Lending

Aave

The latest report submitted by the GHO Liquidity Committee indicates that stablecoin GHO, in collaboration with Maverick, has approached full anchoring to the US dollar for the first time since August, compared to liquidity platforms like Uniswap. Maverick Pools has a decisive advantage in designing and programming liquidity.

On December 2, a large AAVE holder @luggisdoteth deposited 23,700 AAVE into Binance. This address has been continuously purchasing AAVE since November 2020, and this is its first time depositing coins into Binance. The address currently holds 78,300 AAVE.

Venus

According to Arkham monitoring, a whale address for VBTC (starting with 0x1E7) deposited $14 million worth of BTCb into the Venus Protocol on November 2, bringing its total deposits to over $28 million.

This address is the fourth largest VBTC holder and has a trading volume of over $750 million in the protocol. Just two days ago, the address borrowed $5 million in USDT and immediately deposited it into Binance.

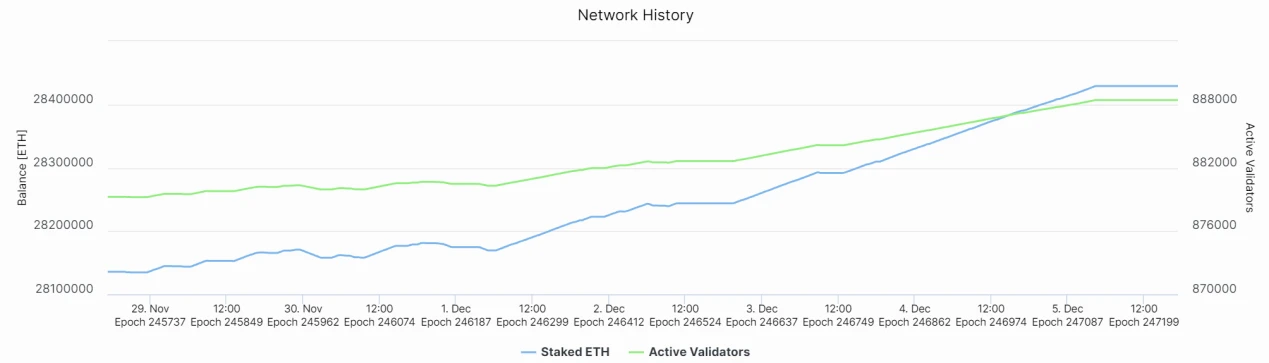

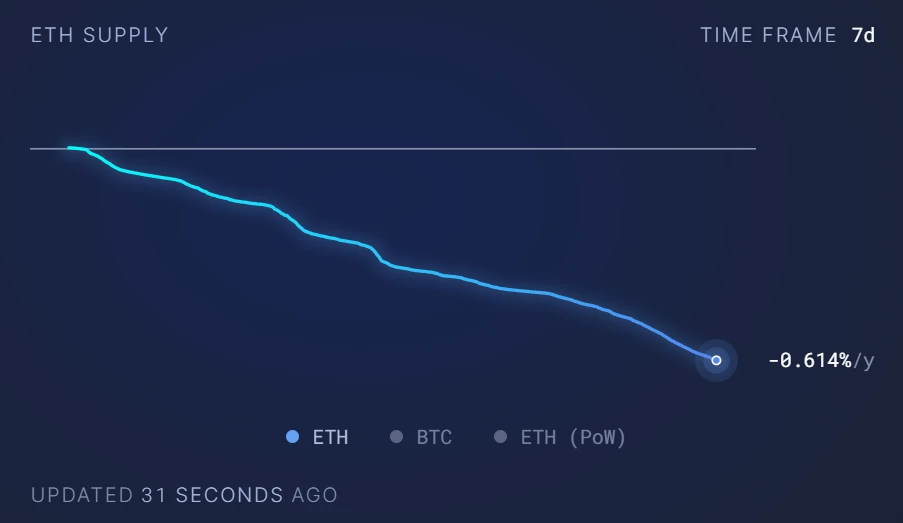

LSD

Last week, 28.78 million ETH were locked in the beacon chain, corresponding to a staking rate of 23.94%, an increase of 0.2% compared to the previous period. Among them, there are 888,400 active validator nodes, an increase of 1.02% compared to the previous period. This week, the ETH staking yield is 3.84%, with an annualized inflation of -0.61%. Uniswap, Maestro, and BananaGun are the top three DeFi platforms in terms of gas burning.

The ETH staking quantity increased by 1.02% this week

Source: Beaconcha.in, LD Capital

The ETH staking yield for this week is 3.84%

Source: LD Capital

ETH annualized inflation has decreased to 0.61%

Source: ultrasound, LD Capital

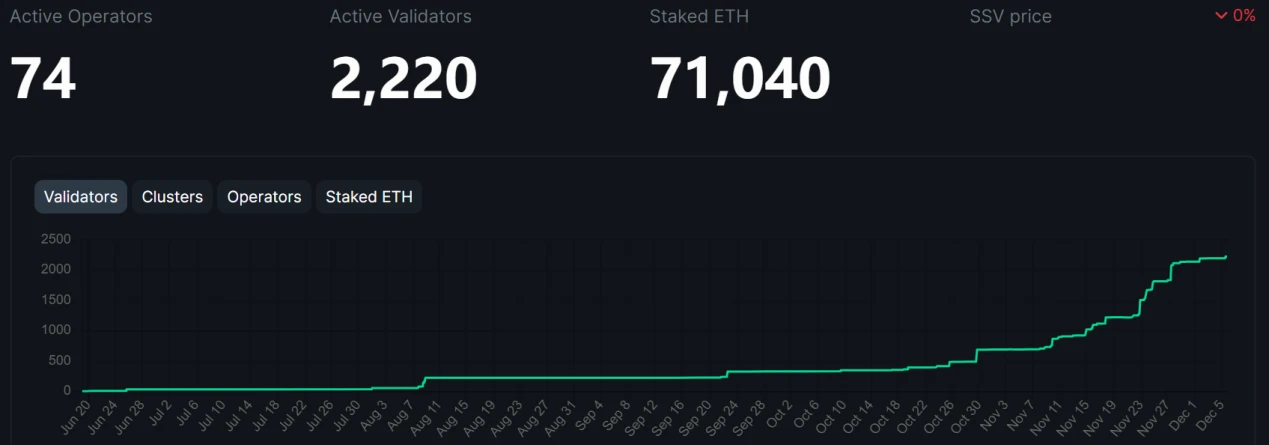

Among the three major LSD protocols, in terms of price performance, LDO increased by 2.3% in the past week, RPL increased by 14.5%, and FXS increased by 21.7%. From the perspective of ETH staking quantity, Lido increased by 0.78% in the past week, Rocket Pool increased by 0.39%, and Frax increased by 1.19%. FXS benefited from the rise of FRAX CR, and the upcoming launch of BAMM and Fraxchain achieved the largest increase last week. RPL, due to its mechanism of pledging RPL to stake ETH, to a certain extent anchors the price of ETH. Currently, the RPL staking rate is 50.89%, with an effective staking rate of 94.14%, and a deposit pool balance of 18,092 ETH. Dragonfly Capital sold $4.5 million worth of LDO last week. The unauthorized mainnet upgrade vote for SSV passed, and the TVL reached 71,000 ETH.

The current SSV TVL has reached 71,000 ETH

Source: SSV Scan, LD Capital

Ethereum L2

TVL

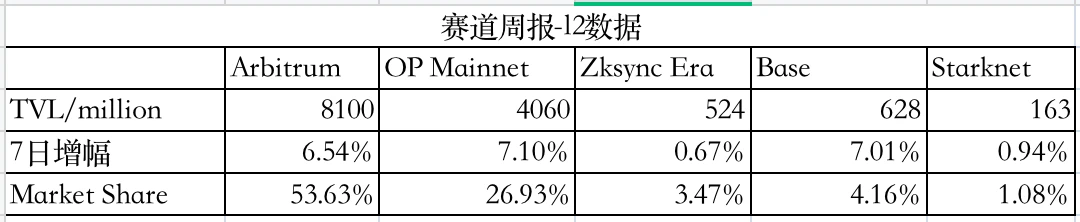

The total Layer2 TVL is $15.11 billion, with an overall TVL increase of 6.91% in the past 7 days.

Source: L2beat, LD Capital

ACDC Meeting

The 123rd ACDC meeting on November 30 mainly shared the test updates for Cancun/Deneb.

Introduction of Devnet #12: The Cancun/Deneb upgrade was activated on Devnet #12 on Wednesday, November 30. The three currently running CL clients did not encounter any major issues, but the most popular CL client, Prysm, has not yet joined. The Prysm team expects to have their software ready for testing on the latest Devnet in two to three weeks. It is expected that the Goerli shadow fork will be launched at some point before the end of this year.

Validator exit issue on Devnet #11: Developers discovered a validator exit issue on Devnet #11, and the Nimbus client team is addressing the issue. Devnet #11 will continue to operate normally until the issue is resolved.

Network specification clarification: Developers discussed clarifying the specifications for "BlockByRoot" and "BlobSidecarsByRoot" requests to explicitly mention whether CL nodes should respond to these requests in a specific order.

Arbitrum

On December 3, the Arbitrum DAO approved a one-time reserve fund of 21.1 million ARB tokens (approximately $23.54 million) to support 26 projects that missed the first round of funding. The 26 projects receiving this funding include Gains Network (4.5 million ARB), Stargate Finance (2 million), Synapse (2 million), PancakeSwap (2 million), Wormhole (1.8 million), Magpie (1.25 million), RabbitHole (1 million), dForce (1 million), Vela (1 million), and others.

On December 5, the multi-chain lending protocol Radiant Capital released an update regarding a 2 million ARB airdrop plan, with eligibility ending before February 16, 2024. The new 6–12 month dLP must be locked or re-locked on Arbitrum after the first snapshot (block 147753665) and before the second snapshot (within the next 30–90 days) to qualify for the airdrop, and a 12-month lock receives more ARB than a 6-month lock.

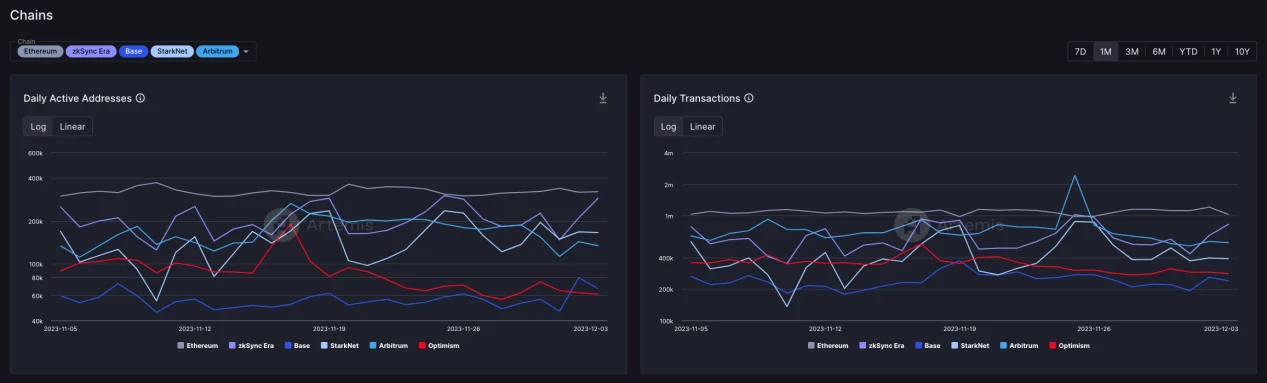

On-chain Activity

Source: Artemis

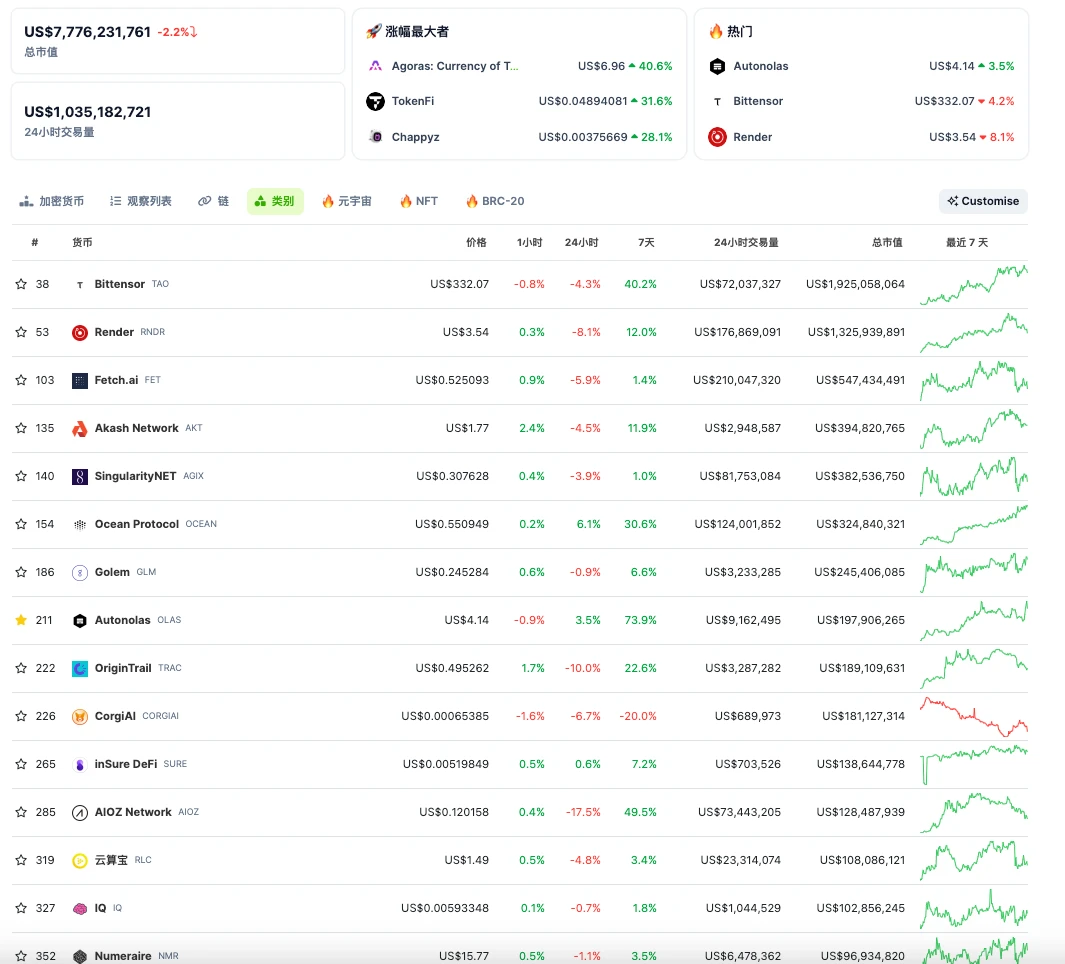

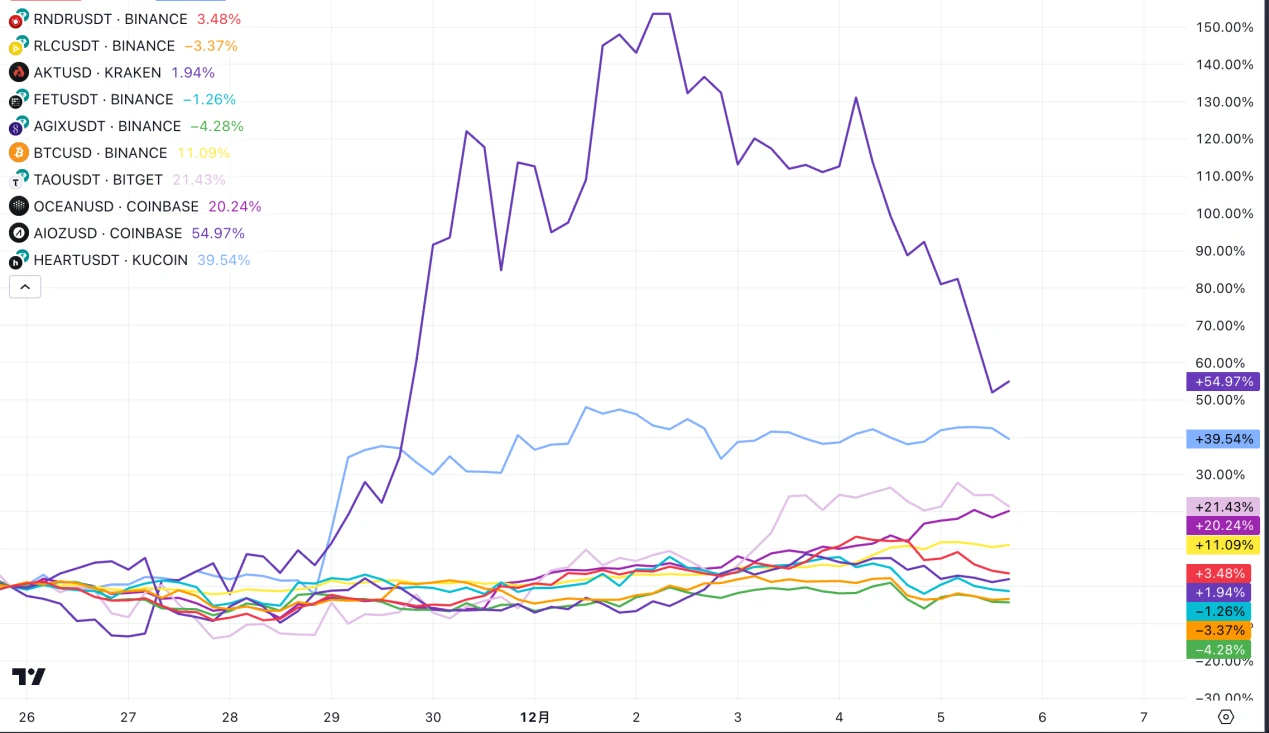

AI

In the past week, AI token prices followed the market with varying degrees of increase, but only a few projects outperformed BTC's increase. Projects that performed well include TAO, OCEAN, OLAS, AIOZ, HEART, and AGRS.

Source: Coingecko

Source: Tradingview

AI Conferences and Tech Companies

- The New York Artificial Intelligence Summit will be held at the Javits Center from December 6th to December 7th, with some Web3 projects sponsoring and speaking at the event.

Source: AI Business

On December 3, according to The Information citing two sources, Google has postponed the release of the artificial intelligence model Gemini to January 2024.

On November 26, Elon Musk tweeted that a "Grok, analysis" button will be added to X (formerly Twitter) tweets in a few weeks.

TAU

On November 29, TAU announced on Twitter that they recently obtained a temporary patent in the United States for a method and system for arbitrary authentication of anonymous internet users. The patent will enhance Tau Net's advantages in five areas:

(1) Enhanced user verification: The system introduced in the patent can verify user information while maintaining anonymity.

(2) Robust governance framework: The patented system supports Tau Net's governance, ensuring democratic and transparent decision-making that reflects community consensus.

(3) Prevention of bot influence: The patent addresses a key issue in decentralized networks, ensuring robust verification processes to prevent bot-driven manipulation or control.

(4) Real-world applications: The system allows users to verify various claims, such as professional certificates, linking them to their digital identity, thereby enhancing trust in online interactions.

(5) User privacy authorization: The patent respects user privacy, not requiring personal information to be associated with public keys, thereby empowering users with governance rights while protecting their identities.

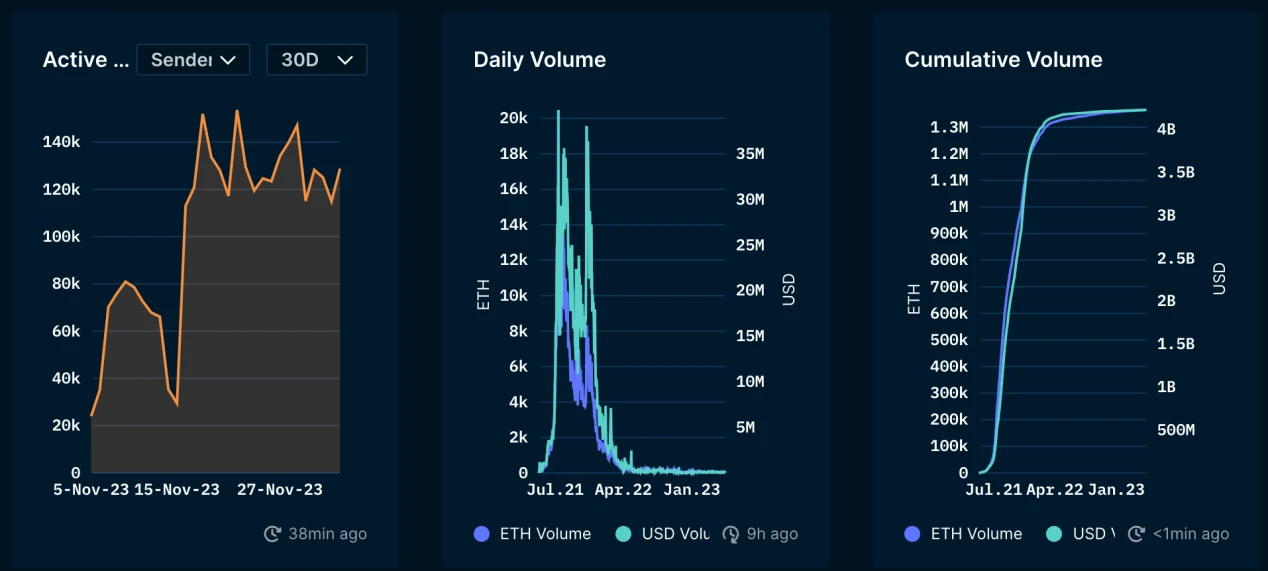

DEX

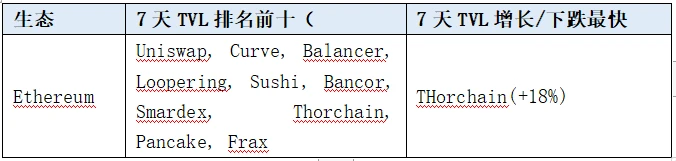

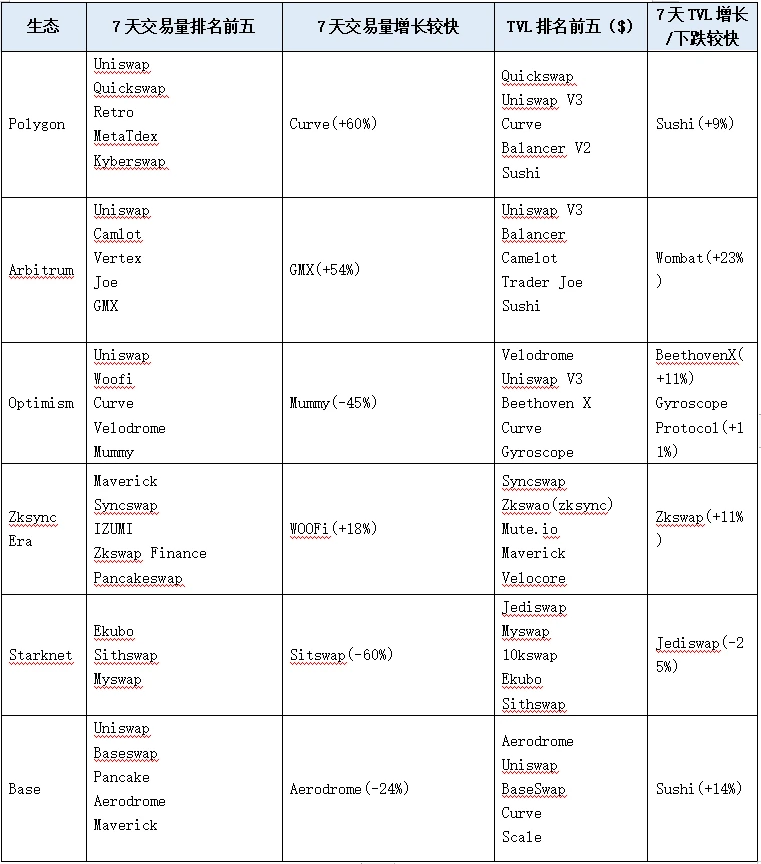

The combined TVL of DEX is $13.3 billion, an increase of $0.62 billion from the previous week. The 24-hour trading volume of DEX is $4.4 billion, with a 7-day trading volume of $21 billion, a decrease of $1 billion from the previous week.

Ethereum

ETH L2/Sidechain

BTC L2/Sidechain

The BTC ecosystem is thriving, with the BRC20 on STX experiencing a threefold increase in TVL from 24 million to 61 million in a week.

Alt L1

Cosmos

The top ten projects in terms of net inflow of IBC volume this week are: Osmosis, Axelar, Cosmos Hub, Kujira, Noble, Celestia, Neutron, Stride, Akash, and Terra.

Cosmos Hub initiated the allocation of 900,000 ATOM to the Osmosis stATOM/ATOM pool for voting. The proposal aims to increase the circulation of ATOM by allocating 900k ATOM to this pool. If the BTC market continues, it is expected that ATOM, RUNE, and NTRN in the Cosmos ecosystem will continue to maintain a good upward trend.

Derivatives DEX

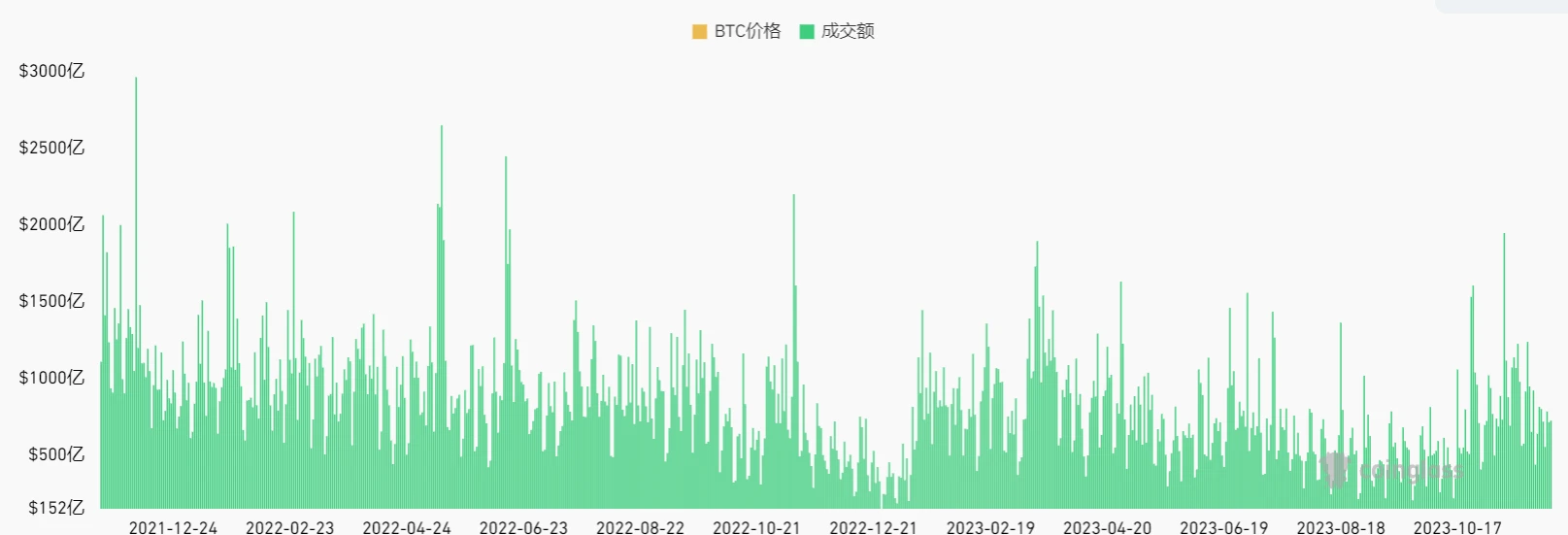

Last week, BTC broke through the resistance at 38,000 and reached 40,000. This led to an increase in open interest, with the current contract open interest reaching $39.4 billion, an increase of approximately $4 billion from before. Open interest has returned to the levels of the first half of 2022.

In the past week, the contracts continued to maintain high trading volume. However, this time when BTC broke through 40,000, it did not generate a very high trading volume as it did when it broke through 32,000.

The pattern of derivatives DEX remains unchanged, with DYDX still in the top tier in terms of trading volume, and GMX/SNX in the second tier. However, the trading volume of derivatives DEX has decreased significantly this week compared to the previous two weeks.

On December 1, DYDX unlocked approximately 30% of the tokens held by the team and investors, accounting for about 15% of the total tokens. The circulating market value ratio before the unlock was about 19%, and after the unlock, it was 38%, effectively doubling the circulating market value. On the day of the unlock, Amber Group deposited approximately 5.7 million unlocked tokens into Binance for sale, causing the token price to drop by about 6%. With the release of potential selling pressure, the short-term bearishness of DYDX has been absorbed.

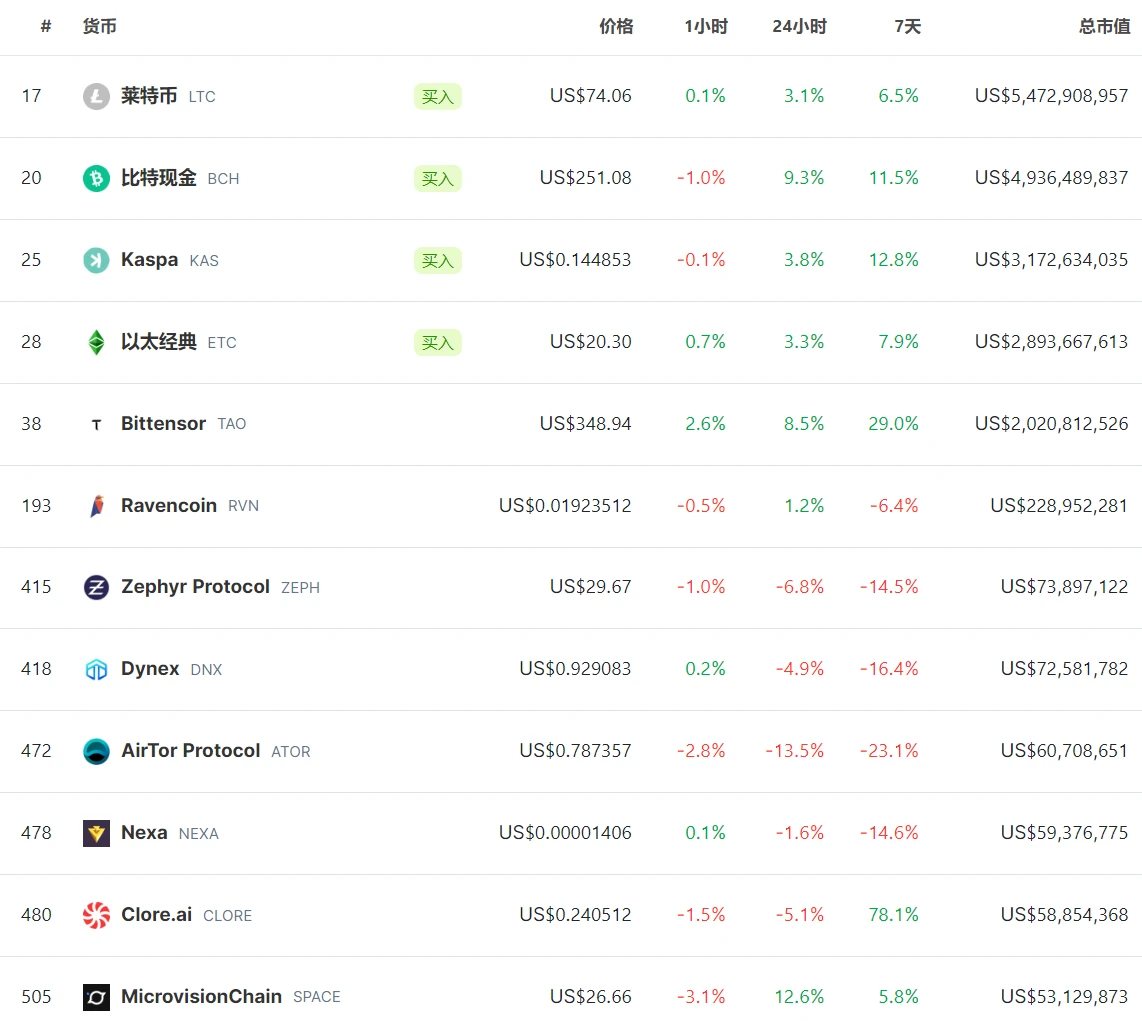

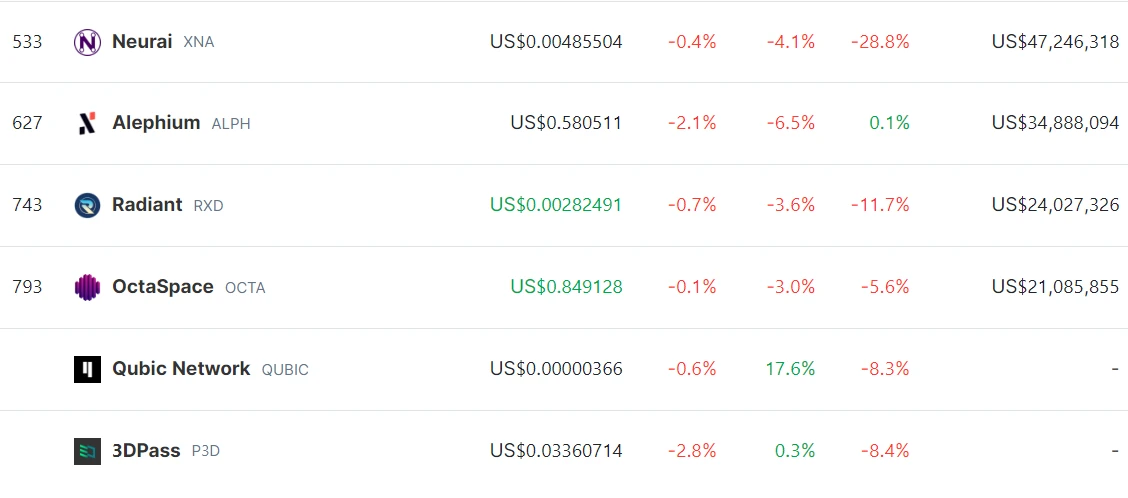

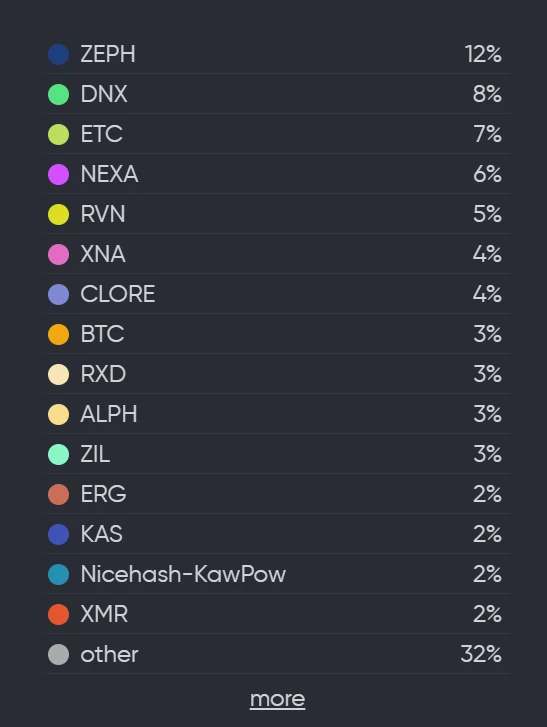

POW

There is a differentiation in the concept tokens of POW. The old POW concept tokens saw an increase as BTC broke through 40,000. The leading new POW concept tokens, KAS and TAO, continue to maintain a fluctuating upward trend. However, except for CLORE, POW new tokens with a market cap of less than $100 million are still in a correction phase. The main reasons are that these low market cap tokens had a significant increase before, and some projects have unclear long-term development, leading to profit-taking. TAO and CLORE not only benefited from the POW concept but also from the AI concept. The AI sector saw an overall increase in the past week.

In terms of GPU/CPU hashrate, ZEPH continues to maintain growth in hashrate. Although the price has retraced about 40% from its peak, the hashrate continues to grow. The hashrate of CLORE increased by about 4% from last week's 3%. DNX's hashrate was consumed by newly developed projects, dropping to less than 10%.

GameFi

This week, the gaming sector was relatively quiet. From November 28th to December 5th, the token with the highest price increase in the GameFi sector was BIGTIME, followed by MEME and then RON. Bigtime and Meme have not had much marketing activity or game progress recently, while Ronin Network has seen an overall increase in active users due to the entry of the Pixels game. However, the main assets on the Ronin chain are still Axie Infinity, and there has been no significant increase in funds flowing into Ronin.

(Note: Due to the large number of GameFi projects, only some projects are included.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。