Last night's surge and plunge left newbies bewildered, while seasoned investors remained unfazed. A friend who deals with physical assets called in the afternoon, saying they wanted 150,000 USDT. We reduced our position when the evening market reached over 61,000, and quickly shorted when it surged to nearly 64,000 in the early morning, making a profit of nearly 6 billion with a short position of over 6,000 points. The greed and fear index is at 80, indicating extreme greed. Currently, both Binance and OKX have annualized funding rates for BTC exceeding 85%, the highest since early April 2021.

Bulls don't talk about peaks. Since 23, we have always believed that the market will replicate the 2019 bull market, reaching the Fibonacci 0.618 level, around 48,000. After a spike to 49,000, the weekly chart stabilized, and profits from 44,000 to the present are all short-term gains.

In a bull market, be cautious about shorting. Every retracement in the past 23 years has been around 20%, but rapid surges and plunges are normal in a bull market. Be cautious about shorting and using high leverage.

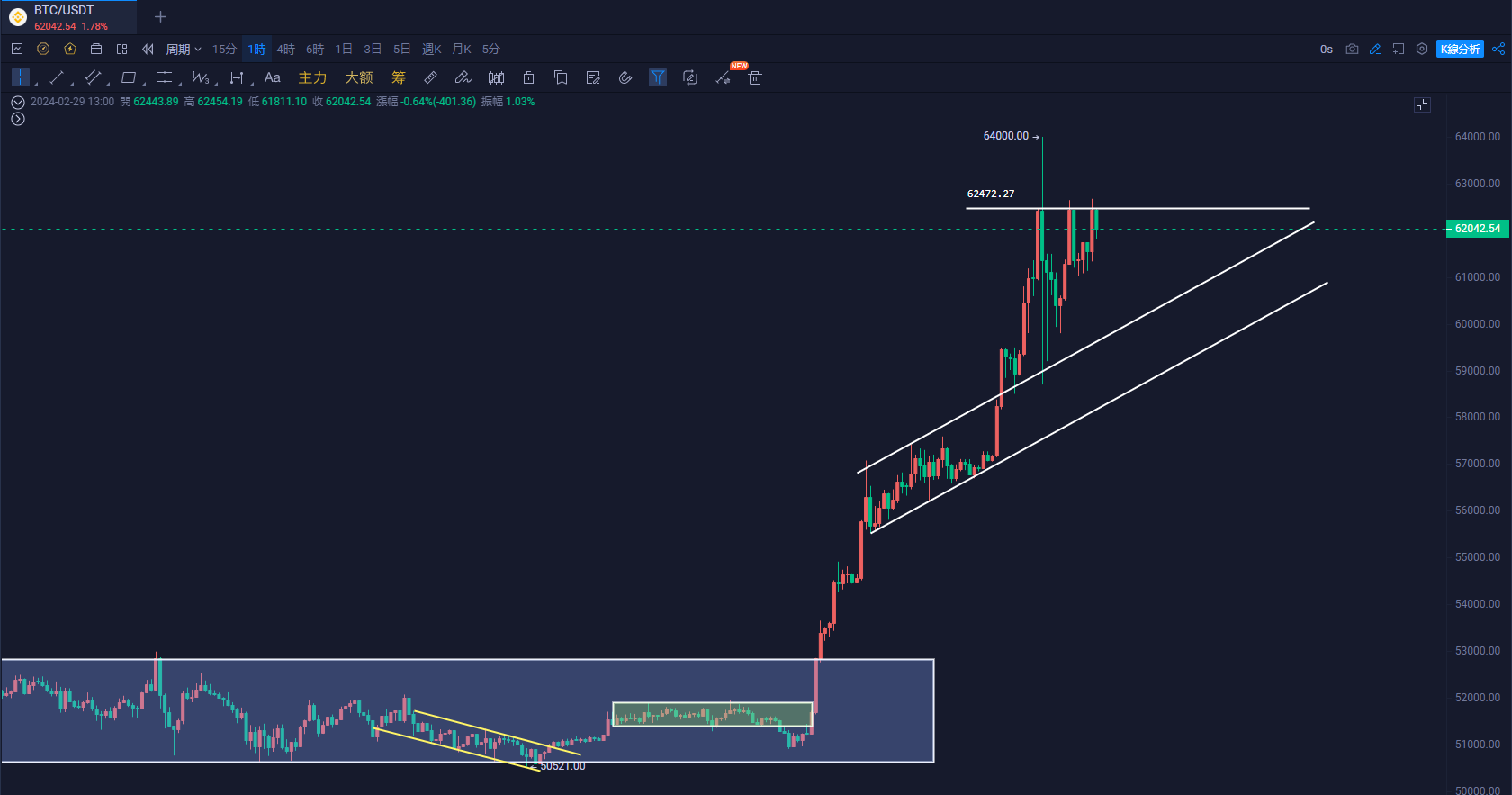

Bitcoin

Breaking through the Fibonacci 0.786 level, it reached the top range of the 2021 bull market, 57,600 to 69,000. Last night's spike showed short-term pressure at 64,000 and an hourly level of 62,647. Short-term testing of upper resistance cannot be ruled out at this point. It's best to wait and see at this level and focus more on opportunities in Ethereum and altcoins. It's only a 7-8% difference from the previous high of 69,000, about 5,000 points. It's optional to take profits or not. I am more optimistic about the opportunity for effective breakthroughs above 69,000 or the opportunity to add positions at a retracement to 50,000 or even lower. There's no need to watch all the ineffective indicators, but defend 60,000.

Support:

Resistance:

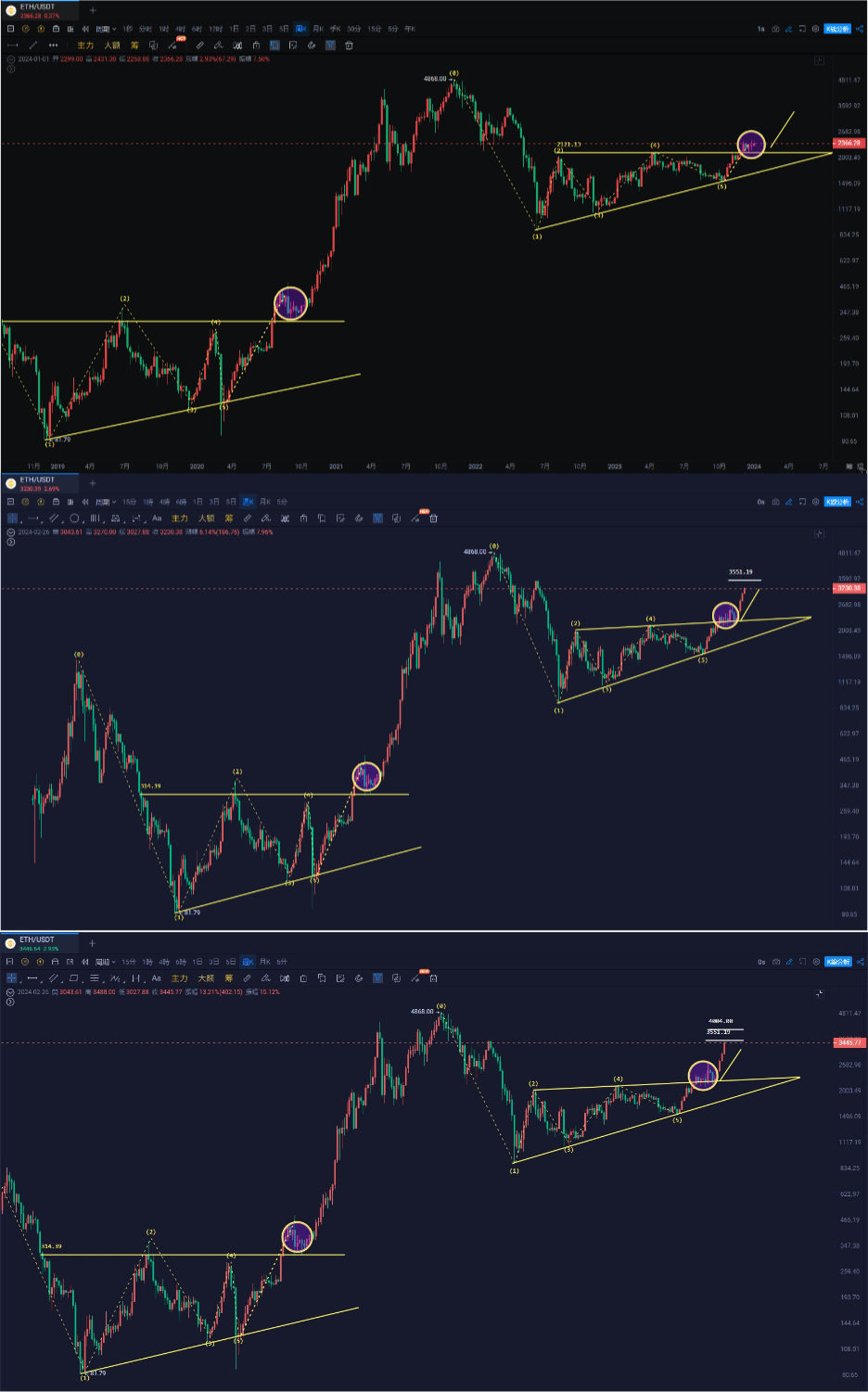

Ethereum

The Ethereum Constantinople upgrade is less than half a month away on March 13. On March 19, there is the FOMC meeting, although I don't pay much attention to these, but with such a surge, it's worth paying attention to. Ethereum's highest point of 3,488 is very close to the 3,550 I mentioned, and the previously mentioned 2,600, 3,000, and 3,300 have all been realized. Let's set a goal for Ethereum to reach 4,000. Don't FOMO, just seize short-term opportunities for pullbacks or breakthroughs. In the altcoin sector, the MEME sector and Twitter coins such as Doge, Shib, Pepe, and Mask are leading the gains.

Support:

Resistance:

The ETH/BTC exchange rate spiked to the 0.51-0.53 range and rebounded. As long as Bitcoin maintains high-level volatility, there are still opportunities for Ethereum and altcoins.

If you like my views, please like, comment, and share. Let's navigate the bull and bear markets together!!!

The article is time-sensitive and is for reference only, with real-time updates.

Focus on candlestick technical research, win-win global investment opportunities. WeChat public account: 交易公子扶苏

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。