News

On February 29th, according to Farside Investors data, the net inflow of the US Bitcoin spot ETF was $673.4 million on February 28th.

According to @ai_9684xtpa monitoring, the whale address that previously shorted BTC to earn $5.16 million during the LUNA/UST crash accurately bought in at the bottom of the BTC rebound last night after it broke through 64,000, buying 66.16 WBTC at an average price of 60,268. This address has accumulated 202 WBTC in the past two weeks, with an average cost of 54,479, currently floating at $1.36 million, and the tokens are all deposited in Aave.

Whistleblower Edward Snowden stated that it is expected that sovereign governments will continue to purchase Bitcoin this year and use it as an alternative to gold reserves.

Market Review

In the previous article, it was mentioned that the market might form a range of fluctuations, and the result was a night of fluctuation, stabilizing around 57,000 and briefly hitting near 64,000. This was beyond expectations. It is normal for the bull market to exceed expectations. Currently, it is rising at a 45-degree angle, rapidly reaching 64,000 in two hours yesterday, possibly triggering a small buying frenzy, leading to a subsequent sharp drop to around 49,000. The current price is around 62,700, and the monthly line is about to close, stabilizing at 60,000. We wait and see.

In the previous article, it was mentioned that the market might form a range of fluctuations, and the result was a night of fluctuation, stabilizing around 57,000 and briefly hitting near 64,000. This was beyond expectations. It is normal for the bull market to exceed expectations. Currently, it is rising at a 45-degree angle, rapidly reaching 64,000 in two hours yesterday, possibly triggering a small buying frenzy, leading to a subsequent sharp drop to around 49,000. The current price is around 62,700, and the monthly line is about to close, stabilizing at 60,000. We wait and see.

Market Analysis

Macro Analysis: First, let's go back to 2020. The pandemic choked the economy. Government officials and central bank governors took unprecedented monetary and fiscal stimulus measures. Trillions of dollars flowed through the economy. The slogan at the time was not to worry about inflation, and later it was said that "inflation is temporary." But savvy investors were not fooled. Paul Tudor Jones and Stanley Druckenmiller said on CNBC, "Inflation is coming!" They both stated that they bought Bitcoin because they believed it would be the fastest horse in the inflation hedge category. Currently, the anticipation of inflation is leading investors to make large purchases of Bitcoin. They hope to be protected before inflation arrives. They will not wait for inflation to buy inflation-hedging assets. They are buying in anticipation. The Fed has been working tirelessly to lower inflation. The media celebrated the continued significant decline in CPI year-on-year. But this is not a true assessment of the situation. According to WinfieldSmart, "The real risk now is the return of inflation. ISM service prices have always been a leading and accurate indicator of inflation, and they have just risen significantly." Most importantly, donnelly_brent pointed out that companies are still seeking price increases. This is the ultimate standard for measuring future inflation—if companies continue to raise prices, then it doesn't matter what the Fed does. Meanwhile, ETFs continue to flow in, seemingly not enough for Wall Street to buy! The US market is abandoning various company stocks and buying Bitcoin like crazy. To be honest, we all underestimated the purchasing power of the US market after the ETF was approved. In summary; inflation. ETF. Media attention. Short covering. Important factors driving the rise include subsequent production cuts.

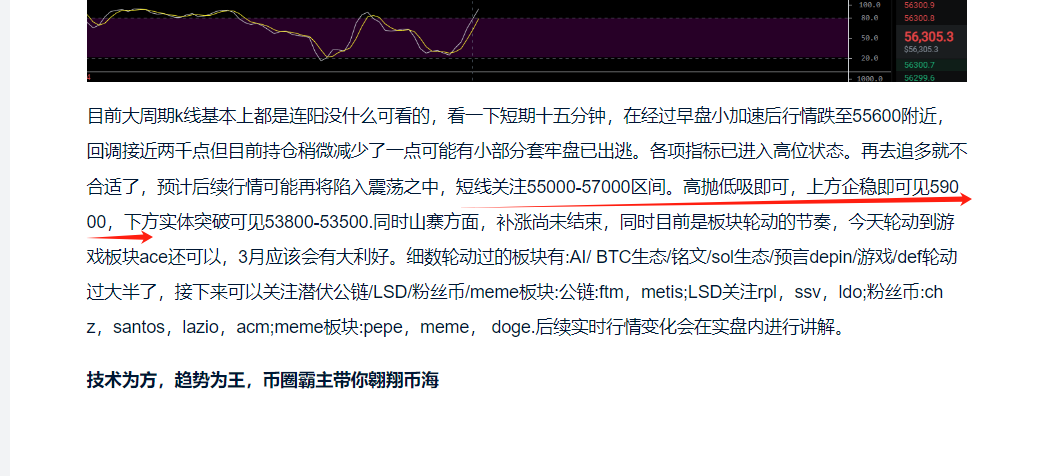

Looking at the market, after the washout yesterday, the market rose again to around 63,700, which is a short-term turning point. Indicators are at high levels, and even if there is no downward correction, there is a need for oscillation correction. At the same time, the previous bull market's turning point on the weekly K-line was around 61,400, and there may be a period of contention here. Currently, it is visually at a resistance stage, so do not blindly chase after more, pay attention to the support around 61,400/60,000. If a large oscillation occurs here, then there will be a breakthrough to new highs in the future. On the other hand, if 61,400 becomes a resistance, then be aware that there may be a 10% to 20% pullback. As February comes to an end, as long as Bitcoin does not crash, the altcoin spring will come. Friends who have not boarded the Bitcoin train can pay more attention to other leading currencies. Pay close attention to the BRC20 track and the BTC ecosystem. Real-time market changes will be explained in the live trading.

Technology is the means, and the trend is the king. Be cautious when entering the market, as there are risks involved.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。