整理 | Odaily星球日报

编辑 | 0xAyA

一、市场交易

1.现货市场

上周 BTC 价格上下波动较大,盘面整体处于回调盘整杀高杠杆的情况,但整体多头走势依然强劲。截至发稿时,BTC 暂报 37300 美元,过去一周涨幅为 0.81% 。

目前,BTC 价格在 4 h 级别窗口内正处于W底的关键颈线位置,此处多空博弈可能较为激烈,需要注意可能存在的风险。

上周 BTC 价格上下波动较大,盘面整体处于回调盘整杀高杠杆的情况。在这样的市场环境下,投资者需要保持谨慎,做好风险控制,同时密切关注市场动态和技术指标,以便及时调整自己的交易策略,合理控制仓位,规避风险。

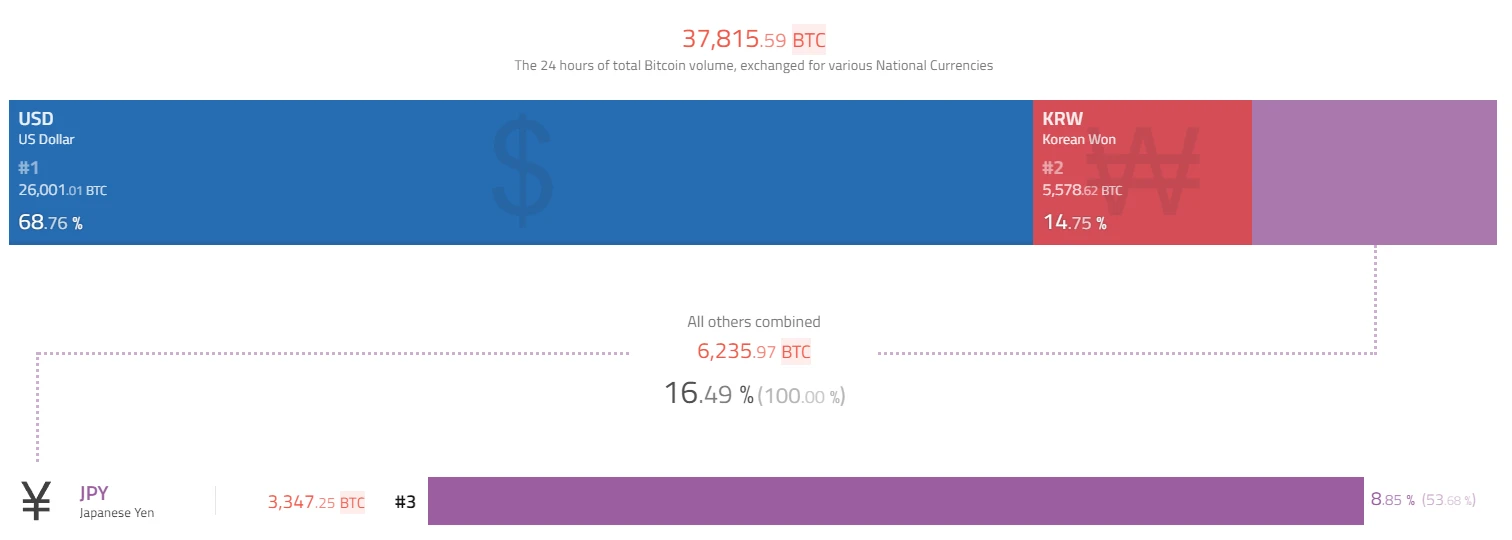

在本周的BTC 兑法币交易中,美元尽管仍然占据第一位置,但份额仅为68.76%,相比上周减少了约26%;韩元本周依然排名第二,市场份额来到了14.75%,相比上周增长了 4%;其余法币兑 BTC 交易的总额合计占比 16.49% ,其中排名第三的依然是日元。本周亚洲市场的买盘有着显著性的增强,值得密切关注。

2.GBTC 表现

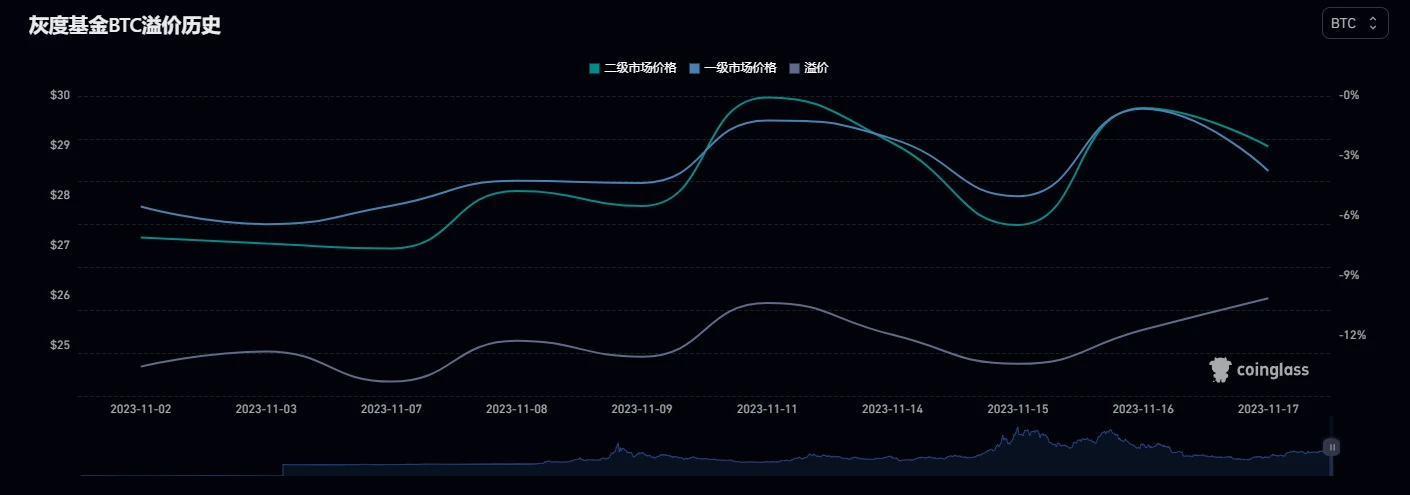

本周 GBTC 折价幅度较小,一级市场价格报每股 32.25 ,二级市场价格报每股 28.99,折价水平从上周的 10.35% (11 月 13 日)缩窄至 10.11% (11 月 19 日)。

3.期货

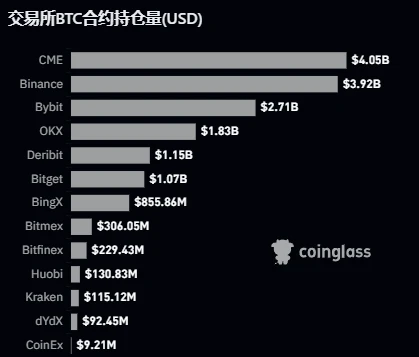

BTC 永续合约资金费率方面,Bitget 上的 USDT 合约资金费率最高,达到 0.0230% , Binance 最低,报 0.0100% 。 季度交割价格相比上周无明显变化,价格在 37600-38000 美元不等。 BTC 合约持仓量方面,CME 在上周超过币安之后继续排在持仓量第一,其持仓量为 40.5 亿美元;其次是币安,其持仓量为 39.2 亿美元; Bybit 则排名第三,持仓量为 27.1 亿美元。

4.期权

本周 BTC 总持仓 为 1251.14 亿美元,同比增长约23.57%。期权持仓比和上周一致,看涨期权占据了 66.59% ,而看跌期权则占据了 33.41%。具体持仓方面,看涨期权的总持仓为 290,158.77 BTC,而看跌期权的总持仓为 145,581.12 BTC,看涨期权在市场中的主导地位依然保持不变,本周期权持仓相比上周大幅增长,可能意味着接下来的一段时间内市场将出现较大波动。

二、矿业

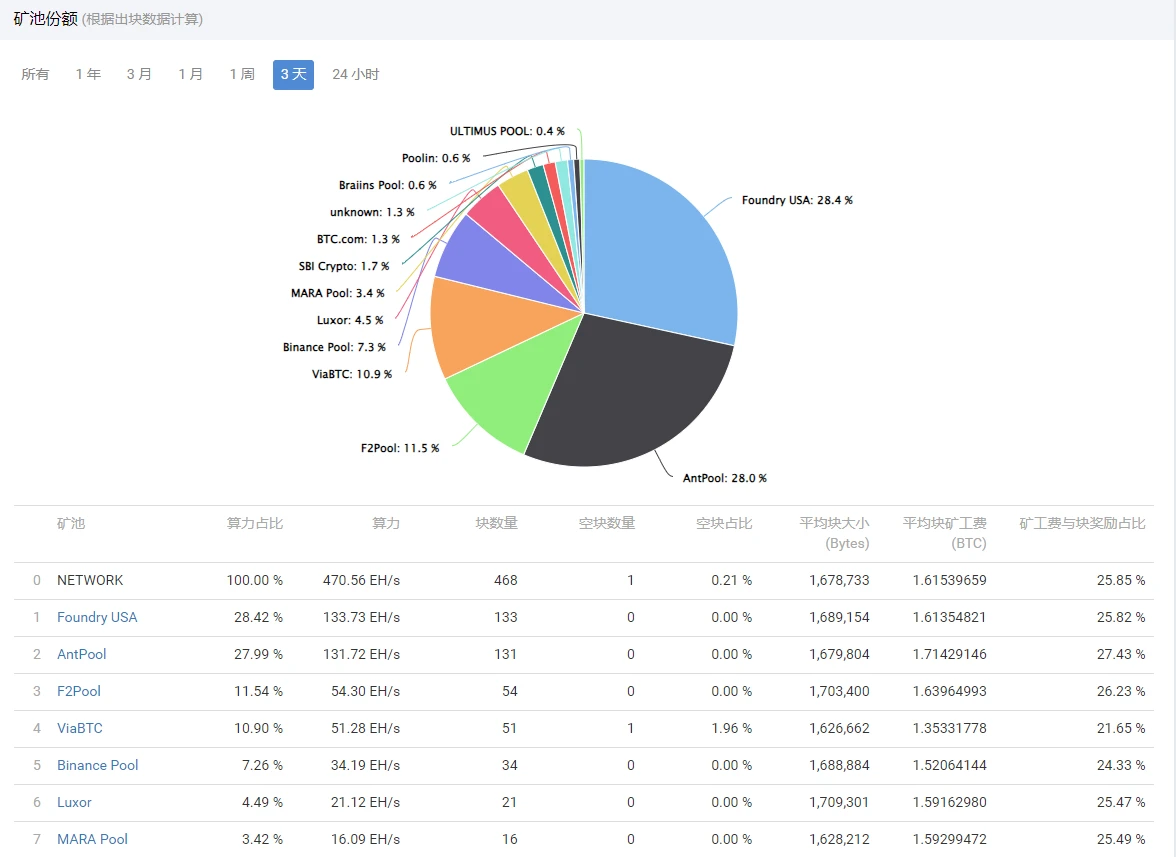

根据BTC.com数据,本周 BTC 网络算力 470.56 EH/s,同比增长3.06% 。7 天前 BTC 全网难度增加了 3.55% , 6 天后全网难度预计增长 0.45% ,如下所示:

排名前三的矿池依然为 Foundry USA、AntPool 和 F2Pool ,占比分别为 28.42% 、27.99% 和 11.54% 。如下所示:

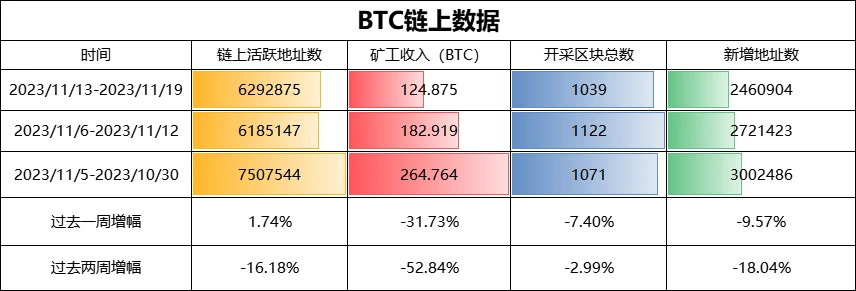

glassnode 数据显示,过去一周 BTC 链上活跃地址数为 6292875 ,同比上升 1.74% ;矿工收入为 124.875 枚 BTC,同比下降 31.73 %;开采区块总数为 1039 个,同比下降 7.4% ;新增地址数为 2460904 ,同比下降 9.57% 。如下所示:

本周链上数据除活跃地址外继续回撤,BTC的铭文生态流量本周被分散到各个链上,如Solana、Polygon、BSC等,进而导致BTC本周数据进一步下滑。

三、生态进展

(1)Oridnals

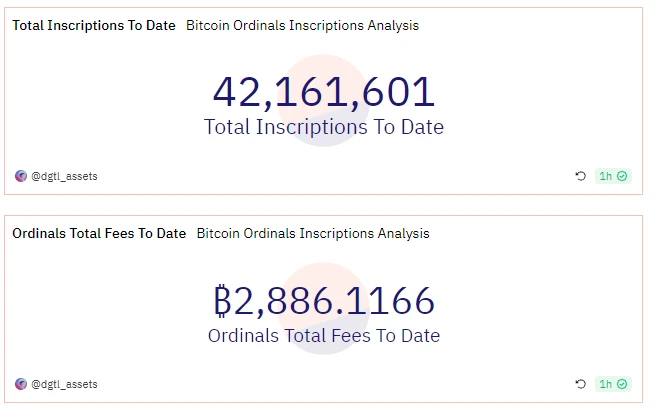

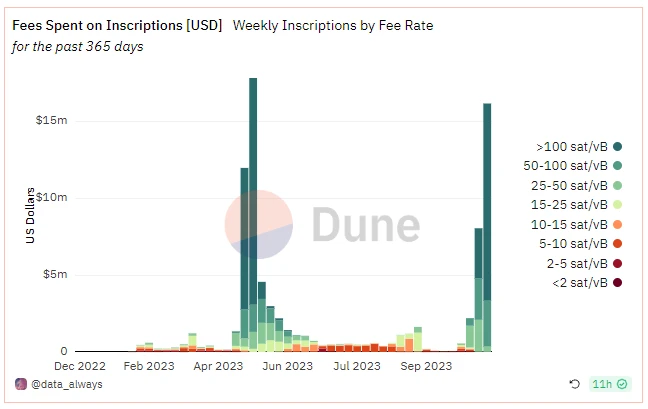

数据显示,Oridnals 铸造的铭文总量已达 4216.1 万枚,迄今产生的总费用达到 2886.1 枚 BTC,折合约 1.05 亿美元。

铭文方面,本周铭文收入费用再破新高,报 1618 万美元的高位,同比上涨超100%

OKX Web3钱包Ordinals市场单日交易量突破2300万USDT,创历史新高

Dune数据显示,11月16日,OKX Web3钱包Ordinals市场单日交易量突破2300万USDT,再次创下历史新高。此外,其市场占比突破84.7%,位居第一。据悉,OKX Web3钱包是一款支持Ordinals的多链钱包,其推出的Ordinals市场交互免平台服务费,并支持一站式转移、交易、铭刻BRC-20和BTC NFT等多个功能,已成为支持比特币生态的主流Web3钱包之一。

Ordinals追踪平台OrdSpace的数据显示,截至周四,已有超过37,000种BRC-20代币被创建。与此同时,一些基于比特币的流行社交应用已经开始引入游戏内代币,作为吸引新用户和提高收入的一部分。例如,Alpha周三开始允许用户向他人提供自己的代币。据悉,Alpha为用户提供去中心化交易、NFT市场和游戏商店服务。

Nostr Assets Protocol考虑向选定BRC20和Ordinal系列持有者空投TRICK和TREAT

据官方消息,比特币闪电网络Nostr Assets Protocol正在考虑向选定的BRC20和Ordinal系列持有者空投TRICK和TREAT,以进一步丰富其生态系统并扩大社区影响力。TRICK和TREAT总量各2.1亿枚,其中:- 20%已经空投至Nostr Assets Protocol社区;- 70%致力于促进Nostr Assets Protocol生态系统和社区发展;- 10%将分配给Nostr Assets Protocol团队,致力于项目的长期成功。

(2)闪电网络

Strike为美国以外用户推出借记卡购买BTC服务,并支持利用闪电网络的日常消费

闪电网络支付应用Strike首席执行官Jack Mallers宣布,Strike已为美国以外用户提供使用借记卡购买比特币的功能,该服务已在36个国家或地区正式上线,并将推广至当前提供Strike应用的 65 个以上国家或地区。此外,Send Globally(fiat-over-lightning)服务现已可供全球Strike用户使用,允许受支持国家 / 地区的客户将法币、USDT或比特币兑现为当地货币(即使他们没有借记卡)。此外,Strike通过与Bitrefill合作允许用户可以使用他们的法定货币、USDT或比特币余额通过闪电网络购买日常必需品。Strike还增加了对闪电地址、零值发票(0-value invoices)、链上支付等级以及Strike用户之间以法定货币、USDT或比特币进行的全球P2P支付的支持。

(3)其他项目:

Ordinals创始人:为新的诅咒铭文创造办法提供0.1 BTC赏金

Ordinals创始人发文表示,为新的诅咒铭文创造办法提供0.1 BTC赏金,截止11月26日,这一计划是为了在Jubilee之前解决所有问题。有资格获得悬赏的案例包括索引、信封或铭文解析器中的错误导致铭文无法识别,或者对铭文编码方式的巨大且有益的改进。

四、其他消息

韩国加密货币溢价回升,BTC交易价格比全球平均水平高出近1,300美元

据cryptocompare数据,周六涉及韩元的BTC交易量占总交易量的3.53%,ETH占总交易量1.65%,solana(SOL)占总交易量8.78%。仅Upbit在过去24小时内就处理了26.2亿美元的交易,使其成为本周末第11大加密货币交易所。韩国的主要交易所,尤其是Upbit和Bithumb,正在经历明显的价格溢价。美国东部时间周六下午1:50,Upbit上的比特币交易价格为每个37,985美元,而全球平均价格为36,700美元,这表明在韩国存在近1,300美元的溢价。

Bitwise首席投资官:ETF对BTC的意义要比对ETH更大

Bitwise首席投资官Matt Hougan在X平台表示,ETF对BTC和ETH都具有积极意义,但对BTC的意义更大,原因有两点。一是BTC ETF可能率先获批,并吸收大部分潜在资金,这一点非常重要,因为许多金融专业人士并不知道BTC和ETH之间的区别。二是比特币如今的杀手级效用是作为法币之外的另一种财富存储方式,ETF可以助推该效用,而以太坊的杀手级应用则是它的功能性,ETF并不会对这点有所帮助。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。