The Federal Reserve will announce its interest rate policy decision and policy statement at 2:00 AM on Thursday, September 21st, Hong Kong time.

After the Federal Reserve raised interest rates by 25 basis points to 5.5% in July, the target range for the federal funds rate in the United States has reached its highest level in 22 years, at 5.25%-5.5%.

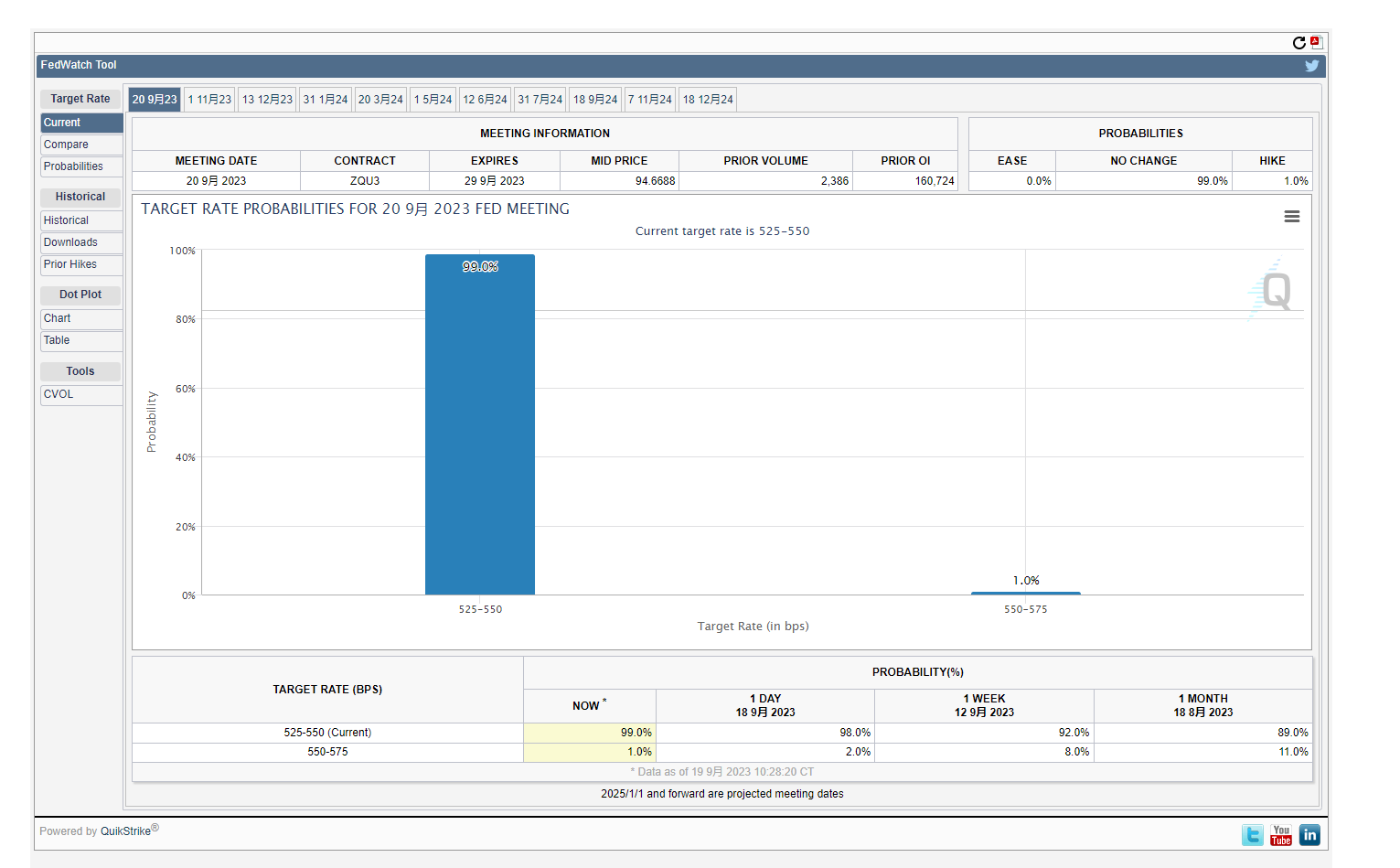

Historical interest rate hike data from the Federal Reserve

Market widely expects the Federal Reserve to maintain interest rates

According to CME's "FedWatch": the probability of the Federal Reserve maintaining interest rates at 5.25%-5.50% in September is 99%, with a 1% probability of a 25 basis point hike to the 5.50%-5.75% range; the probability of maintaining interest rates in November is 68.2%, with a cumulative 25 basis point hike probability of 31.5% and a cumulative 50 basis point hike probability of 0.3%. The market widely expects the Federal Reserve to maintain interest rates.

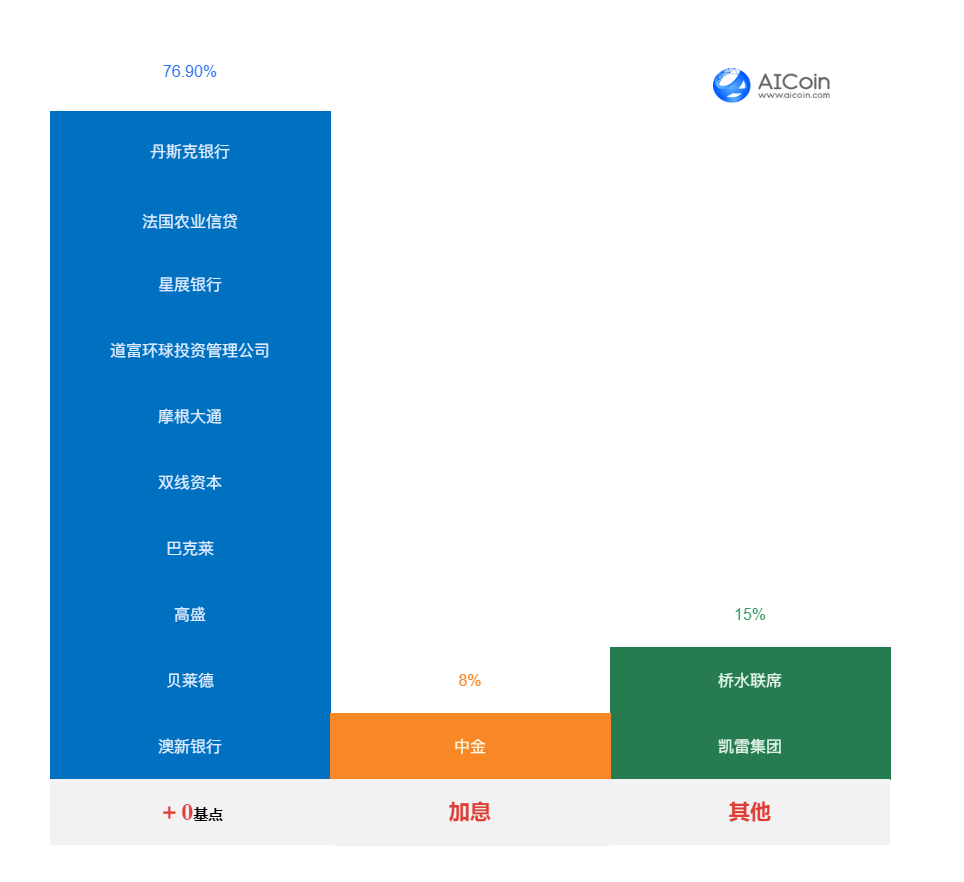

Nearly 80% of institutions predict no rate hike in September

According to AICoin statistics, 76.9% of institutions such as BlackRock, Goldman Sachs, JPMorgan, and DBS Bank predict that the Federal Reserve will maintain interest rates in September. For specific predictions, see “Multiple institutions predict no rate hike in September”

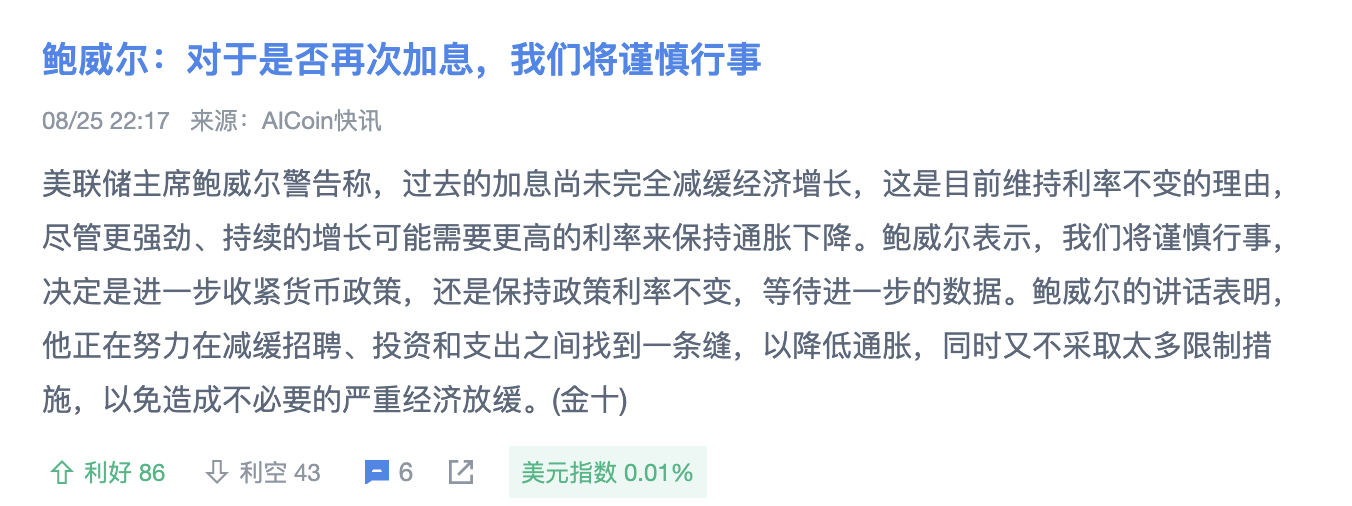

Powell's recent remarks seem to signal a "hawkish" stance

At the end of August, Federal Reserve Chairman Powell stated at the Jackson Hole Economic Symposium that, if conditions are right, he is prepared to further raise interest rates and intends to maintain monetary policy at a restrictive level until he is confident that inflation is consistently moving towards the target.

Analyst Bai Xue believes that the hawkish stance is more of a guidance for expectations, with limited actual implementation possibilities.

Is there still a possibility of a rate hike in the fourth quarter in the United States?

Bai Xue stated that although the U.S. CPI rebounded in August, it was mainly due to the transmission effect of the international oil price increase and seasonal factors on the inflation of gasoline prices, energy services, and related transportation services. The month-on-month core goods inflation and housing inflation continue to decline, indicating that the overall trend of slowing core inflation in the United States has not changed.

Data source: https://aicoin.app/data/cpi

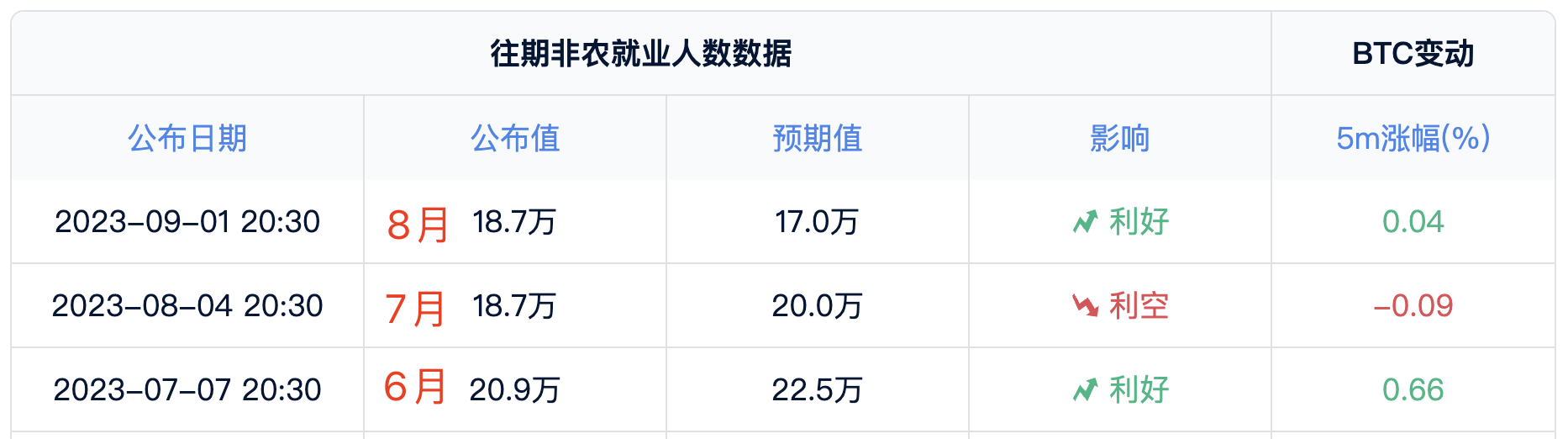

Regarding the labor market, Bai Xue stated that the U.S. non-farm employment market continued to cool in August, with the unemployment rate rising more than expected, and the month-on-month wage growth rate falling more than expected. In addition, the rapid decline in job vacancies in July and a significant narrowing of the employment gap indicate that the cooling trend in the labor market has been further confirmed. Therefore, the Federal Reserve will skip a rate hike this month and adopt a wait-and-see policy stance.

Data source: https://aicoin.app/data/npe

Schedule for the Federal Reserve's interest rate decisions in the fourth quarter of 2023

7th meeting: 2:00 AM, November 1, 2023

8th meeting: 3:00 AM, December 14, 2023 (Daylight Saving Time)

Reference article: “Preview: Will the Federal Reserve maintain interest rates tomorrow morning, and what is the probability of another rate hike this year?”

Cover generated by ChatGPT

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。