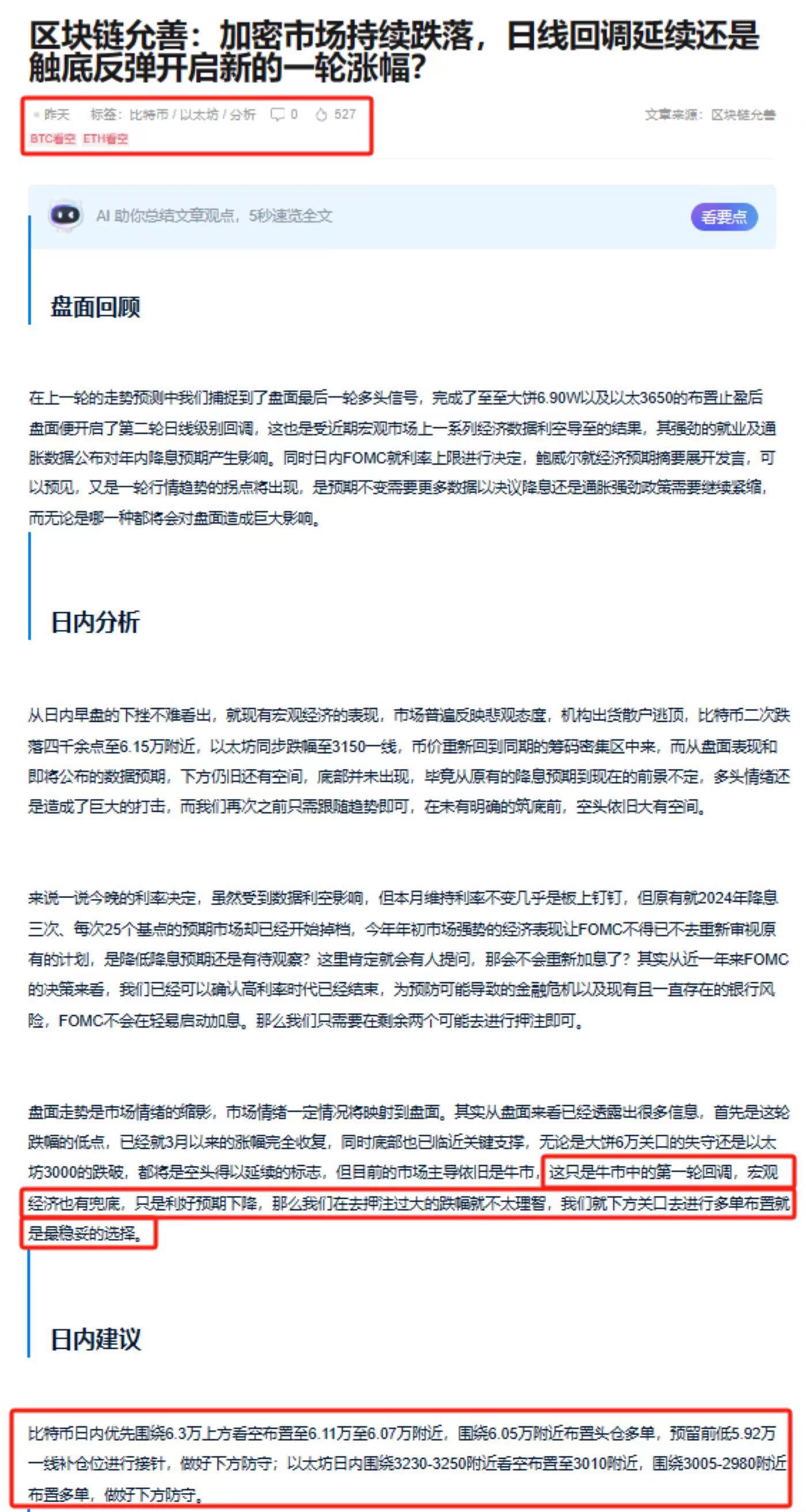

又是一轮精准的预测,在昨日早间我们就比特币以太坊后市走势同宏观趋势的影响做了全方面剖析,就日内FOMC利率决定及鲍威尔发言做出分析,就利率不变这一大前提展开预测,于比特币现价6.38万以太坊3250一线给出了明确做空思路,同时于6.1W一线实现精准止盈离场布置多单,以太坊同步3100一线完成止盈布置多单,并于后市的实盘布置种精准上看至比特币6.82万一线,两轮布置收获比特币近万点空间。

日内分析

此次利率决定不出意外的维持不变,在随后鲍威尔的发言中表示利率已见顶,并将继续维持当前利率水平,同时为降息敞开大门,也就1、2月份PCE及CPI利空数据归咎为季节性影响,无疑此次发言是彻头彻尾的鸽派言论,纳指期货日内再创历史新高,比特币重回6.8万关口创下自21年以来最大日涨幅,一切信息都指向牛市依旧未结束,不管你认同不认同,第二轮牛市将要来到了,同时到来的还有沉寂数月的山寨。

既然明确了多头趋势,我们在从盘面出发,此轮比特币成功完成了自3月19日以后的所有跌幅走出V返,中长线级别均线方向在跌幅期间夜并未发生拐头方向依旧朝上,小级别走势突破阻力,虽然目前临近4H级别MA60均线阻力,但突破只是时间问题,那么我们只需要判断行情预期在6.6w-6.8w区间震荡多长时间即可。

日内建议

比特币我们可以优先看空至6.6w-6.55w一线布置多单进仓,做好6.5w支撑下方防守即可;以太坊方面优先关注3460-3430一线布置多单,做好3400下方防守即可。

更多策略指导可关注允善微博,50W粉财经分析师:区块链允善

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。