Original Author: CoinGeckoMiguel Benitez

Compiled by: Odaily Planet Daily, Nianyinsitang

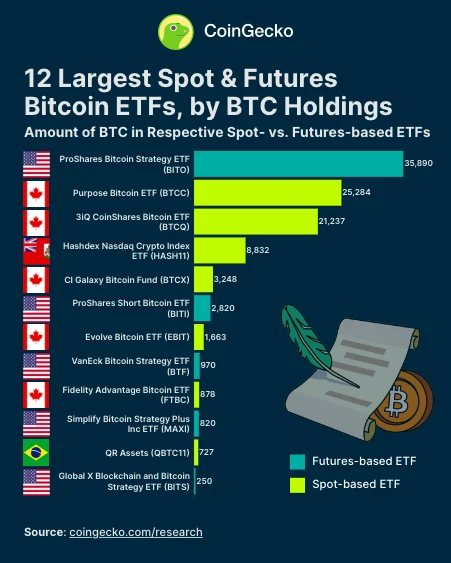

Editor's Note: CoinGecko has recently released the report "12 Largest Spot & Futures Bitcoin ETFs," providing a comprehensive overview of the current status of global Bitcoin ETFs. Based on this, Odaily Planet Daily has compiled the following:

Bitcoin ETF has always been one of the most anticipated developments in the crypto space.

While Bitcoin ETFs have been trading in countries such as Canada, Brazil, and Europe, the spot Bitcoin ETF in the U.S. market still faces regulatory obstacles. However, there are several popular futures-based ETFs in the U.S., and multiple spot ETF applications are awaiting SEC approval.

The ProShares Bitcoin Strategy ETF is the first Bitcoin ETF to trade on a major U.S. exchange, launched in the fourth quarter of 2021—right at the peak of the bull market. Currently, the ETF holds 35,890 bitcoins, making it the oldest and largest fund in the field. Two of the top 12 Bitcoin ETFs (holding 16.6% of the assets of Bitcoin ETFs) are managed by ProShares and are tradable in the U.S.

With the increasing appearance of ETFs and ETPs globally, the amount of Bitcoin held by investment tools is rising every year. In total, the top 12 Bitcoin ETFs hold 102,619 bitcoins, slightly less than 0.5% of the total Bitcoin supply (21 million). Due to regular rebalancing, the amount of Bitcoin held by ETFs follows the price changes. The frequency of ETF rebalancing varies from daily to annually. For example, the Purpose Bitcoin ETF (BTCC) rebalances monthly, while the S&P 500 index rebalances quarterly.

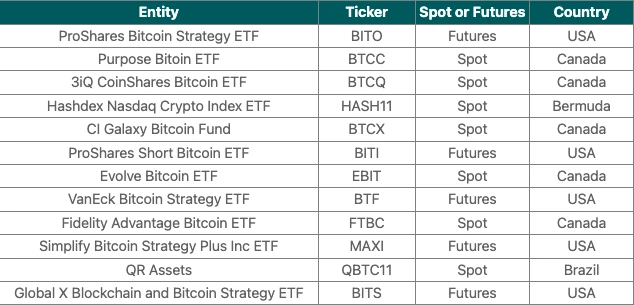

Who are the Top 12 Bitcoin Spot and Futures ETFs?

The tradable Top 12 Bitcoin Spot and Futures ETFs are as follows:

Bitcoin ETFs Outside the U.S.

In fact, several countries have approved direct investment in Bitcoin ETFs ahead of the U.S., with the top spot Bitcoin ETFs including:

- Purpose Bitcoin ETF (BTCC)

The Purpose Bitcoin ETF was launched in February 2021 and is the first spot Bitcoin ETF in North America. As of September 2023, it currently holds over 25,000 bitcoins. This ETF trades on the Toronto Stock Exchange and has been very popular, with assets under management exceeding $1.1 billion.

- 3iQ CoinShares Bitcoin ETF (BTCQ)

This is another Canadian Bitcoin ETF, also trading on the Toronto Stock Exchange, holding over 21,000 bitcoins as of September 2023.

- QBTC11 by QR Asset Management (QBTC11)

The first Bitcoin ETF in Latin America was launched in June 2021 on the Brazilian Stock Exchange. As of September 2023, the QBTC11 ETF currently holds 727 bitcoins.

The success of these Bitcoin ETFs demonstrates strong investor demand. Meanwhile, relative to Bitcoin's market capitalization of about $1 trillion, the scale of ETFs undoubtedly still has a lot of room to grow. This may also indicate that once the U.S. spot ETF is launched, there will be significant room for Bitcoin price growth.

What is the Current Status of U.S. Spot Bitcoin ETFs?

While Bitcoin futures ETFs already exist in the U.S., the prospects for spot Bitcoin ETFs remain uncertain. One of the main reasons for the lack of spot ETFs in the U.S. is regulatory concerns. The SEC has repeatedly rejected applications for spot Bitcoin ETFs, citing concerns about the liquidity, custody, and potential price manipulation in the Bitcoin market.

However, multiple applications from global asset management companies have recently been published in the Federal Register, marking a step closer to final approval. Some of these have been formally accepted for review and have opened a three-week comment period.

Which companies have applied for spot Bitcoin ETFs in the U.S.?

The following companies have applied for spot Bitcoin ETFs in the U.S.:

BlackRock, July 2023

WisdomTree, July 2023

Invesco/Galaxy, July 2023

Valkyrie, June 2023

In addition, other large companies with existing futures ETFs have also joined the ranks of resubmitting applications for the first spot ETF in the U.S., including VanEck and Fidelity. Companies that have not resubmitted their applications after being rejected include Global X, Kryptoin, and First Trust.

Another asset management company, Grayscale, is currently awaiting a ruling from the federal appeals court to review its application to convert the Bitcoin Trust to an ETF. The Grayscale Bitcoin Trust (GBTC) is currently the largest Bitcoin ETP, holding 623,645 bitcoins. The ruling stated that the SEC did not provide enough information to explain why Grayscale's application was not "substantially similar" to other approved futures ETFs—failing to convince the judge that the spot market is not as safe as the futures market for investors.

Some Notable Futures ETFs

Despite expectations that the launch of futures ETFs would increase pressure to approve spot ETFs, there is little evidence of this so far.

Several major Bitcoin futures ETFs have been launched since October 2021, but their asset sizes are smaller than those of ETFs in Canada and Brazil. The performance of futures ETFs also lags behind the price of Bitcoin, raising doubts about their effectiveness. The main futures ETFs include:

- ProShares Bitcoin Strategy ETF (BITO)

This ETF holds 7,178 CME contracts, equivalent to over 38,000 bitcoins. As of September 2023, the ETF's assets under management are slightly less than $1 billion.

- ProShares Short Bitcoin ETF (BITI)

This is ProShares' second ETF product, holding 564 CME contracts, equivalent to 2,820 bitcoins.

- VanEck Bitcoin Strategy ETF (XBTF)

This ETF holds 320 CME contracts, equivalent to 1,600 bitcoins.

What Impact Would U.S. Spot Bitcoin ETFs Have on the Market?

If spot Bitcoin ETFs are ultimately approved, they could have a significant impact on the Bitcoin and crypto markets for the following reasons:

Mainstream exposure: Spot ETFs will provide unprecedented exposure to Bitcoin for millions of new investors through retirement accounts and brokerage accounts.

Increased legitimacy: SEC approval will increase the legitimacy of Bitcoin and reduce institutional investors' and advisors' doubts about Bitcoin as an investable asset class.

Positive price effects: After the launch of ETFs in Canada and Brazil, there was a significant surge in Bitcoin prices in 2021. The launch of spot ETFs in the U.S. could similarly spark investor interest, leading to a similar bull market.

While it is currently unclear when the SEC might approve spot Bitcoin ETFs, the launch of Bitcoin ETFs overseas and the recent publication of various applications in the Federal Register highlight favorable regulatory momentum for these products.

Note: This study evaluates the availability of global spot and futures Bitcoin ETFs in 2023. Data was collected from BuyBitcoinWorldwide.com (spot ETFs) and Forbes (futures ETFs).

Only ETFs that exclusively trade Bitcoin or Bitcoin futures are included in the final list. Therefore, all ETPs, trusts, and ETFs trading blockchain-related stocks or other cryptocurrencies are not included. This study is for illustration and informational purposes only and is not financial advice. DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。