○/文:Deepcoin研究院

老李迫击炮

本周研报目录:

一、本周宏观经济数据和加密市场的重点事件预告;

二、加密行业重点新闻回顾;

三、社区互动交流分享;

四、重要事件和数据及Deepcoin研究院解读;

五、机构观点+海外视角;

六、上周加密市场涨幅榜及社区热点币种筛选;

七、项目代币解锁利空数据关注;

八、加密市场概念板块涨幅榜;

九、全球市场宏观分析综述;

十、Deepcoin研究院后市研判。

一、本周宏观经济数据和加密市场重点事件预告:

1月2日(周二):美国和欧元区制造业PMI;中国外汇交易中心推出澳门元外汇交易相关服务;中证A50指数发布。ETF专家:比特币现货ETF在1月2日后任意时间都可能获批;

1月3日(周三):美国12月ISM制造业PMI;美联储巴尔金发表讲话;A股创业板成长指数修订。贝莱德计划为其现货比特币ETF注入1000万美元种子资金。比特币铭文项目Rune .Alpha将开放交易市场;Web3游戏Gas Hero将正式推出。

1月4日(周四):欧元区CPI、美国服务业PMI、美国12月ADP就业人数;美联储公布货币政策会议纪要。BakerySwap将启动BRC 20第四期项目 BendDAO;

1月5日(周五):欧元区12月CPI年和11月PPI、美国12月非农就业人口和失业率。Xai空投推迟进行。

1月6日(周六):美国CFTC公布周度持仓报告;美联储巴尔金发表讲话。

本周HFT、SUI、ACA等代币将大解锁,总价值约4337万美元。

二、加密行业重点新闻回顾(独家梳理):

新闻综述:加密市场呈现多样化趋势。Coinbase持有量下降可能反映投资者转向其他资产。Marathon Digital等公司表现强劲,与整体市场趋势脱节。FTX破产案引起关注,估值争议凸显数字资产估值难题。比特币期货价格升势显示市场对未来乐观。机构与SEC接近比特币现货ETF共识,预示着更多机构资金可能涌入。整体来看,加密市场仍然充满活力,投资者需关注多方面信息做出明智决策。

数据方面:

Coinbase的比特币余额大幅下降,几天内约有3万个比特币离开平台,为今年5月份以来最大规模的比特币提款。这一减少使该平台的比特币持有量估计达到411,000枚,为2015年以来的最低水平。

行情显示,Marathon digital股价年初至今涨幅已超8倍 ,在估值50亿美元或以上的加密相关公司中表现最佳。此外,Coinbase、MicroStrategy和Grayscale Bitcoin Trust在2023年的涨幅均超过300%,这些股票不仅跑赢了主流加密货币,而且还成为整个美国市场涨幅最大的股票之一。FactSet数据显示,在市值至少50亿美元的美国上市企业中,这四只与比特币相关的股票位居表现最佳的八只股票之列。

数据显示,比特币2024年年底期货价格已升至51,450美元,较当前溢价13.71%。而上周末时,该价格还处于47,000美元水平。

项目和平台方面:

根据12月27日的法庭文件,破产的FTX寻求法院批准以美元估算其客户的数字资产索赔,该平台建议按以下价格估算:比特币为16,871美元,以太坊为1,258美元,SOL为16美元,AVAX为14.19美元。FTX认为,其估值代表了截至破产日期(2022年11月11日)这些数字资产的“公平合理”价值。该动议引起了FTX债权人的批评,该破产公司最著名的债权人之一Sunil Kavuri指出,该动议严重低估了数字资产的价值,并敦促客户“抗争”。破产案件各方必须在1月11日之前提出异议,并定于1月25日就此事举行听证会。

宏观政策和监管方面:

美ETF专家Nate Geraci表示,机构提及已与SEC就比特币现货ETF结构问题进行了非常详细的对话,且“已很接近”达成共识。预期比特币现货ETF将以现金形式创建新基金份额。此外,Nate Geraci表示,ETF上市相关的产品准备工作和后端基础设施均已完成,美SEC在1月2日之后的任意时间都有可能批准比特币现货ETF。

机构研报和观点方面:

彭博ETF分析表示,ARK出售了其全部剩余的GBTC头寸(一个月前它还是ARKW的最大持仓),并用其中的一半资金(1亿美元左右)购买了BITO,这可能是作为一种过渡工具,在比特币达到ARKW或ARKB时保持beta值。

ETF研究公司ETFGI报告:全球上市的加密ETF年初至今已吸引了16亿美元的净流入,其中仅11月份就增加了13.1亿美元。这一总投资几乎是2022年加密货币ETP净流入7.5亿美元的两倍。在150只加密货币基金中,排名前20的ETF吸引了最大的投资量,2023年总共流入了13亿美元。ProShares比特币策略ETF(BITO)在2021年10月的加密货币牛市期间推出,见证了最大的个人资金流入,在2023年额外获得了2.787亿美元的资金流入。

10x Research最新研报:MicroStrategy的股价似乎被高估了26%,这一结论基于该公司的回归模型,研究了因变量MSTR和自变量BTC现货价格之间的关系。分析师表示,以周四MSTR的收盘价673美元计算,MSTR相对于比特币43000美元左右的市场价格被高估了超过20%。

三、社区互动交流分享:

关于TRB主力操盘手法,在过去的两个月里,鲸鱼逐步地将其代币存入交易所,创造了一个pump-and-dump的循环,以清算他们持有的代币。拉高出货的英文叫做“Pump and Dump”,意即资产价格急剧上涨,但随后价格因抛售出现急剧下跌,这就会出现拉高出货的情况。

关于止损设置。一般止损点应该设置在关键价格之外,而不是能承受的风险点。

关于现货持仓。每个人对于风控和偏好不同,现货持仓这个没有限定的比例,我现在现货仓位还剩四五成,以BTC为主,如果未来回调,我会加仓;如果未来再次大幅上涨,我会进行高抛。

关于期权交割和最大痛点。年底的年度大交割日,共计110亿美元期权到期交割,高于去年年度大交割日时的总持仓98亿美元,而且超过了彼时年度交割量的2倍。每年年底,市场总会进入低波动期,但由于预计明年1月将推出ETF,目前整体IV水平并不算太低。我以前做过详细解答,在传统金融市场,最大痛点一般会影响价格朝向痛点波动,但加密市场的期权类衍生品还未成规模,所以影响相对有限,但考虑是年度交割,还是会引发一定波动的。

四、重要事件和数据及Deepcoin研究院解读:

关于巨鲸动向。据The Data Nerd监测,因BTC突破45400美元创下近2年新高,一群BTC巨鲸赚取了超过10亿美元的利润。从2022年10月到11月,他们从Binance累积了21528枚BTC,价值4亿美元,买入均价18582美元。他们在近期以最高价格总共售出了12391枚BTC,他们的总实现利润为1.054亿美元。他们目前在2个主要钱包中总共持有26287枚BTC,价值11.9亿美元,他们的未实现利润总额为6.543亿美元,获利121%以上。

Deepcoin研究院认为,这群BTC巨鲸的交易行为表明,他们对BTC的长期前景持乐观态度。他们在2022年下半年开始累积BTC,并在近期以最高价格出售部分BTC,以实现利润,也就是说在45400美元这个位置,巨鲸卖出了57.56%的持仓,价值5.63亿美元,短期可能会影响价格回调。目前,他们仍持有大量BTC,这表明他们对BTC的长期价值仍然有信心。

这群BTC巨鲸的交易行为可能会对BTC市场产生一定的影响。他们的出售行为可能导致短期的BTC价格下跌,但他们的持续持有行为也可能为BTC市场提供支撑。

我们应密切关注这群BTC巨鲸的交易行为,以评估其对BTC市场的影响。巨鲸们的行为可以作为一种参考,但不应作为决策的唯一依据。如果这群巨鲸继续出售BTC,可能会导致市场短期内出现调整。但如果他们继续持有BTC,可能会为市场提供支撑。

关于MicroStrategy及子公司在11月30日至12月26日期间以约6.157亿美元现金购买约14620枚比特币。目前共持有189150枚BTC。

Deepcoin研究院认为,也正是这条消息促使昨夜行情大幅反弹,几乎完全收复了圣诞以来的跌幅。与我们前期聊到的近一个月来木头姐抛售coinbase股票和gbtc份额截然不同,MicroStrategy在近期的加大比特币购买力度,表明该公司对比特币的长期价值仍有信心。从分析研究的角度来看,MicroStrategy的此次加仓具有以下几点意义:

其一是,我们都知道比特币的稀缺性,具有天然的价值储备。根据MicroStrategy公司高管以往的多次言论来看,此次加仓很大可能是在通货膨胀压力加大的背景下,对财务资产进行保值,因为该公司认为比特币具有长期的价值,可以抵御通货膨胀和经济衰退,为其带来高回报率。其二是,MicroStrategy作为全球最大的比特币持有公司之一,此次加仓将进一步增加其对比特币市场的影响力,可能被视为市场信号,从而对比特币的价格产生一定的支撑和推升,对BTC流动性也有积极作用,这点而言,无疑是利好币价的。其三是,MicroStrategy是一家知名的上市公司,我们熟知的加密市场最具领导力的机构之一,其加仓比特币的行为,将为其他机构投资者提供信心,鼓励他们也进行比特币投资,也会吸引其他散户投资者加仓。总而言之,MicroStrategy的此次加仓,表明了比特币作为价值储备的潜力,并将为比特币的机构化投资提供推动力。

另外,我们需要注意的是,这是过去将近一个月的数据,如果是二级市场的场内交易,那么已经表现在了盘面上;而如果是场外交易,本身不会太多影响BTC价格。他们买入卖出并不是实时披露,而是发生之后才会公布。所以,本次消息只是在短期市场情绪上产生了一定的影响,跟风效应导致了币价上涨。而在长期趋势上,可能无法产生太多的推动作用。

从我们研究院查证的最新数据来看,在MicroStrategy这段时间内增加了其比特币持有量的9.2%,并且平均价格42093美元远高于其之前的购买价格。当前持有的比特币数量总计为189150枚,以约59亿美元的价格收购,平均买入成本价为31168美元,当前总价值81.15亿美元。MicroStrategy持仓比特币浮盈超22亿美元。保持这么大的盈利空间,后期也有可能会进行抛售,也是潜在的回调风险,这也是我们需要注意的。

关于Solana超越以太坊话题解读。

Deepcoin研究院认为,可能是近期Solana强势上涨的表现太过耀眼,让一些炒作者对其产生了无限遐想,幻想着to the moon。上午就有条比较有意思的观点,这里也分享给大家,知名天使投资人Santos表示,Solana将与以太坊平起平坐并最终超越它,在本轮周期行情发生这种情况的概率为80%。随着资金流入和加密市场整体市值的增长,Solana价格可能会再次上涨,Solana兑换以太的汇率最终可能等于1:1。

以上内容仅代表Santos个人观点,而Deepcoin研究院认为,作为知名天使投资人,他的看法可能对市场投资者具有一定的参考价值,但也存在太多的局限性。

首先,本轮Solana上涨是因为Solana生态在DePin概念带动下整体表现抢眼,从Google搜索量增加来看,该资产的表现和Meme币的激增相吻合,Solana链铭文铸造的概念火热,推动Solana最高涨至126美元上方附近,并且市值在近期接连超越瑞波和bnb,跻身加密币种市值排行第四位,仅次于比特币、以太坊和稳定币USDT;但熟悉加密市场热点概念炒作的我们应该都知道,一个热点持续的周期是有限的,一般等热潮消退,相关代币都会迎来退潮期,所以,Solana能否一直持续上涨也是存疑的,我们认为Solana很难在接下来的以年为周期的时间尺度里保持长期牛市。

其次,说到热点炒作,接下来明年的热点可能会切换到以太坊坎昆升级上来,届时会吸引更多的流量和资金,纵观历史以太的升级大多会带来一定的行情,以太可能也会水涨船高。虽然Solana有“以太坊杀手”的美誉,但在市场共识和价值认可度上还相差甚远,比如老李经常提到目前约94%的山寨代币项目是基于以太坊技术开发的,而Solana生态份额占比还相对较小,如果到时以太在媒体报道加上市场炒作的氛围中,很可能会抢夺目前Solana的热度,甚至我们认为Solana热度可能都难持续到明年炒作以太坊坎昆升级的时候。

再次,FTX和Alameda是Solana的主要持有者,他们目前持有200万枚,价值约2亿多美元可能会被随时清算。 另外,还有4050万枚Solana,价值40多亿美元将按月线性释放,主要是在2025年,未来有潜在的通胀预期。这两点是利空Solana价格的,所以在汇率层面,Solana很难与以太对等,毕竟Solana历史最高价格仅仅260美元,而以太历史最高涨至4868美元附近,目前两者还存在约20倍的价差,也就是说,我们认为很难在接下来的时间,Solana涨幅超过以太的20倍。

最后,Solana也有一定的技术优势,它们自称世界最快的区块链,可以实现每秒处理高达65000笔交易,远高于以太坊,而且交易费用非常低。Solana的速度和可扩展性吸引了许多开发者和用户,尤其是在DeFi和NFT等领域。Solana生态上也有许多创新的项目和应用,为其提供了丰富的功能和流动性,也增加了Solana的需求和价值。但Solana也存在着劣势,比如,在安全性上,Solana在2022年曾发生过两次宕机,导致用户损失。另外在生态系统上,Solana的生态系统仍处于发展初期,与以太坊相比存在一定的差距。

总之,加密市场仍然处于高度不确定的状态,资金流入的方向难以预测,Solana走势又与加密市场整体大环境有很大关系。DeFi和NFT等领域仍处于早期发展阶段,其未来发展方向尚不明确。所以单纯只以这两方面判断未来Solana超越以太坊以及汇率价格层面对等是不科学的。

五、机构观点+海外视角:

数字资产金融服务公司Matrixport发文表示,预计在比特币现货ETF即将获批、机构买盘以及供应短缺和历史趋势等因素的推动下,比特币将在1月份大幅飙升至50,000美元,并有可能迎来加密币季节,融资率将达到+66%。

Greeks发文,在ETF内幕消息的推动下,BTC上涨至45,000美元,触及近一年高位。受此影响,短期期权IV大幅上涨,现在扁平期权IV在1月12日已经超过70%,本周扁平期权IV增长至65%。与此同时,沉寂数日的大宗交易再次火热,今天大宗看涨期权的名义价值交易量接近3亿美元,其中以短期持平和中期普通交易为主。很难不怀疑这些订单来自来源,并且ETF很可能在本月上半月取得成果。

Hashdex首席投资官表示,如果现货比特币ETF没有很快获得批准,我们相信BTC2024年的投资理由仍然非常强劲。越来越多的投资者开始意识到比特币作为数字黄金或价值储存储的好处。下一次比特币减半即将到来,如果历史再次押韵,比特币的价格将对这次预定的供应减少做出积极反应。他说:“无论现货比特币ETF何时获得批准,BTC前景从未如此强劲。

华尔街分析师Max Keizer表示,比特币挖矿难度的上调将使其价格超过40万美元。此前报道,据BTC.com数据显示,比特币挖矿难度在区块高度822,528(2023年12月23日14:04:24)处迎来挖矿难度调整,挖矿难度上调6.98%至72.01 T,续创历史新高,目前全网平均算力为531.98 EH/s。

以太坊上周突破年内新高,涨至2450美元附近,Grayscale Investments高级研究分析师对此表示,以太坊周三的上涨表明,市场终于转向了以ETH为中心的交易,尽管在美国现货比特币ETF获得适当的监管批准之前,这种情况可能不会完全显现出来。以太坊的链上活动仍然非常强劲,未来以太坊会赶上来补涨。

归纳总结:在多重积极因素推动下,加密货币市场呈现看涨趋势。Matrixport预测,受比特币现货ETF获批、机构买盘和历史趋势等因素影响,比特币价格有望在1月份大幅飙升至50,000美元。此外,在ETF内幕消息的推动下,BTC已涨至近一年高位,短期期权交易活跃,大宗看涨期权交易量增长显著。与此同时,越来越多的投资者意识到比特币作为数字黄金的价值,认为其前景强劲。此外,华尔街分析师预测,随着比特币挖矿难度创新高,比特币价格将超过40万美元。以太坊方面,尽管市场转向以ETH为中心的交易仍需时日,但其链上活动强劲,未来有望补涨。总体而言,加密货币市场正处于积极的发展态势。

六、上周加密市场涨幅榜及社区热点币种筛选:

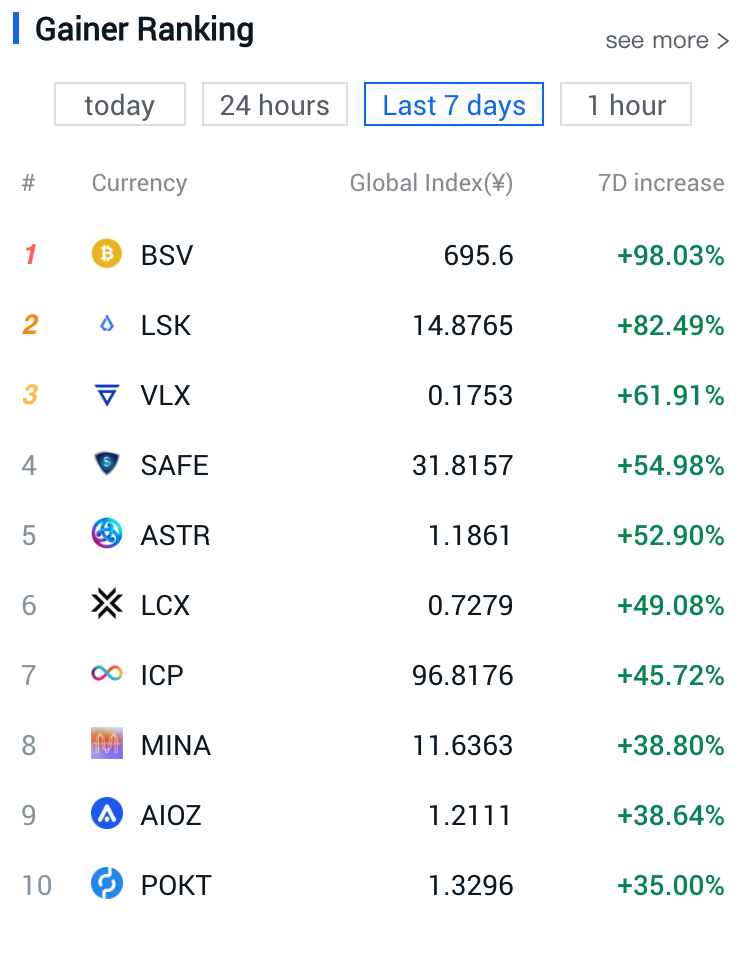

过去一周山寨币种涨幅排行如上,BSV接近翻倍,LSK上涨82.49%,VLX上涨61.91%,其他SAFE/ASTR/LCX/ ICP涨幅约为45%-55%之间;榜单还有币种在涨幅较大,本周可继续关注交易时机。

以下为dc社区讨论热点币种,筛选如下,观点仅供参考,不构成买卖依据:

2024年1月1日凌晨6点左右,价格一路攀升近600美元的TRB突然直线跳水,一度跌破200美元。TRB在24小时出现剧烈波动,于12月31日晚20:47创下315美元历史新高后短时下跌25%触及236美元,随后在短短数个小时内上涨超150%,于1日凌晨6点创下593美元的历史新高,随即又开启暴跌模式。一度下跌近80%,报价209美元。如此剧烈波动让昨晚一路追高的投资者迅速爆仓。据Coinglass数据显示,过去24小时内爆仓量达7168万美元,爆仓金额居首位。据监测,目前在流通的250万枚TRB中,约170万枚在交易所,66万枚TRB由20个主力账户持有。

关注xlm不如关注xrp,消息面而言,xrp更多些。

跟bsv的强势相比,bch走势相对平和,甚至连btc走势都没有跟上,目前上方阻力参考去年6月高点329美元附近,短期支撑247.4-249.1美元附近。

目前icp上方阻力参考23.5美元附近。

flow周线图如图所示,下降趋势线在11月初已经是突破状态,另外从项目基本面和数据层面来看,前期在底部震荡了一年时间,加上整体历史跌幅近百倍,也是A16Z和Coinbase投资的项目,属于公链、NFT、游戏、Layer 1的概念板块,未来还是有一定的前景的。

ftt前期上涨是因为ftx有重启的预期,近期炒作又相对偏淡的,目前得失关注2.76美元附近,这里关系未来方向,如果守住会有反弹;如果跌破,则将加速下跌。

link日线在高位整体有个上升通道存在,没有突破上下沿技术位置之前,预计还将震荡调整为主。目前支撑参考14美元附近,压力参考18美元上方附近。

dot日线属于上涨后的回调期,目前支撑参考7.6美元附近,如果在此附近企稳,有机会再次反弹。强支撑参考6.2-6.4美元附近。

bsv目前上方阻力200美元附近。bsv属于知名的妖币,一般上涨不具有持续性,经常在拉涨之后伴随着回落。如果想二次买入的话,可以在元支撑位置附近再考虑介入。

loom在10月份大涨大跌之后,整体走势越来越收敛,波动性降低,目前看日线图,没有太明显的趋势性,需要等待一根长阳或长阴才能确定接下来的方向,短期可高抛低吸操作,未来等待突破后再顺势跟进。

七、项目代币解锁利空数据关注:

数据显示,本周HFT、SUI、ACA等代币将迎来一次性大额解锁,总计释放价值约4337万美元。其中:

1月1日15时,Acala将解锁2743万枚ACA(约295万美元),占流通供应量的3.1%;

1月2日8时,Sui将解锁3462万枚SUI(约2688万美元),占流通供应量的3.35%;

1月5日8时,Galxe将解锁300万枚GAL(约697万美元),占流通供应量的3.34%;

1月7日8时,Hashflow将解锁1362万枚HFT(约514万美元),占流通供应量的4.81%;此外,HFT还将于自该日起每日解锁31.62万枚代币,持续366天。

本周关注这些代币因解锁带来的利空效应,避开现货,合约寻求做空机会。每个币种解锁幅度都相对较大,多加留意。

八、上周加密市场概念板块涨幅榜:

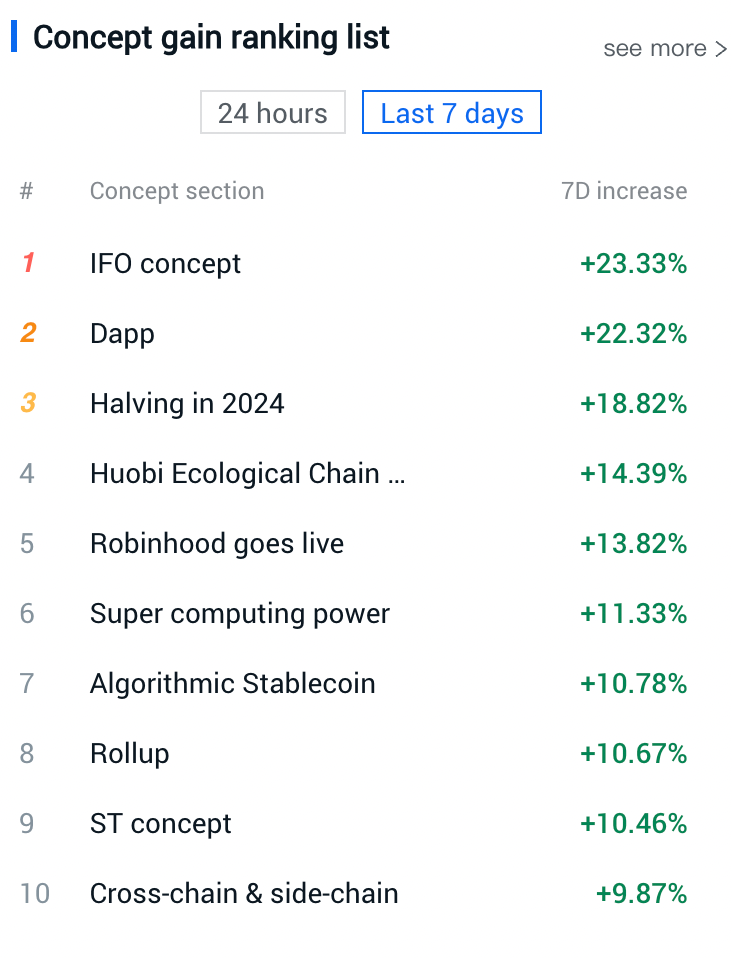

过去一周,概念版块具体表现如上,按涨跌幅度来划分,最近七日涨幅,IFO概念、Dapp、2024减半、火币生态链Heco、Robinhood 上线等概念或版块上涨领先,关注版块轮动炒作行情。还有超级算力、算法稳定币、Rollup、ST概念、跨链&侧链等概念板块也值得关注。

九、全球市场宏观分析综述:

上周全球主要股指均呈现上涨态势,但科技股表现相对较弱。从市场情绪来看,投资者对经济复苏的预期有所提升,但对通胀压力仍存在担忧。从基本面来看,全球经济复苏仍在进行中,但通胀压力仍然存在。港股市场相对稳定但板块表现分化;美股市场呈现复杂情绪,科技股与银行股走势分化;A股市场活跃度提升且多数指数上涨,行业板块表现亦有所分化。投资者在决策时应关注各市场动态及行业趋势变化。具体来看:

港股方面,上周五三大指数微涨,香港恒生指数涨0.02%,国企指数涨0.06%,恒生科技指数涨0.01%。虚拟现实、智能家居、新能源汽车等板块涨幅居前;安防、一体化压铸、在线旅游、生命科学工具等板块低迷。

美股方面,上周三大指数普涨,纳指跌累涨0.12%,标普500指数累涨0.32%,道指累涨0.81%。上周五科技股多数下跌,苹果跌0.54%,亚马逊跌0.94%,奈飞跌0.74%,谷歌跌0.39%,脸书跌1.22%,微软涨0.2%。银行股全线走低,热门中概股普遍上涨。

A股方面,上周主要指数多数上涨,上证指数和创业板指分别上涨2.06%和3.59%,MSCI中国A50指数上涨3.54%。全市场日成交额在最后两个交易日放量至8000-9000亿元。板块上,电力设备及新能源行业领涨,有色金属、食品饮料、电子、机械行业涨幅居前,传媒、房地产、交通运输和煤炭行业下跌。中证A50指数选取50只各行业市值最大的证券作为指数样本,行业分布较为均衡,更全面刻画各行业代表性龙头上市公司证券的整体表现。

2023年,沙特主权财富基金成为全球最活跃的主权投资者。全球主权财富基金数据平台(Global SWF)报告显示,沙特主权财富基金在2023年的支出高达316亿美元,远高于前一年的207亿美元。而全球所有主权财富基金的支出为1238亿美元,同比减少约五分之一。新加坡政府投资公司领跌,该投资公司减少了46%的资本配置至199亿美元,六年来首次失去了全球最活跃主权财富基金的宝座。在市场动荡的背景下,淡马锡也减少了53%的新投资至63亿美元,导致这两家总部位于新加坡的投资者报告回报率不断下降。报道指出,由油气资源丰富的阿布扎比、沙特和卡塔尔政府控制的主权财富基金在去年最活跃的10只主权基金中占据了5个席位,而这一趋势可能会持续下去。

综合而言,沙特主权财富基金的强劲表现显示了中东地区在全球投资中的影响力增强,而新加坡投资者的相对滞后可能需要调整策略以适应市场的不断变化。同时,全球主权财富基金在不确定的经济环境下仍在谨慎行事,反映了对风险的敏感性。

十、后市研判:

BTC日线图,新年伊始,市场上有部分资金在押注ETF会通过,这种预期让市场情绪高涨,btc在1月2日突破了近期高点44700美元,按我们前期分析判断突破震荡区间可顺势跟进,目前最高涨至45880美元附近。目前btc上方阻力参考48190-48555美元附近。

不过从爆仓数据来看,空头较少。在etf通过与否公布之前可能会相对强势,等消息公布时,如果是通过,可能会中小幅上涨再下跌;如果是未通过,可能会直接下跌。其中从既定时间表来看,现货比特币 ETF 申请结果相距最近的时间节点是 1月10日:已经历经两次延迟的ARK 21Shares Bitcoin ETF 将迎来最终决定。另外1月14日至17日,也密集有 7 家的现货比特币 ETF 申请将迎来美 SEC 做出决定的时间节点,不过按以往的惯例,大概率还要继续推迟到3月中旬的最后时间窗口。

大级别来看,从2023年年初其实btc一直是处于阶段上涨之中,而突破25200美元和32400美元后都是我们前期多次提及的牛市行情。而从据链上分析监测,比特币矿工在上周24小时内售出了超过3000个BTC,价值约1.29亿美元。这种大幅抛售一般会影响BTC价格,所以在行情大幅上涨过程中,我们也需要关注矿工和巨鲸们的动作,做好交易规划。

关注我们:老李迫击炮

Deepcoin研究院

2024年1月2日

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。