Organizing | Odaily Planet Daily

Author | Qin Xiaofeng

I. Overview

According to official news, MetaMask announced the launch of the latest feature "Sell," allowing users to exchange cryptocurrencies for fiat currency through the MetaMask Portfolio and send funds to a bank account. The feature is currently available in the United States, the United Kingdom, and some European regions, initially supporting ETH on the Ethereum mainnet, with plans to soon expand to the native gas tokens on Layer2 networks.

On September 7th, ARK Invest and 21Shares jointly submitted the first spot Ethereum ETF application - "ARK 21Shares Ethereum ETF." Bloomberg ETF analyst James Seyffart commented on X platform, "The Ethereum ETF competition has officially begun. I estimate that the deadline for the SEC's review of these applications is around May 23, 2024."

In the secondary market, the price of ETH may continue to consolidate in the short term, with support at $1600 and resistance at $1650.

II. Secondary Market

1. Spot Market

Data from OKX Market shows that last week, ETH rebounded to 1672 USDT at one point and closed at 1619 USDT for the week, a 3.1% decrease from the previous week.

ETH daily chart, from OKX

The daily chart shows that the price is currently consolidating around $1600, with support at $1600. If it falls below, it may further decline to $1500; the resistance level is $1650.

2. Network Operation

Data from Etherscan shows that the Ethereum network produced 50,002 blocks in the past week, remaining relatively consistent; the number of active addresses per week was 2,606,521, a 7.8% decrease from the previous week; block reward income was 3379 ETH, a 5.6% decrease from the previous week; and the weekly ETH burn reached 11,454, a 26.1% decrease from the previous week.

3. Large Transactions

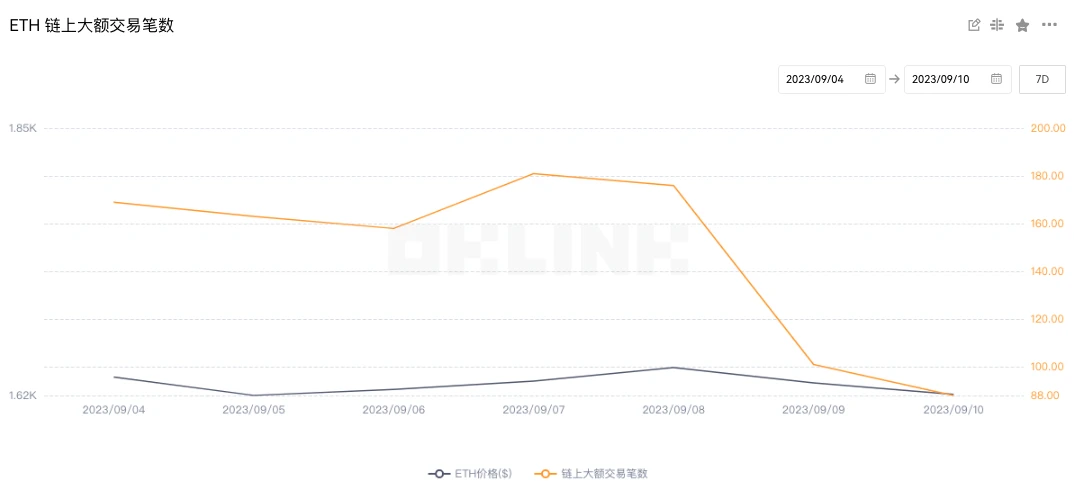

Data from OKlink shows that the number of large on-chain transactions reached 1036 last week, a 14% decrease from the previous week (1205), indicating a significant decrease in whale trading enthusiasm.

4. Wealthy Address Rankings

OKLink data shows that the total deposit amount of ETH2.0 has reached 26.58 million ETH, with a staking rate of 22.12%; looking at the distribution of ETH holding addresses, exchanges account for 8.63%. This remains consistent; DeFi projects account for 30.55%, a 0.17% increase from the previous period; the top 1000 addresses excluding exchanges and DeFi projects account for 29.39%, a 0.22% decrease from the previous period; other addresses account for 31.43%, a 0.05% increase from the previous period.

5. Lock-up Data

Data from DeFiLlama shows that the on-chain locked collateral value decreased from $217.3 billion to $212.6 billion last week, a 2.1% decrease; the top three locked values for individual projects are: Lido at $139.5 billion; MakerDAO at $50.1 billion; Aave at $39.1 billion;

III. Ecosystem and Technology

1. Technological Progress

The 117th Ethereum ACDC Meeting: Devnet #9 is expected to launch on September 19

Christine Kim, Vice President of Research at Galaxy, summarized the 117th Ethereum All Core Developers Consensus Call (ACDC) meeting, discussing Dencun testing, EIP 4844 blob parameterization, SSZ StableContainer proposal, and mitigating validator churn.

Regarding Dencun testing, developers are continuing to test the Cancun/Deneb (Dencun) upgrade on Devnet #8, and they have agreed to postpone the release of Devnet #9 by one week, to next Tuesday (September 19); developers are considering increasing the target maximum blob count from 2/4 to 3/6; Etan Kissling, a developer of the Nimbus (CL) client, is working on upgrading Ethereum's data structure to a new serialization format called SSZ. He has named the new approach for this upgrade "StableContainer" and is formatting it as a formal Ethereum Improvement Proposal (EIP).

2. Community Voices

(1) Vitalik: Ethereum's top priority is achieving a higher level of scalability

Vitalik Buterin, co-founder of Ethereum, stated that node centralization is one of the main challenges facing Ethereum, and the issue should be addressed by reducing and simplifying the operating costs of nodes. However, a perfect solution may need to wait another 10 or even 20 years. Vitalik stated that subsequent important measures to reduce Ethereum centralization include simplifying documentation, lowering the threshold for distributed staking, ensuring staking is safer and more widespread, and making ETH staking more convenient. Vitalik believes that the most urgent issue for Ethereum overall is achieving a higher level of scalability. (Cointelegraph)

(2) Vitalik and others jointly release research paper on "Privacy Pools" privacy protocol

Vitalik Buterin, co-founder of Ethereum, and others co-authored a research paper on a privacy-enhancing protocol titled "Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium."

The paper explores a new smart contract-based privacy-enhancing protocol - Privacy Pools, discussing its advantages and disadvantages, and demonstrating how it can be used to create a balance between honest and dishonest users. The protocol aims to use zero-knowledge proofs to verify the legitimacy of user funds without revealing their complete transaction history, while balancing privacy and regulatory requirements by filtering out funds related to criminal activities.

Blockchain detective Cobie and other KOLs posted on X platform, warning that Vitalik Buterin's X account, co-founder of Ethereum, was suspected to have been hacked and used to publish a phishing link related to ConsenSys' Proto Danksharding NFT giveaway (actually a phishing link). ZachXBT stated that the hacker has stolen $691,000. Upon inspection, the tweet containing the phishing link has been deleted.

3. Project Trends

(1) Starknet community initiates proposal to simplify decentralized protocols

I. Overview

Ethereum Layer 2 scaling solution Starknet has initiated a proposal for a "Simple Decentralized Protocol" aimed at allowing the community to propose a simple, complete decentralized Starknet protocol candidate, allowing for maximum protocol simplification under the assumption that over 2/3 of staking participants are honest.

The simplified protocol will mainly consist of four key parts: leader election based on proof of stake to determine block proposers' schedule; creation of a Tendermint-style consensus protocol for proposer networks to agree on each block; a chain-based proof mechanism where each proposer must prove the previous block to ensure decentralized proof; and periodic updates of L1 state to regularly migrate L2 state to L1 while merging chain proofs.

II. Project Trends

dYdX Foundation CEO: dYdX will migrate to the Cosmos network, and dYdX on Ethereum will close in a few months. (Source: Cointelegraph)

MetaMask has launched the latest feature "Sell," allowing users to exchange cryptocurrencies for fiat currency and send funds to a bank account. The feature is currently available in the United States, the United Kingdom, and some European regions, initially supporting ETH on the Ethereum mainnet and planning to expand to native gas tokens on Layer 2 networks.

Ethereum Layer 2 network Linea has announced the launch of "The Entertainment Festival" to expand the Linea gaming ecosystem and promote community participation in online gaming.

Circle has announced that the cross-chain transfer protocol CCTP is now live on the OP Mainnet, allowing transfer of USDC across four networks, including Ethereum, Avalanche, Arbitrum, and Optimism.

ARK Invest and 21Shares have jointly submitted the first spot Ethereum ETF application "ARK 21Shares Ethereum ETF." The competition for Ethereum ETFs has officially begun, with an estimated SEC review deadline of around May 23, 2024.

Self-custody platform Casa has launched an Ethereum vault relay service to enhance user privacy protection, allowing users to conduct transactions through relays to increase privacy protection.

Ethereum staking protocol Swell Network has integrated the LayerZero cross-chain interoperability protocol, supporting the cross-chain conversion of swETH to fully chain-homogeneous tokens (OFT). Users can trade swETH on Arbitrum and provide liquidity, with Swell planning to support other L2 solutions in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。