前天在香港线下活动分享,主持人叫我带点Alpha给大家,我毫不犹豫的推荐了 $OLAS , 当时的币价也在 5块多,逢人便叫留意这个币,今天涨到快 $7.3 ,距离新高一步之遥,也算是现场发红包,那到底他们是做什么的?

1)@autonolas 简介:

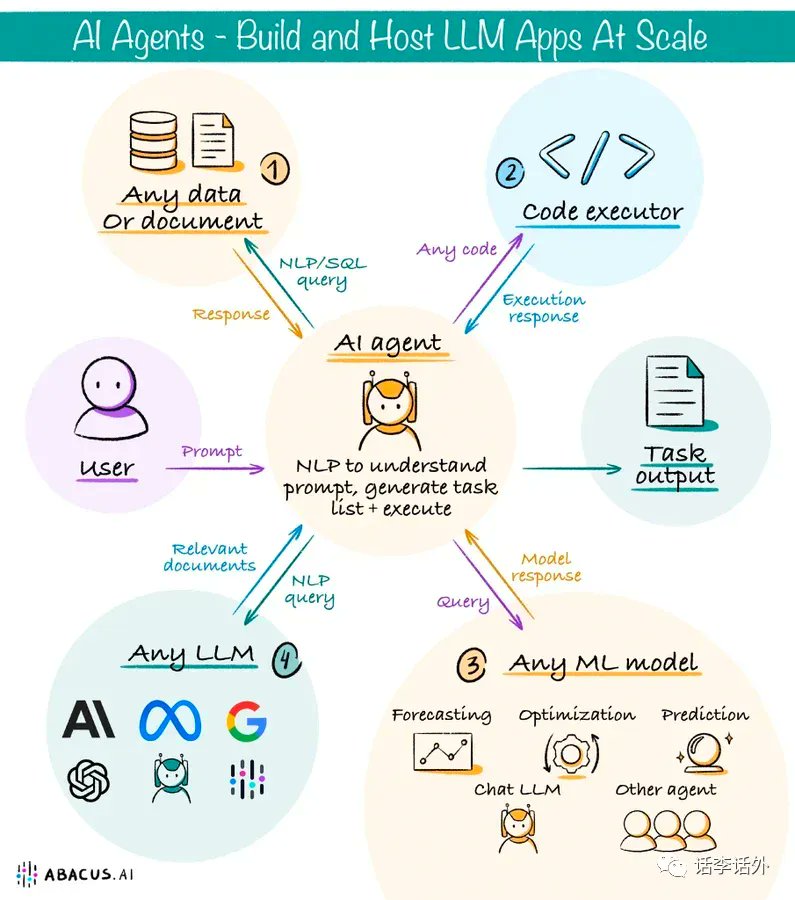

Autonolas 是一个专为加密领域设计的平台,它提供了一个 AI 代理开发工具包,帮助开发者更容易地完成各种任务。这个平台旨在让开发流程变得更加简单直接。核心目标是弥合链上和链下世界之间的差距,从而实现更无缝、高效和可扩展的方法来在 Dapp 中利用外部资料和服务。

Autonolas 有三个主要部分:开发者工具包、一套保护软件和奖励贡献的智能合约体系,以及一个管理生态系统决策的治理结构。它们提供了独特的服务,例如扩展智能合约的功能,这是其他平台所不具备的。被认为是比智能合约还要创新的项目。

2)团队背景 & 融资情况:

Autonolas 的团队成员包括16人,首席执行官 David Minarsch 是剑桥大学毕业生,曾是 https://t.co/0QOVOYoGSW 团队的一员,曾在 $FET 负责AI代理工作。

最新的信息是开发团队 Valory 在2022年完成了400万美元的融资,这次融资由 True Ventures 领投,其他投资者也参与了投资。

3)市场价值

现在,$OLAS 的代币价格大约是 7.3 USDT,流通市值约为3.1亿美元。与市值大约45亿美元的 $TAO 和 $FET 相比, $OLAS 还有很大的增长潜力。(假设在 AI 浪潮继续的情况下)。

4)与 Fetch 的区别

$FET 和 $OLAS 都允许部署AI代理,两者都使用自主经济代理框架。 $OLAS 的创始人 David Minarsch 曾是 $FET 的成员。两者的不同在于,$FET 更专注于自动化任务的部署来提升效率,而 $OLAS 着重于AI代理的共同所有权和链下操作的自主服务。 $OLAS 提供的是一个更广泛的应用程序和多代理任务的工具包,而 $FET 专注于单一的代理任务,如预订服务或业务查找等。

5)技术特色:

Autonolas 利用其技术,将AI融合到web3中,不仅支持应用的建设和发展,还能让开发者在此过程中获得经济上的回报。这种模式将代码的实用性和代币价值紧密联系,鼓励创新。

在更广泛的使用场景中,Autonolas 的AI代理在加密项目的各个流程都能派上用场,无论是大型代码操作还是细节流程管理。更重要的是,Autonolas 不受限于特定区块链,并正考虑扩展到其他平台,如Arbitrum。同时,Autonolas 通过API与TAO网络链接,使用 Bittensor 的去中心化AI模型,形成相互补充。

Autonolas 还致力于在链下释放服务潜力,创建了可以自由在链上和链下交互的服务。这扩大了智能合约的功能范围,允许无需人工介入地与链下世界互动,打通 Web2 和 Web3 的隔阂。

Autonolas 的兼容性和链下扩展能力,使其成为AI领域的关键力量。它不仅能丰富自身的工具和产品,还能为其他项目提供增值服务,同时将AI代理的范围扩展到更广阔的领域。

6)代币经济和分配:

他们的代币经济学非常复杂,在未来十年内,Autonolas 计划发行总计10亿个 $OLAS 代币,目前尚有大约4.6亿未发行。目前流通的代币约为 4200万。特别值得注意的是,将有近一半的代币用来奖励那些为生态系统贡献高质量代码的开发者,这显示了Autonolas 对优秀代码和生态系统正向增长的重视。展望未来,随着剩余代币的发行,我们期待看到Autonolas 生态系统的飞速发展。另外,从通胀率来看前三年相对比较多,但占总量也还可以,新发行的代币大部分都在Bond了,团队虽然持股一半但是锁定到26年

7)重大更新事件:

Autonolas 最近的重大更新是开启了质押功能,这标志着协议本身的一个重要进化。他们使用的是一种叫做 PoAA 的治理模式,这个模型的好处是能奖励有潜力的项目,并且帮助平衡新代币的产生。团队相信,这种质押机制将为建立一个庞大的AI智能体经济提供坚实的基础,并且能够给Autonolas带来更强的经济支持。

接下来,Autonolas 会集中精力提高协议的安全性,推出一系列结构化计划(Build-A-PoSe),并且通过工作流程来实现Triple Lock的协议升级。从2023年6月起,Autonolas 开始在推特上每周更新他们的进展(你可以点击这里查看:https://t.co/SYOF8hi8M7 ,并且一直坚持到现在,这显示了他们的执着和持续的努力。

总而言之,Autonolas 想成为包含 AI、预言机(透过继承个大数据中心来用AI 预测和投喂价格)、跨链通讯等链下服务的统一网络,打通链上与链下的隔阂,一匹行业黑马终会被发掘,喜欢不要忘记转发

#AI

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。