Click to watch the video: Master Chen's 11.27 Video: Bull Market Signal in the Market Again? Teaching You How to Identify the Next Buying Point

Today, we will continue to look for the next long opportunity and some knowledge inside the charts, especially how to judge the next buying point.

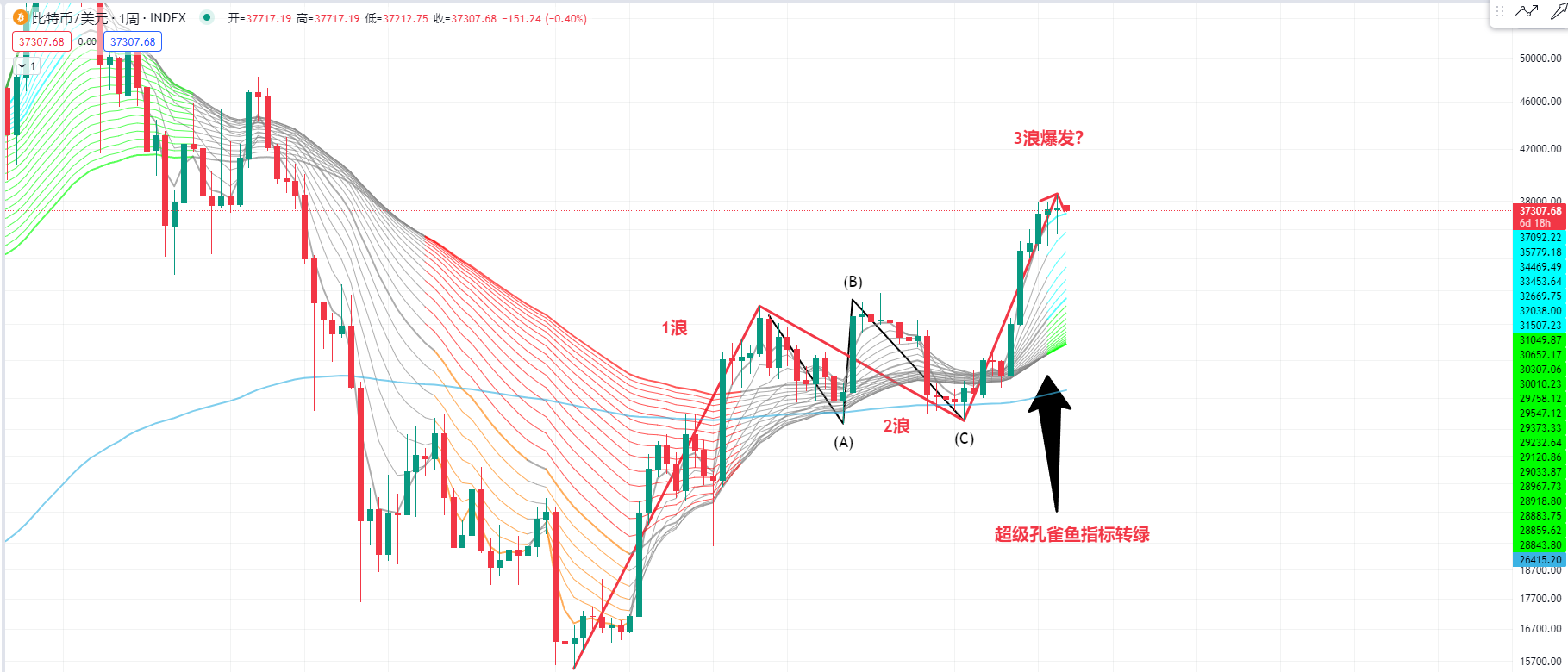

First, let's take a look at the weekly chart of Bitcoin. There is a legendary super peacock fish indicator here. After more than a year of Bitcoin, the super peacock fish indicator has officially turned green in 2022 from the bear market. My view is that as I previously predicted, this might be the beginning of a first wave of rise, followed by an ABC second wave correction, and currently breaking out into a third wave surge structure.

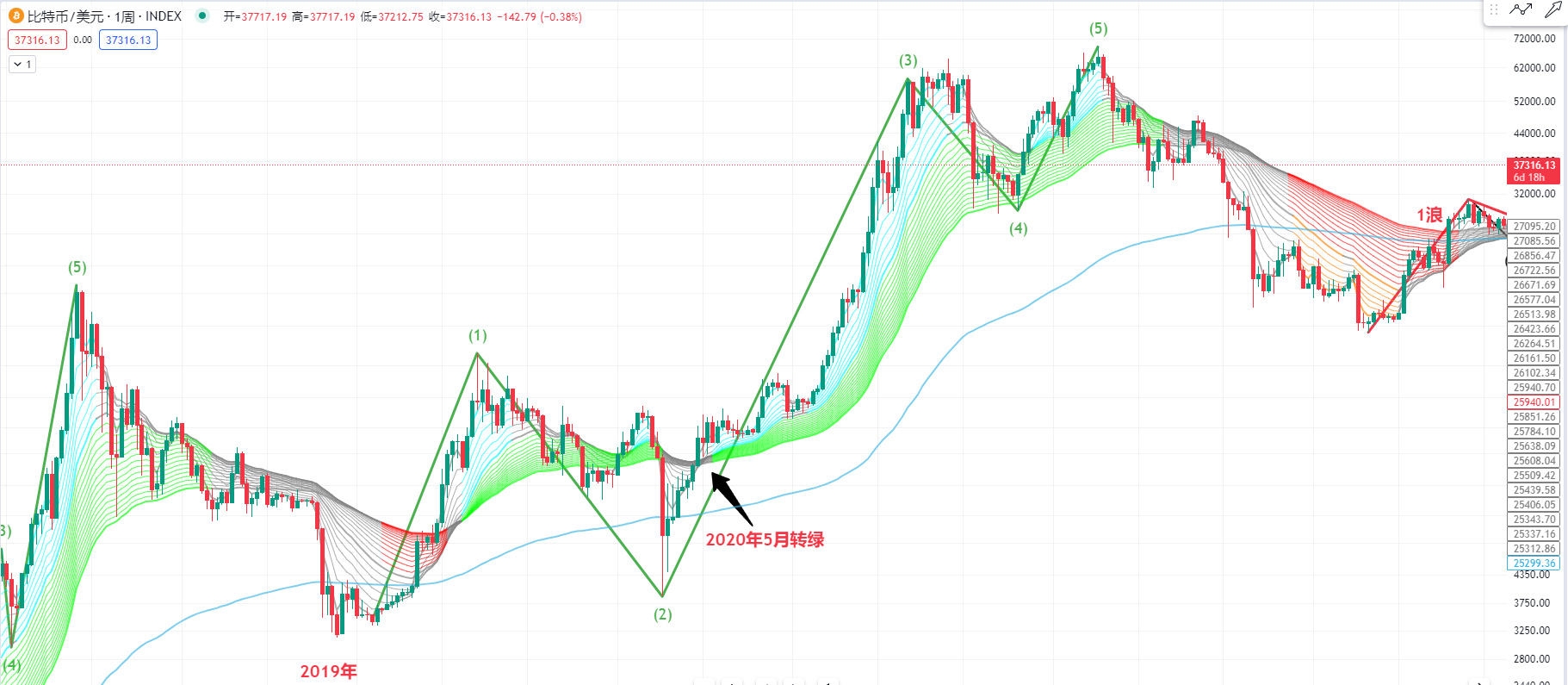

We can look at historical experiences, such as the rise of Bitcoin in 2015. After a wave of bearish trend in 2015, we can see the rise of the first wave and the subsequent second wave correction. It is possible that the position where the super peacock fish indicator turns green is the connection point between the second and third waves turning green. We can then observe when it turns red again and see how much the market has risen afterwards, possibly by several tens of times.

Alternatively, we can look at the bull market of Bitcoin in 2012. It is also possible that this position is the rise of the third wave, or the subsequent fourth and fifth waves, with the first and second waves in the front. We can observe the position where the super peacock fish indicator turns green, which might be the start of the third wave. Therefore, we can see the structure of Bitcoin in 2012 when the super peacock fish indicator turned green, and the market rose significantly afterwards.

Next, let's look at the structure of Bitcoin in 2019. In 2019, the super peacock fish indicator turned green within the first wave. There was a black swan event of the epidemic, and it is possible that this was the second wave. The green structure at that time turned gray, and we can see the subsequent surge of the third wave. The structure of the fourth and fifth waves was also within the third wave. In May 2020, the super peacock fish indicator turned green at this position, and the market rose from around $10,000 to a high of $65,000, which is a rise of more than 6 times.

So, my current view is that the super peacock fish indicator is completely possible to be within the structure of the third wave at the moment. This green has already been released, so whether it is the long position bought at the bottom last year or the long position made in the range below 30,000, everyone must hold their positions patiently.

Then, let's take a look at the daily chart of Bitcoin. It is currently in a box oscillation. We can observe the range of this box, and there are two low points where the KDJ indicator is in a dead cross near 50, which are very important buying points. We need to prevent whether the black 20MA moving average can hold at this position. If it holds, that would be the best, and we can directly attack upwards. Because at this position, we need to feel whether the KDJ indicator is going to have a dead cross or a golden cross.

In case a dead cross appears at this position, we need to observe the forms of the previous boxes, which are a wave of rise, or like this kind of rise, but the price cannot stabilize afterwards, or when it falls below this platform. We can see that the KDJ indicator at the bottom is near 20, as I mentioned before, these buying points are all near 20.

Alternatively, we can look at Bitcoin in March of this year, also in this range, with several low points as buying points, where the KDJ indicator is in a dead cross and has not broken 50. These positions are relatively important buying points. Including the position of the K-line at that time, it felt like it was going to break 20, and then there was a golden cross near 50, and the price broke upwards. But then it fell back. We can see that if the KDJ indicator at the bottom of these low points is below 50, then we need to look for the possibility of a long position near 20.

Then let's look at the daily chart of Bitcoin. We start counting from this K-line. I mentioned before that 13 days are a turning point upward at this K-line, and then it pulled to the position of 21 days, and this K-line also turned upward. Now the price is still above the 20-day moving average. My view is that in the next two days, because tomorrow is a 34-day window, it is best to quickly turn upward. That would be the best. If it doesn't turn upward, my view is that it might still be in this box. The support levels I mentioned before, I think are still around 34,500, and this is also a very important support.

For more strategies, you can add real trading accounts.

Candlesticks are king, trends are emperor. I am Master Chen, focusing on BTC, ETH spot and contract for many years. There is no 100% method, only 100% follow the trend; daily updates on macro analysis articles and technical analysis review videos across the web.  Friendly reminder: Only the official public account (shown in the picture above) is written by Master Chen. The advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully between true and false. Thank you for reading.

Friendly reminder: Only the official public account (shown in the picture above) is written by Master Chen. The advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。