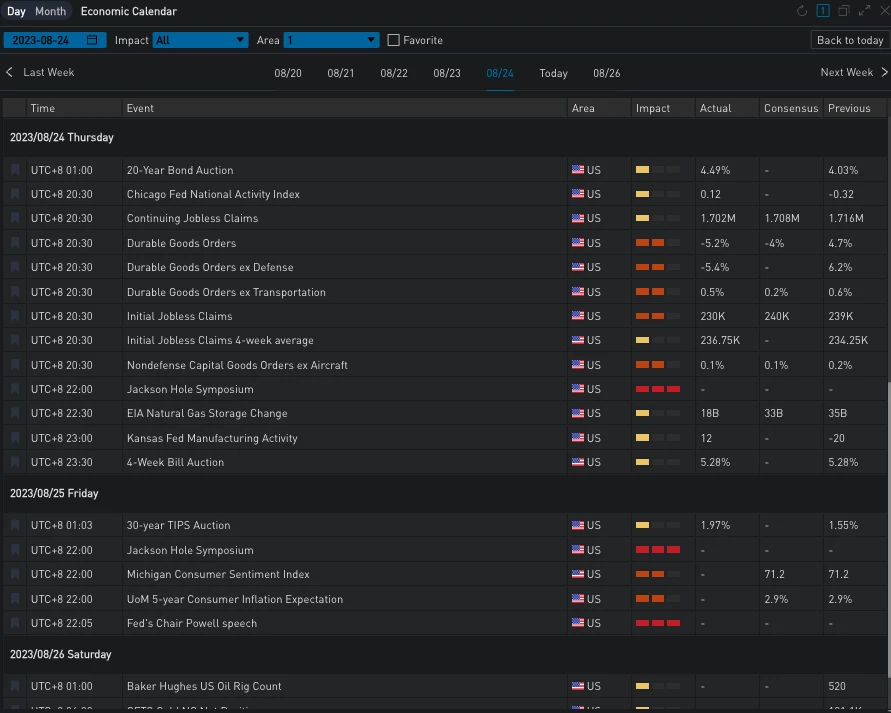

Due to cautious market sentiment before Powell's speech, the US stock market gave back the gains from the previous day's positive tech stock earnings reports. Nvidia's stock price dropped nearly 10% from the overnight high, and the S&P 500 closed down 1.35%. In terms of data, the US initial jobless claims for the past week (24Aug 08:30pm) came in at 230,000, lower than the expected 240,000, marking a new low in three weeks, highlighting the ongoing tightness in the labor market. Additionally, the Atlanta Fed's GDPNow model further raised its third-quarter GDP forecast to 5.9%, adding more hawkish pressure to Powell's speech at Jackson Hole today. However, on the other hand, there were divergent views among Federal Reserve officials ahead of this important speech: Philadelphia Fed President Harker (a voting FOMC member this year) believes that the Fed will maintain the current level of interest rates this year, and if inflation continues to decrease, there may be rate cuts next year. Boston Fed President Collins (a voting FOMC member in 2025) stated that interest rates may be very close to their peak, but further rate hikes should not be ruled out.

Source: SignalPlus

Source: Binance & TradingView, BTC price falls to 26,000 whole number

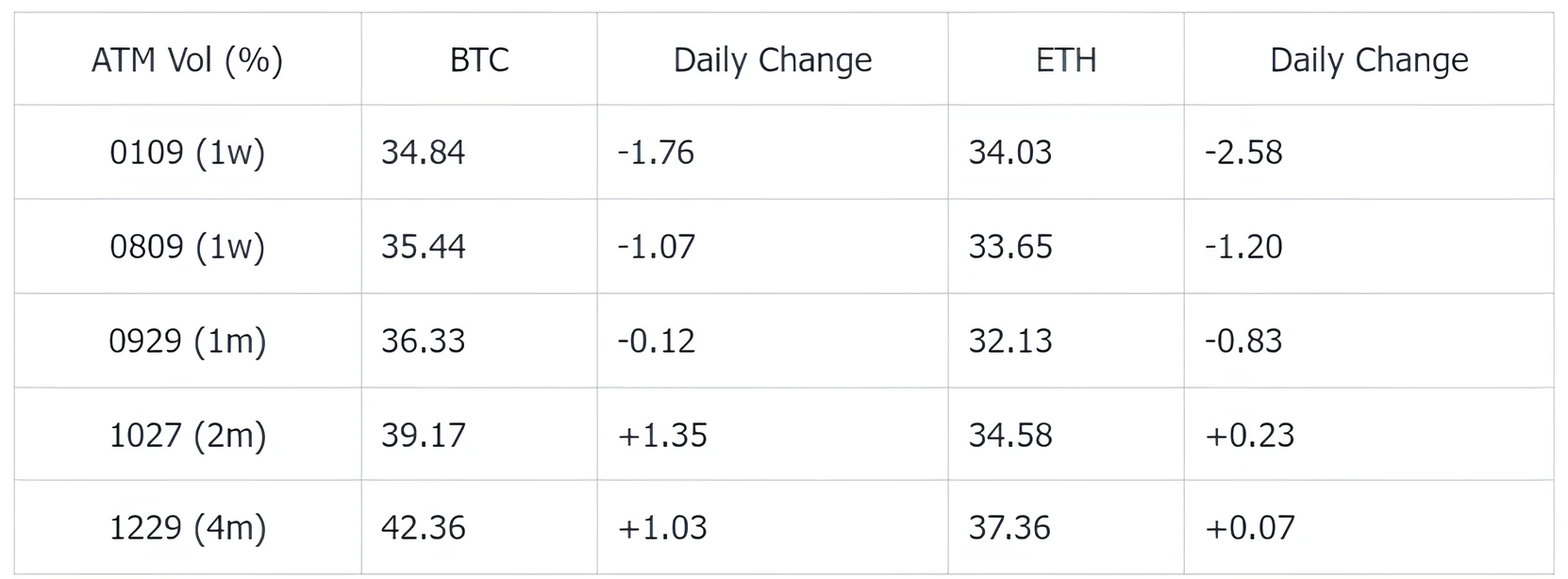

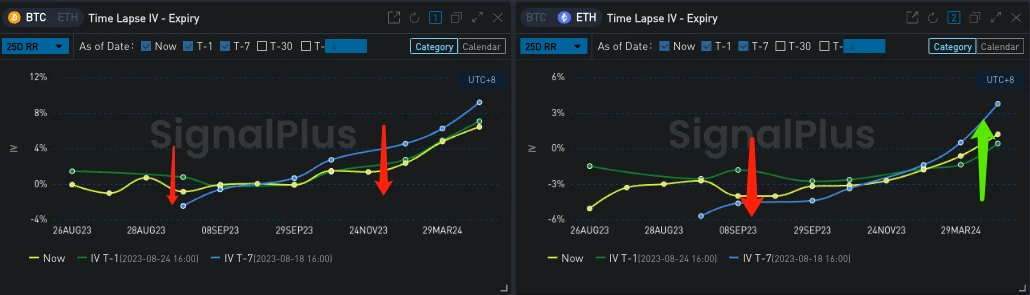

In the cryptocurrency realm, BTC continued its correlation with the S&P index, dropping by approximately -1.8%, returning to the vicinity of 26,000. The mid-term IV, driven by bullish sentiment the previous day, also saw a pullback today, generally declining by about 1-2%, with the curve steepening overall, but short-term implied volatility still carrying a premium due to the uncertainty brought by Jackson Hole and the approaching expiration.

Source: SignalPlus

Source: SignalPlus, mid-term IV declines, curve steepens

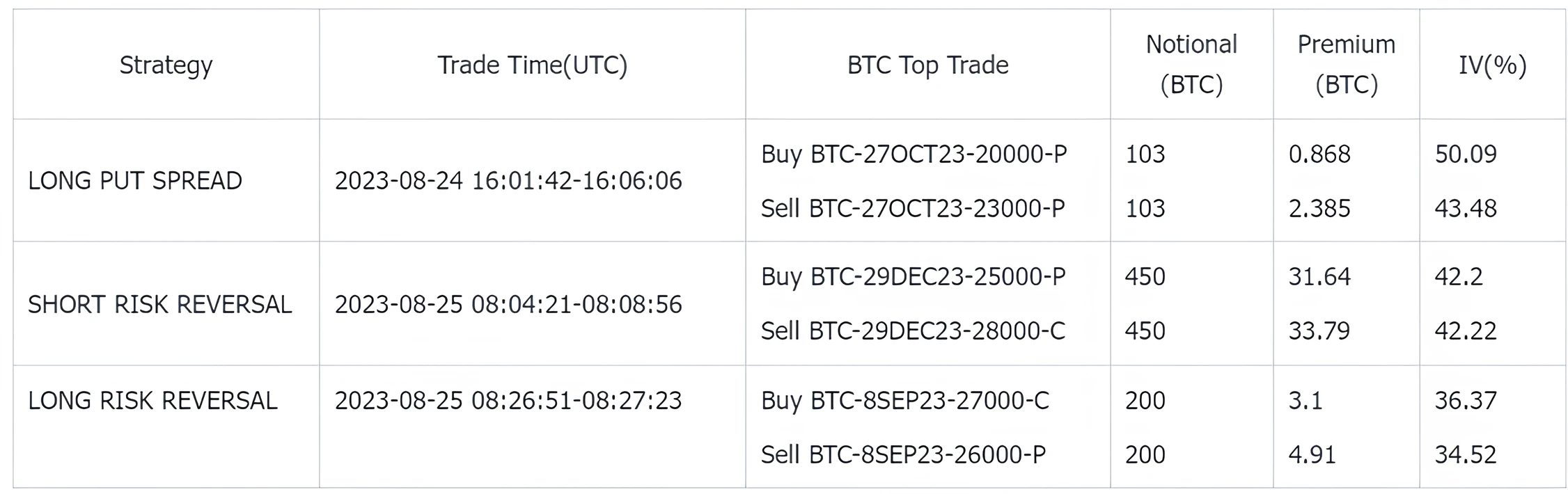

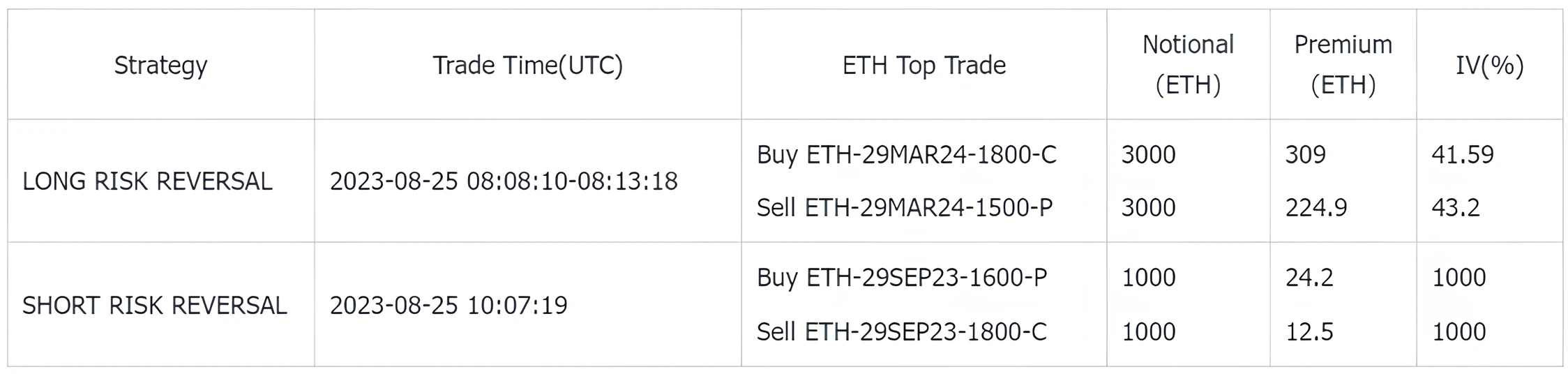

From a trading perspective, this price drop has generated some bearish sentiment, with a significant amount of buying of Put Spread trades seen on BTC-27Oct and ETH-1Sep. In addition, over the past 24 hours, numerous Risky trades have emerged on the Deribit platform, with BTC near-term (1Sep23/8Sep23) mostly being bought and year-end (29Dec23) being sold, while ETH shows the opposite pattern, being sold near-term (29Sep23) and bought long-term (29Mar24), reflecting traders' differing views on the BTC/ETH Skew trade.

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the PluginStore of ChatGPT 4.0 to get real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add the assistant's WeChat: chillywzq), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。