【一周资金面分析,恐怕都是bad NEWs】

1 重点概况

1)稳定币总市值下降了3亿美金,成为近6周来的首次下降。虽然USDT依然增发了2.6亿美金,但都是其它稳定币兑换而来。

2)BTC净流入交易所1.4万枚,并且上上周也是净流入1.4万枚。在铭文如此fomo的情况下,在btc爆拉到4.4w的情况下,实在不是什么好的消息。

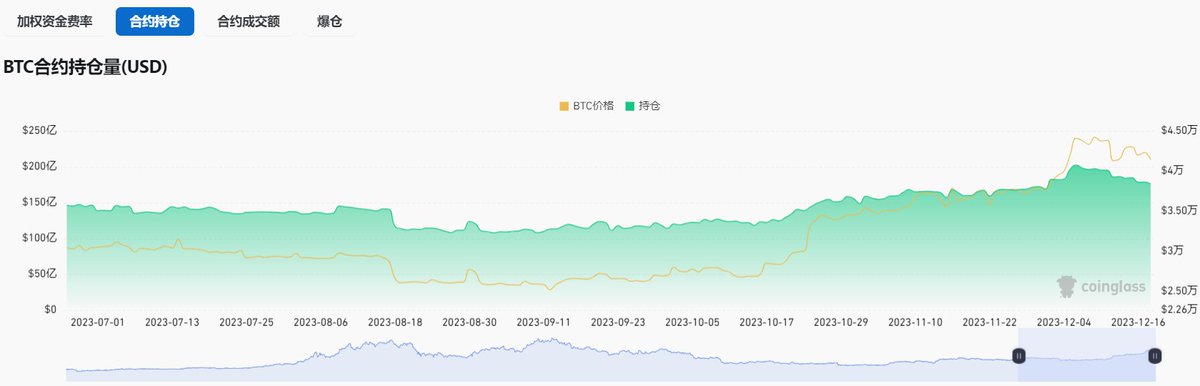

3)比特币合约持仓量从12月6日以来,持续下降,上周下降了20亿美金。特别是代表美国资金的CME合约持仓,也是剧烈的下降。并且根据历史来看,在btc高位的时候,CME的合约持仓大的减仓,都会带来一波不小的下跌。

4)整体来说,数据不是很好,希望各位安好~

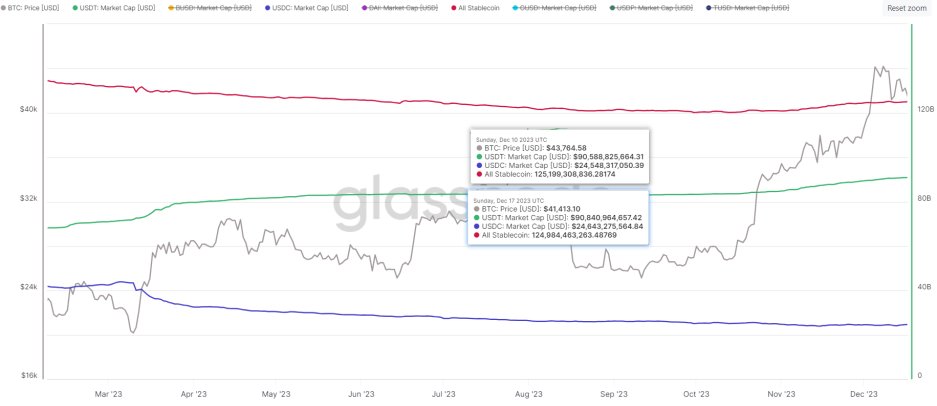

2 稳定币总市值

过去一周,稳定币总市值从1251.9亿美金下降到1248.8亿美金,减少了3亿美金。在主流稳定币方面,USDT从905.8亿美金增加到908.4亿美金,增发了2.6亿美金。USDC从245亿美金增加到264亿美金,增发了1亿枚。其它的山寨币有主要是TUSD和BUSD的在减小。

从稳定币方面,表现出不利的消息。

1)稳定币总市值在连续6周后,出现了第一次的下降。而之前2周,在5~6亿美金增发。11月每周有10亿美金的增发。而到了btc拉盘到4.4万美金后,反而出现了下降。

2)虽然看USDT在上周依然增发了2.6亿美金,但是跟之前几周,已经下降了很多。并且,这增发并不是新入场资金的结果,而是其它稳定币主要是TUSD和BUSD兑换而来的。

3 主要交易所的稳定币情况

在币安交易所,USDT从194.1亿美金上升到197.9亿美金,净流入了3.8亿美金。USDC从72.9亿美金下降到69.9亿,净流出了3亿美金。所以整体来看,币安交易所过去一周的稳定币净流入了0.8亿美金,量并不是很大。在okx上,USDT从49.6亿美金下降到48.9亿美金,净流出了7千万美金。USDC也是净流出了5千万美金。整体而言,交易所的稳定币并没有特别大的波动。

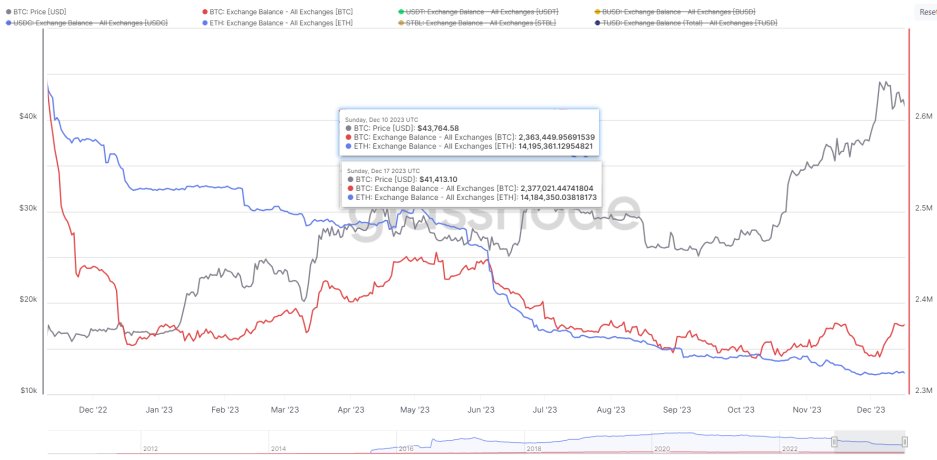

4 btc/eth在交易所的存量

过去一周,BTC在交易所的数量从236.3万增加到了237.7万,净流入1.4万枚。以太坊从1419万枚增加到1418万枚,净流出了1万枚,以太坊并没有大的变动。主要是btc的净流入比较大,特别是在上周铭文市场极度FOMO的情况下,btc却是大额的净流入交易所。

5 BTC合约持仓量

btc的合约持仓量正在不断地降低。具体来说,在12月6日达到202亿美金之后,一直在降低,上周整体降低了20亿美金。同时,CME的比特币期货的持仓同样也是有比较的下降,CME属于美国的大资金,而且在12月初的持仓金额已经超过了21年牛市。但是在上周开始很大幅度的降低。从历史来看,CME的持仓的下降都会带来一波很大的调整。

#Bitcoin #USDT

欢迎加入TG群交流: https://t.co/aQPRi0uCQM

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。