说实话早间开盘波幅并不大,给到一定下探至26473一线,随后反弹26686一线,进入微幅震荡,演变节奏基本都在许斌计划范围预料之内,没有太大看点同时,也是非常墨迹搞人心态。

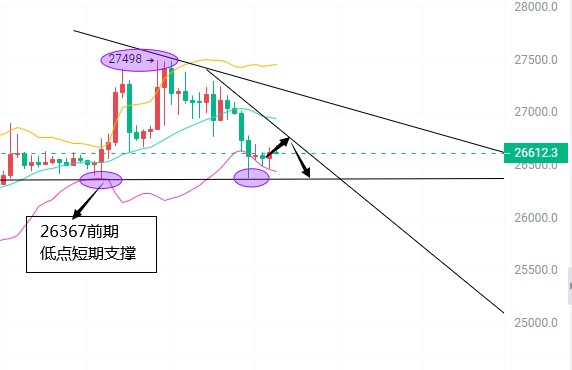

4小时盘面图而言,顿挫式的震荡下跌,此前多次冲击27498一线承压回调,形成一波台阶式下跌走低,破掉了区间下轨,但是收盘不算太低。昨日下探回升的十字K线,仍收回区间内,使得短线看弱不弱。延续性是一个问题。可能以震荡拉锯式的下跌呈现,也就是下跌空间大,反弹空间也大的走法。欧盘先关注一下26800附近一带的阻力。不破则会再次弱势回落。反之上破则是震荡下跌。先反弹寻求强一点的阻力再承压回落。4小时结构整体还是处于下行趋势当中,只是短线迂回反复,更加考验进场点位。

BTC短线:26800做空 目标26350 破位25800(以太坊走势接近同步进行即可)

BCH短线:210-209做空 目标206 破位201

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。