加密世界发展得如此之快,以至于以太坊的合并让人感觉已经过去了很久。但距离网络完全过渡到使用权益证明(PoS)刚够一年而已。就价格而言,以太坊的交易价格与 2022 年 9 月合并时的价格大致相同,合并前一天 ETH 的交易价格约为 1,600 美元。但这只是冰山的一角,有很多方面自以太坊改变以来发生了实质性的变化。本期,veDAO研究院将就以太坊合并后的这一年发生的各种变化进行一个盘点。

能源消耗

在转变之前,以太坊使用与比特币相同的共识机制来验证链上交易:工作量证明(PoW)。它要求矿工们竞争解决复杂的数学方程,作为参与能源密集型过程的交换,矿工因此获得奖励。但当以太坊转向PoS时,这意味着验证者而不是矿工需要质押以太坊来确保网络安全,从而换取奖励。最显着的影响之一便是以太坊能源消耗的减少。加密碳评级研究所(Crypto Carbon Ratings Institute,CCRI)的一份报告指出,以太坊现在使用的能源比合并完成之前减少了约99.99%,即以太坊网络的碳足迹减少了 99.99%。

加密货币因消耗大量能源而“扬名”于主流媒体。因此,包括ESG评级等环保相关因素都将是阻碍加密货币被采用的因素。由于对加密货币的环境问题,从贝莱德(BlackRock)到富达(Fidelity)等金融机构的加密货币举措也备受关注。而这次以太坊合并,使得这些反对的声音变得失去意义。

流动性质押

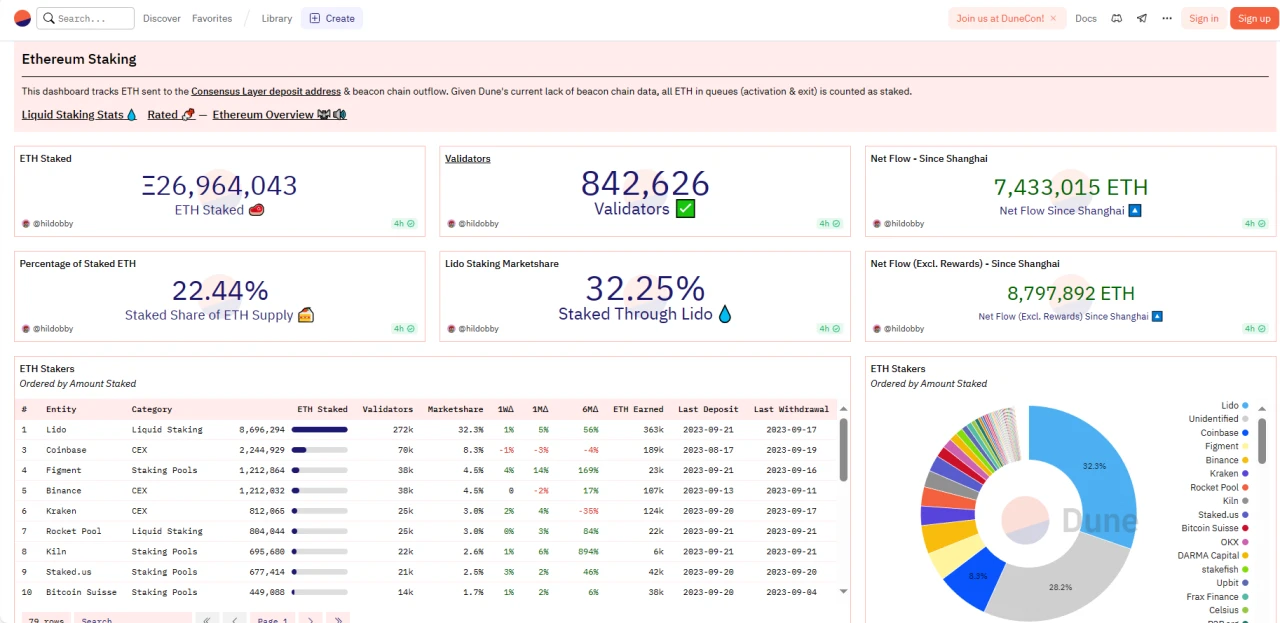

自以太坊合并以来,以太坊质押数量几乎翻了一番。根据 Dragonfly 数据分析师 @hildobby 在 Dune 上创建的Dashboard显示,当前以太坊存款合约中质押的 ETH 数量已超过 2696 万枚,质押率达 22.44%。

链接:https://dune.com/hildobby/eth2-staking

但以太坊升级后也引发了集中化和审查制度的担忧。这是因为人们担心验证网络交易的控制权可能会被孤立在少数人手中,无论是像交易所这样的公司还是让用户更容易聚集资金并获得质押奖励的项目。由于Coinbase曾资助一群Tornado Cash用户对美国财政部和OFAC(美国财政部海外资产控制办公室)的诉讼,在以太坊合并之前,一些人特别担心 Coinbase 等交易所因美国对混币服务 Tornado Cash 的制裁而参与质押。由于担心中心化实体会审查交易以保持合规性,因此像 Lido Finance 这样的应用在去中心化方面成为更好的选择。

然而,Lido 现在约占所有质押 ETH 的 32.3%,它现在被认为是以太坊生态系统在去中心化方面的潜在弱点,这让一些社区成员感到担忧。他们说,Lido 日益增长的影响力正在削弱整个以太坊的去中心化特征。

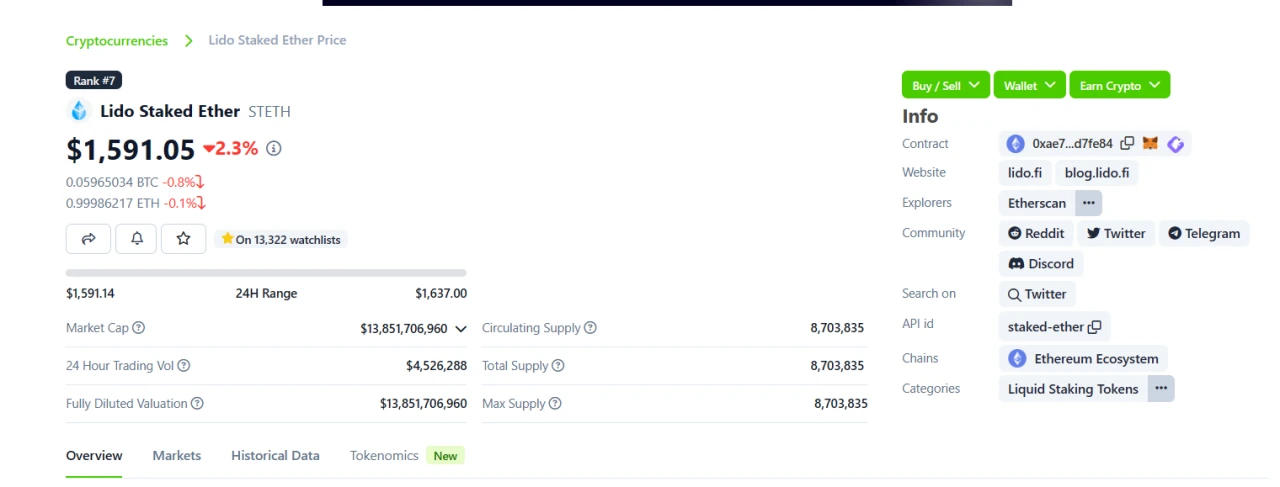

据 CoinGecko 数据,在流动性质押代币方面,STETH 表现突出,市值达 138 亿美元。而作为以太坊市值的第二大代币 Rocket Pool ETH (RETH),市值则为 9.12 亿美元。

尽管如此,流动性质押一直是去中心化金融增长的主要来源。流动性质押使ETH持有者能够质押他们的代币以获得奖励,并且仍然能够通过发行并与其价格挂钩的相应代币来利用以太坊的价值。尽管自合并以来,去中心化交易所的相关资产价值有所下降,但流动性质押仍在继续蓬勃发展。

扩展解决方案

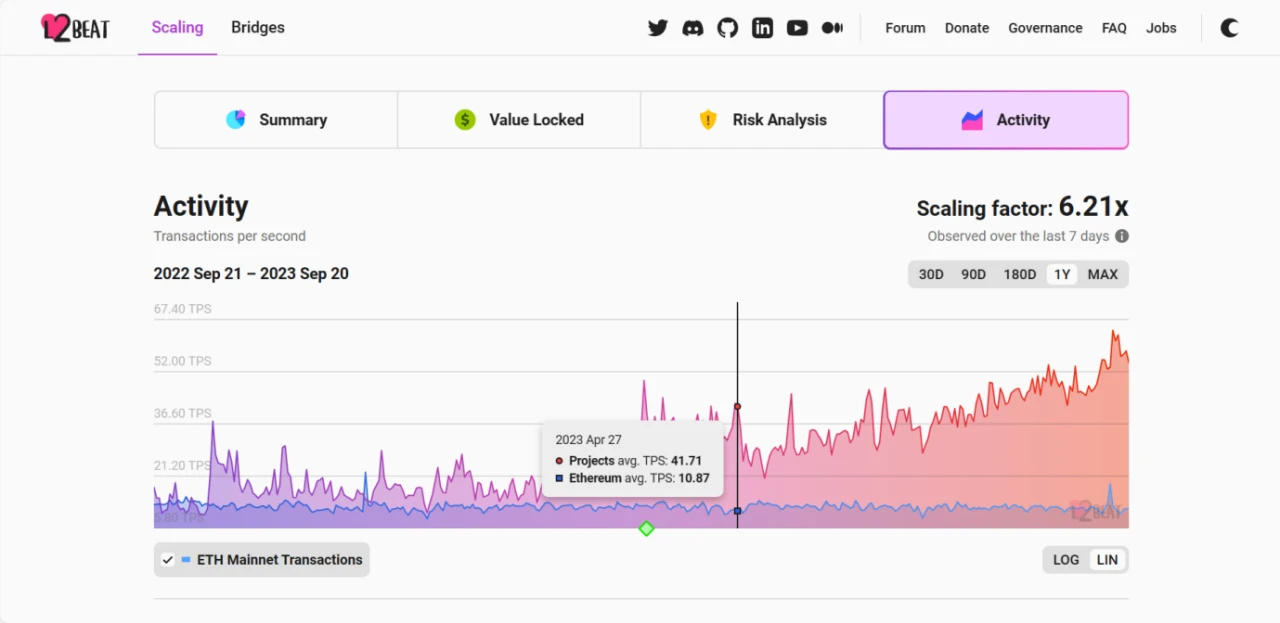

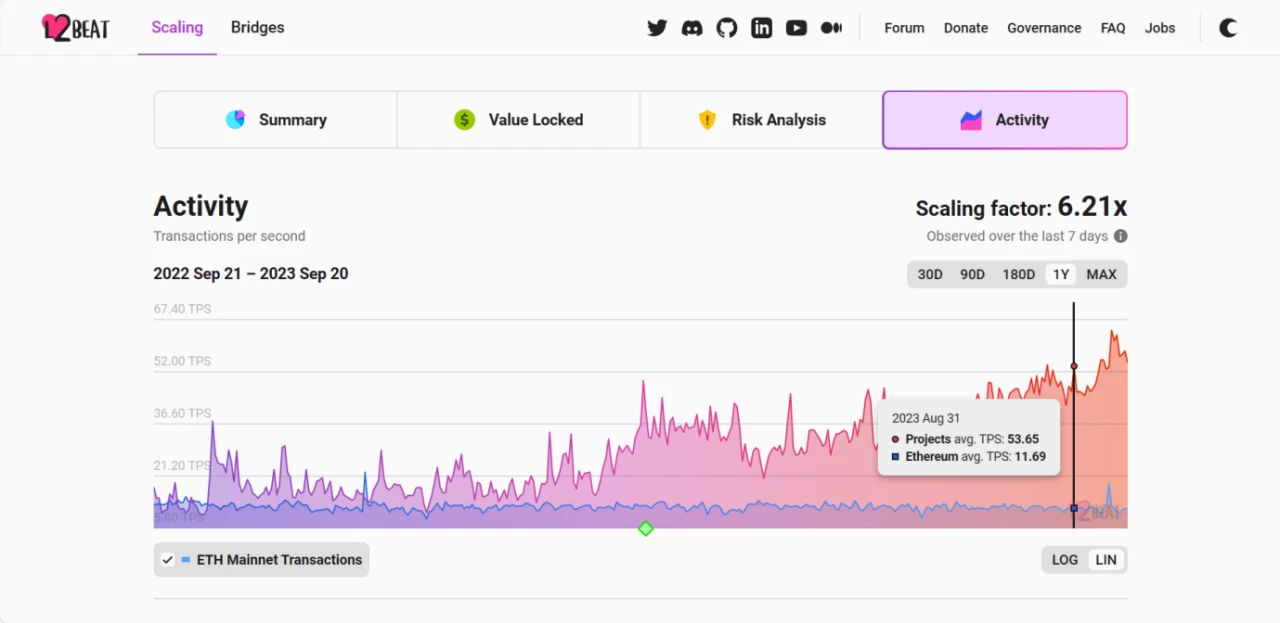

合并并不是为了提高以太坊的速度,因此,根据分析网站 L2Beat 的数据,自去年 9 月以来,以太坊的平均TPS(每秒交易量)大多徘徊在10左右。尽管如此,它还是为接下来的事情奠定了基础。根据 Vitalik Buterin 在去年 7 月合并前阐述的以太坊路线图愿景,此次“激增”是合并后计划进行的一系列升级,预计将提高以太坊的可扩展性。

然而,旨在解决以太坊当前局限性的扩展解决方案也越来越多地出现在加密货币中。根据 L2Beat 的数据可以看出,所有以太坊L2网络之间的平均TPS现已超过 50 笔,比去年有了显着改善。

综合起来,知名的L2网络 zkSync Era、Optimism 和 Arbitrum Nova 在过去 30 天内的交易总数总计超过 6100 万笔。这是同一时间段内以太坊交易数量的两倍。可以说以太坊底层安全性方面的合并,助长了最近 L2 技术的不断涌现。总体而言,这次合并确实为进一步增强可扩展性奠定了基础。

美国证券交易委员会(SEC)

与此同时,质押已成为美国的监管热点,SEC对多家提供帮助用户赚取网络奖励服务的加密货币交易所进行了追查。

Kraken 在 2 月份与 SEC 达成和解,涉及 3000 万美元的罚款,原因是其质押即服务计划构成未经注册的证券发行。在针对 Coinbase 和 Binance 各自质押产品的诉讼中,也提出了类似的索赔。尽管SEC在针对币安和 Coinbase 的诉讼中牵涉到一些代币,声称它们是未注册证券的例子,但一些人注意到并质疑为什么监管机构没有将使用PoW的代币列为非法发行的资产。

但美国监管机构对于如何对以太坊进行分类仍存在分歧。结果是两个最大的金融监管机构,SEC和商品期货交易委员会(CFTC)之间发生了明显的地盘争夺战:CFTC 的主席 Rostin Behnam 在三月份表示ETH是一种商品;而在二月份,SEC 的主席 Gary Gensler 曾表示,“除了比特币之外的一切”都是证券,然后他在 4 月份却回避了有关以太坊的问题。

结语

以太坊的核心开发人员一直在制定以太坊下一个重大升级计划,称为“Dencun 升级”。它包括引入一项名为 proto-danksharding的功能,一旦完全实现,预计将把以太坊扩展到每秒超过 100,000 笔交易。其他正在开发的其他功能,例如帐户抽象,将有效地使管理加密钱包像管理电子邮件帐户一样简单。本月初,Vitalk 在韩国区块链周期间的演讲中,谈到了一项名为“Stateless Clients”的功能,该功能将使在智能手机上运行以太坊节点成为可能。

链接:https://ethereum.org/en/roadmap/danksharding/

回想起来,与 2022 年加密市场的动荡和企业崩塌相比,这次合并似乎只是加密历史书中的一个平淡脚注。但就未来而言,这或许是照亮以太坊整体方向的灯塔,使人们重新相信以太坊可以实现这些重大技术升级,并完成一些雄心勃勃的事;虽然以太坊可能比我们希望的要慢,但它最终会在忠于自己的价值观的同时不断向前发展。

关于veDAO

veDAO是一个由AI技术驱动的Web3投资决策平台,通过情绪指标和链上链下指标进行大数据分析,发现趋势,精准捕获Alpha。通过打造AI顾问,帮用户高效投资获益。

Website:https://app.vedao.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。