Market News

On March 8th, according to BitMEX Research data, the net inflow of Bitcoin spot ETF on March 7th was $472.6 million. Since January 11, 2024, GBTC has seen a net outflow of over $10 billion.

On March 8th, EthStorage, a dynamic storage expansion project for Ethereum, announced the allocation of 1% of the total token supply to Protocol Guild to support the latter's ongoing management of Ethereum. It is reported that Protocol Guild consists of over 160 Ethereum core contributors and aims to support Ethereum ecosystem projects.

On March 8th, according to @ai_9684xtpa monitoring, PulseX distributed 200 million DAI to 10 addresses in the past 14 hours and accumulated purchases of 51,809 ETH on-chain at an average price of $3870. Over the past three days, PulseX and PulseChain associated addresses have accumulated 149,105 ETH, with a total value of up to $5.83 billion.

Market Review

In yesterday's article, it was mentioned that the resistance of Bitcoin was in the range of 68000-67500, and as expected, the highest point of yesterday's rebound was near 68000, briefly falling below 67. On the other hand, Ethereum showed more strength, as the resistance did not hold, reaching a high of 3940. This change indicates that the overall market will not easily decline, at least not before the Cancun upgrade. So, how should one proceed? Can Ethereum successfully break through 4000?

Market Analysis

Macro Analysis: With the entry of Bitcoin ETF into the US stock market, it is gradually becoming more like the stock market. In a loose monetary environment, the stock market mostly rises, and the market for Bitcoin is small. The upward momentum and space will be greater. For Bitcoin above 60,000, funds will flow downstream, and the cryptocurrency market will continue to attract waves of capital, with potential gains possibly exceeding any previous bull market, as the inflow of funds and market expansion are several times larger than before. The fundamentals of the bull market are good, with interest rate cuts on the way, leading the way in hot spots, and the rest catching up. Furthermore, there will be more positive news for Ethereum in the future. The Cancun upgrade this month will reduce transaction fees on the L2 network, which will increase network activity and may even attract mainstream demand for Ethereum. In the long term, most positive sentiments will be reflected in the weeks or months after the upgrade, while in the short term, the positive news landing will be negative. In the days leading up to the release of news, there may be early volatility or a short-term acceleration.

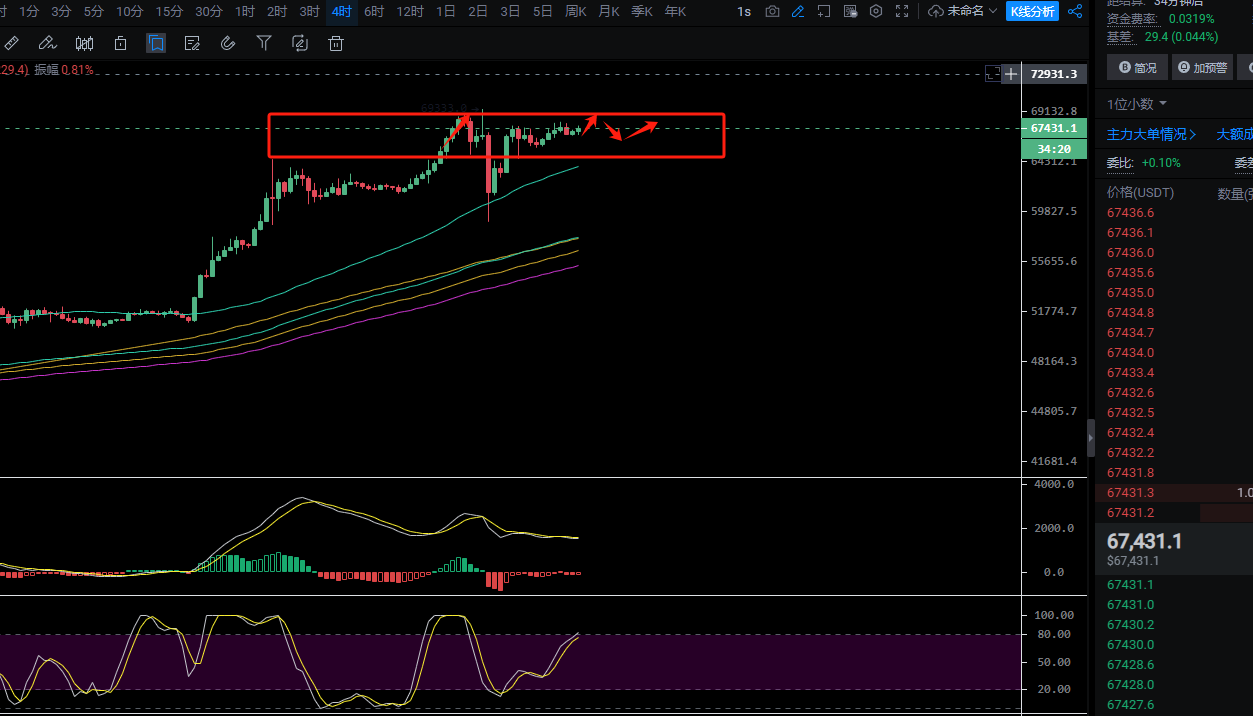

Looking at the four-hour chart, Bitcoin is currently in a high-level oscillation, with not very large fluctuations, and the RSI indicator is continuously spreading upwards, indicating that the bulls have not yet finished. The decline from the resistance at 68000 yesterday also showed insufficient strength. Meanwhile, the ETF continues to maintain a high level of inflow. The bulls remain strong. Therefore, in the short term, it is advisable to buy on dips. The support below is at 65800/63800, and the resistance above is at 68400. 68400 can be seen as a watershed for high-level oscillation. The next high can be seen at 73000. As for Ethereum, as mentioned earlier, there are five days of positive news to be realized, and the price is already close to 4000, hovering around 3940. However, no signs of a bearish trend have been observed. With the positive news about to be realized, Ethereum may experience an accelerated market. In terms of operation, it is advisable to buy on dips. The support below is at 3840/3810, and the resistance is around 4075, which is still a watershed, with the next target at 4555. The current market is rising three steps and retreating two steps. Pay attention to position control. In summary, the uptrend is not over, at least wait for the positive news to be realized before considering the possibility of a deep correction. Real-time market changes will be explained in the live trading.

Looking at the four-hour chart, Bitcoin is currently in a high-level oscillation, with not very large fluctuations, and the RSI indicator is continuously spreading upwards, indicating that the bulls have not yet finished. The decline from the resistance at 68000 yesterday also showed insufficient strength. Meanwhile, the ETF continues to maintain a high level of inflow. The bulls remain strong. Therefore, in the short term, it is advisable to buy on dips. The support below is at 65800/63800, and the resistance above is at 68400. 68400 can be seen as a watershed for high-level oscillation. The next high can be seen at 73000. As for Ethereum, as mentioned earlier, there are five days of positive news to be realized, and the price is already close to 4000, hovering around 3940. However, no signs of a bearish trend have been observed. With the positive news about to be realized, Ethereum may experience an accelerated market. In terms of operation, it is advisable to buy on dips. The support below is at 3840/3810, and the resistance is around 4075, which is still a watershed, with the next target at 4555. The current market is rising three steps and retreating two steps. Pay attention to position control. In summary, the uptrend is not over, at least wait for the positive news to be realized before considering the possibility of a deep correction. Real-time market changes will be explained in the live trading.

Technology is the means, and the trend is the king. The cryptocurrency leader takes you to soar in the sea of coins.

Be cautious when entering the market, as trading carries risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。