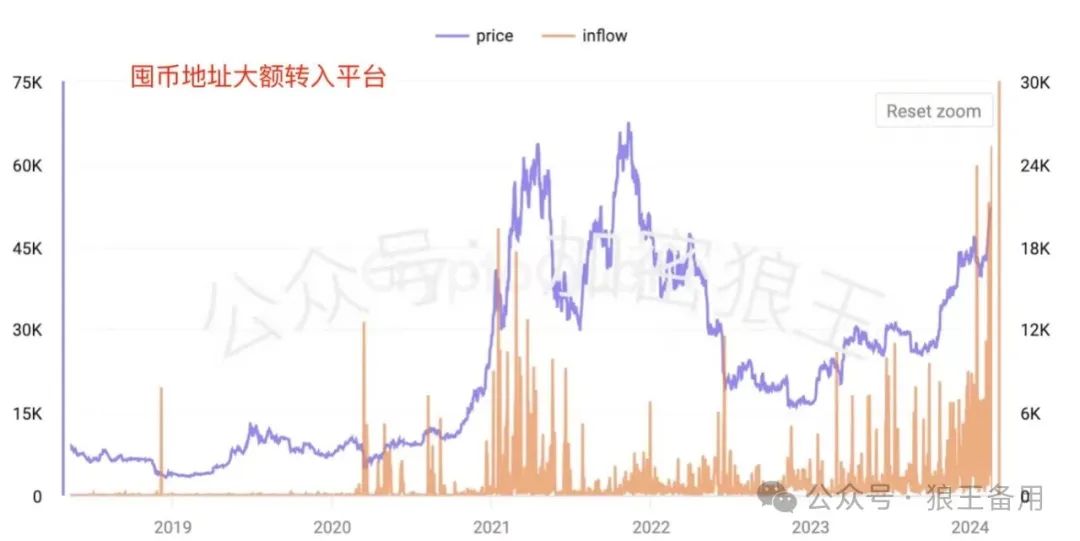

CQ创始人表示,囤币地址正大额转入平台,前几次出现类似情况,不是大牛末期,就是熊市末期。

这和昨天老狼聊过多空分歧点相似,囤币地址排除掉矿商和平台的地址,当大量囤币的人赚到钱之后,他们想要卖出,就需要有新资金接力,才能保证价格再上一个台阶。

现货ETF交易量持续飙升,让BTC的ETF交易量冲入美股前十名,可能再过几周,BTC会成为全市场最拥挤的交易,场内博弈还在继续,这两天BTC连续画门,持仓量创新高,预计本周内会出现变盘节点。

BTC:

沿5日线整理,BTC仍处于震荡走势,小时线连续插针,做放量V字反弹,确认箱体阻力,上方52444美元是阻力位关键点,只有站稳52444美元,才能筑底走高,开启逼空拉升,接下来BTC在52444美元插针回落。

阻力位:52444,53135,53753

支撑位:51377,50485,49852

ETH:

ETH沿5日线走高,低点不断抬高,说明多头趁ETF和升级预期利好撑盘,带动ETH走强,夜间出现双插针回落,上方2998美元多次面临深度抛压,只有快速拉升,突破3000美元关口,才能带动新资金入场撑盘,接下来ETH需要测试高点,在2998美元插针回落。

阻力位:2998,3052,3097

支撑位:2917,2833,2776

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。