消息面

2 月 1 日,彭博 ETF 分析师 James Seyffart 在社交平台发文表示,在现货比特币 ETF 第 14 个交易日中,BITB 流入 1800 万美元,ARKB 流入 1500 万美元此外,GBTC 流出 1.88 亿美元,是除 1 月 11 日第一个交易日外流出最少的一天。

据 CryptoSlate 报道,贝莱德在 1 月 31 日提交给美国证券交易委员会 (SEC) 的文件中提出了一项计划,拟将其比特币现货 ETF 的广告投放到建筑物的侧面。文件简要描述了贝莱德的计划,指出:「IBIT 广告是一个动画,旨在投射到纽约、迈阿密和洛杉矶的前金融机构的外墙上。这个故事板使用我们的迈阿密外观作为模板。」IBIT 代码在大多数动画运行时都会暴露,该广告内容展示了贝莱德今年 1 月推出现货比特币 ETF 之前的事件时间表,场景片段包括描述了 1790 年美国第一个股票市场的推出、1993 年第一个美国 ETF 的推出、2009 年比特币推出、以及 2017 年首个比特币期货合约推出,最后突出的场景广告语包括「一个新的准入时代」和「现货比特币 ETF 来了」。

2月 1 日,据 Coinglass 数据显示,灰度 GBTC 已无溢价/折价,ETH 信托负溢价率为 11.61%。此外,ETC 信托负溢价为 37.61%,LTC 信托正溢价为 111.07%,BCH 信托正溢价为 70.79%。

行情回顾

在前天的文章中讲到,行情可能会先回调到支撑附近再度开启上涨,而昨日最低回踩到42400附近并反弹到43800一线,符合预期。唯一可惜的是并未突破44000就出现了下破。凌晨因数据影响行情一度下跌到41900附近。反弹是否已经结束?震荡将要开启?

行情分析

宏观上讲 ,币安稳定币储备推动了价格从底部的上涨 ,安稳定币的部分储备一直在上涨,尤其是从ETF获批到价格底部再到43k。如果我们看看USDT和USDC,我们可以看到它已经进了币安,并推动了价格的上涨。有趣的是,在币安现货CVD中可以清楚地看到稳定币的走势。这是一个需要密切关注的指标。同时大饼etf昨日净留入247m,相比灰度的净流出,目前一个IBIT就能覆盖住了,剩下的etf全都是净流入。

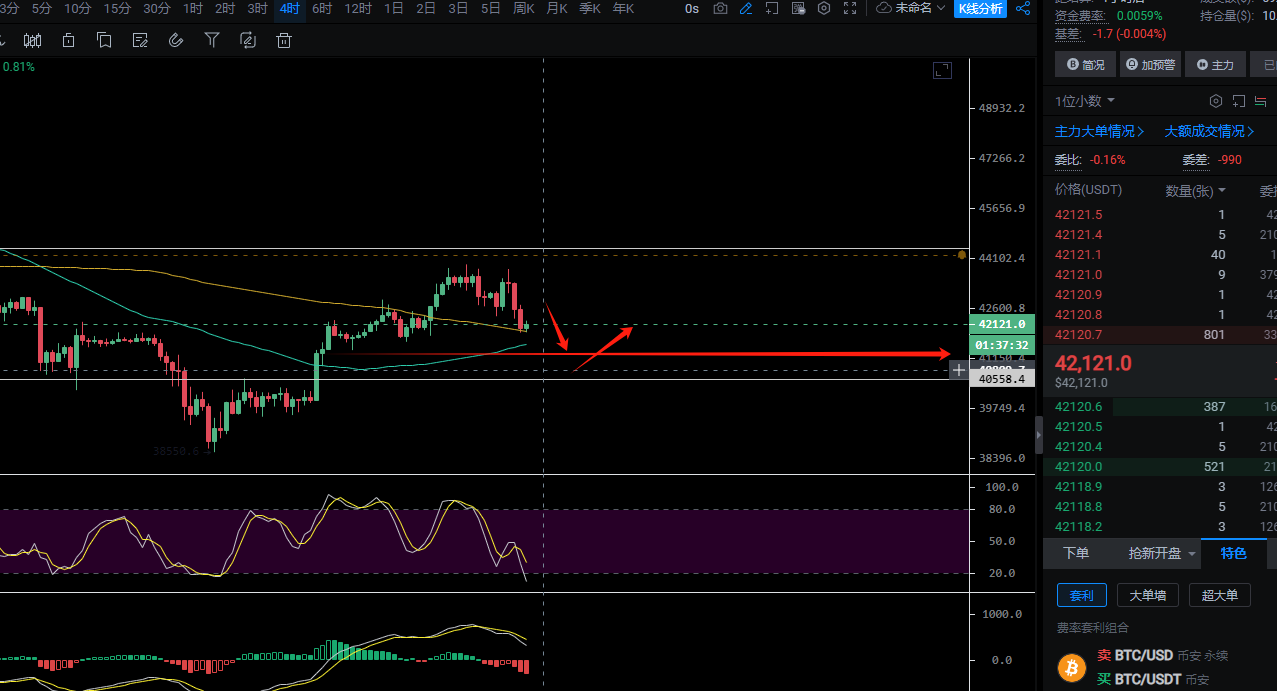

通过四小时盘面上可以看到。行情在昨天试探43800阻力位后出现高位十字星,随后行情一度进行回落,而通过指标可以看到目前已经出现拐头,有向下扩散的需求。短期回调并未结束。而中期上讲,上周强势收阳,但多头量能持续萎靡。把38000-44000这一段作为反弹,那么后续出现二探的概率很大。也符合我在前面文章中讲到的44200可能会是这波反弹的终结点。可惜差一口气。但这个行情的连续性很低,震荡大舞台,有梦你就来。差不多地狱模式开启了。不要有任何格局 。总结中期走势持续走弱,有二探需求,短期震荡向下,同时操作建议关注上方阻力42500-42800,下方支撑关注41350/40600.依然是高抛低吸,短线不要格局 。自行把握操作。后续实时行情变化会在实盘内进行讲解。

技术为方,趋势为王,币圈霸主带你翱翔币海

入市需谨慎,操作有风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。