3 月 13 日以太坊坎昆升級正式啟動,這不僅意味著網路功能和性能的重大躍升,Layer 2 賽道預期也將迎來爆炸性增長並進入低費時代。這一切,既源於以太坊本身性能的提升,也得益於升級後更低的交易費用和更高的處理速度。然而 Layer 2 解決方案的多樣化和複雜性也為 Layer 2 賽道帶來了前所未有的機遇和挑戰,可能徹底改寫 DeFi 領域格局。

一、以太坊 Layer 2 賽道概述

以太坊作為全球最大的去中心化應用平臺,其網路擁堵和交易費用高昂的問題日益凸顯,成為了制約其進一步發展的主要瓶頸。為了解決這些問題,Layer 2 技術應運而生,旨在不改變原有 Layer 1 安全性和去中心化特性的前提下,通過在以太坊之上構建附加的層來提高交易速度和降低成本,為以太坊生態的發展注入新的活力。具體地,Layer 2 技術是一系列旨在擴展以太坊主鏈容量和處理速度的解決方案的總稱,包括狀態通道、側鏈、Rollups 等多種形式。

1.狀態通道(State Channels)

狀態通道允許參與者在鏈下進行多次交易,僅在開始和結束時將狀態更新提交到主鏈。這種方法的優勢在於能夠顯著減少鏈上的交易次數,從而降低總體手續費並提升網路吞吐量。狀態通道最著名的實例是 Lightning Network,儘管它主要應用於比特幣網路,但同樣的概念也被應用於以太坊上,如 Raiden Network。狀態通道適合於那些參與者固定、交易頻繁的應用場景,如支付網路和遊戲。

2.側鏈(Sidechains)

側鏈是獨立於主鏈運行的區塊鏈,它通過雙向錨定機制與主鏈交換資產。側鏈可以擁有自己的共識機制和區塊參數,從而在保證安全性的同時提高交易處理速度。側鏈技術為以太坊網路提供了一個可擴展的解決方案,允許開發者創建具有特定功能的獨立區塊鏈,同時保持與以太坊生態的相容性。著名的側鏈專案包括 Polygon(之前的 Matic Network)和 xDAI Chain。側鏈提供了更高的靈活性和可定制性,適用於需要特定規則或性能要求的 DApp 開發。

3.Rollups

Rollups 是目前最受關注的 Layer 2 擴容技術之一,它通過在鏈外處理交易並最終將交易數據(而非所有交易的執行結果)打包提交到主鏈,以此大幅提升網路的處理能力。Rollups 因其高度的相容性和擴展性,成為了普遍適用於各種以太坊應用的優選方案,特別是對於 DeFi 和 NFT 市場等需要高吞吐量和低交易費用的場景。Rollups 分為 Optimistic Rollups 和 ZK Rollups:

Optimistic Rollups:這種方案假設所有交易默認有效,僅在有人提出質疑時才進行驗證。它們通過延遲交易最終確定性的方法來減少鏈上計算,從而實現擴容。Optimism、Arbitrum 以及 Blast 都是知名的 Optimistic Rollups 專案。

ZK Rollups:ZK Rollups 利用零知識證明來驗證交易的有效性,允許即時確定交易而無需等待挑戰窗口。它們通過將計算和狀態存儲移至鏈下,僅在鏈上存儲驗證資訊,有效減輕了主鏈的負擔。Starknet 和 zkSync 是 ZK Rollups 技術的代表。

Hybrid Rollups 是由 Metis 提出的一種新的 Rollup 方案,它採用了結合 OP Rollup 和 ZKPs Rollup 的技術架構,在保持 OP Rollup 高效處理交易的同時,利用 ZKP 技術減少欺詐和錯誤交易的風險。

二、以太坊 Layer 2 賽道的發展現狀

目前,多個 Layer 2 專案已經進入到了實際應用階段,其中 Optimism 和 Arbitrum 作為 Optimistic Rollups 解決方案的代表,以及 Starknet 和 zkSync 作為 ZK Rollups 解決方案的代表,已經吸引了大量的開發者和用戶。市場對這些 Layer 2 解決方案的需求強烈,伴隨著這些專案的快速發展,以太坊生態正在經歷一次前所未有的擴張。

隨著坎昆升級的啟動, 3 月 14 日 zkSync 宣佈成為首個使用 Blob 的 L2,更多專案將在未來幾天跟進。在使用 Blob 之前,zkSync Era 排序器(sequencer)使用 Calldata 成本為 0.11 ETH 左右,而在使用 Blob 之後,其成本降至 0.013 ETH 左右,降幅約為 88% 。隨後 Starknet 也宣佈支持 blob 交易,實際 Gas 費降低至 0.01 美元。

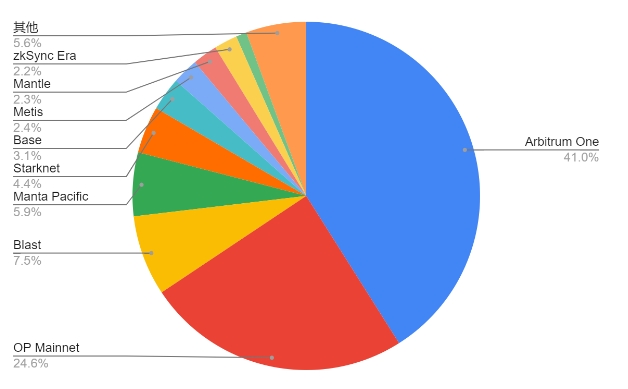

根據L2 BEAT 數據,截至 2024 年 3 月 14 日,以太坊 Layer 2 市值已達 390 億美元。其中,Optimism 和 Arbitrum 兩大 OP Rollup 方案佔據超過 65% 的市場份額,且排名前 10 的專案中僅有 Starknet、zkSync Era 和 dYdX v3 三個專案為 ZK Rollup,這說明 OP Rollup 依然是當前市場的主流選擇。

市值排名 Top 10 以太坊 Layer 2 專案

三、坎昆升級背景下 Layer 2 賽道的投資機會

隨著以太坊坎昆升級的進行,Layer 2 龍頭專案及其網路上應用、Optimism 分叉、ZK Rollup 專案、轉向 ZK 技術的 Polygon 等專案預計將出現投資機會。

1.Layer 2 龍頭:Arbitrum 和 Optimism 作為當前總鎖倉量(TVL)最高和用戶最多的L2平臺,擁有強大的先發優勢和生態正統性。這兩個平臺已經構建了較為穩固的生態護城河,是坎昆升級的核心標的。Arbitrum 和 Optimism 的成功不僅在於技術實力,還在於它們能夠吸引大量的開發者和專案入駐,形成了良好的生態迴圈。

2.龍頭應用:GMX、RDNT、Magic 作為 Arbitrum 生態中的重要應用,以及 Velo、Snx 作為 Optimism 生態的關鍵專案,都獲得了各自L2平臺的支持。這些應用在L2爆發的同時,也會推動自身生態的增長。特別是 DeFi 和 NFT 領域的應用,隨著用戶的增加和交易量的提升,有望實現快速發展。

3.Polygon:雖然 Polygon 主要以側鏈身份存在,並擁有自己的獨立共識,但它也推出了幾個基於 ZK 技術的 Layer 2 解決方案,例如 Polygon ZKEVM。Polygon 的這一轉向,顯示了其擁抱以太坊L2生態,同時展示了強大的技術實力和市場推動力。

4.ZK Rollup 應用專案:StarkNet 是 StarkWare Ltd 發佈的 ZK Rollup 協議,非 EVM 相容,以自研 Cairo 作為開發語言。Starknet 2 月 20 日推出代幣,成為首個發幣的 ZK 賽道核心專案,具有較強的出圈效應,也是目前 Layer 2 增長最快的網路。此外,Loopring 和 Immutable X 作為較早推出的專案,也具備一定的市場認可度和用戶基礎。

5.Optimism 分叉:Blast 網路能夠為用戶提供 ETH 和穩定幣的原生收益,以及空投獎勵和邀請制的社交裂變機制,這些都是其他 L2 網路所沒有的。Metis 是 Optimism 最早的分叉專案,最大的亮點是其為首個成功實現排序器去中心化的 Optimistic Rollup。

四、以太坊 Layer 2 賽道風險與挑戰

儘管 Layer 2 技術提供了巨大的潛力和機會,但仍面臨著一系列挑戰和投資風險,投資者在考慮投資 Layer 2 專案時,需要全面評估這些風險因素。

1.用戶體驗不佳:Optimistic Rollup 用戶可能需要等待長達一周時間從 Layer 2 提取資金回以太坊主網,這嚴重影響用戶體驗。ZK 網路雖然提現時間更短,但因技術仍處於初期階段,存在穩定性問題和較高的使用成本。

2.中心化風險:Layer 2 解決方案為提升效率,有時犧牲了去中心化原則,尤其是在交易執行層採用中心化排序器節點時,引發審查和干預的擔憂。

3.擴展性與網路穩定性挑戰:隨著對 DeFi 效率和可擴展性需求的增長,Layer 2 生態迅速擴展,帶來了網路穩定性和處理能力的挑戰。

4.市場份額分佈不均:儘管 Arbitrum 和 Optimism 佔據較大市場份額,但新興專案如 Blast、Manta 等正逐步增加市場份額,市場競爭加劇。

5.安全性與隱私保護需求:必須確保 Layer 2 解決方案與以太坊的安全性共用不降低,在提升交易效率的同時,不犧牲安全性和用戶隱私。

五、以太坊 Layer 2 賽道前景展望

未來隨著以太坊 2.0 的逐步推進和 Layer 2 技術的不斷創新,Layer 2 賽道有望迎來更加廣闊的發展空間,不僅為現有的 DeFi 和 NFT 領域提供了更強的基礎,也為未來的加密應用開闢了新的可能性。

1.技術升級與 Layer 2 多樣化:隨著坎昆升級的推進和 EIP-4844 的提出,Layer 2 技術正迎來重大的發展機遇,直接促進 Layer 2 解決方案的多樣化和發展。可以重點關注 Optimistic Rollups 和 ZK Rollups 領域的先行者,如 Optimism、Arbitrum、zkSync 和 StarkWare 等及一些創新解決方案的發展。

2.資本市場的關注:資本的關注和投資對於 Layer 2 專案的成長至關重要,眾多投資者和風險資本正在積極尋找有潛力的 Layer 2 專案進行投資。從 Metis、Boba、Aztec 到 zkSwap 和 zkSpace,這些專案因為能夠提供更低的上鏈費用和更豐富的生態系統而受益,成為投資者的關注焦點。

3.DeFi 和 NFT 的進一步擴展:Layer 2 技術的成熟將為 DeFi 和 NFT 等領域提供更高效、低成本的解決方案,進而吸引更多用戶參與。這不僅意味著現有 DeFi 和 NFT 專案將獲得更大的發展空間,也為新的創意和創新提供了平臺。例如,Layer 2 技術可以使遊戲和社交應用在去中心化的環境中以前所未有的方式運行,創造出全新的用戶體驗和商業模式。

4.數據可用性層(DA 層)的新機遇:Blob 數據的短期存儲限制和對歷史數據調用的需求將推動去中心化存儲協議的發展,為 Layer 2 擴容方案提供支持。這意味著投資者應當關注那些在去中心化存儲解決方案如 IPFS、Arweave 和 Filecoin 上有所佈局的專案,因為它們在數據可用性層面將扮演越來越重要的角色。

5.RaaS 賽道的競爭與合作:定制化的 Rollup-as-a-Service(RaaS)提供了一個充滿機遇的市場。基於 ZK 的 RaaS 由於其低成本和高定制化的優勢可能長期佔據競爭優勢。同時,基於 OP 的 RaaS 如 Optimism 和 Arbitrum 憑藉快速搭建生態的能力在短期內吸引了大量開發者和用戶。投資者應關注這一領域內部的競爭動態以及各個專案如何利用 EIP-4844 等技術進步來提升自身的服務和產品。

總體而言,儘管面臨挑戰和投資風險,以太坊 Layer 2 賽道的前景依然被廣泛看好。隨著技術的成熟、專案的推進和生態的建設,Layer 2 有望在不久的將來為以太坊乃至整個加密貨幣世界帶來更加高效、安全、可擴展的解決方案。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。