Market Review

Bitcoin made a morning push to the 44500 level yesterday and then began to consolidate as expected. We successfully entered long positions around the low levels: Bitcoin provided entry positions around the 43400 level twice yesterday. The first retracement at midday reached the 43450 level, and in the evening, after reaching a high of 44350, it retraced slightly before precisely reaching the entry point at 43377. As the US stock market opened, Bitcoin reached above 44300 once again, and we successfully closed two rounds of long positions set around the low levels, gaining a total of over 1500 points in Bitcoin. Meanwhile, Ethereum showed overall weakness during the day and presented a downward trend. However, it also provided opportunities for long positions. After the first retracement dipped to the 2230 level, it rebounded, and our long position set at 2250 successfully guided the exit at 2280, gaining 30 points in Ethereum. Through the two retracements during the day, it can be seen that solid support was provided at the lower end of the market under the bullish trend. In the future, we will continue to adopt a buy-on-dip approach.

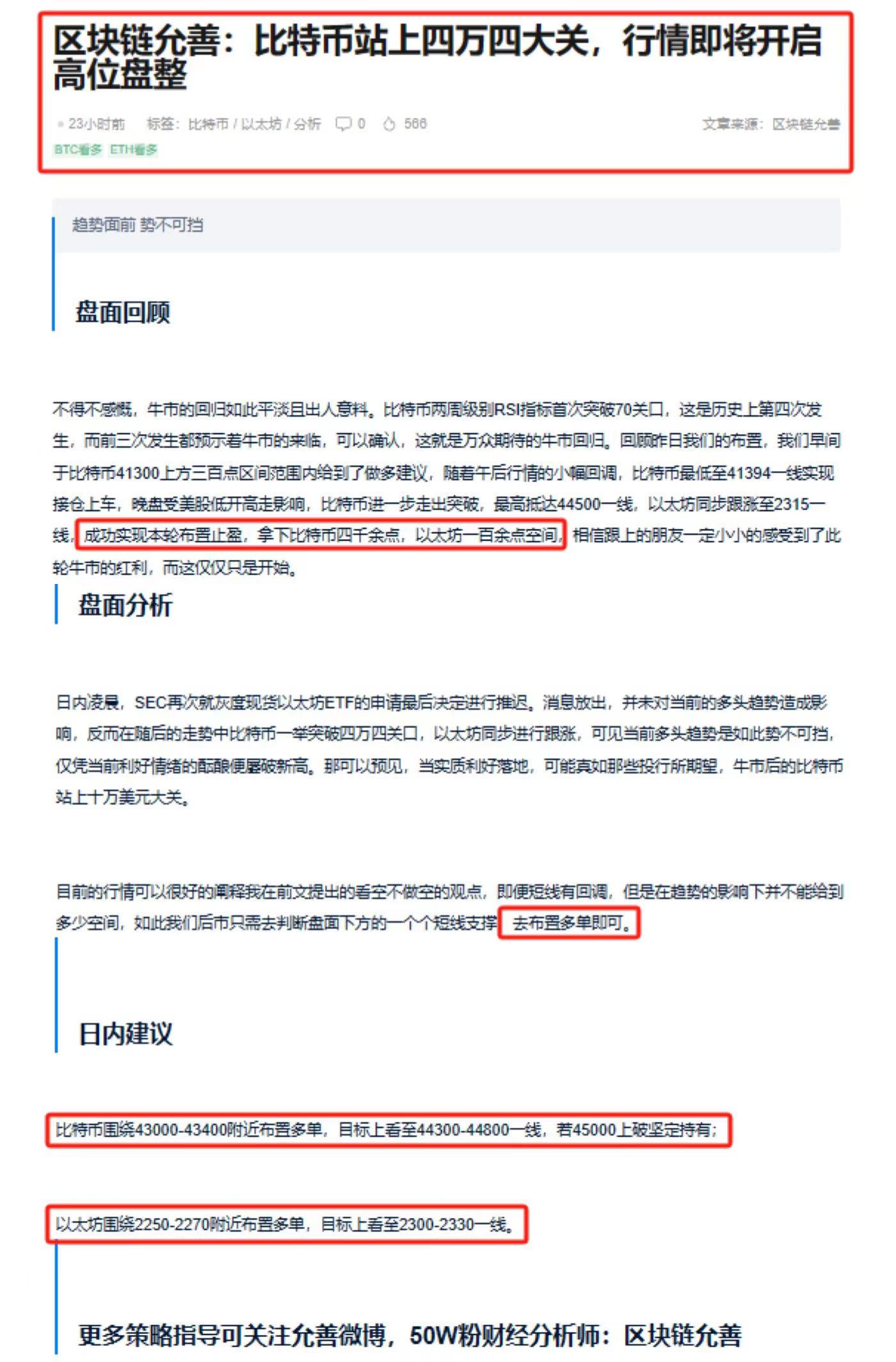

Market Analysis

In the past two days, there have been no major changes in the macro market, but the US labor market has caused some waves. As is well known, the US places great emphasis on labor welfare, but the reduction in wage increases this year has led to several major strikes. Additionally, due to the increase in borrowing costs, some companies have been affected by the interest rate hikes, resulting in a slowdown in recruitment and widespread layoffs. From these developments, it is not difficult to see that the US labor force has rapidly cooled down under the influence of interest rate hikes, which has reduced a considerable amount of inflationary pressure. This indirectly supports our venture capital market. Therefore, we can anticipate today's weekly data, but we are more eager for tomorrow's non-farm payroll report.

There is still not much to analyze in the market. We will continue to focus on setting up long positions around short-term support. Recently, there have been many retail investors or "teachers" making bold claims in the market, saying that Bitcoin and Ethereum are seriously diverging in their daily and weekly charts, and a significant correction is imminent in the short term, with some even suggesting that Bitcoin will return to twenty thousand. WTF? Isn't the return of a bull market characterized by continuous divergence and upward movement? So, are these nonsensical statements meant to discourage others from buying while they themselves go long? At least for now, it seems that Bitcoin has no intention of correcting at all.

Intraday Suggestions

For Bitcoin, set up long positions around 43700-43400, with a target of 44390-44700. Pay close attention to the key level of 45000, and hold the position if it is breached.

For Ethereum, set up long positions around 2220-2240, with a target of 2275-2295.

For more strategic guidance, follow Yunshe on Weibo, a financial analyst with 500,000 followers: Blockchain Yunshe

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。