Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Tuesday, August 29, 2023. Welcome to follow Yibo's coin talk. I am Yibo! We do not predict trades, but actually observe market fluctuations (narrowing, diffusion), structure (market batch structure), emotions (external market stocks, US dollars, etc.). As a trader, you (through trading) affect prices, and prices also affect your emotions and behavior as a factor.

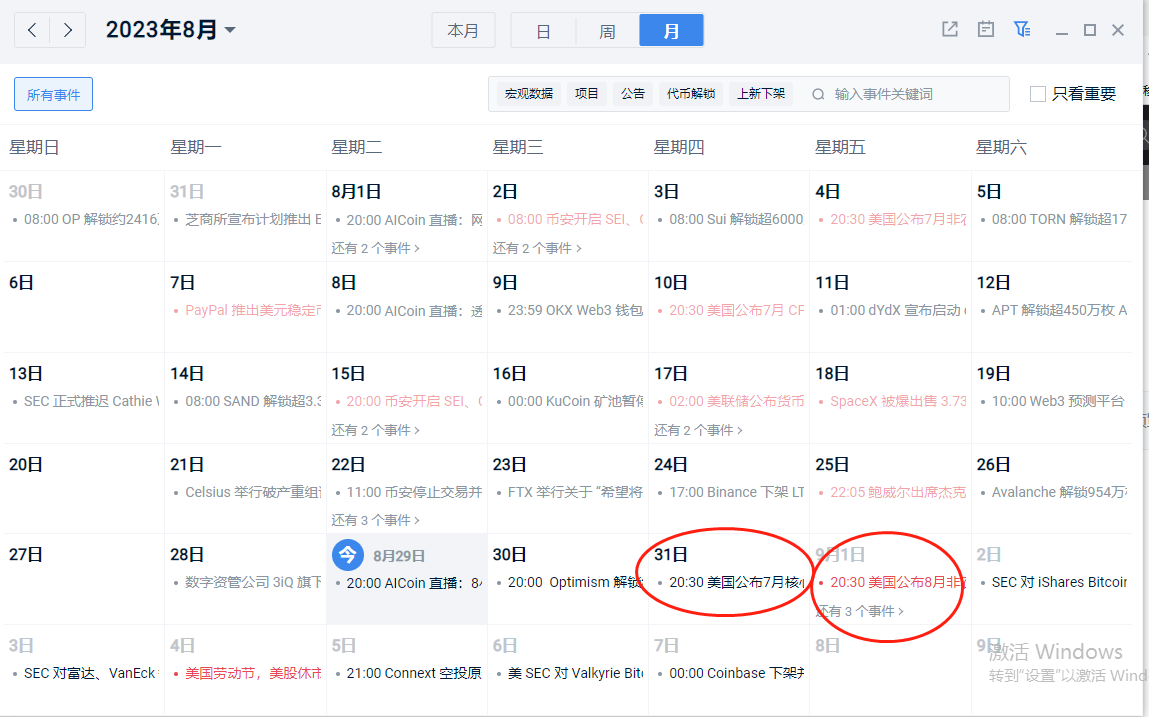

The market is beginning to refocus on the upcoming economic data and evaluate the prospects of the Fed's monetary policy. At 20:30 on August 31 (UTC+8), the US will release the July core PCE price index, with the market expecting a 4.2% increase. At 20:30 on September 1 (UTC+8), the US will release the August non-farm payroll data, with the market predicting an unemployment rate of 3.5% and an increase of 170,000 non-farm jobs. The focus is on whether the data can drive market fluctuations. If there is a lower unemployment rate, increased personal consumption expenditure, and enhanced confidence, it may push the US dollar index higher, which is bearish for Bitcoin. Conversely, if the unemployment rate rises as personal consumption expenditure and confidence decline, there may be a rebound in risk assets, leading to a decline in the US dollar index or US bond yields, ultimately benefiting the Bitcoin market. Most people believe that signs of a slowdown in the US economy will gradually emerge, and this round of tightening may be coming to an end. Powell's speech last week did not change the market's expectations for a rate hike next month, with the current probability of a rate hike still around 20%. Although his stance is hawkish, there has been no major policy change, and he tends to take a middle-of-the-road approach. Therefore, they believe that the US stock market will have a chance to rebound. Related to the US stock market is the crypto market, and the two are positively correlated. If the US stock market rebounds this week, there is a high probability that the overall market will be influenced and rebound.

After the sharp drop on August 18, the market has entered a stagnant state, causing investors to waver between bottom fishing and fleeing the market. At this time, "waiting" has become key in trading. However, many people are not clear about what they are waiting for, reflecting investors' uncertainty and confusion in the face of market fluctuations. The fundamental reason is the inaccurate grasp of market cycles, and a lack of in-depth understanding and analysis of the market. In investment, waiting is a common strategy, but it must be based on a thorough understanding of the market and one's own goals. If investors do not have a clear strategy and goal, and just wait blindly, they are likely to fall into an unfavorable situation.

ETH morning trading plan on August 29:

Review: The market has been in a downward trend during the morning session, with weak oscillations. It quickly rebounded to the 1660 range after a rapid drop to around 1620, which was the strategy layout provided in yesterday's morning live broadcast, securing a profit of 30 points. The current price is running at around 1655, and the rebound has not continued to the high. It still needs to consolidate. It is still in a range-bound oscillation, and it is best to maintain operations within the range. Waiting for a breakthrough in pressure, it is still in the process of confirming support after the pullback. The daily and short-term movements are relatively gentle, still in the process of range-bound oscillation and repair after the sharp drop in the middle of the month. There has been no effective breakthrough or breach in either direction, as the volatility in the middle of the month was indeed too large. It still needs time and space to ease, but this range-bound structure without a breach makes it easy to continue the previous decline. Therefore, our strategy for this week is mainly to go short, while also looking for the probability of a secondary short-term wave while laying out positions.

Trading suggestion: Enter a short position in the 1660-1680 range, with a defensive position at 1700, and targets at 1640-1620-1600!

BTC morning trading plan on August 29:

Review: Although the intraday market is still fluctuating within a range, we have enough room for operation. The price reached a high of around 26200 and dropped to near 25850. Despite the small fluctuations, our strategy remains unchanged, with small profits taken. From a technical analysis perspective, the monthly chart is still showing a bullish trend, with a sharp rise to a high point in the middle of a month and a half, followed by a continuous oscillation and decline, and then a sharp drop of nearly 4,000 points last week. After that, it continued to oscillate and adjust. On Friday, due to some space created by the news, but it did not lead to a good continuation. Looking at the four-hour chart, the Bollinger Bands are running open, and the pullback is indeed an indication of the opening of the downward space. The current range-bound consolidation is actually a preparation for continued downward momentum, and the volume arrangement continues to show a situation of increasing volume. Therefore, the overall direction in the future will still be downward, focusing on the upper pressure for operation.

Trading suggestion: Enter a short position in the 26200-26400 range, with targets at 25800-25500, and a defensive position at 26600.

A thousand words are not as good as one profitable trade. Instead of repeated failures, it's better to come to Yibo! Frequent operations are not as good as precise ones, making every trade valuable. Your task is to find Yibo, and our task is to prove that our words are not empty. May our acquaintance begin with words, match in character, be trapped in technology, last in kindness, and end in character. (For friends who are still confused in their operations, you might as well take a look at Yibo's strategies. Real-time guidance for 24 hours, as market fluctuations are fast. Due to the impact of review timeliness on the subsequent market trends, real-time layout based on actual trading is the main focus. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。