Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Thursday, March 7, 2024, and I am Yibo! We do not predict trades, but actually observe market fluctuations (narrowing, spreading), structure (market batch structure), and sentiment (external market such as US stocks, the US dollar, etc.). As a trader, you (through trading) affect prices, and prices also affect your emotions and behavior.

The market has reached a divergence point, it's time for the bulls and bears to greet each other. In a bull market, there will always be people who fear highs, guess tops, and touch tops. What I see is that the thousand-point decline has been repaired, and it's obvious that the bullish engulfing pattern is present. Perhaps you have luckily caught a rebound, but do not think that the trend has reversed. The simplest truth is that in a market trend, most of the time is spent in oscillation before entering a one-way uptrend or downtrend. Trend reversals only occur in very few cases, and have you just happened to catch these very few cases? Abandon fantasies, follow the trend, do not easily go against the trend, and do not judge trend reversals. The rest is much simpler.

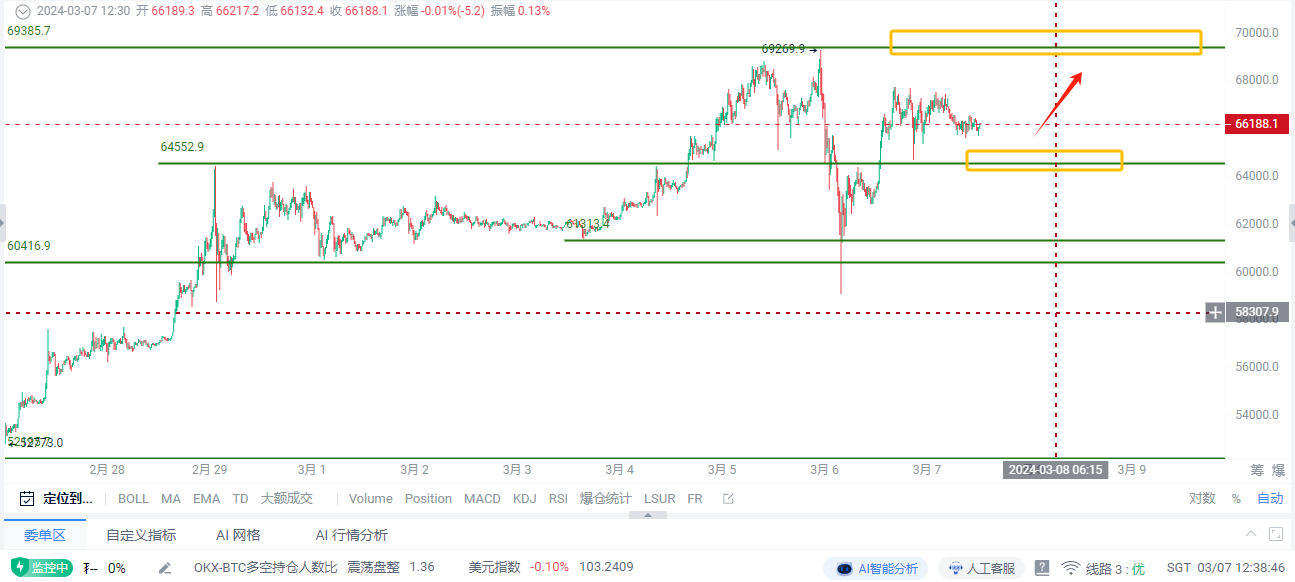

Yesterday, the price of Bitcoin began to oscillate after the morning opening, and gradually rose in the afternoon until it reached the 67730 level, but did not continue, instead it fell under pressure and went through oscillation and repair. In the evening, Bitcoin once again plummeted, with the price falling to around 64600 before rebounding and correcting, and the current market is stable around 66100, entering a short-term oscillation and consolidation phase again. Looking at the daily chart, there are two bullish candles sandwiching a bearish one, and yesterday also formed a candle with a long upper shadow, so it will be difficult to break to a new high in the next few days. It needs a period of accumulation. All moving averages are in an upward trend, forming multiple supports. To completely return to the support level, it can only be achieved by a large volume bearish candle breaking through, otherwise it will be gradually repaired through time to release the risk. The oscillation range on the small timeframe is between 61000-63000, and this range forms a critical turning point. If it is not breached, it will be a bullish market, otherwise it will continue to be bearish and further retest. The recent high-level consolidation also forms a range. Without considering the situation of breaking through the range, the upper resistance is at 69200, and the lower support is at 64500. The recent pressure has led to a retracement, and the support has led to a rebound. Refer to the specific positions in the image!

The Ethereum Cancun upgrade (Dencun) will be officially activated on the mainnet at 21:55 on March 13, 2024. The market believes that this may become a driving force for the rise of Ethereum and Layer 2 tokens. The recent market volatility in the currency circle, but Ethereum rebounded strongly to hit a new high for the year, and Layer 2 tokens also showed strong momentum, with OP and STRK both rising instead of falling. With the Ethereum Cancun upgrade approaching, Layer 2 may become the next market hotspot. The core of the Cancun upgrade is EIP-4844, also known as "proto-danksharding", which is the first step in Ethereum's expansion. It introduces a new transaction type (blob-carrying transaction), and EIP-4844 expands the blockchain by providing more space for data "blob", enabling Ethereum nodes to temporarily store and search off-chain data, thereby reducing transaction costs for Layer 2 networks. The total value locked (TVL) of Ethereum Layer 2 has risen to $36.74 billion, reaching a new high, with a 7-day increase of 14.8%.

ETH surged to a high of 3900 yesterday, also hitting a new high since 2022. Currently, the support below is at 3720, and the resistance above is at 3900. The trend is basically the same as Bitcoin's. If there is no pullback, ETH will aim for a new high of 4200-4500 this month under the dual positive news of the Cancun upgrade and ETF. Looking at the weekly chart of Ethereum, the candlesticks have risen for 6 consecutive weeks, constantly hitting recent highs, and the bulls are strong. With its MACD indicator continuously strengthening, in the short term, attention needs to be paid to the continuity of the market and the breakthrough of the recent resistance, whether it can continue to be bullish in the subsequent market will be the key to opening up the upward space for the bulls. Currently, there are no clear signals at the high level, and the correction still favors the continuation of the bullish trend. Refer to the specific positions in the image!

In this market, it ultimately comes down to ability. If your ability is insufficient, what the market gives you will eventually be taken back. Therefore, when your wealth exceeds your ability, you need to control the drawdown, although this control is futile because that kind of profitable arrogance and arrogance will ultimately destroy a person's rationality. However, in the capital market, we do not need to worry about the situation where our wealth is lower than our ability, because this kind of imbalance will eventually be corrected by time. If it is not corrected, there is only one reason, which is that your ability is insufficient. If you are still in a state of confusion, not understanding the technology, not knowing how to read the market, not knowing when to enter, not knowing when to stop loss, not knowing when to take profit, randomly adding positions, getting trapped at the bottom, unable to hold onto profits, and unable to seize opportunities when the market comes. These are common problems among retail investors, but it's okay. You can come to me, and I will guide you in the right way of trading. A thousand words are not as good as one profitable trade. Instead of frequent operations, it's better to be precise, making every trade valuable. What you need to do is to find me, and what we need to do is to prove that what we say is not empty. 24-hour real-time guidance for trading. The market fluctuates quickly, and due to the impact of review timeliness, for the subsequent market trends, real-time layout based on actual trading is the main focus. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。