本文仅为个人行情看法,不构成投资意见,如据此操作,盈亏自负。

BTC距离价格前高只有一步之遥。看两个数据:

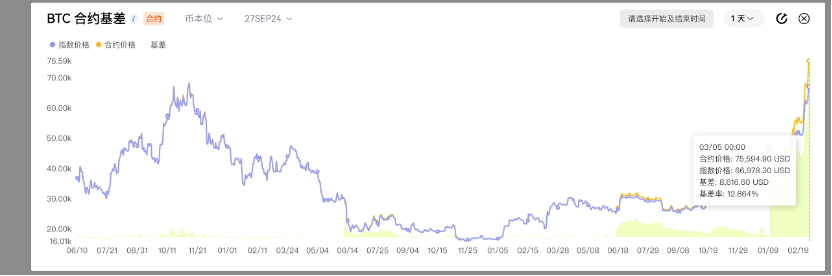

BTC的9月底交割合约,还剩7个月不到的时间,目前有12.86%的溢价幅度,年化已经超过22%。这个溢价幅度我印象里只在2017和2021年年底的顶部见过。在2月20日左右,这个溢价幅度是8%,随后到2月底涨至9%,最近几天快速上涨至12.86%,对应的年化套利空间为13.7%、15.4%和22%。这说明3月初以来,有大量资金进入,迅速推高了远期合约的溢价。

这个数据有两个解读的角度:

1. 现货角度:因为远期套利空间的存在,会刺激现货购买需求。即有人不断地买入现货,同时1倍币本位做空合约,获取这个稳定的套利收益。这就形成了一个良性循环,也是牛市的现货购买力发动机。只要这个溢价空间仍然存在,现货的购买力就会继续得到保障。

2. 情绪角度:根据我自己的经验,过往牛市期间一般正常的溢价,年化12%-15%左右是比较常见和正常的。达到20%左右,说明短期可能产生了FOMO情绪。

再看一看目前的贪婪指数,目前已经达到90。上一次这个数值还是21年11月份。指数到90,也说明目前短期进入了FOMO阶段。

需要注意的是:指标给出Fomo提示,不代表价格会立马跌。也有可能继续保持FOMO状态一段时间。但进入这个阶段的一个特点是:波动会明显加大。所以合约交易难度会显著加大。对于交易的提示就是:不应该再高杠杆搞合约了。甚至可以将合约阶段性平仓了结了。待一切恢复到正常阶段再重新构建合约仓位。

牛市中,现货其实无所谓回调了,我也不认为有卖出现货的必要。FOMO阶段,什么走势都有可能。唯有以不变应万变,回调来临时,记得入场就好。晚上美股开盘,价格可能还有机会再次冲击前高,甚至一鼓作气冲破7w,吸引大量踏空资金进场,让FOMO情绪进一步高涨再做回调。

最后再看一下ETH的汇率,我认为ETH汇率很可能见底了。周级别的底背离很清晰。如果将1.8日当周的那根K线看做是新一轮汇率的起涨点,现在就是汇率的2浪回调阶段,并且已经进入最末段了,已经没有多少汇率的下跌空间了。ETH的领涨行情应该不远了。

关注我,用最少的操作赚取最大化的趋势利润。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。