陈斌点金:11.28黄金偏离均线看多不宜追多,早盘先空再多!

生活的美好,不在于努力后的纸醉金迷,更不是自我放纵,真正的美是在于奋斗的过程,不要被短暂的风景迷失了前行的步伐,思考来自于冷静后的决断,而不是冲动后的幻想,只有心存希望,有所追求,才能不断向前,就如交易一样,不会因为某个人的失落和狂妄,而停滞不前,被淘汰的总是曾经张扬的,机会永远留给有准备的人,而不是留给做梦的人。

黄金这一次的上涨当中,涨势看似比较慢,但相对非常稳,很多人看到了慢,却忽略了稳,总觉得到了压力要回撤,看到阴线就激动,可是最后发现市场用横盘的方式消耗了下跌的动力,之前一直是2000上方回撤后的震荡,当你不明白或者不清楚的时候,那么这个单子的入场就会变成一种负担,老感觉要下跌,拿着多单如坐针毡,做了的空单却不是套牢就是止损。

持续性的上涨,主要是因为上周的探底回升非常完美,守住了1965的低点位置,并且还破位了周线MA5或者靠近这个压力点,后面的上涨就变的理当所以然了,思路的转变往往是要自我的劝降,太多的人做不到这一点,人们愿意拼命自我的肯定支持自己的观点,哪怕是错误的也在所不惜,而发现原有的坚持是一种徒劳,甚至是对资金的变相伤害,谁在这个时间能让自己放弃原有的想法,重新客观的定位,谁就能取得进步,就如这一次的上涨,死守只是一种自残。

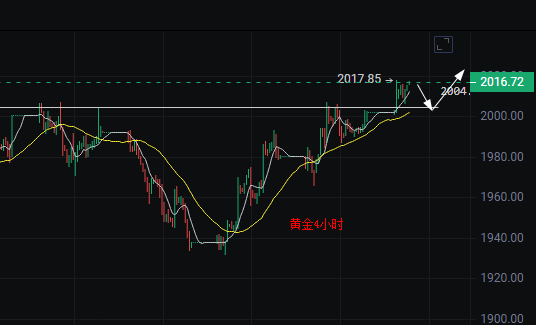

此次,黄金价格偏离均线的位置较远,回撤的支撑就两个位置。第一:最后一次刷新高点前回撤支撑位置2000。第二:前期2005顶底转换的位置,也是今天凌晨回撤的低点,加之5日均线的支撑也是在2005这里,最大的极限就会走一个探底回升!不过面对这样的强势上涨和价格的高位,直接追多是不可取的!

而无论今天怎么样,回撤到2004-2001区域是一定要出手多一次,由于偏离5日均线位置较远,在亚盘,我并不想急于追单操作,靠近2017的位置过于激进,有个再一再二,没个再三再四,所以我不喜欢在反复盈利后,更加的放肆或者任性,而是更倾向于稳健的交易思路。亚盘暂时并无计划,不怕它涨到2016-2017没有机会入场,就好比上周二美盘前到了1994,太多人觉得价位太多没法做多,而回撤后的1985多单不照样止盈20美金。今天回撤到了2000附近会考虑多,或者亚盘上涨,在美盘前后以最后上次刷新高点前的支撑为入场多,而此时,不计划急于建仓追多,激进的今天早盘可以轻仓做空一次。

11月28日黄金操作建议:

1、现价2016-2017轻仓做空,止损2022,目标2007-2005

2、回撤2004-2021再做多,止损1996,目标2020-2025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。