前言:投资有风险,操作需谨慎。

文章审核需要时间,会出现延迟发布情况,文章仅供参考,欢迎阅览!

本文撰写时间:北京时间3月6日15:41

市场资讯

1、比特币现货ETF 3月5日净流入6.625亿美元,创单日净流入新高;

2、昨日贝莱德IBIT流入7.88亿美元;

3、休眠14年的巨鲸20小时前售出1,000枚BTC,利润约6000万美元;

4、ETFStore总裁:鉴于美SEC允许以太坊期货ETF,批准现货以太坊ETF只是时间问题;

5、现货比特币ETF单日成交额达100亿美元,创历史新高;

行情回顾

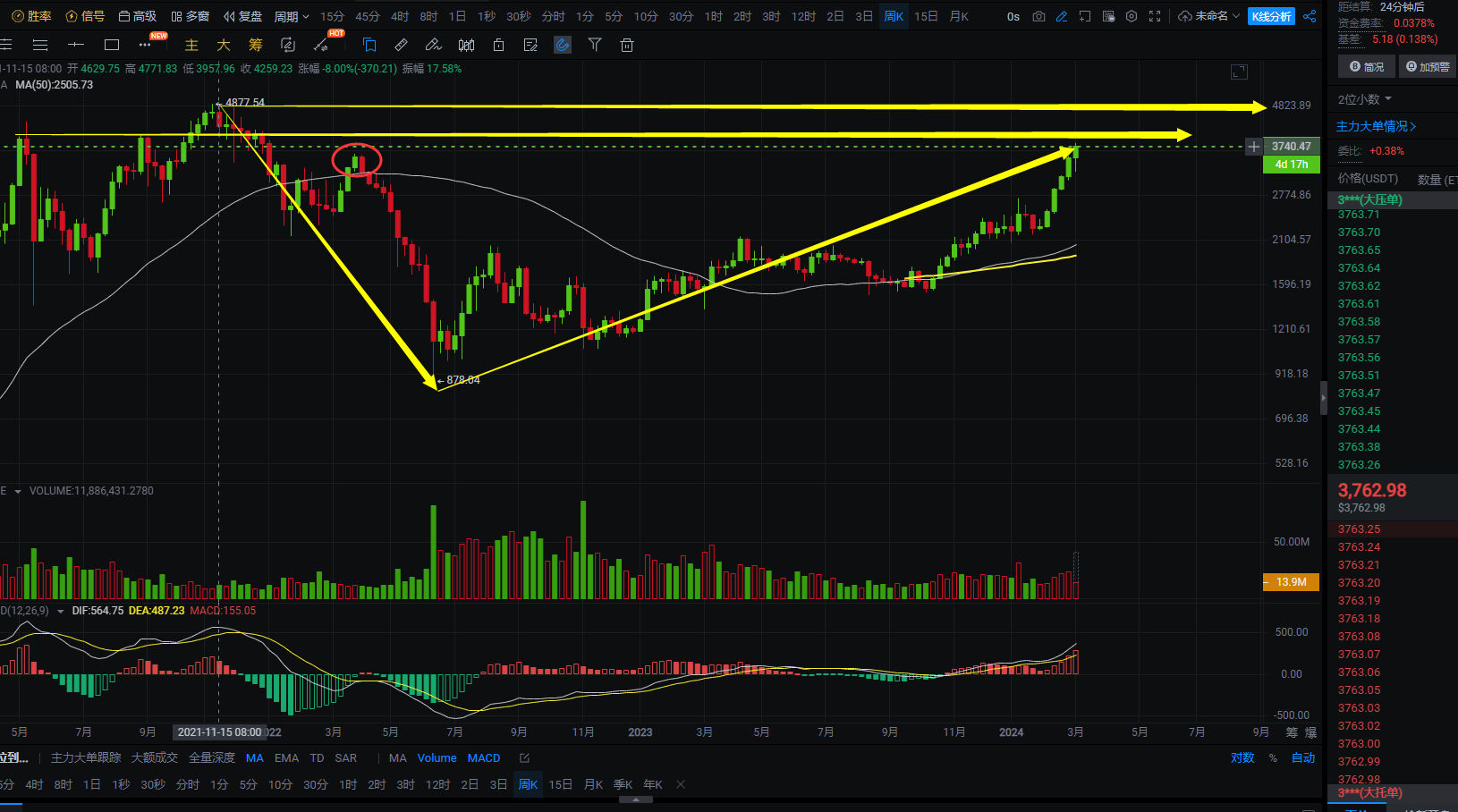

前面我们说本周破69000的机会很大,昨晚就拉升突破了历史高点,目前价格最高在69350位置,但突破后行情没有延续反弹,而是走出快速下跌,下跌低点在59112,直接下跌万点,可能也与市场巨鲸苏醒卖出有一定关系;以太走势也是先走出拉升后跟随大饼走一波下跌,拉升点位在3827位置,前面我们说本周以太去试探4000的机会是很大,目前还未到,以太还有反弹机会,日内交易上,还是保持回调做多的思路去交易;

行情解析

BTC:

周线级别上看,大饼破了前面高点,拉升后并未出现很大的成交量,说明市场还没有很大的出货的动作,日线级别上是有一定的成交量,就算回调也不会走出很大回调,后续再多几次出现高额成交量那就有出货的嫌疑,目前大饼周线上看,还要继续去走反弹,这个69350位置不会是顶,交易上我们保持回调做多的思路就可以了,前面跟大家说了,破历史高点上方将没有压力,历史高点突破后价格将会往10万去靠,还需要给行情一点时间,后续还有减半,以及降息等等利好,都是属于长期的利好,今年大饼到10万是一点问题没有;日内短线交易上,任何回调都是做多机会,65000附近可直接去布局,看69000以及更高,自行把握进场机会;短线交易,控制风险,盈亏自理;

ETH:

周线图上看,以太走势虽然没有破高点,但多头也是 比较猛的,以太的上方还是看得到压力的,下个到达点位在4050附近,距离现价还有300点左右,昨晚以太下跌后日线收十字星,以太白盘的走势是基本上已经要突破十字星了,这样的走势上看,以太日内还是会继续去走反弹,下个点位预计就是在4050附近,交易上直接去追涨都能有不错的利润,现在想去等大一点的回调机会是不多了,可直接追涨,目标就先看4050附近,然后关注大饼69350高点破位情况决定是否持有到历史高点上方,自行把握进场机会;短线交易,控制风险,盈亏自理;

综上所述:

大饼破前高后下跌,白盘再度拉升,多头还是更加强势,回调做多为主;

文章具有时效性,注意风险,以上仅个人建议,仅供参考!

关注公众号 加密老赵 一起探讨行情;

没有任何人愿意亏钱,但我从未见过没有亏过钱的富人,却常常见到一毛都不愿亏的穷人。多数人是为了规避损失理财,而不是为了盈利理财,人人都想上天堂,但没有人愿意去死。

认知,是一个人看待世界的高度,而观点,是一个人看待世界的角度。站在一楼的高度,看到的多是垃圾,站在十层看到的是远处的风景,面朝北永远讲不出朝南的话。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。