十年磨一剑,涨跌皆有因;多空不恋战,落袋方为安。

大家好,我是汤米,一个加密经济学者,一个扎根在币圈研究以太坊(ETH)6年的交易者先给大家谈下我的交易三不做:累、困、乏的时候不做;心情不好的时候不做;看不懂行情的时候不做; (状态不好的情况下,无法发挥正常水平,因此对行情的判断会产生很大的误差)

关注公众号: K线人生汤米 :机会每天分时段创造,何须急于一时,初衷从未改变,创造利润的同时,潜心专业把握风控,让投资产生价值,走得长远,也不负曾经的相遇与信任,每天都有实时指导本人24小时在线有问题可以留言,公开策略全部免费开放。

复盘:周六周日的行情一如既往平静。数据方面,美国8月私营部门新增就业人数环比增加17.7万人,不仅远低于7月经修订后的37.1万人,也低于市场普遍预计的20万人。GDP数据方面,美国2023年第二季度GDP按年率计算增长2.1%,较首次预估数据下调0.3个百分点。获利回吐等因素加剧了标普500指数在8月上旬的下跌,但进入本周(截至9月1日)标普500指数重拾涨势;预计整体上市场的波动性将增大,美联储的任何行动或评论都将对市场行情带来扰动。本周四将公布周度失业金申请人数等;下周五将公布7月商业批发库存报告。

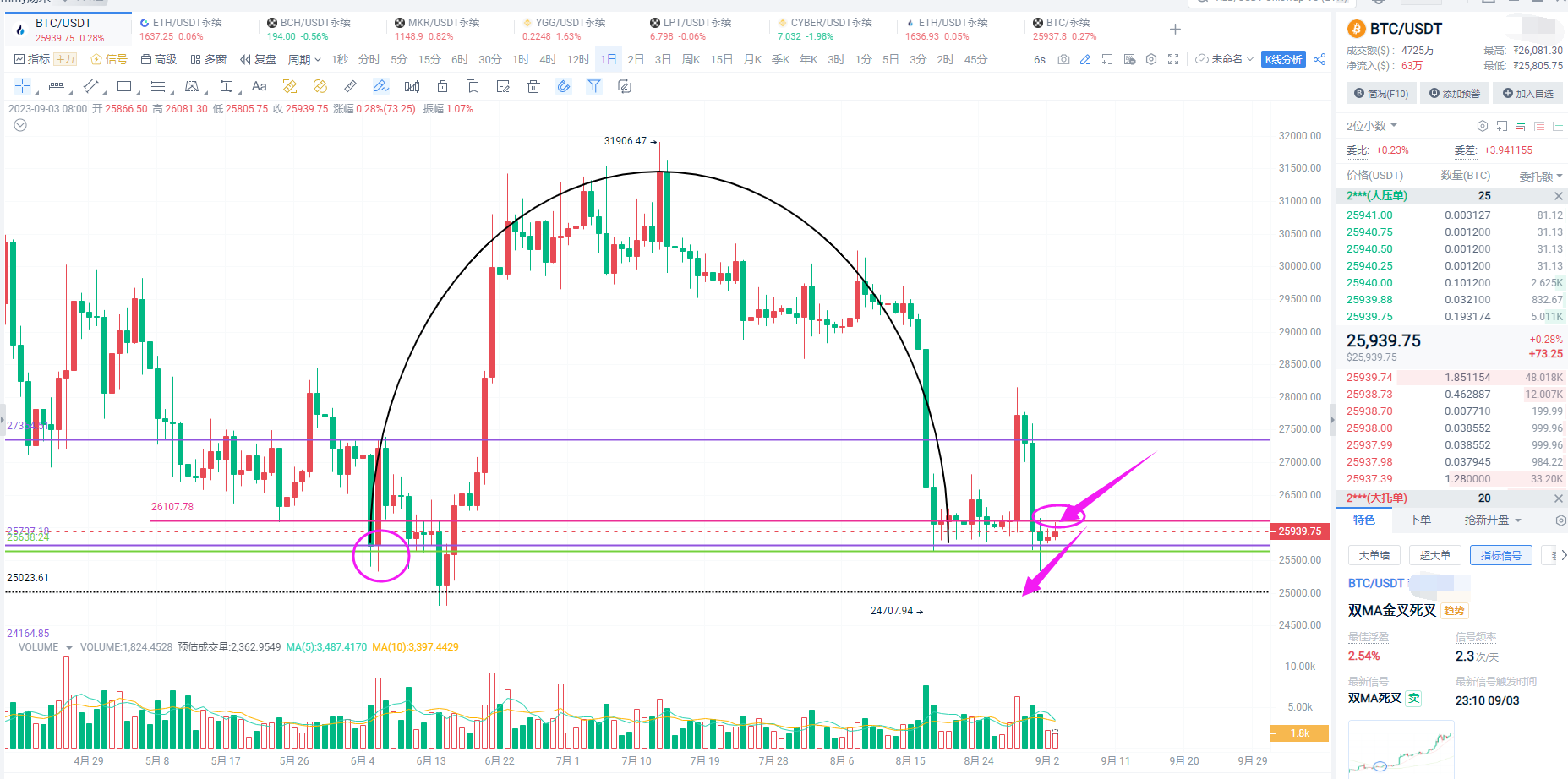

盘面上BTC依旧是维持在26100-25800区间震荡,ETH围绕1650-1630窄幅震荡,BTC上方的26100多头的资金已经有进场的信号,但是需要注意的是能否在26100-26200呈现量价齐升,做到下方底部夯实,相对ETH而言目前比特币的下方支撑更强,以太坊上方筑底走出的信号是相对更弱,而且多头的量能明显没有给出进场的信号,所以短期操作建议还是遵循高空低多的思路做窄幅的收益期望。

日线级别没有突破1680-1700的前期平台位,并且需要量能支撑,如果没有具备这两个条件短期的趋势依旧是看回调二次筑底

以太坊空头箱顶1650附近可空单进场 止损1675,止盈1610-1580

比特币25800昨天说的25800支撑破位同样继续下看下一区间支撑25000附近.中阴线击穿前期的平台位,空头目前依旧是强势回调。

BCH:224附近是上方多头筑底的筹码区域.前期的大阳线190附近没有二次筑底信号,要么继续回调筑底,要么继续下单更低的平台140,224不破 目前的价格继续向下看二次 吸筹平台180一线.前期给到的高位空单不用过多担心 继续持有

日线级别进入多头区域迅速回落,还是会面临二次的下探筑底。

9月新的投资计划依旧开启,需要跟上实盘实时指导的可关注文章末公众号了解

公开只统计ETH的收益,全网可查阅监督。实盘数据以实时指导为主。详情关注公众号添加了解。

主要面向现货、合约、BTC/ETH/ETC

擅长风格:K线交易

独创成交量交易战法.

短线波段高低位,中长线趋势单,日线极限回踩,周K顶部预测,月线头部预测

公众号二维码

温馨提示:文末只有微信公众号是笔者本人所创!!

请大家谨慎辨别真假,感谢阅读!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。