"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment and Entrepreneurship

The bull market story has a key element: innovative currency printing. The cryptocurrency industry is best at printing money.

Forked coins of Bitcoin are the original currency printing machines in the cryptocurrency world. At that time, launching new coins was expensive because these proof-of-work mechanisms required electricity to maintain network security. With ERC-20 tokens supported by Ethereum smart contracts, issuing new tokens became easier and cheaper. Tokenization became ubiquitous. As cryptocurrency prices rose, the use cases for cryptocurrency continued to increase. The reason for the collapse during this stage (ERC20 era) was that the funds flowing into the cryptocurrency system could not sustain the exponential growth of new tokens launched every day. We ended up printing too many tokens. In addition, as the number of tokens in circulation increased, attention became dispersed, leading to confusion about investment direction. During DeFi Summer, protocols distributed tokens for free through airdrops to liquidity providers or users. The real motivation behind these tokens was still to bootstrap liquidity. When the daily issuance of tokens exceeded the funds entering the system, the DeFi market collapsed. The same happened with NFTs later on.

We are currently in a season similar to the DeFi bull market, laying the foundation for innovative currency printing and compelling narratives. The top opportunities with the potential to create a bigger bubble than the short-term narratives we have witnessed in this bear market are: re-staking (represented by EigenLayer) and Bitcoin DeFi. And these two narratives will also have moments of collapse, creating too many tokens to meet the demand and growth rate of attention.

We expect to reach an ATH of $69,000 by the fourth quarter of 2024 and experience a crazy bull market before reaching a new ATH in the fourth quarter of 2025.

Ark Invest's ARK 21 Shares Bitcoin ETF is the earliest Bitcoin spot ETF application in this round, and it has undergone two replies, both of which have been delayed. The first reply dates for the remaining ETFs are all in early September.

Except for BlackRock, the other companies all have experience in applying for Bitcoin spot ETFs. Among them, VanEck has the most experience. It has had three experiences of applying for Bitcoin spot ETFs since 2018.

All 8 ETF application documents added the rejection reason repeatedly mentioned in the 2021 application, which is the Surveillance Sharing Agreement (SSA).

All 8 ETF applications propose trading on one of three exchanges: Nasdaq, Cboe BZX, and NYSE Arca. Among them, the exchange with the largest proportion in the applications is Cboe BZX, accounting for 5 out of 8. This may be related to Cboe BZX's positive attitude towards crypto assets and their derivatives.

There are slight differences in the detailed information in the application documents of the 8 ETFs. For example, Valkyrie and VanEck did not disclose detailed custodian information.

Find a (practical) low fairness, high volatility, and as high trading efficiency as possible target;

Establish a trading platform with a trading mining subsidy mechanism;

Subsidize buying behavior through the trading mining mechanism to completely control the target;

Ensure that the total customer loss is slightly higher than the total subsidy (including the cost of pulling up the market);

Package the mining mechanism with market-making terms to expand the project's selection;

Activate the target.

DeFi

Using Lido as an Example, In-depth Discussion of the Potential Risks of the LSD Protocol

Dual governance is an important step in reducing governance risks in the Lido protocol. It represents a shift from shareholder capitalism to stakeholder capitalism. It also provides a practical way for Ethereum holders to have a say in changes to the Lido protocol. Its main purpose is to prevent LDO holders from changing the protocol and the social contract between stETH holders without the agreement of the protocol and stETH holders.

Even if LSD governance has a time delay, allowing pooled capital to exit the system before changes occur, the LSD protocol is still vulnerable to gradual governance attacks. Small, slow changes are unlikely to cause invested capital to exit the system, but the system will still undergo drastic changes over time. Nevertheless, this is true for any governance mechanism, whether it is primarily informal (soft) or formal (hard).

Good validators are a public good that needs financial support. The EF should not rely on them to provide funds (partly because its closed governance structure and strong soft power do not allow it to formulate trustworthy neutral rules well), and only a successful liquidity staking protocol (>50% market share) can afford the financial inefficiency required to maintain a good validator market, sponsor expensive validators, provide ecosystem support, and still be profitable in the long term (next 100 years).

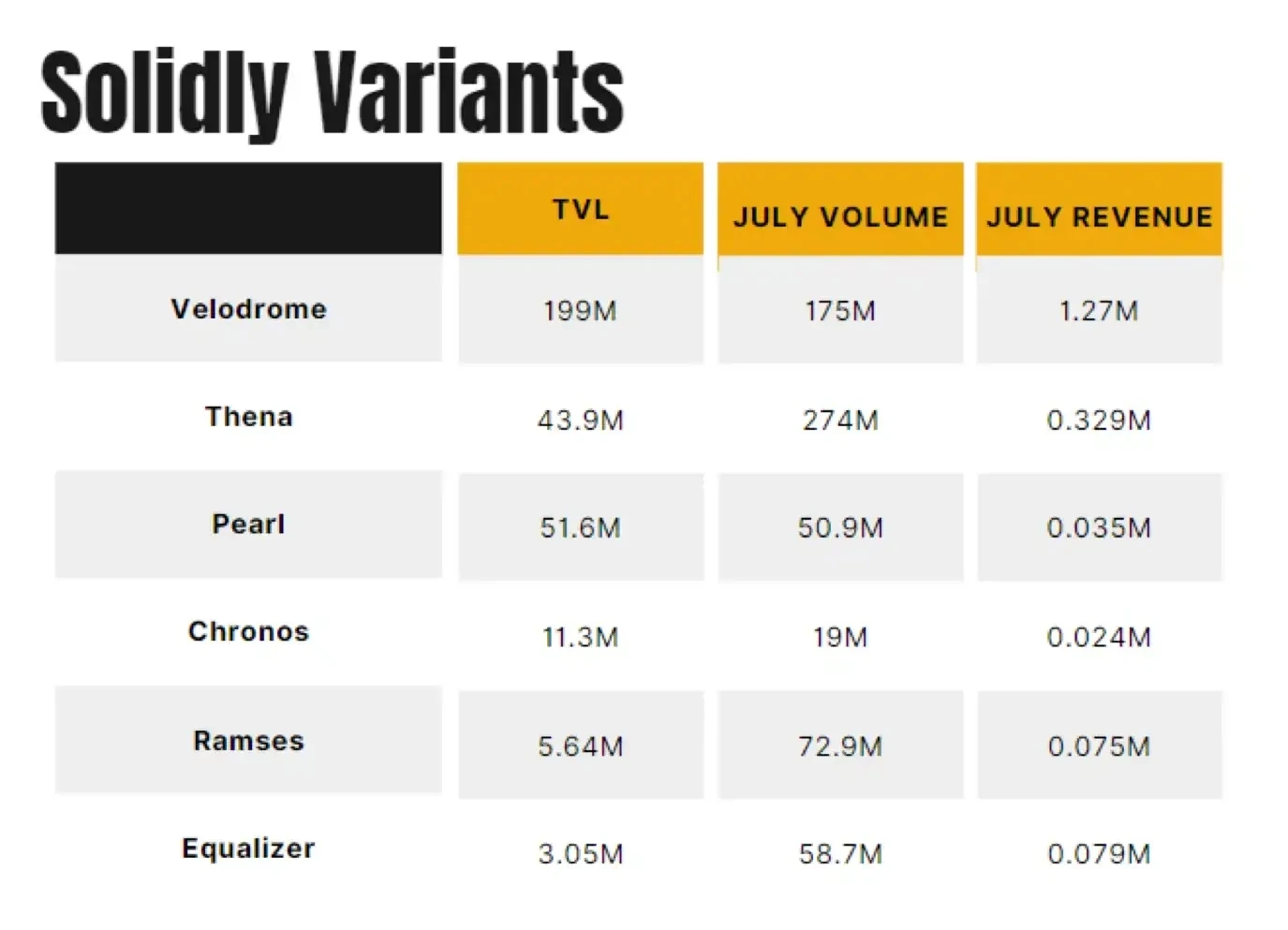

After the Hype of Solidly, What Is the Current Status of the ve (3,3) DEX Project?

Six forks of Solidly

The Solidly model has had a very positive impact on DeFi and may continue to be a highlight of DEX innovation in the future because it can adjust token emissions and trading volume. In the current low-yield, volatile market, trading volume is also the biggest test for Builders.

The project needs to find ways to maintain the incentive flywheel for growth, such as:

- Product versions: Perps (Thena)

- Bribery income: RWA income (Pearl), OP subsidies (Velo)

- Capital efficiency: Gamma's treasury w Conc liq

- Emission exp: Dynamic emission (Velo)

GameFi

PSE Trading: A Revelation of Full-Chain Games, Pixel-level Dissection of the Industry Chain

The article outlines the concept of full-chain games and presents a panoramic view of the value chain.

Ethereum and Scalability

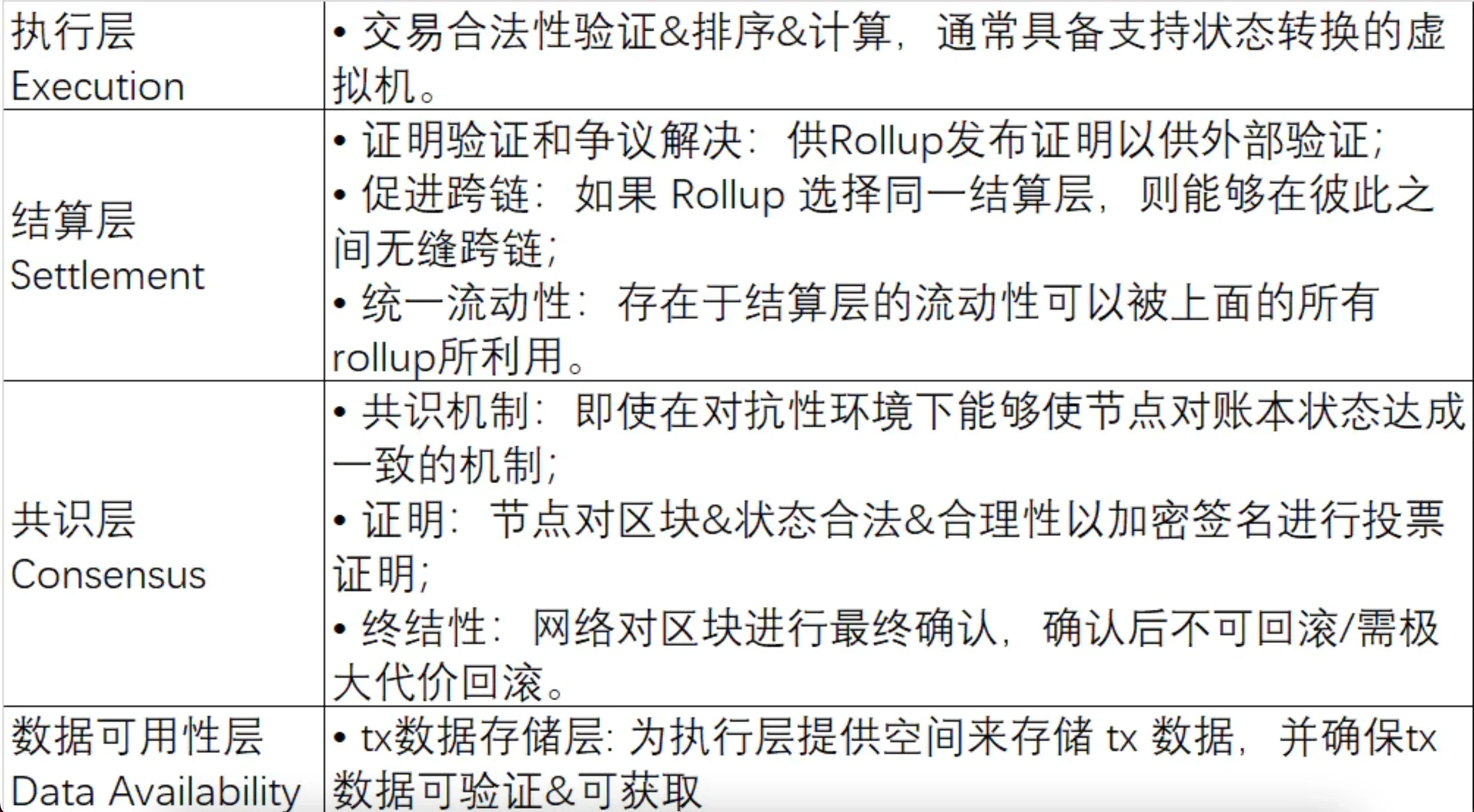

PSE Trading: New Narrative of Modular Blockchain—DA Layer Competing for Supremacy

The four core functional modules of blockchain

Currently, nearly 70% of the cost of Rollups is in publishing tx data and proof data on Ethereum L1. The next foreseeable step for modular blockchains is that the competition between ETH L1 and many specialized DA layers in terms of data availability will significantly reduce the entry barriers for new rollups, further enhancing the scalability of blockchains and reducing interaction costs without sacrificing security and decentralization.

A unified settlement layer can allow many Rollups to enjoy cross-chain security and aggregate liquidity. The right to order transactions should not be borne by the DA layer. In the next ten years, Ethereum is still the best option for most Rollup consensus layers and settlement layers.

Mainstream DA layer projects include Celestia, EigenDA, Espresso, and ETH Proto-Darksharding.

- Ethereum Rollup benefits from the cost reduction of blob data storage brought by EIP 4844 after the Cancun upgrade, or will continue to maintain the market competitiveness of ETH L1 in the DA module.

- Optimistic about DA layer solutions based on ETH L1 as the settlement layer (such as Celestium), which can improve the "Lego block" interoperability between execution layers by enabling cross-chain security/liquidity sharing, contributing to a virtuous cycle of ecosystem development.

- Optimistic about DA layer solutions relying on the EigenLayer re-staking protocol (such as EigenDA, Espresso), which can not only reduce the cost of storing tx data but also share some ETH L1 security.

- Shared sequencer solutions with good incentive allocation mechanisms (such as PBS) will be adopted by leading Rollup execution layers. The right to filter/sort transactions should not be given to the DA layer, and the DA layer should focus on the task of ensuring data availability.

Binance Research: In-depth Analysis of Decentralized Sequencers

Rollups actually do not need sequencers; this is just a design choice aimed at providing users with a better experience in terms of lower fees and faster transaction confirmation speed.

Since the sequencer controls the order of transactions, it has the power to review user transactions (although complete review is unlikely, as users can submit transactions directly to L1). The sequencer can also extract maximum extractable value ("MEV"), which may cause economic losses to the user group. In addition, reliability may also be a major issue, i.e., if the only centralized sequencer goes down, users will be unable to use the sequencer, and the entire rollup will be affected.

The solution to the problem is a shared, decentralized sequencer. Espresso, Astria, and Radius are developing innovative shared sequencing solutions, each with various unique features in their architecture. Espresso is trying to leverage EigenLayer to guide its network, while Astria maintains close ties with the modular data availability network Celestia. Radius brings its unique encrypted mempool into the conversation.

The Battle of ZK/OP Routes for RaaS: Why ZK-RaaS Is Superior?

Compared to Optimistic Rollups, ZK-Rollups have the following advantages:

- Compressed transaction data saves L1 gas costs.

- More secure, without the need for trust.

- Faster transaction confirmation speed and shorter withdrawal time.

ZK-RaaS also has advantages in network effects:

- ZK-RaaS provides scalable computing power for a massive number of ZK-Rollups through ZK-PoW, reducing the cost of ZKP computation.

- Due to the faster transaction confirmation speed of ZK-Rollups (on the order of minutes), native cross-Rollup communication (NCRC) protocols can be implemented between ZK-Rollups, solving the problem of fragmented liquidity.

Multi-Ecosystem and Cross-Chain

Investigation and Analysis of Public Chain User Activity Data Reveals These Seven Key Points

- The Cardano and Polygon communities are very strong.

- Litecoin is rarely used.

- In terms of users and usage, BNB Chain > Solana > Avalanche.

- Ethereum is still the leader. Apart from Ethereum L1, voters prefer to use Optimistic Rollup chains.

- Tron is usually used for CEX transfers and as a payment method in developing countries with weak banking systems.

OP Research: Is "Cosmos" the Ultimate Form of Layer 2?

OP Stack replicates Cosmos' approach, and the market will definitely see the emergence of a role similar to Cosmos or an OP superchain. This role will act as a hub connecting different blockchain networks, achieving ecosystem growth through creating synergies and sharing ecosystem resources.

With the maturity and democratization of ZK technology, it is likely that ZK series or OP series Stacks incorporating ZK technology will take over the banner of Layer 2 multi-chain. ZK technology inherently provides high TPS and decentralization, which are crucial properties for scalability and expansion, in addition to compatibility, under highly shared security conditions.

Can Liquidity Staking Save the Cosmos Ecosystem?

The goal of the Cosmos network is to realize the vision of application chains (App Chains): each application has its own PoS blockchain and they are interconnected. However, this means that almost all value is locked on the chain for staking its native tokens to secure the network. LSD can unlock this dormant value on Cosmos. By allowing stakers to mint derivative tokens representing their staked assets, liquidity can flow freely again. Moreover, since staking is crucial for Cosmos, the adoption of the LSD platform may be very rapid and widespread.

Massive liquidity influx can greatly expand the DeFi potential on the Cosmos chain. Additionally, Cosmos' cross-chain features are very suitable for LSD products.

However, there is currently no efficient and validated liquidity staking solution in the ecosystem. But this situation may be changing. Stride will become the dominant LSD solution in Cosmos, given its impressive growth and critical use for inter-chain security.

Weekly Hot Topics Recap

In the past week, after Grayscale won the lawsuit against the SEC (various perspectives and interpretation), the crypto market surged, and the SEC delayed the results of at least 3 Bitcoin spot ETF applications, leading to a market downturn. X obtained a money transmission license in Rhode Island and can provide payment services in seven states, and Elon Musk denied the statement that X platform will issue X tokens for creators.

In addition, in terms of policy and macro markets, Hashdex applied to hold spot Bitcoin in its Bitcoin futures ETF, a judge dismissed a class-action lawsuit against Uniswap, stating that developers should not be held responsible for third-party misconduct, crypto bank SEBA has received a provisional approval from the Hong Kong Securities and Futures Commission to offer OTC derivatives and other crypto-related products, Hong Kong implements a dual licensing system for virtual asset trading platforms, and OSL and HashKey are applying for a second type of license. The People's Court of China's newspaper: "Virtual currency is legal property and is protected by law".

In terms of opinions and statements, the CEO of Grayscale: Management fees will decrease when GBTC is converted to a spot Bitcoin ETF, Xiao Feng: The Hong Kong Securities and Futures Commission may issue regulatory guidance for STOs by the end of this year, COO of Hashkey: It is expected that only 5 to 8 exchanges will eventually obtain compliant licenses in Hong Kong, PYUSD adoption rate is lower than expected, with 90% of the total tokens still held in the issuer Paxos Trust's address.

Institutions, large companies, and leading projects: Paradigm launches Rivet, a wallet tool for developers, Victory Securities may open virtual asset trading for retail investors in the fourth quarter, Coinbase has launched the PayPal-backed stablecoin PYUSD, HashKey Exchange opens BTC/USD and ETH/USD trading pairs to retail investors, OKX Hong Kong enables bank card purchases of cryptocurrencies, Ethereum Foundation introduces Ethereum execution layer specifications, Ethereum Foundation officially launches Ethereum execution layer specifications, Balancer: Mitigation procedures have been formulated for the vulnerability but cannot pause affected pools, exact loss amount cannot be disclosed at the moment, "Deploy V2 on all chains with Uniswap V3" proposal temperature check vote has been approved, Optimism allocates initial OP tokens grant to Base, friend.tech: Users will have their existing points confiscated if they use the counterfeit version of the app, friend.tech hype subsides, PEPE dumps.

In the NFT and GameFi fields, OpenSea releases redeemable NFT standards, and will introduce on-chain redeemable support for creators, Binance Mining Pool launches Ordinals engraving service … Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series link.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。