消息面

据 BTC.com 显示,当前区块高度距离比特币减半时间剩余已不足 60 天,由于每 21 万个区块就会发生一次减半,所以下一次比特币减半预计发生在 2024 年 4 月区块高度达到 840,000 之时,届时区块奖励将从 6.25 BTC 降至 3.125 BTC。

2 月 21 日,据 Whale Alert 数据,Tether 于以太坊网络增发 10 亿枚 USDT。对此 Tether 首席执行官 Paolo Ardoino 表示,此次 10 亿枚 USDT 是对以太坊网络库存的补充。这是一笔已授权但未发行的交易,意味着本次增发将用于下一期发行请求和跨链交换的库存。

据 Spot On Chain 监测,做市商 Flow Traders 收到 500 万枚 STRK,已向 Binance 和 Crypto.com 存入总计 360 万枚 STRK,并通过 Uniswap 以 3.82 美元均价将 94.3 万枚 STRK(约 360 万美元)兑换为 ETH 和 USDC。

行情回顾

大饼昨日晚间行情直冲43000后进行画门,符合我前面文章的预期同时50800依然还是比较坚挺,大饼将会持续震荡一段时间,这段时间将要交给以太及山寨发挥空间,而以太也是如此在突破3000后进行画门,但依然是在支撑位止跌后一度打到目标位3030附近。跟上霸主思路,带你驰骋币海。

行情分析

宏观分析:上周数字资产投资产品流入额创历史新高,总计24.5亿美元,今年迄今流入额达52亿美元,使管理资产总额升至670亿美元,创2021年12月以来的最高。Bitwise首席投资官Matt Hougan表示,大饼现货ETF的推出是BTC在美国市场的IPO,引发了传统金融的巨大兴趣,在资金流入现货ETF和即将到来的减半之后,预计将出现供应紧缩。加密市场至明年底,退一步进两步,牛市氛围浓厚,这期间小伙伴们做的最多的事情是不断寻找低估值项目,从去年的AI、铭文、L2热点板块,再到今年的AI、L2,和今天的存储板块,一波又一波接力上升,以新币们为主!

上轮牛市诸多板块龙头们迈进百亿市值门槛, SOL甚至进入了千亿门槛。牛市,少些怀疑,多些信任!BTC现货ETF上市美股后,BTC和加密货币正在成为一种重要的资产类别,仅年初至今9支新基金流入已达140亿美元,现货E TF资金开始外溢,以太突破3000美元,资金会持续外溢各类山寨币种,之后会见到更多加密繁荣!

灰度已经在自己内部研究Brc20赛道,灰度在关于减半的最新研究报告中,专门找时间重点阐述BRC-20铭文的。

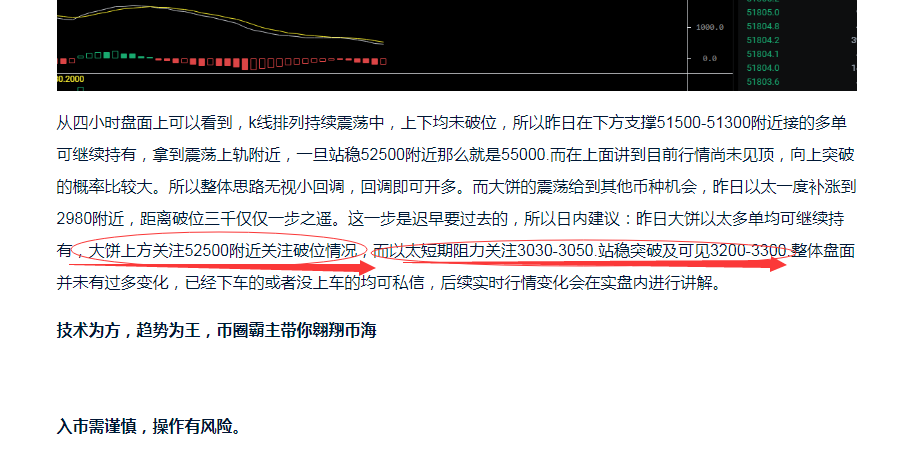

从四小时盘面上可以看到,昨日上下插针并未破位整箱震荡,触底反弹依然在上轨52500附近受阻回调。而指标上看macd有回调到零轴的意思。日内可能会有回调,但看空不做空,下方第一支撑关注51300-51000附近跌破50600就会到达49900-50100附近。如图所示可可能会先跌后涨。大饼呈震荡弱势。原因资金外流到其他币种。但大方向依然是多头趋势。拒绝空头,拥抱多头,阻力依然在52500/53000,站稳53000看55000.就是一个震荡高抛低吸即可。

而以太方面达到3030附近受阻回调,但多头依然非常强劲,依然在上涨趋势中,终极目标3300.止盈掉的可等回调后再进行介入,下方第一支撑关注2920-2940附近,第二支撑依然是2880-2890附近。而上方关注3050站稳即可看3300目标。总结只要大饼持续保持震荡,相信以太用不了多久就会到达终极目标。

自行把握操作。后续实时行情变化会在实盘内进行讲解。

技术为方,趋势为王,币圈霸主带你翱翔币海

入市需谨慎,操作有风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。