The first liquidity pool based on the native Bitcoin network, Orders.Exchange LP, is about to start public testing.

The first liquidity pool based on the native Bitcoin network is about to go live

The first liquidity pool based on the native Bitcoin network, independently developed by Orders, will go live at 8:00 pm on Monday, November 6th (Hong Kong time). The first batch will open seven liquidity pools including $ORDI-BTC. It is reported that the liquidity pool has characteristics such as risk-free, decentralized, and fully based on the BTC mainnet. The liquidity added by users will always remain in their wallets before being used, and users retain absolute control over it. After being used, it will be transferred to a multi-signature address managed jointly by the user and the exchange, to be released by the user, bringing a completely new DeFi experience.

This liquidity pool will use the BRC20 token $RDEX as a liquidity reward. This token has characteristics such as daily deflation and linear release, and is the first functional BRC20 Token, which has already been integrated into the OKX wallet. Orders, as the first Bitcoin network order book DEX that fully supports ASK and BID, aims to explore the boundaries of BTCFi. It innovatively uses technologies such as PSBT, multi-signature, and Nostr, aiming to create an interconnected on-chain trading market.

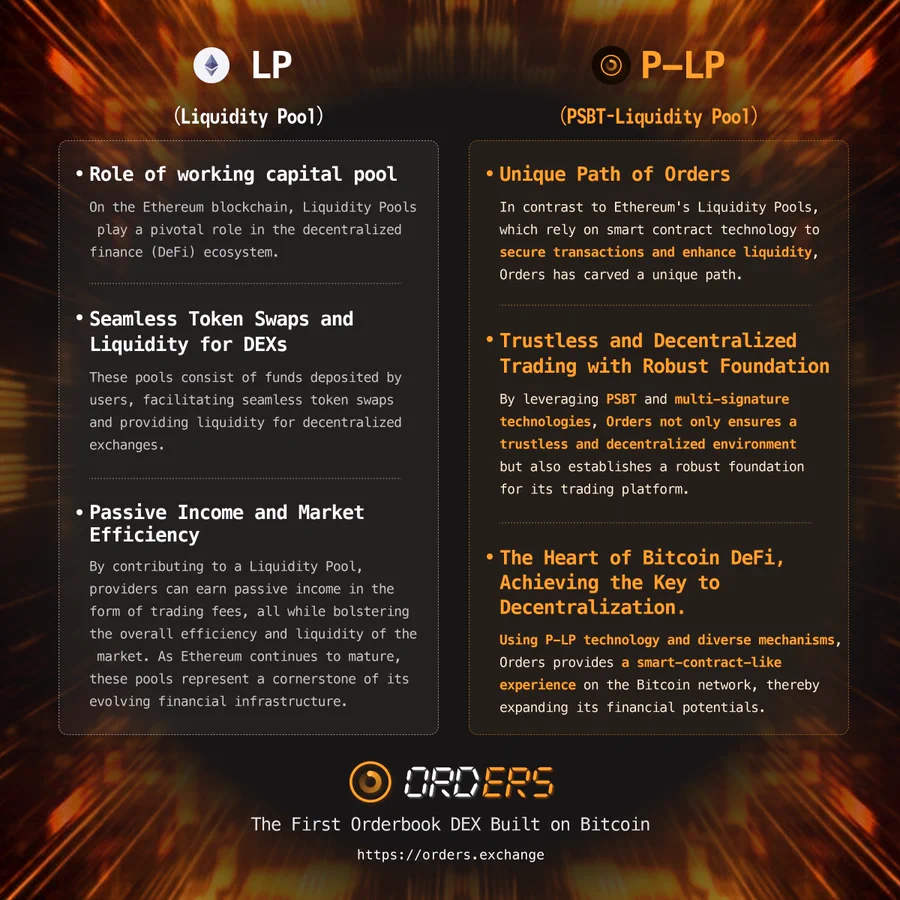

Previously, there has never been a solution where a liquidity pool could be extended from the Bitcoin network, which should have been based on smart contracts. In order to understand where the innovation of Orders' P-LP solution lies, we need to first spend some time discussing AMMs.

Automated Market Makers (AMMs) that surpass traditional finance

Looking back at the development of blockchain, we can observe many unforgettable milestones. Among them, the most impressive is the emergence of smart contracts. Ethereum completely changed the operation mode of decentralized finance by introducing these self-executing contracts. Smart contracts brought higher transparency and lower interaction risks to transactions, while eliminating transaction intermediaries, opening a new era of financial innovation. Mechanisms such as AMMs have also attracted long-standing attention to Ethereum.

Automated Market Makers (AMMs) are a perfect embodiment of the potential of smart contracts. Compared to traditional financial structures, AMMs like Uniswap and Balancer have greatly simplified the trading process and ensured continuous liquidity by using liquidity pools instead of traditional centralized order book trading. Thanks to smart contracts, these AMMs can drive transactions without the need for mutual trust, making them a core component of decentralized financial liquidity on Ethereum.

In addition, these platforms have enhanced the security and reliability of transactions, allowing users to provide funds for liquidity pools and earn passive income. Overall, AMMs further promote the democratization of finance on Ethereum, ensuring that power truly returns to the hands of users.

What if Bitcoin had similar mechanisms?

Compared to the flourishing of Ethereum blockchain applications in recent years, Bitcoin's development has not been as promising. As a pioneer in cryptocurrency, Bitcoin was originally designed to achieve decentralized peer-to-peer transactions. To ensure the robustness and security of its transaction logic, its script language was intentionally limited. Ethereum, on the other hand, has a more flexible script language, allowing for the execution of complex decentralized applications (dApps) and smart contracts, while Bitcoin prioritized simplicity and security over programmability.

From the perspective of the user ecosystem, Bitcoin is often seen as "digital gold," more as a store of value than a platform for decentralized applications. This positioning has solidified its status as the leading cryptocurrency, but it also means that its ecosystem lacks the same level of innovation as the DeFi platforms on Ethereum.

If Bitcoin could integrate functions similar to AMMs, it would undoubtedly lead to a wave of change. Firstly, it could significantly increase Bitcoin's liquidity, making it not only a store of value but also a powerful medium of exchange. Secondly, Bitcoin's large user base could benefit from the advantages of decentralized exchanges, such as lower fees and higher security. This could also attract more institutional investors, as the entire system could provide more complex financial tools and products.

Integrating AMMs into the Bitcoin framework would inspire innovation in native Bitcoin DeFi projects, bridging the gap between Bitcoin and the decentralized financial world. Essentially, despite Bitcoin's original design lacking smart contracts, the emergence of solutions like AMMs would redefine the financial ecosystem under the Bitcoin category.

DIMM, AMMs on the Bitcoin network

As mentioned at the beginning of the article, Ethereum has received widespread attention for its automated market makers. Many have wondered when Bitcoin will be able to gain such vitality in the field of decentralized finance, similar to Ethereum. Today, we can finally see the emergence of something like DIMM, which represents the future of decentralized finance on the Bitcoin network.

DIMM, short for Decentralized Instant Market Maker, was launched by Orders, the world's first order book-based decentralized exchange based on the native Bitcoin network. Its unique mechanism brings a new perspective to decentralized trading on the Bitcoin network.

Unlike the widely adopted AMM model on Ethereum, DIMM focuses on rapidly executing BID buy orders. This design prioritizes sellers, creating a trading environment that ensures rapid identification of suitable bidders and completion of transactions, thereby guaranteeing the efficiency and real-time nature of transactions.

Essentially, DIMM continues the core concept of decentralization, free from the control of any central entity or platform. Traditionally, market makers provide the necessary liquidity for transactions, which directly relates to the ability to buy and sell assets. In the DIMM model, this responsibility is shared by the entire system and the liquidity pool, ensuring that both buyers and sellers can quickly find trading partners.

Although Bitcoin does not have built-in smart contract functionality, Orders' DIMM design cleverly replicates this type of experience. By using technologies such as PSBT and multi-signature, DIMM achieves a transaction method similar to smart contracts, completely independent of any third-party intervention. The liquidity added by users will always remain in their wallets before being used, and after being used, it will be transferred to a multi-signature address managed jointly by the user and the exchange, to be released by the user. The entire process will take place entirely on the native Bitcoin network, and the platform cannot manipulate or transfer user assets at the code level, achieving complete decentralization, making it a completely unprecedented DeFi model.

Overall, DIMM expands new dimensions for Bitcoin, allowing it to compete with the smart contract experience on other platforms. With instant execution of BID orders, instant returns for liquidity providers, and its decentralized and trustless trading system, Bitcoin can finally gain competitiveness in the field of decentralized finance.

P-LP, the world's first liquidity pool deployed on Bitcoin

With the help of DIMM, the world's first liquidity pool fully based on the Bitcoin network, P-LP, has also emerged. P-LP, short for PSBT Liquidity Pool, is key in that it combines PSBT (partially signed Bitcoin transaction) with multi-signature technology. Through PSBT, liquidity can circulate securely off-chain when not in use. Essentially, this method ensures that assets are always in a secure state, allowing for the initiation of transaction intentions without completing the transaction until all necessary signatures are obtained, preventing unauthorized asset transfers.

Building on PSBT, Orders also employs multi-signature protocols to further enhance the security of P-LP. This design ensures that assets are not independently transferred by any single party. To execute a transaction, multiple signatures are required to be signed simultaneously, completely avoiding the possibility of exchange malpractice.

With P-LP, the Bitcoin network can achieve seamless, trustless, and decentralized transactions. Orders' introduction of DIMM and P-LP also symbolizes a huge leap for Bitcoin in the DeFi field, finally revitalizing Bitcoin, the OG of blockchain, with new vitality.

Orders, exploring the boundaries of the decentralized world of Bitcoin

Orders, a technology-driven team, has always been committed to their core mission: continuously exploring the infinite possibilities of Bitcoin in decentralized finance (DeFi).

With the launch of DIMM, the infinite imagination of Bitcoin's ecosystem has been opened. We can foresee that Bitcoin is transitioning from a trading system to a fully decentralized application platform. In such a future, Bitcoin will not only be a means of storing value but will become a feature-rich platform, giving rise to various financial services and innovations.

Orders is paving the way for innovation in the Bitcoin DeFi field. As the ecosystem continues to expand and evolve, we can expect to see more technical teams continuously unleash their creativity and strength, allowing Bitcoin to break through its own limitations and bring more opportunities to the entire blockchain industry.

- Website: https://www.orders.exchange/ - Twitter: https://twitter.com/orders_exchange - Telegram Group: https://t.me/orders_exchange - Discord: https://discord.com/invite/rKM5HSfKxK - Gitbook: https://orders-exchange.gitbook.io/ - Github: https://github.com/ordersproject免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。