「每周编辑精选」是Odaily星球日报的一档“功能性”栏目。星球日报在每周覆盖大量即时资讯的基础上,也会发布许多优质的深度分析内容,但它们也许会藏在信息流和热点新闻中,与你擦肩而过。

因此,我们编辑部将于每周六从过去7天发布的内容中,摘选一些值得花费时间品读、收藏的优质文章,从数据分析、行业判断、观点输出等角度,给身处加密世界的你带来新的启发。

下面,来和我们一起阅读吧:

投资与创业

我们需要驾驭牛市的各个阶段,将利润最大化,并避免最常见的陷阱。

在积累阶段,囤积好的项目、节省弹药、不过度交易、填补知识空白、监控流动性;在牛市早期,减少亏损头寸并、增加盈利头寸、上涨途中获利了结、警惕过高风险、观察市场情绪、保持专注;在牛市顶峰,考虑推出计划;在下跌阶段,坚信会有下个Crypto牛市。

我们的目标是在熊市期间将资金投入到一种流动性资产中,并获得比在该叙事的早期风险投资交易中更好的回报。

叙事在牛市开始时就蓄势待发,通常由技术发展引起。特定领域的早期参与者由于叙事和使用规模同时扩大而获得了超额回报。Compound、UniSwap 和 BoredApes都是叙事风口与产品使用相结合,为投资者带来超额回报的例子。

挑战在于,你必须投资那些在可能吸引足够多用户之前就会消失的叙事。市场通常会在短期内对叙事定价。鉴于 Web3 投资的流动性特点,流动性资产可能在一个季度内退出。

鉴于风险投资的非流动性特点,当产品上线时,创业公司可能没有市场可以利用,因为产品需要时间发展。这往往意味着慢性死亡,并对用户的回归进行赌博。产品实际上成为对“牛回”的赌注。对于创始人来说,这是一个生存的备忘录。

如果在一个有意义的时间范围内找不到产品市场契合度,结束业务是有意义的。

在非洲,加密货币支付已经成为一种方便的获取美元的方法。

由于早期扩张和促进点对点市场,币安在非洲很受欢迎。

非洲人希望根据能力而非地理位置来获得收入,并且他们有毅力去追求。

长期目标应该是减少欧洲人和非洲人在数字领域的差异。

非洲人面临许多挑战,包括缺乏监管支持、无法旅行、难以遵守 KYC/AML 规定、几乎没有风险投资网络,以及没有时间尝试新想法。

更重要的是,几乎所有尼日利亚人都举手承认,他们失去了机会,因为人们不信任他们。

Web3 Bridge 的教育计划正在做着重要的工作,下一步是西方国家亲自协助开展夏季学校。

DeFi

详解全链LSD双雄Entangle和Tenet:能否盘活Cosmos生态?

全链 LSD 协议 Entangle Protocol 和Tenet Protocol均来自 Cosmos 生态。

Entangle 是以原生预言机为中心、EVM 兼容的全链 LSD 应用链,其“全链”的属性体现在可以创建支持的任意链 LP 在其他链的跨链 LSD,从而实现多链收益。Entangle 为 LP-LSD 提供全链的应用场景,而 Tenet 是为全链的 LSD 提供特定的应用场景(Tenet 链质押)。前者近似为网状的结构,后者更像是汇聚状的。Tenet 同样是基于 Cosmos SDK 搭建的 EVM 兼容应用链,深度集成LayerZero全链互操作基础设施,使 LSD 资产实现链级的赋能。

Entangle 的核心侧重点是 LP-LSD,即为 LP 资产提供跨链的 LSD 服务;Tenet 的重心在 DiPoS,支持多元化的 LSD 资产参与质押共识。两者间的关系似乎更多是合作而非竞争。

CeFi

对话PayPal:PYUSD会从Tether和Circle手中夺走市场份额吗?

PayPal 的整体愿景一直是成为法币和 Web3 之间的桥梁,为支付系统带来主流应用。Paypal 希望发布平台产品,然后开发者会在其基础上进行开发。

稳定币是目前区块链的杀手级应用,非常接近支付市场,并在结算时间上优势明显。在 B2B 支付领域,Paypal 看到越来越多的稳定币采用。

PYUSD 是唯一被 PayPal 生态系统接受的稳定币,这包括现在的 PayPal,很快还将包括 Venmo,以及其双边网络。因此,有数百万消费者和商家将能够获得它并且可以将其用作 PayPal 交易的资金工具。PayPal 利用了多年建立起的银行资源。用户可以转移 PYUSD 并出售它,然后提取到银行账户。PYUSD还有合规和监管优势。PayPal 生收取交易费,但对于稳定币则没有收费,用户唯一需要支付的费用是以太坊 Gas。

Mint Ventures:中短期RWA唯一正解,Web3国债业务漫谈

国债RWA项目在中短期内可能胜出的业务模式:

底层资产:采用国债 ETF 可能是一个相对取巧的方式,将流动性管理等问题交给了传统金融领域的巨头来操作。如果是直接购买美债或混合类资产,则考验项目方自身挑选合作方的能力;

业务架构:已经存在相对成熟的模式可以套用,最好其可扩展性较强,方便更快扩充规模,以及在未来纳入新的资产品类;

用户端:中短期来看,无需 KYC、无资金门槛要求的项目的用户群体更加广泛。未来若监管强制要求需要 KYC,轻量级 KYC 项目则可能会成为较主流的方案;

收益分配:为了让国债 RWA 的投资者对于收益率的预期更稳更放心,最佳方案是项目提供给用户的收益率与国债收益率保持比率的一致;

可组合性:在监管尚未对链上 RWA 资产的访问许可做限制之前,尽可能拓展用户国债 RWA 代币的使用场景,是各个项目方能在中长期内获得更大业务体量的重要因素。

中长期的竞争,或许会由于监管越来越深度的介入,某些轻量级 KYC 的项目可能拥有更大的机会。

NFT、GameFi与元宇宙

文章从开发团队、项目背景、全链技术和经济模型四个方面对Dark Forest、Loot Survivor、Treaty、Isaac、Mithraeum、Influence、Wolf Game进行了细致的介绍。

UGC 的两大源头——模组(如Minecraft)和开放经济体(如EVE),是全链游戏可能实现的突破方向。

把游戏全部放在区块链上,最有力的理由是,可组合的修改和无需许可的开放经济。可组合模组和无需许可的经济的组合可能产生大型的链上游戏世界。此外,可组合性天生具有金融化特性,全链游戏需要找出如何利用金融化压力而不被它们所消耗。其中的研究方向包含抗脆弱设计、权限设定、订单流拍卖。

全链游戏未来有4个研究方向:TEE、MACI(用于增强链上投票系统的防串通能力)、自定义Rollups、使用 ZKP 来启用私有状态。

以太坊与扩容

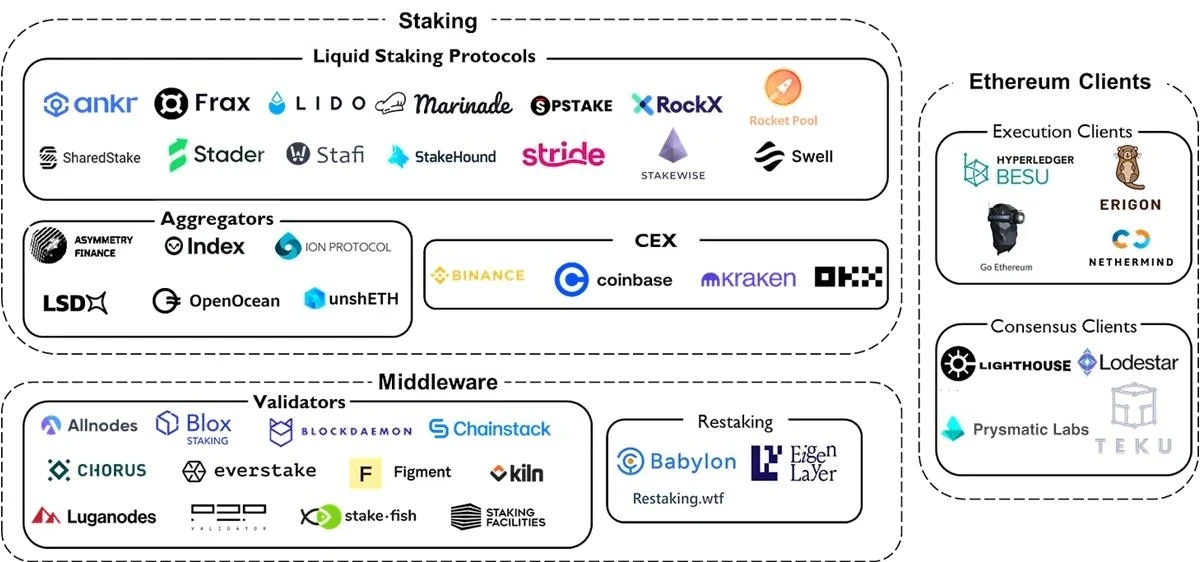

质押市场规模的一种方法是将所有基于 PoS 的链的市值相加。这个数字大约为 3180 亿美元。其中 72% 是以太坊。以太坊在网络中的权益质押比率是最低的之一。以太坊是唯一一个通过燃烧部分手续费来抵消每日发行量的网络。以太坊上燃烧的手续费与网络的使用量成比例。

质押赛道全景

流动性质押投资衍生品(LSD)带来了一下好处:首先,它允许零售参与者在不失去对其质押资产访问权的情况下进行投资。用户可以随时提取他们的收益。其次,即使拥有较少数量的 ETH,人们也可以参与质押。Lido 是为数不多的几个能够大规模从闲置资产中获利的加密项目之一。约有 150 亿美元的 ETH 被质押在 Lido 上。只要 ETH 能够产生收益且资金不会流出,流动性质押投资企业就会处于良好状态。此外,与 Uniswap 或 Aave 不同,Lido 不太受市场波动的影响。Lido 利用了人们的懒惰。

EigenLayer则是支持再抵押的领先中间件之一。区块空间是由位于其下方的节点或验证者所提供的去中心化散信任的产物。这种去中心化信任的价值越大,区块空间的价格就越高。再质押机制使我们能够深入去中心化堆栈,并为去中心化信任创造市场。EigenLayer 允许以太坊的验证者重新利用他们的信任,并使新的区块链从相同的信任中受益。

不是每个链都需要建立自己的安全性。因为并不是每个链都试图成为像以太坊、比特币或 SWIFT 那样的全球结算网络。公共区块链中不存在绝对的安全性。区块是概率性的(回滚一两个区块并不罕见),安全性是一个范围。当团队专注于构建应用程序时,可能更应该关注用户。让安全性达到可以与具有巨大网络效应的链竞争的程度是缓慢而痛苦的。而如果项目是一个特定于应用程序的链,用户并不关心安全性,只要对于所提供的应用程序来说足够了。

L2演化出了新的趋势,包括Superchain、L3和 Hyperchain。这些进步有望成为下一代以太坊扩展的基石,简化开发流程,增强安全性,并在生态系统中建立更大的互操作性。

Optimism 的 OP 堆栈正在往超级链走,具有高度互操作性,Bedrock升级代表又迈向他们的愿景一步。

Arbitrum 也处于以太坊扩展前沿,通过 Arbitrum Orbit 开发L3网络,在 Arbitrum L2上提供一个部署定制链的无许可框架。

zkSync 提出了 Hyperchain,这是一组可定制的无信任链接区块链,实现超扩展性、改进的可组合性和增强的安全性。

StarkWare 正在开发一个多层解决方案,探索L3用于定制扩展,并利用L2进行通用扩展。

Polygon2.0 旨在通过统一其L2解决方案套件来创建“互联网的价值层”,其中包括 Polygon PoS、Supernets 和 zkEVM。

Mint Ventures:布局坎昆升级,OP和ARB谁是更佳选择?

L2 的盈利模式清晰且简单,即一方面通过向可信的 DA(Data Availablity,数据可用性)层采购存储空间,对自己的 L2 数据进行备份(这样当 L2 运行出现问题时就可以通过备份数据进行还原),另一方面为用户提供更便宜的区块空间服务并据此收费,它的利润来自:L2 的收费(基础费用 +MEV 收入)- 给 DA 服务商支付的成本。

L2 的费用收取和 L1 的成本支付都由 L2 的排序器(sequencer)执行,利润也归于排序器,而目前 OP 与 ARB 的排序器均由官方运行,利润也归于官方国库。当然,中心化的排序器意味着极高的单点风险,OP 和 ARB 长期都有将排序器去中心化的承诺。届时,ARB 和 OP 代币将获得除了单纯治理之外的经济价值赋能。

曾经的 L2 项目的服务对象是使用自己区块空间的用户,Superchain 和 OP stack 则把用户的定义扩大至 L2 的运营方们,从一门 2C(这里把 L2 的开发者也定义为 C)的生意,变成了一门 2 B2C 的生意,这为 OP 构建了新的价值来源和护城河:多链网络效应、规模效应、利益共同体。

与 OP 快速上升的业务数据对应,OP 主链相对于 ARB 的估值在变得越来越有吸引力。Arbitrum one 虽然作为 L2 单链,相对于其他 L2 仍然保持着业务数据的略微领先,但其在整个 L2 市场的用户份额实际上是快速滑坡的,因为大量新老用户都流向了 OP 系和混合系 L2。坎昆升级后 L2 们将大幅降低的成本惠及 L2 的用户的比率越低,其 L2 运行利润越高。L2 们降低二层费用带来的转账活跃提升比率越高,其 L2 运营利润越高。

需要关注 OP 的以下风险:ARB 选择开放自己的 L2 许可,采用与 OP 雷同的方式争夺 L2 的总网络人口;L2 服务市场整体竞争的白热化;Superchain 整体生态的发展,价值能否传导给 OP 基金会和 OP 代币;估值风险(是否已经Price in 预期)。

Optimism 敏锐抓住两个机会窗口:一是去年 5 月份凭借 OP 空投及激励计划,二是此次 OP Stack 超级链的新叙事,Optimism似乎终于找到了一条行之有效的差异化竞争新路径,能够真正在与Arbitrum的竞争中站稳脚跟,不落下风。

Optimism 敏锐抓住两个机会窗口:一是去年 5 月份凭借 OP 空投及激励计划,二是此次 OP Stack 超级链的新叙事,Optimism似乎终于找到了一条行之有效的差异化竞争新路径,能够真正在与Arbitrum的竞争中站稳脚跟,不落下风。

「前期依靠Synthetix生态,后期借力 OP Stack 宇宙」,OP Stack 正在搭建起自己的「超级链生态叙事」。

另推荐两篇关于Rollup的好文:《多角度解读Rollup去中心化的重要性》《Rollup经济学2.0:解析成熟Rollup生态的多层经济关系》。

新生态与跨链

模块化系统增加了开发复杂性,模块化链无法更快执行代码,模块化增加了用户的交易成本,应用程序 Rollup 不会为开发者创造新的盈利机会,应用程序 Rollup 无法解决跨应用程序拥塞问题,灵活性被高估,扩展 DA 不需要重新抵押,为应用程序开发人员构建。

DAO

The SeeDAO唐晗的长文。

VC 和投资型 DAO 的特点对比

投资 DAO 的参与门槛通常有两种类型:仅会员费;会员费+贡献。

投资 DAO的六个关键问题有风险管理、动态投票权、跨DAO信誉系统、DAO孵化器、DAO-to-DAO服务、DAO法律工具包。

一周热点恶补

过去的一周内,SpaceX减记3.73亿美元比特币,加密市场大幅下跌,Coinbase获批向符合条件的美国客户提供合规加密货币期货交易,欧洲上线首个现货比特币 ETF,Sei公布代币经济:空投占比3%,早期贡献者占比20%,并开启空投,Celsius计划90天内关闭其应用程序并分配20.3亿美元加密资产,已选定PayPal分发BTC,PayPal将为特定用户推出加密货币中心,允许特定用户进行加密货币交易,ARK Invest提交了新的数字资产和区块链ETF($ARKD)申请;

此外,政策与宏观市场方面,新加坡金管局已最终确定稳定币监管框架,发行方需满足信息披露等要求(详解),李家超:香港特区政府重视金融科技和Web 3.0的发展;

观点与发声方面,1confirmation联创:预测市场将是下一个吸引主流关注的市场,ArkStream Capital:市场未必只有L2,新公链不可忽略,Vitalik:X平台社区笔记功能或在主流世界中最接近“加密价值”实例,V神谈AI:别担心被取代,我们终将适应新技术浪潮,V神称XRP完全中心化,引发XRP社区不满,PayPal高管:公司计划通过PYUSD与DeFi生态整合,并确保其尽快上线CEX,Wintermute创始人:“YFI贷款及CRV计划”旨在实现双赢,不存在市场操纵,Aave创始人:未来几个月引入稳定性模块等改进后,GHO会恢复锚定;

机构、大公司与头部项目方面,Visa测试支持信用卡或借记卡以法币支付链上Gas费的方法,Kraken超越Coinbase成为美国最具流动性山寨币交易市场,CyberConnect开放领取空投,Aave社区通过“aCRV OTC交易”提案,使用Aave DAO财库中的200万枚aUSDT战略性购买500万枚aCRV代币,ImmutablezkEVM测试网已上线,主网预计第四季度发布,Unibot推出统一交易终端Unibot X,Shiba InuL2解决方案Shibarium主网上线,friend.tech将向测试用户空投奖励积分;

NFT和GameFi领域,DeGods一夜暴跌,联创Finny将离职,仍看好DeGods和y00ts,可口可乐作为OnchainSummer活动品牌于Base链发行系列NFT……嗯,又是跌宕起伏的一周。

附《每周编辑精选》系列传送门。

下期再会~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。