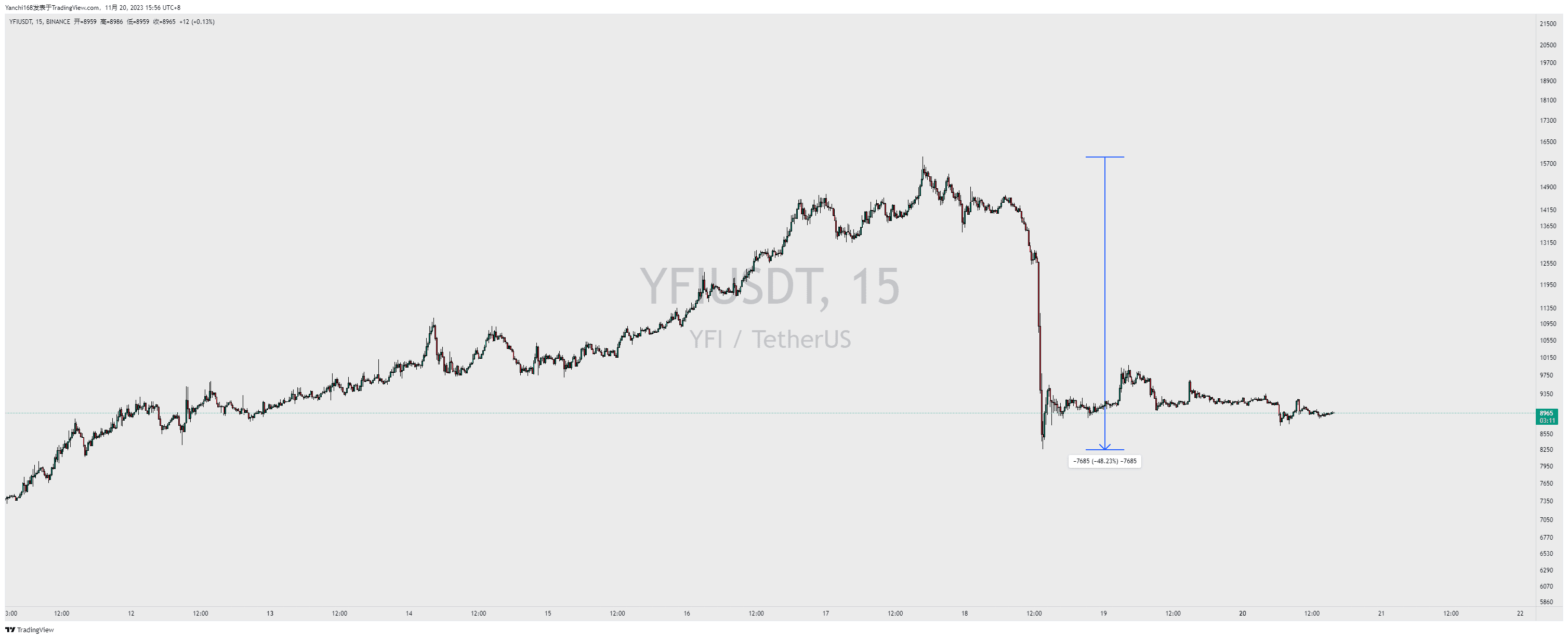

YFI 日内暴跌48%。😱

相信defi老用户对YFi的神话应该不太陌生,

新伙伴如果不太明白我稍微解答一下。

YFI是什么?对于二级交易者而言似乎不太去管他的生态,反倒是关心什么时候有波动,有涨跌。

其实20年的YFI的增长是非常夸张,在2020年的时候,甚至被列入千倍币!万倍币。

价格最高点一度超过BTC,来到9.5万美元。

YFI从最初的3美元,一星期上涨到4500刀。一周1500倍。

如果按最高点,95000/3=31666倍。😱如果你3刀的时候,买入1万块,最高点9.5万刀卖出,你算算,你能获得多少钱?(评论区打出来)。

那么这跟前日的暴跌,又有什么关系呢?

详细解读;这次的暴跌,导致dydx上有近5000万美元的未平仓头寸被清算,包括DYDX的保险基金,也疑似因高利润交易策略而损失800万刀, 该策略导致大量YFI 被清算。YFI市值从5亿美元,直接降低到3亿美元。

为何突然暴跌?有关说法如下;

市场认为是由于内部人员的抛压。因为YFI的供应量中,接近一半的筹码被10个钱包持有。这波操作被说为是割韭菜行为?有人在价格高点卖出。并且有明显空头敞口。

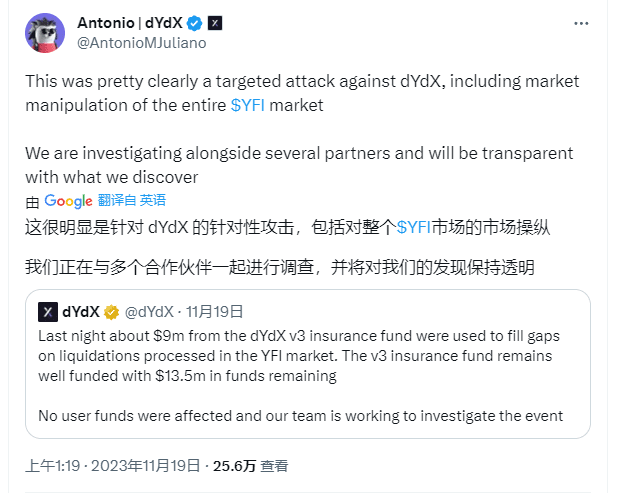

DYDX创始人出来发言,他认为在过去几天,DYDX上的YFI未平仓合约量从80万美元,飙升至6700万美元,这个操作基本上都是由一个人所为。两周前,他试图以类似的方式去攻击dydx上的sushi市场,但没有成功,dydx上的YFI未平仓合约,比任何交易所都搞。

在价格暴跌之前,dydx确实采取行动,以提高YFI的初始保证金比率,但最终未能成功抵御攻击,攻击者在价格崩溃之前,从DYDX上提取了大量的USDC,现货市场上,YFI的价格暴跌。似乎是故意针对dydx上大额未平仓发起的攻击。

dydx创始人Antonio认为 这是由一名资金充足的攻击者来强制进行的一次市场操纵。

目的在于耗尽DYDX的保险池资金。此外,创始人公布了一系列关于dydx的更新。

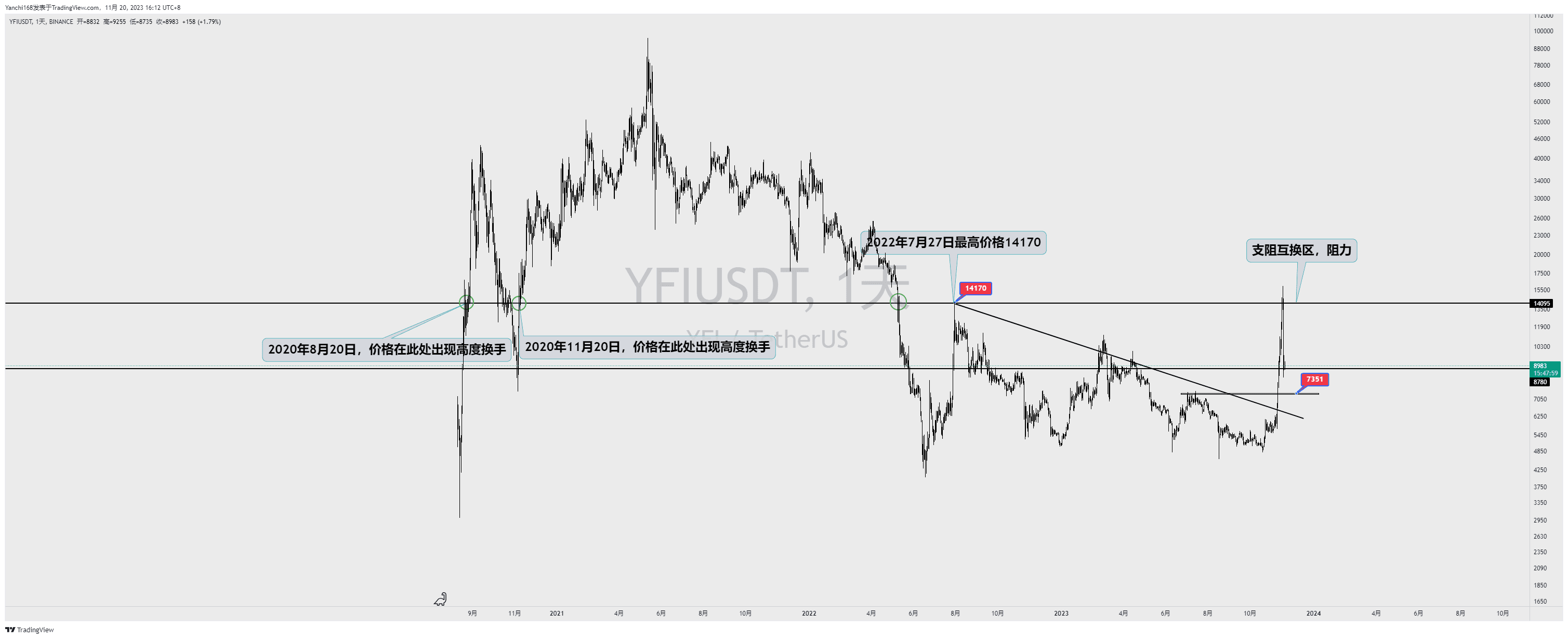

那么这真的是一场无法避免的突发暴跌行情吗?

我仔细看了下盘面,我觉得并非如此。

下面这张图为 YFI/USDT 日线图表

14200这个位置,如果你对技术分析有所判断,这里是个极大的阻力位。

按操作上来讲,并不是一个进场做多的机会,反观是多单离场,而考虑是否介入部分空单头寸的极佳位置。

很多交易者懂的前高,双顶,既然你懂前高,跟双顶,那么这里的下跌是否就非常符合技术分析呢? 不符合预期的是下跌幅度,币价并未是正常调整,而是加速暴跌来形容。 归根结底,做交易,做投资,还是要严格执行好自己每一笔订单的止损空间。

止损在这种行情面前发挥得淋漓尽致。 如果你有设置好止损,似乎这场暴跌,对你而言并未有太多的损失。 至于链上的叙事,似乎与我们无瓜了~

我并非刻意解读交易技术能够在这种行情之下抓住48%的暴跌,止盈是预期值,并非绝对值,我想通过此事以及盘面分析,告诫大家,让大家在每一笔交易的同时,能够多方面的去进行分析判断。而非追涨杀跌的交易行为。 #YFI

关注驰哥,更多交易内容分享。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。