Established trend, position control, and selection of positions are the three key steps to success!!!!!!

Last week, after the market experienced a turning point, the market was in a mess, lifeless, and the suppressed emotions continued for three days. The sudden downturn and rebound were both bottomless, and the trends of both long and short positions were short-lived, leaving behind nothing but lamentations and curses.

In just a few minutes, the market completed a few hundred points of movement, and by the time you finished drinking water, the critical time point was still in the early hours at 5 a.m., the time when mental and physical exhaustion is at its peak. After that came the rebound, returning to the initial position of the first drop, forming a V-shaped pattern with astonishing speed and space.

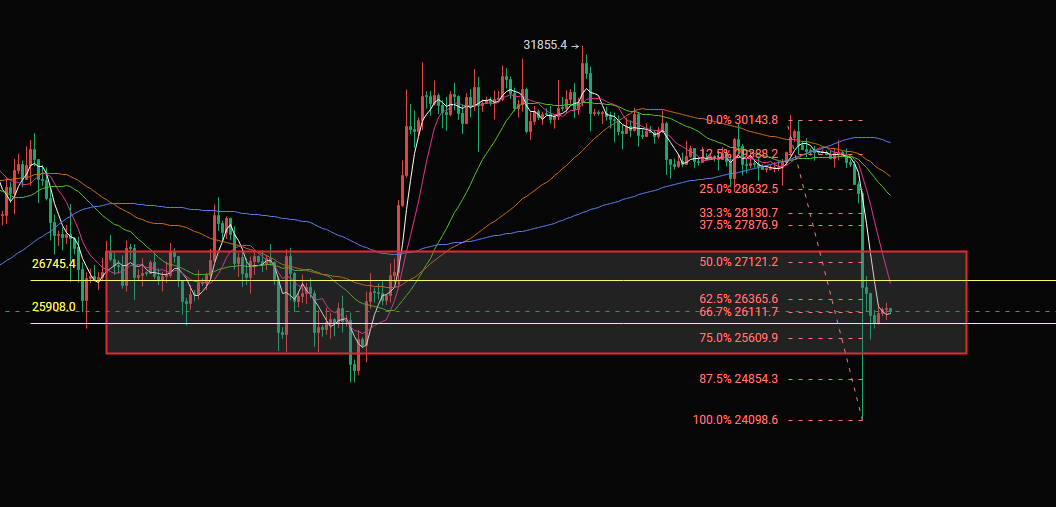

The 5,000-point drop in Bitcoin also underwent a three-day market recovery, and the indicators gradually began to return to normal. The deviation situation has improved, and currently, on a large scale, it is in a stage of oscillation and recovery. The 5-day moving average has turned upward, with resistance at the 26,800 level and support at 25,900 below. It is highly probable that the market will operate in this range for some time until the indicators return to normal positions.

On a small scale, the Bollinger Bands are still wide open, but as time passes, they have begun to close, having swallowed the recent movement. It will take a few days for digestion. The closure of the Bollinger Bands also indicates that there will not be a major market movement in the short term, making it the best time for swing trading.

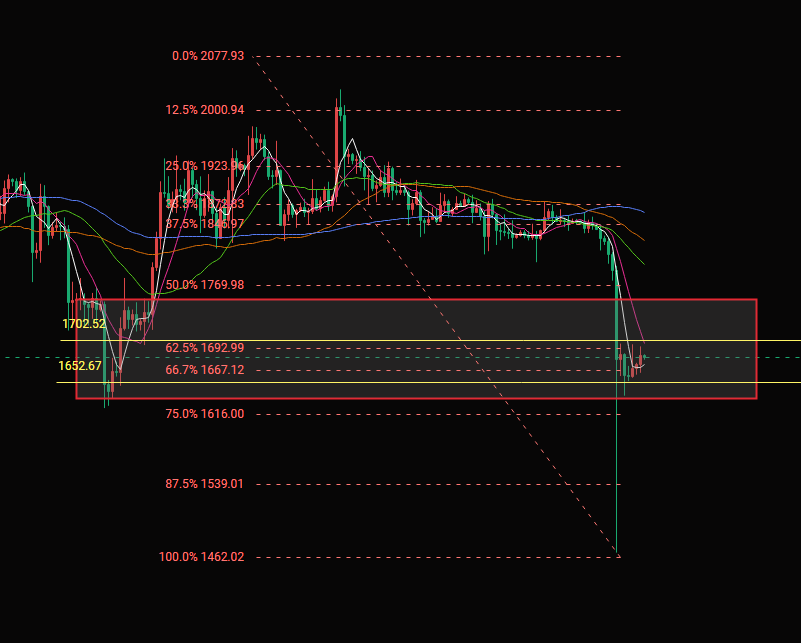

Ethereum experienced a 200-point long shadow, which is both painful and somewhat laughable. It can only be said that one must be in awe of this market, where anything is possible. On a large scale, it is also in a stage of oscillation, consolidation, and recovery. It can continue to close higher, but the space is limited. Although the moving averages show signs of turning upward, the golden cross has not yet formed. Everything is still uncertain, so it is best to follow the trend and focus on short positions.

On a small time frame, the Bollinger Bands are also contracting, pausing the harvesting process. The "leeks" have already been cut, and new "leeks" need time to grow. The various moving averages are slightly upward, currently running above the middle track. There is heavy resistance from the various moving averages above, making it difficult to directly break through. It can only be achieved through time and space, time and indicators. Currently, there is pressure at the 1715 level above and support at 1655 below.

In the event of a sudden change in the market, making trades can only rely on experience for the time being, as technical indicators may malfunction and cannot be used as a reference for making trades. It is advisable to consider resistance and support levels when making trades.

In summary: For intraday swing trading, short positions are still suitable in the 26,400-26,550 range for Bitcoin, and in the 1705-1715 range for Ethereum. The main focus is on taking high short positions and low long positions as a supplement. Specific real-time orders will be adjusted according to the market conditions.

Due to the impact of the review process, for subsequent real-time adjustments, the real-time strategies in the live trading group are the main reference. This article is for reference only, and it is recommended to follow my trades and make money. Rain or shine, I'll be waiting for you.

Official Account: Zhuge Talks Coins

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。