The Bitcoin market has been experiencing continuous small fluctuations recently. Although the bulls have intentions to rebound, the momentum is not strong enough. In my personal judgment, the risk of a downward breakthrough will increase after the bulls' energy is further consumed. Everyone should pay attention to the support level of $25,300. If it is broken, it may test the support area of $23,500 to $24,000. In terms of operation, it is recommended to focus on short positions, but caution is advised.

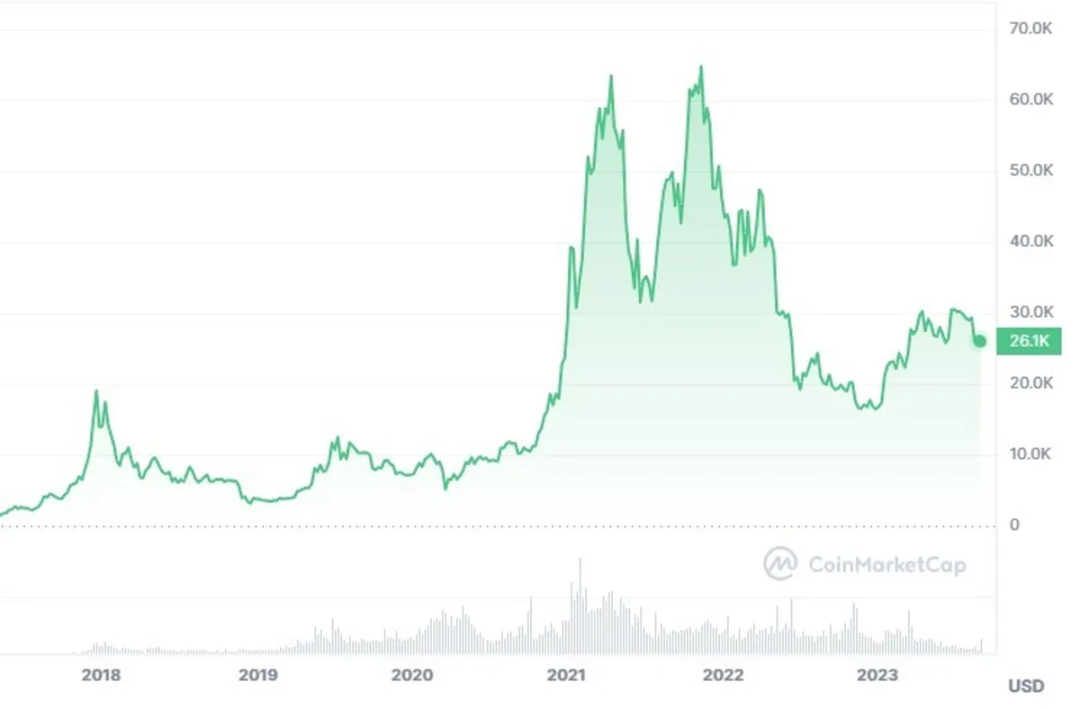

Some people believe that the current market is the longest bear market in history, but the terms "bull market" and "bear market" are actually subjective and have no clear definition. This ambiguity has led to various debates, but it is meaningless. Investors generally refer to the trend of Bitcoin reaching its all-time high of $69,000 on November 10, 2021, as a "multi-year bear market," which has lasted for 659 days. However, there have been longer bear markets in history, such as the period from November 2013 to January 2017, when the Bitcoin price remained below the previous high of $1,000 for 37 consecutive months (approximately 1,125 days). For example, after Bitcoin first reached $20,000 in December 2017, it entered another "bear market" that lasted for 1,095 days.

But from a different perspective, perhaps Bitcoin is not currently in a bear market at all. Some studies suggest that when a market index or asset falls more than 20% from its recent high, it can be considered to have entered a bear market. According to CoinGecko's data, Bitcoin's recent high occurred in mid-July 2023, at around $31,400. Based on the current price, the decline of Bitcoin is only about 13%.

Returning to the market trend, after the end of a bear market, the early stage of a bull market usually experiences significant volatility. As we have seen, the decline last Friday triggered a sharp drop in the overall Bitcoin market, returning to the starting point and forming a solid support level. This kind of market mainly affects user contracts. As we mentioned before, this kind of market stimulated by short-term positive news will not last and cannot change the fundamental trend of the market. Therefore, what we should be concerned about now is the oscillating adjustment, mainly dominated by adjustments in September and gradually accumulating strength. After October, the market may gradually gain momentum and usher in a significant uptrend.

Next, we need to pay attention to some important events this week. The week begins with a U.S. holiday, which may affect trading volume. Also this week, Christine Lagarde, President of the European Central Bank, will deliver a speech, and investors will closely watch her views on the European economic outlook. In addition, the integration of CYBER and OpBNB will take place this week, which may cause fluctuations in the cryptocurrency field. Fans of Baby Doge Coin are also eagerly awaiting the announcement of a new artificial intelligence project.

On Tuesday, September 5, we will see the release of China's Manufacturing Purchasing Managers' Index (PMI) data, with the previous data at 51.3, a value closely watched by everyone to observe signs of economic activity. At the same time, we will also learn about the Producer Price Index (PPI) for the Eurozone, expected to be -7.8%, lower than the previous -3.4%. This data may reveal the inflationary pressures facing the Eurozone, which could have an impact on the cryptocurrency market.

On Wednesday and Thursday, macroeconomic developments will intensify. On September 6, the U.S. Services PMI data will be released, expected to be 51, slightly lower than the previous 52.3. On the same day, the Institute for Supply Management (ISM) will release PMI data, expected to be 52.5, slightly lower than the previous 52.7. In addition, the Federal Reserve will release the Beige Book, providing information on the current economic conditions in various regions. Fed officials Lael Brainard and Mary Daly will also make statements, sharing their views on economic issues, all of which could affect the sentiment of the cryptocurrency market.

On Thursday, GDP data for the Eurozone will be released, expected to be 0.6%, lower than the previous 1.1%, indicating continued challenges for the Eurozone economy. At the same time, we also need to pay attention to the U.S. jobless claims data, expected to be 235,000, slightly higher than the previous 228,000. This is an important indicator of the health of the labor market. Finally, Fed officials John Williams and Michelle Bowman will discuss important economic issues, and their remarks could affect the sentiment of the cryptocurrency market.

This weekend, we also need to closely monitor some important data. On Saturday, China will release inflation data, expected to be 0.1%, slightly higher than the previous -0.3%. This data will tell us about their impact on the cryptocurrency market.

In summary, the Bitcoin market is currently experiencing continuous fluctuations, and the future trend is uncertain. Investors need to be cautious and make decisions based on market dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。