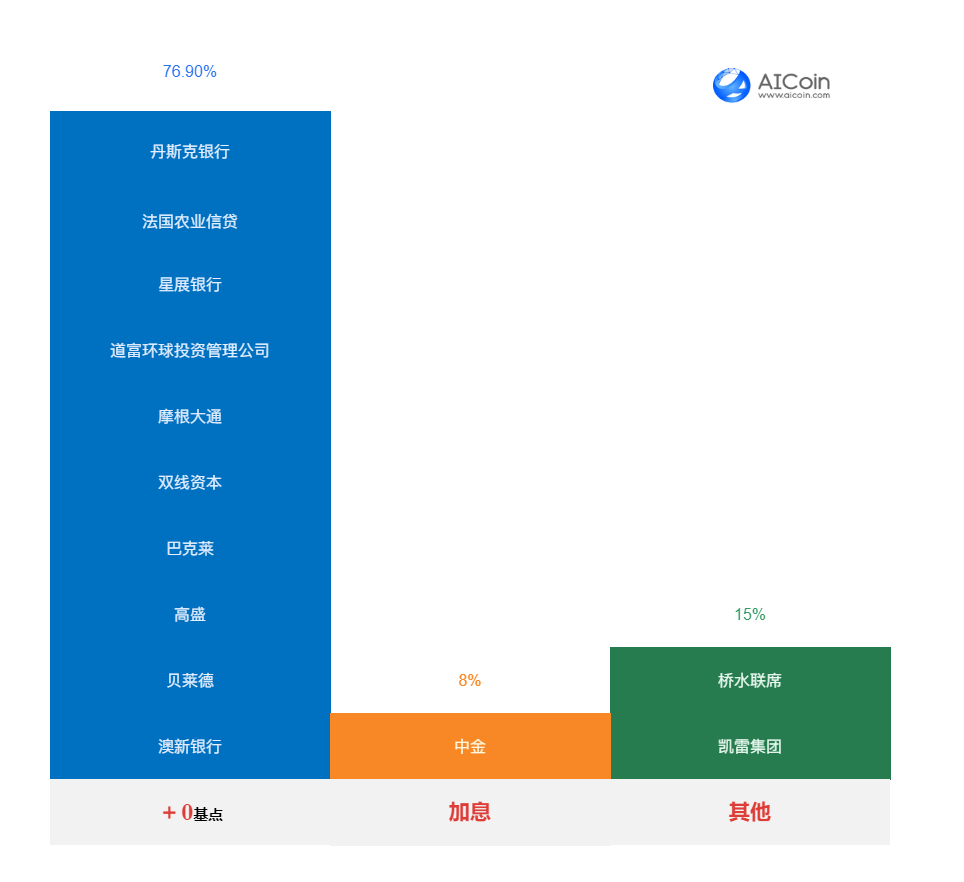

No Rate Hike Camp

DBS Bank: The Fed's rate hike cycle "is almost complete."

Invesco: The unemployment rate rising to 3.8% indicates that the labor market is weakening, but this is still at historically low levels. Therefore, 3.8% is still considered to be full employment level. However, declining inflation and wage inflation will prevent the Fed from raising interest rates.

J.P. Morgan: The Fed will keep interest rates unchanged.

DoubleLine Capital: I believe the Fed has finished raising interest rates.

Barclays: The Fed's rate hike action is nearing its end.

Goldman Sachs: The Fed is expected to stand pat in September and begin a slow rate cut next year.

BlackRock: The Fed should have finished raising interest rates and it's time to enter the U.S. bond market in a big way.

ANZ Bank: Data supports the Fed pausing its rate hikes, leading to higher gold prices.

Credit Agricole: Non-farm data may support the Fed's decision to stand pat in September.

Danske Bank: It is expected that the Fed will stand pat and focus on potential rate hike guidance.

Rate Hike Camp

CICC: The downward trend in U.S. inflation still faces significant resistance, and there is still a possibility of a rate hike in the fourth quarter.

Others

Carlyle Group: The Fed will raise interest rates once again this year.

Bridgewater Associates: The Fed will need more time before cutting interest rates.

To explore the impact of rate hikes on the BTC trend, go to the app [Home-Data] or the webpage to view historical data: https://aicoin.app/data/ffr

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。